Cannabis is rolling out to be the one thing the COVID-19 cannot destroy. Sale of cannabisis booming, with some countries seeing 20 percent spike in sales as anxious and pot stocks are seeing a sign of hope amidst the COVID-19 pandemic. In many cities with self-quarantine and lockdown, thesale of marijuana skyrocketed when the coronavirus outbreak started, many medical cannabis patients and advocates were concerned that they would not have access to marijuana. Cannabis was deemedunder non-essential item; consequently, many statesmandate cannabis dispensaries or stores to close.

However, surprisingly, marijuana sales are skyrocketing, and people want to stock up on marijuana as well. Since the government declaredlockdown or self-quarantine to preventthe spread of the coronavirus infection, persons have keptmarijuana in addition tohand sanitizer,food and other essentials.

Related: What's happening in the Cannabis space?

The marijuana sector is one of the most debated industry at a global scale, and significant development have been observedpresently in this industry,across the world. Medicinal cannabis products manufactured in Australia must be created under a Good Manufacturing Practice (GMP) license, and the Australiangovernment through the Office of Drug Control and the Therapeutic Goods Administration (TGA) regulates medicinal cannabis in Australia.

To know more, Do read: A Deep Dive Into The Australian Cannabis Market

In this article, we are highlighting how ASX listed cannabis stocks are performing during this COVID-19 pandemic- AGH, AC8, IHL

Althea’s significant progress across Australia, UK and Canada

An ASX listed licensed medicinal cannabis sector player Althea Group Holdings Limited(ASX:AGH)is into the supply of pharmaceutical grade cannabis formulations for the patients having debilitating diseases. Althea currently operates in the cannabis market of the United Kingdom and Australia, and it has plans to expand intoGermany.The Company was established in 2017 and listed on ASX in September 2018 and made enormous developments in a short period.

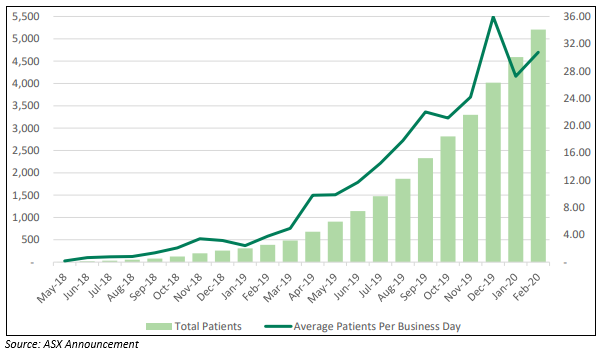

Recently, Althea provideda market update for its businesses across Australia, the United Kingdom and Canada. Moreover, the Company also disclosed that February continued Althea’s great start to 2020 as the total number of patients exceeded 5,000.

It is noteworthy to mention that February bettered January as the second-best month on record for Althea, with 617 new Australian patients added, while total Australian patients surpassed 5,000.The Company revealed that as of 28 February 2020, approximately 5,207 Australian patients had been prescribed its medicinal cannabis products by 440 healthcare professionals.

COVID-19 update-

Althea also provided an update on COVID-19 impact and mentioned that the Company continues to monitor the pandemic situation due to coronavirus cautiously in terms of its impact on AGH, the ability for Healthcare Professionals to continue to serve patients, and patients’ access to its medicinal cannabis products.

The supply of medication of Althea is continuing as normal, and the Company is working closely with healthcare professionals and pharmacies for reducing any interruption to patients, by-

- Sponsoring telehealth services;

- Fast-tracking use of electronic prescriptions;

- Launching e-commerce sales through Althea Concierge platform;

- Shipment of products directly to patients’ homes.

Stock Information-

The stock of AGH was trading at $0.275on 01 April 2020 (at AEDT 03:59 PM), up by 1.852% with the market capitalisation at nearly $62.99million. The fifty weeks high and low price of AGH stocks was noted at $1.445 and $0.150, respectively, with almost 233.31 million shares outstanding.

AusCann Group Holdings Limited to Commence Clinical Trial and Product Distribution-

An Australian-based cannabis sector Company AusCann Group Holdings Limited (ASX:AC8) is engaged in the development as well as the supply of medicines derived from cannabis within Australia and worldwide. The Company provides balanced, standardised and trustworthy cannabinoid based therapeutic products to the physicians for the treatment of patients. AusCannis led by the management team having robust worldwide pharmaceutical expertise.

On 31 March 2020, AusCann Group provided an update that the Company is well prepared to begin its first clinical evaluation at Nucleus Network (an independent clinical site). The Company mentioned that now in Australia, itscannabinoid based hard-shell capsulesare available for prescribing by the authorised doctors.

Moreover, AusCann highlighted that the Company anticipatesconducting an open-label, cross-over, randomised Phase 1 bioavailability study trial in healthy volunteers for evaluation of the pharmacokinetics of its hard-shell capsules at two distinctdosageconcentrations of balanced CBD: THC formulations.

The Phase 1 study will be open for recruitment during April via Nucleus Network, subsequentrecruitment of the participant, and is scheduled to commence on April 20, 2020.

Stock Information-

On 01 April 2020,the stock of AC8lasttraded flat at $0.190, with the market capitalisation at nearly $60.24million. The fifty weeks low and high price of AC8 stockwas noted at $0.140 and $0.530, respectively, with almost317.05 million shares outstanding.

Impression Healthcare’s IHL-42x accelerated FDA approval pathway-

An Australian based health care Company,Impression Healthcare Limited (ASX:IHL)is the largest dental entity providing oral devices such as gameday mouthguards, Instant Teeth Whitening kits, the knight guard, as well as the sleep guardian. The Company is manufacturer of four unique cannabis-based medicines as well as the owner of INCANNEXTM cannabis oils.

IHL commissioned Camargo Pharmaceuticals Services for providing an independent strategic assessment report on the Food and Drug Administration(FDA) approval pathway for cannabinoid IHL-42X.

- Camargo pharma is an expert FDA advisory having advised upon over 250 successful FDA applications in the previousseventeen years;

- Camargo pharma has confirmed that IHL is a potential candidate for the 505(b)(2) new drug approval pathway, reducing time and cost to commercialisation, subject to successful clinical assessment;

- Plan to bring IHL-42X to market in approximately 2.5 years, rather than up to 12 years for new molecular entities

Moreover, IHL is not required to complete pre-clinical and phase 1 clinical trial prior to commencing phase 2 studies for its FDA new drug application for IHL-42X, because extensive clinical information (with safety data) on the primary constituents of IHL-42X is existing publicly available.

Stock Information-

On 01 April 2020, the stock of IHL last traded at $0.038going up by 5.556%from its previous close, with the market capitalisation at nearly $25.83 million. The fifty weeks low and high price of IHL stock was noted at $0.019 and $0.110, respectively, with almost717.42million shares outstanding.