Oil prices plummeted in the international market, with benchmark Brent Crude oil futures dropping from the level of US$75.60 (High in April 2019) to the level of 59.45 (low in June so far) amid weakening demand in the international market.

The crude oil posted its highest monthly loss in May this year, and since then it is trending lower, which in turn, is causing concerns among the bulls of the oil market, who hoped for the glory level of US$100 a barrel in the international market.

Not just the oil market, the natural gas prices are also plummeting in the international market, with the prices of natural gas futures on NYMEX falling from the level of US$4.666 (high in December 2018) to the level of US$2.305 (low in June so far).

The falling prices are raising concerns among the oil and gas explorer who are trying to figure out different ways to preserve their strengthened balance sheet, which they built during the first quarter of the year 2019 amid high commodity prices in the international market.

The share price of many oil and gas players has lost significant value amid weak commodities price in the second quarter of the year 2019.

Oil and Gas explorer:

Senex Energy Limited (ASX: SXY)

General Outlook and Recent Updates:

Senex is one of the players who secured a Queenslandâs government offered acreage in May 2019, as domestic supply constraints prevailed in the Australian domestic market. The company received a preferred tender in the Surat Basin.

SXY is working on the development of its key asset- Project Atlas, for which the company secured two offtake agreements recently. SXY secured a 3.25 petajoules offtake for Project Atlas from CSR Limited (ASX: CSR), and 9.9 petajoules from Orora Limited (ASX: ORA).

Latest Announcement:

In an announcement made public by the company today, SXY mentioned that it has secured a domestic sales agreement from O-I Australia, a leading glass-packaging manufacturer, for its Wallumbilla Gas Hub in Queensland.

As per the agreement, SXY would provide O-I with one petajoule of natural gas per year from the starting of the year 2021, for five years, totalling to 5 petajoules of natural gas for a period of 5 years.

Apart from this, under the agreement terms O-I Australia has an option to increase the total contract volume by up to an additional 1.1 petajoules per year; however, no earlier than the starting of the year 2022. The total volume of the offtake agreement would be at 10.5 petajoules if O-I decides to exercise the option, and as seen in the previous contract the supply pricing would be indexed annually and would be at a fixed price in line with the current market pricing.

March 2019 Quarter Highlights:

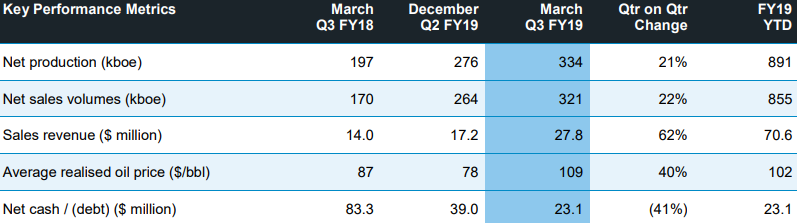

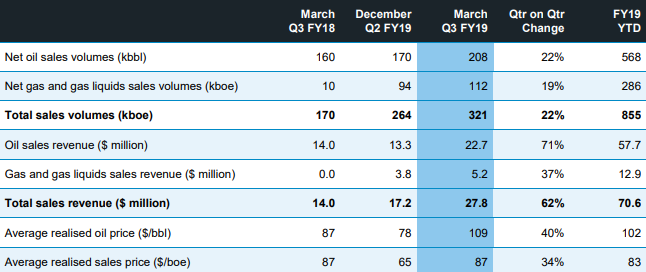

Sales and Production Figures for March Quarter (Source: Companyâs Quarterly Report)

SXY realised an average price of $87/Boe (barrels of oil equivalent) and $109 per barrel oil price during the March quarter of the year 2019. The company is relatively inching up offtakes agreement in the present quarter; however, amid the fall in commodity prices, the market participants are expecting the average realised price to fall in the present quarter and investors should keep a close eye over the counter.

Financials for March 2019 Quarter (Source: Companyâs Quarterly Report)

Price Actions and Performance:

Price Actions:

The shares of the company inched up on ASX in the first quarter of the year 2019 from A$0.262 (low in January 2019) to the level of A$0.390 (high in February). However, the shares of the company lost its charm and fell from March 2019 (A$0.380 high) to the level of A$0.280 (low in June so far).

Performance:

SXY delivered a return of 7.55 per cent on a YTD basis and a return of -29.63 per cent on a yearly basis. The six-months and one month returns of the stock stands at -19.72 per cent and -17.39 per cent, respectively.

Woodside Petroleum Limited (ASX: WPL)

General Outlook and Recent Updates:

Woodside Petroleum announced on ASX today that the company completed the Pluto LNG turnaround as planned. As a result, WPL commenced the further activities for the turnaround to achieve the restart of production, which was scheduled for the end of June 2019.

As per the company, the production for the year 2019 is expected to be at the lower range of the production guidance of the year 2019, which was set by the company in the range of 88 â 94 MM barrels of oil equivalent.

