In the year 2019, both Bitcoin and Gold prices have increased drastically by ~92.2% and 17.6% respectively. The weekly average price of bitcoin rose from USD 3,748.11 (January 2019 first week average) to USD 7,203.82 per bitcoin (December 2019 last week average) and gold price during same time interval has improved from USD 1,284.83 to USD 1,510.42 per ounce.

The global uncertainty amid the period due to the US-China trade war, shrinking bond returns, negative debt yield and high price by earning ratio of stock in comparison to interest rate has boosted the demand. The mentioned factors were bubbling the price than the tension between the US and Iran surged the gold price further by 3% from December 2019 last week average price to USD 1,562.03 per ounce in the second week of January 2020.

Interestingly during the same period, the bitcoin price soared by 13% to USD 8,025.51 from USD 7,203.82, last week average price of December 2019.

To understand the relation further let us go through the correlation between the two duos.

Correlation between Gold and Bitcoin

The correlation between the gold and bitcoin price has increased positively from ~63.91% in 2018 to ~71.33% in 2019. This increment relation of bitcoin to gold has compelled the investors to think of it as an alternative to gold investment which started propelling it as digital gold and thus further increasing the price to USD 8,681.53 per bitcoin in the third week of January.

The movement of bitcoin in line with gold trends may raise a question to the investors whether bitcoin really is digital gold? How is the movement of bitcoin dependent on the gold or vice versa?

To unfold the quest, let us sail through the correlation coefficient of gold and bitcoin over a certain time interval.

Interesting Read: Top Reasons for Using Bitcoin instead of Cash

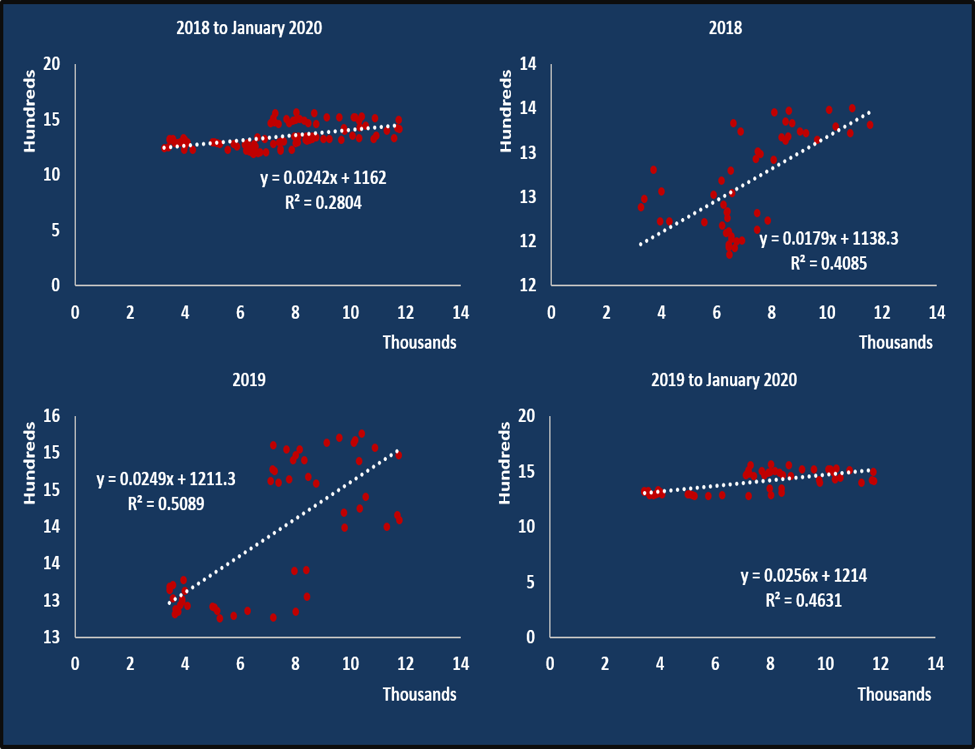

Correlation Coefficient between Gold and Bitcoin (Bitcoin x-axis and Gold y-axis, Value in USD)

Source: Kalkine Research

From the above graph, it is evident that the dependency between the two is not as strong as the linear association. Increasing the number of variable intervals phase out the irregularities and thus has resulted in a correlation of coefficient (r2) as ~28% for the period between 2018 to 17th January 2020.

In the year 2018, when the prices of bitcoin were performing superlatively worst than the gold exhibited r2 of ~41%. Post the year, duos dwelled well in the lap of uncertainty and demonstrated the mutual dependency of around ~51% that means in the year ~49% variations were the external factors driving the prices.

