In Australia, banks have been classified into four main sub-categories:

- Major banks: The four largest Australian banks are the Commonwealth Bank of Australia, Australia and New Zealand Banking Group Limited, the National Australia Bank Limited, Westpac Banking Corporation and their subsidiary banks;

- Other domestic banks: All locally owned banks excluding those classified as major banks (e.g. Bank of Queensland Limited, Macquarie Bank Limited);

- Foreign subsidiary banks: Foreign banks authorised to carry on banking business in Australia through a locally incorporated subsidiary (e.g. HSBC Bank Australia Limited, ING Bank (Australia) Limited);

- Foreign bank branches: Foreign banks licensed to conduct banking business in Australia through branches, subject to a condition which specifically restricts the acceptance of retail deposits (e.g. Citibank, N.A., Credit Suisse AG).

Let’s have a look at three domestic banks of Australia.

Bank of Queensland Limited (ASX: BOQ)

Bank of Queensland Limited is one of Australia’s leading regional banks and among the few still not owned by one of the four leading big banks. Many of its branches are operated by local Owner-Manager, which means they're operating a small business and realize what it means to deliver personal service.

Bank of Queensland Limited has more than 180 branches across Australia and it is one of the top 100 Australian companies rated by market-cap on the ASX and is regulated by the Australian Prudential Regulation Authority (APRA) as an Authorised Deposit-taking Institution.

BOQ Completes Institutional Placement

Bank of Queensland Limited on 26 November 2019 unveiled the completion of an institutional share placement, worth $250 million (fully underwritten). The placement would result in the issue of approximately 32.1 million new fully paid ordinary shares in BOQ at a price of $7.78 per new share. The placement is part of a capital raising recently announced by the company, which also includes a non-underwritten share purchase plan (SPP), under which BOQ is targeting to raise approximately $25 million.

- The main purpose of this capital raising is to strengthen bank’s balance sheet and to provide an increased buffer above the APRA’s “unquestionably strong” Common Equity Tier 1 (CET1) capital ratio benchmark;

- This offer is expected to add approximately 80 to 88 basis points to BOQ’s Level 2 CET1 capital ratio.

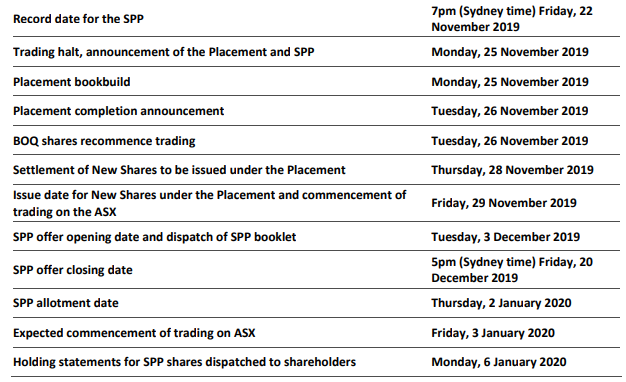

Key Dates (Source: Company’s Report)

Stock Performance

The stock of BOQ was trading at $8.150 per share on 26th November 2019 (AEST 01:05 PM). The bank has a market capitalisation of $3.51 billion as on 26th November 2019 with an annual dividend yield of 7.52%. The total outstanding shares of the company stood at 405.78 million. The stock has given a total return of -4.42% and -5.88% in the time period of 3 months and 6 months, respectively.

MyState Limited (ASX: MYS)

MyState Limited is the ASX-listed non-operating holding company of the diversified financial services group consisting of MyState Bank and Tasmanian Perpetual Trustees, a trustee and wealth management company and it is regulated by the APRA. MyState Bank and Tasmanian Perpetual Trustees hold Australian Financial Services Licences issued by the Australian Securities and Investments Commission.

Highlights of 2019 AGM; NPAT fell by 1.5%

Bank’s FY19 results were slightly disappointing, but in the perspective of the digital journey and the overall circumstances of the banking sector, it was a solid performance. Statutory NPAT fell 1.5% to $31 million, but when the discontinued operations are excluded, NPAT fell from $31.3 million to $29.8 million, which was mainly due to the decline in net interest margin (NIM). The decline in NIMs happened by a combination of increased competition for loans and deposits but also impacted by adverse movements in the Bank Bill Swap Rate that impacted the cost of securitisation funding in the first half of FY 2019.

- In 2019, the bank recorded a 10.7% increase in its loan book, well above peers in the industry;

- The group capital position fell slightly from 13.5% to 12.90% but nevertheless remains very strong;

- The bank has maintained the full-year dividend at 28.75 cents per share.

FY19 Results (Source: Company’s Report)

Stock Performance

The stock of MYS was trading at $4.770 per share on 26th November 2019 (AEST 01:07 PM), down 0.625% compared to its previous closing price. The bank has a market capitalisation of $438.89 million as on 26th November 2019 with an annual dividend yield of 5.99%. The total outstanding shares of the company stood at 91.43 million. The stock has given a total return of 2.13% and 12.15% in the time period of 3 months and 6 months, respectively.

Bendigo and Adelaide Bank Limited (ASX: BEN)

Bendigo And Adelaide Bank Limited provides a wide range of banking and other financial services comprising business, residential, rural and commercial lending, consumer banking, payments services, deposit-taking services, superannuation and wealth management, treasury and foreign exchange services, etc.

Director Retirement & Company Secretary Resignation

The Bank has confirmed the resignation of Mr Robert Johanson, who announced his intention to retire at this year’s annual general meeting earlier this year. As per the newly appointed Chairman, Mr Johanson had helped steer the Bank through significant growth during his 31 years at the bank, the last 14 years as Chairman.

The Chairman also paid tribute to Mr Will Conlan who, after eight years, has resigned as Company Secretary.

Highlights of 2019 AGM

In FY19, the bank had a challenging environment due to enhanced regulatory control, record lower level of interest rates and the cascading effects of the multitude of enquiries catered to in recent years, is pressurising bank returns.

Other major highlights during the year:

- The launch of Up, Australia’s first and largest next-gen digital bank, which has exceeded initial expectations of customer growth, attracting over 130,000 customers in the first 12 months since launch;

- Adoption of Tic: Toc’s instant home loan technology to become the first lender globally to offer a digital home loan application and assessment process under its own brand, Bendigo Express.

Appointment of Company Secretary

The bank has announced the appointment of Ms Carmen Lunderstedt as Company Secretary. Ms Lunderstedt (BCom, GradCertFinPlan, FGIA, FCIS) is a Chartered Secretary with 17 years’ experience in governance, risk and compliance, with ten of these years in the financial services industry.

She has a solid experience in operating in highly regulated environments. Ms Lunderstedt brings to the Bank in-depth, practical experience in best-practice modern governance, supplemented by a strong understanding of prudential regulation.

Stock Performance

The stock of BEN was trading at $10.180 per share on 26th November 2019 (AEST 01:13 PM), down by 0.973% from its previous closing price. The bank has a market capitalisation of $5.08 billion as on 26th November 2019 with an annual dividend yield of 6.81%. The total outstanding shares of the company stood at 493.84 million. The stock has given a total return of -4.04% and -7.20% in the time period of 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.