March 2019 Quarter Highlights:

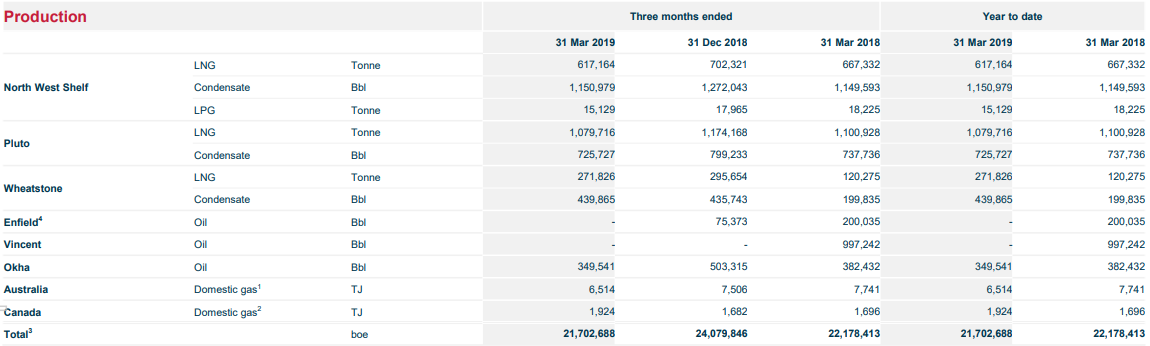

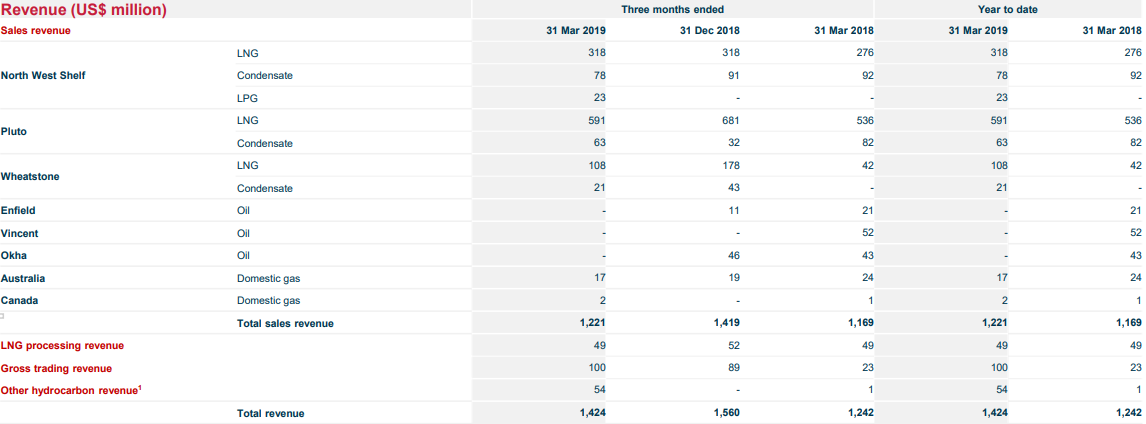

During the quarter, the sales revenue of the company decreased from $1,419 million in the fourth quarter of the year 2018 to $1,221 million. During the first quarter of the year 2019, the overall production totalled at 21,702,688 barrels of oil equivalent, down by almost 11 per cent from the overall production of 24,079,846 in the December 2018 quarter.

The break-up of the production level of different prospects are as:

Source: Companyâs Quarterly Report

Source: Companyâs Quarterly Report

Price Actions and Performance:

Price Actions:

The share price of the company reacts to the movement in crude oil and tracks it in the same trend.

The share price of the company inched up at the beginning of the year from the level of A$30.480 (low in January 2019) to the level of A$37.700 (high in February 2019); however a week quarterly result affected the prices, and the shares of the company plunged in March.

In March 2019, the shares made a low of A$34.060; however, the price again recovered to make a high of 37.550 in May 2019, and in the current month it is trading in a range of A$33.835 to A$35.215.

Performance:

WPL delivered a return of 13.61 per cent on a YTD basis and a return of 4.21 per cent on a yearly basis. The six-months return of the stock is at 11.63 per cent; however, last one-month return is negative at 0.74 per cent.

Oil Search Limited (ASX: OSH)

General Outlook and Recent Updates:

OSH recently received Federal Record of Decision under section 404 of the United States Clean Water Act. The company is among the participants of PRL 3 (Pânyang) Joint Venture, which recently signed a Letter of Intent with Santos Limited (ASX: STO). As per the LOI, STO would purchase 14.32 per cent interest in the PRL 3 JV.

March 2019 Quarter Highlights:

The overall production decreased by 3 per cent and stood at 7.25mmboe during the quarter, whereas it stood at 7.44mmboe in the last quarter of the year 2018. The total sales of the company also marked a decline of 15 per cent to stand at 6.65mmboe during the quarter as compared to 7.82mmboe in the fourth quarter of the year 2018.

The revenue of the company took a jab over the decline in sales and stood at US$398.1 million, down by 21 per cent as compared to the last quarter of the year 2018.

Price Actions and Performance:

Price Actions:

The shares rose from the level of A$6.910 (low in January 2019) till A$8.460 (high in February); however, the share price lost significant value since then and plunged till A$6.810 (low in June so far).

Performance:

OSH delivered a return of -0.14 per cent on a YTD basis and a return of -16.71 per cent on a yearly basis. The six-months return of the stock stands at -4.94 per cent and last one month return stands at -6.85 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.