Government bodies across the globe are legalising the manufacturing and consumption of medical cannabis products, resulting in vast opportunities for investors. In 2018, Canada became the second largest country in the world to legalise cannabis products for adult use. Moreover, because of the increasing popularity of cannabis products and support from government authorities, many companies are eyeing to enter the cannabis space.

Australian medical cannabis sector is budding at a fast pace and has emerged as a multibillion-dollar sector with strong growth prospects. Recently, several changes recommended towards the licensing that regulates cannabis associated business in the country were listed in the Australian Parliament in September 2019.

Letâs zoom in further into five cannabis stocks along with their ASX stock market performance.

Medlab Clinical Limited (ASX: MDC)

Australian-headquartered medical life science company, Medlab Clinical Limited is engaged in the sale of nutritional products in Australia and the United States as well as in the development of therapeutic pathways for chronic diseases like depression, obesity and pain management (cannabis-based medicines).

Medlabâs Nutraceuticals Business to Expand in the US

MDC implemented a Definitive Commercial Agreement with American Nutritional Corp Inc (ANC) to enter the US market with its existing nutraceuticals, expanding the companyâs nutraceuticals business, which follows the market announcement dated 5 August 2019 on the execution of the Heads of Agreement with ANC. With robust research and extensive patents, MDCâs nutraceutical products are placed well for ANC clients.

Under the terms of the agreement,

- ANC would have rights to distribute as well as manufacture MDCâs nutraceutical products in the US. With a CAGR of 6.4%, the US dietary supplements market stood at US$124.8 billion in 2018.

- MDC products would be made available in both the medical and consumer markets via healthcare doctors, chemists and health food stores via larger, existing companies already robuts in branding and distribution.

- The companyâs overall intention is rebranding to suit the general branding strategy of the clients, with Medlab featuring on the label.

- It is further reported that at the 27th Annual World Congress, which is a major US medical conference, run by the American Academy of Anti-Aging Medicine (A4M), the official launch of the 1st Brand will happen. This conference is scheduled in December 2019.

Moreover, this deal provides substantial opportunity to MDC to further enhance its rapport with ANC and utilise the latterâs manufacturing capabilities, providing ongoing economies of scale for the local market.

Cann Group Limited (ASX: CAN)

Cann Group Limited (ASX: CAN) is a company engaged into the business of breeding, cultivating and manufacturing medicinal cannabis for sale and use within Australia with research and cultivation facilities established in Melbourne.

In February and March 2017, Cann Group acquired the countryâs 1st medicinal cannabis research licence and 1st medicinal cannabis cultivation licence, respectively. One of Canadaâs largest listed medicinal cannabis company, Aurora Cannabis Inc is one of the key investors in Cann Group Limited, with a significant 22.54% shareholding.

Highlights from Cannâs Full-Year Results Presentation

The company released its annual results presentation on 27 August 2019 for the year ended 30 June 2019, with the following key highlights-

Financial Progress

- Recorded revenue of $2,347,668 in FY2019 as compared to $560,00 for the year 2018.

- Loss before transaction costs, finance costs, and expenditure related to income tax amounted to $10,727,408, while for 2018 it was $4,717, 476.

- Total comprehensive loss attributable to members of the group was $10,926,317 in comparison to $ 4,725, 857 for the year 2018.

- Basic and diluted loss per share (EPS) amounted to $0.078 for FY2019 and $0.038 for FY2018.

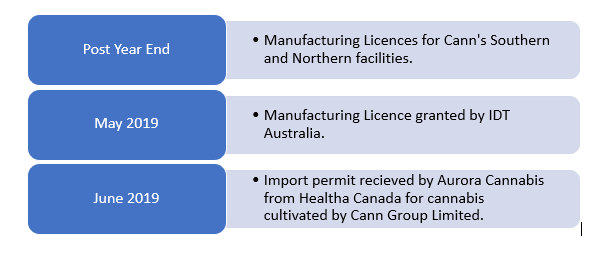

Regulatory Approval

Outlook

On the outlook front, CAN anticipates progress in the development of its Mildura facility, export pathways to be tested with Aurora and commencement of exports as per the supply under the offtake agreement with Aurora Cannabis. Also, the company look forward to commencing IDT manufacturing.

AusCann Group Holdings Ltd (ASX: AC8)

AusCann Group Holdings Ltd (ASX:AC8) is a leading pharmaceutical company focused on developing and commercialising cannabinoid-based pharmaceuticals.

AC8âs Investment Strategy

- The investment strategy of AC8 includes the development of patented products as well as clinical evidence to address significant unmet medical needs improving patientsâ lives.