However, post-2019 the interdependency was reduced to ~46%, courtesy to the cessation of US-Iran tension and phase 1 US-China trade dispute settlement.

What does r2 of ~51% mean in the year 2019?

To comprehend the relation, let us go through the era of bitcoin bubble which busted in 2018, leading to a dramatic fall in prices from USD 19187.78 in December 2017 to USD 3193.78 in December 2018. During the time of higher prices, i.e. 2017 investors started investing in the other cryptocurrency with lower market values in the hope of turning into bitcoin and at the bearish time, the same investors started taking money out of the digital currency.

Similarly, for gold, the year 2018 was not profitable due to the higher interest rate, stronger US dollar and the optimistic economy which pushed down the market of gold. Investors started lending money or investing in securities with higher returns, rather than opting for holding non-yielding ones. Likewise, bitcoin too faced the heat of soaring interest rate courtesy to his intrinsic nature of no income stream to the holders.

Right after 2018, as discussed above when the world economy was not that strong with falling interest rate and global trade dispute has supported the rally of gold prices, investors started moving toward safe-haven investment at the time of global turmoil. In same line, bitcoin price too surged in 2019 since investors started moving towards other portfolios to invest or hedge at the time of uncertainty and skyrocketed the price of gold.

At the same time, halvening of bitcoin rewards to miners has tightened the supply resulted in the price wave foreseeing liquidity crunch in the market and starting Facebook own cryptocurrency added positively to the cause.

Hence, we see that bitcoin and gold hop the same trends at the time of different economic conditions. This may be due to the fact that both are a non-revenue generating investment with no yield or P/E ratio.

To know more about different cryptocurrency please click here

Is Bitcoin a Commodity?

While going through extensive relations between bitcoin and gold, one question may pop up-concerning bitcoin as a commodity. A commodity is always linked with supply and demand, i.e. consumption drives the commodity demand as in case of wheat, copper etc. However, in the case of bitcoin, the demand is not created by the sense of consumption and all the requirement can easily be met by the existing stocks. The most important difference is that the bitcoin does not have physical assets like any other commodities.

Bitcoin or Gold: A better Investing

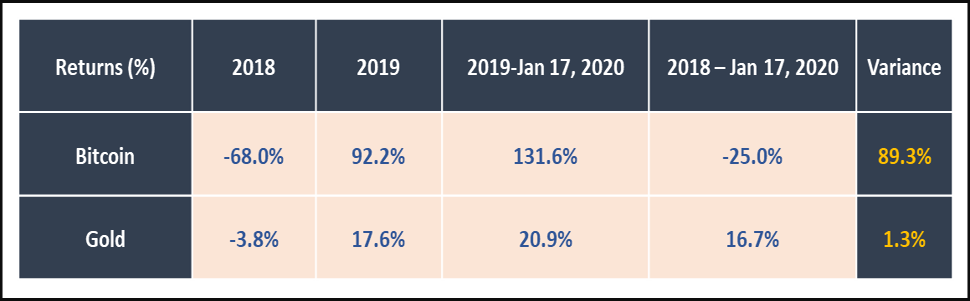

Volatility determines the riskiness of the investment and bitcoin is more volatile in comparison to gold, as shown below.

Source: Kalkine Research

The yearly return of bitcoin has varied much with negative (68%) return in 2018 followed by the huge positive return of 92.2% in 2019 which increased to 131.6% if taking 3 weeks price movement of January 2020. Whereas overall return in the duration from 2018 to 17th January 2020 is (25%).

Now, gold has shown consistent return after recovering from a slump in 2018. The variance in returns for gold is only 1.3% in comparison to 89.3% of bitcoin.

Therefore, investment in the two duos depends on the motive of investors. If investors are willing to take the risk and gain over the volatility, they can opt for bitcoin and with less risk-averse investors can opt for gold.

However, for the purpose of hedging gold has always been the better option and investors can even choose bitcoin vigilantly, since the surge in gold price is expected to pull the price of bitcoin at the time of global uncertainty.

Good Read: Equity Charmer Gold 2020 outlook

The Bitcoin long term outlook is unpredictable and presently is surging, possibly due to technology advancement in blockchain as well as new projects venturing into cryptocurrencies such as Libra of Facebook and crypto Yuan of China apart from gold and economic conditions. However, in the short term, it is expected to seat on the sweet spot as the gold price is expected to climb up in 2020.