Australia Energy Sector

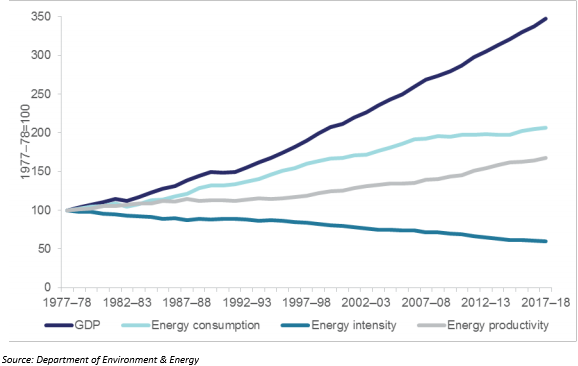

The Australian economy has drifted towards lower energy usage and higher energy productivity over time, as economic growth in Australia over recent decades has generally outpaced growth in energy consumption. The economy of Australia grew by 2.8 per cent in 2017-18 to reach approximately $1.8 trillion. The population of the country grew by 1.6 per cent to reach approximately 25.0 million people. Due to the increased population, the consumption of energy also rose by 0.9 per cent in 2017-2018. Most of the growth in energy usage is witnessed in the mining sector. Oil accounted for the largest share in the energy mix of Australia at 39 per cent in 2017-18, followed by coal and natural gas accounting 30 per cent and 25 per cent respectively.

On 20 November 2019, the S&P/ASX 200 Index last traded at 6,722.40 points, down by 1.35 per cent from its previous close. The S&P/ASX 200 Energy Sector Index closed the market session for the day and declined by 1.55 per cent from the previous close to 11,126.40 points.

Flagship Projects driving Woodside Petroleum Limitedâs growth

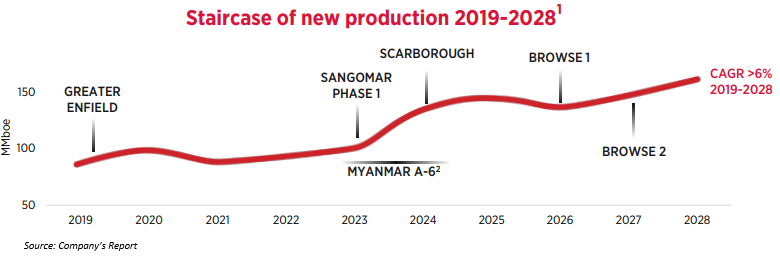

Woodside flagship projects such as Greater Enfield, Scarborough, Sangomar Phase 1, Myanmar A-6 etc, unveil the companyâs future growth plans in the next ten years. These growth plans will double the companyâs equity LNG production by 2027 and deliver significant benefits to shareholders and the broader community. The companyâs Scarborough resource volume increased to 52 per cent which, could meet the increasing demand for the gas in Asia and beyond. Post completion of greater Enfield Project, WPL also achieved the pleasing performance from Ngujima-Yin FOSO with more than 2.5 million barrels of oil produced since restart of the facility. Woodside Petroleum has also signed an HOA with Uniper Global Commodities SE for the supply of Liquified Natural Gas (LNG) for a time frame of thirteen years from 2021. These projects act as a major driver for the company future growth in the next ten years.

Letâs go through the recent updates of Woodside Petroleum Limited from the Energy sector:

Woodside Petroleum Limited (ASX: WPL)

Woodside Petroleum Limited is a leading natural gas producer with a production of 6 per cent of global LNG supply. The companyâs segments include Pluto Liquified Natural Gas, Northwest Shelf and Australia Oil.

Investor Presentation 2019

On 19 November 2019, the company has released the investor briefing presentation for the FY 2019, key highlights from the presentation were as follows;

- The company delivered Greater Enfield and Greater Western Flank Phase 2 projects on time and under budget.

- WPL about to take the final investment decision on the Sangomar Phase 1 development.

- WPL has fine-tuned its 2019 production guidance to 89 - 91 MMBoe.

- The Scarborough resources rose by 500MMboe.

- 6 per cent Compound Annual Growth Rate (CAGR) for production targeted for 2019-2018.

- Targeted production for Burrup Hub of approximately 40 Tcf.

Scarborough Resources volumes soared by 52 per cent

On 8 November 2019, the company has announced the dry gas volume for the Scarborough field has grown by 52 per cent from 7.3 Tcf to 11.1 Tcf. The companyâs interest in Greater Scarborough comprises a 75-cent interest in WA-1-R and a 50 per cent interest in each of WA-61-R, WA-62-R and WA-63-R. The final decision of investment for the development of the project will be targeted in the first half of 2020. The project will be processed on a deep-water floating production unit and shipped through an approx. 430 Km Pipeline to a planned second LNG production train at the existing Pluto LNG facility in the Burrup Peninsula, Western Australia.

Change in Substantial Holding

On 5 November 2019, the company declared the change in the holding of Vanguard Group with, and 6.025 per cent voting power and 56,772,669 shares against 5.022 per cent voting power and 47,017,778 shares held initially.

Production increased by 44 per cent in Q3 2019

On 17 October 2019, the company has declared the third quarter results for the period ended 30 September 2019, a few highlights of results are as follows;

- The company delivered production of 24.9 MMboe, up 44 per cent from the previous quarter.

- Sales revenue soared by 58 per cent to $1,164 million as compared to the previous quarter.

- WPL has attained reliability of 99.7 per cent at Pluto LNG after executing major turnaround activities in the previous quarter.

- The company has executed an agreement for the supply of approx. 3.5 million tonnes of LNG from year 2020 to 2026.

- Final Investment decision has been made by the company for the Pyxis Hub Project which will support the upcoming operation of Pluto

- To Find out the feasibility of a green hydrogen pilot project, WPL signed a non-binding letter of agreement with Korea Gas Corporation.

Dividend Re-Investment Plan

On 13 September 2019, the company had determined a share price for Dividend Reinvestment Plan for the 2019 interim dividend to be paid in respect of the period ended 30 June 2019 to be $31.3447. The price has been decided by the company in accordance with DRP rule. The shares have been issued to the participants of the DRP on 20 September 2019.

Stock Performance

On 20 November 2019, the stock of WPL closed at $33.990, down by 1.278 per cent from its previous close. The company has ~942.29 million shares outstanding and a market cap of $32.44 billion. The stock has generated negative returns of 7.07 per cent in the last six months, while its YTD return stands positive at 12.92 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.