- AC8 had acquired all the required Australian licences.

- Patented cannabinoid-based capsules that target a variety of indications have been developed, and the company expects to release these capsules for clinical trials by the end of 2019.

- In term of funding, the company is funded with more than $35 million in cash as on 30 June 2019 to implement its strategy in FY2020.

- Additionally, AC8 has a focused distribution of its capital including product development, partnership with health care providers, and product commercialisation.

- Moreover, the company has an experienced medical and pharmaceutical team, supported by global strategic partnerships for achieving growth.

AC8âs Financial Position for 12-Month Period ended 30 June 2019

- For the financial year 2019, the company realised a loss of the consolidated entity amounting to $7,649,221, when compared with the loss for the year 2018 valued $7,668,308.

- Total income for the period stood at $1,532,376, up from $288,878 in FY2018

- AC8âs continued operational expenditure led to a rise in net assets of the consolidated entity to $41,668,347 at 30 June 2019 from $14,112,032 as at 30 June 2018.

Elixinol Global Limited (ASX: EXL)

A global leader in the cannabis industry, Elixinol Global Limited (ASX:EXL) is engaged in commercialising hemp-derived CBD dietary supplements, hemp food and other wellness products. The company is also involved in the cultivation and manufacture of medicinal cannabis products.

Highlights for first half of the financial year 2019 ended 30 June 2019

The company significantly invested in building scale in order to support anticipated future growth.

- Revenue generated from Elixinol branded products stood at $7.5 million, rose by 63%, representing 52% of total US revenue, up 36% on the previous corresponding period.

- For H1 FY19, revenues rose by 19% amounting to $18.3 million, as consequence of a solid sale of Elixinol branded products, compared to H1 FY18.

- Excluding the private business label, revenue growth was recorded at 34% in H1 FY19, compared to H1 FY18.

- First revenues from Europe and the UK were recognized in late H1 FY19.

- Elixinol experienced substantial increase in operating expenses. The expenditure on marketing rose to 21% of revenue for H1 FY19 compared to 7% in H1 FY18.

- Elixinolâs strong balance sheet is reflected by net cash of $47.9 million.

Elixinolâs Financial Summary for H1 2019 (Source: Company Presentation)

Recently, Elixinol presented at the US Investor Conferences held on 03 October 2019.

Creso Pharma Limited (ASX: CPH)

Creso Pharma Limited (ASX: CPH) is focused on the development and commercialisation of superior quality, GMP, CBD nutraceuticals standardised for human and animal consumption.

Robust Revenue Growth from Human Nutraceuticals and Animal Complementary Feed

Highlights from European Operations

- In its market update released on 14 October 2019, Creso Pharma reported more than two folds increase in revenues generated from its nutraceutical product sales, amounting to $1.136 million for nine months till 30 September 2019, relative to the total revenues of FY2018, valued $0.55 million.

- For the full year 2019, it is expected that the estimated revenues from nutraceutical product sales would surpass $2 million, representing increase of more than 260% on the previous corresponding period.

- Further, the company intends to launch four new products in Human Health and three new products in Animal Health category, in the year 2020.

- In Europe, Cresco Pharmaâs operational activities for product development would continue, supported by its partnership with PharmaCielo.

Highlights from Canadian Operations

- Cresco Pharmaâs Mernova Facility at Nova Scotia, Canada, reached full production capacity.

- The company attained licence of the facilityâs processing amendment permitting the packaging of Mernovaâ Ritual Green brand. Also, this lately acquired licence enables preparation for extraction installation as well as value added processing.

Highlights from Australian and New Zealand Operations

- Creso Phrama received first orders for cannaQIX® 50 from Burleigh Heads Cannabis Limited.

- A distribution agreement has been signed with Medleaf Therapeutics, a cannabis company headquartered at New Zealand.

As at 30 September 2019, Cresco Phrama held $3.726 million cash on hand.

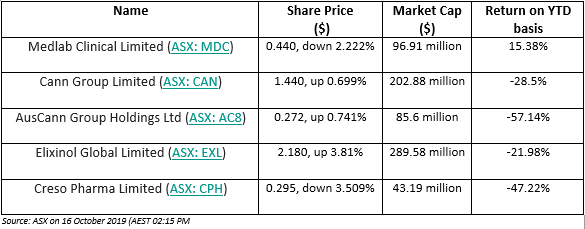

How These Cannabis Stocks are Performing? Letâs have a look.

Source: ASX on 16 October 2019 (AEST 02:15 PM)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.