The Information technology sector is one of the fastest growing sectors in the world. The industry usually witnesses shifts at a rapid pace. Whenever there is an innovation in the industry, there is a significant change in the outlook for the industry.

With the emergence of artificial intelligence (AI), machine learning (ML) and cloud computing, the technology industry has a seen a big shift with more and more sectors looking to implement technology to streamline their relevant businesses and make them more efficient, both in terms of quality and time consumed. Information technology in electronic products industry includes companies that are in the business of computer hardware and software, operating systems, web-based information and applications, among others.

In Australia, the S&P/ASX 200 Information Technology had a strong 2019 with returns of 32.97% during the year. Within the sector, WAAAX stocks, which include WiseTech Global Limited (ASX:WTC), Appen Limited (ASX:APX), Altium Limited (ASX:ALU), Afterpay Touch Group Limited (ASX:APT) and Xero Limited (ASX:XRO), have been the standout performers. WTC, APX, ALU, APT and XRO have delivered impressive returns of 32.97%, 37.23%, 75.47%, 144.00% and 90.70%, respectively. WAAAX stocks, just like the FAANG stocks in the US, are the high-growing technology companies which are expected to continue growing and create value for their shareholders.

In the below article, we will be looking at one of the ASX-listed information technology companies and a part of WAAAX, Altium Limited, and deep dive into the growth prospects of the company.

Altium Limited

Altium Limited is engaged in the development and sales of computer software for the design of electronic products. In 1999, the company got officially listed on the Australian Stock Exchange. Altium recently announced that Commonwealth Bank of Australia and its related bodies corporate have ceased to become a substantial holder in the company. Also, it has scheduled to release its half-year results for the financial year 2020 on 17 February 2020.

Let us look at how Altium has performed recently by looking at the company’s financial results in the year 2019. We will also throw light on how some product helped the company to reach decent operational performance.

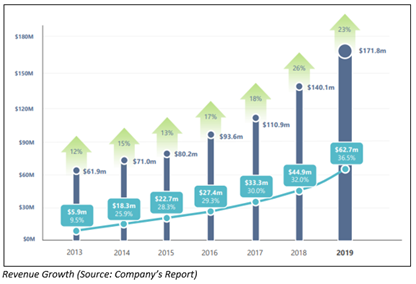

During the financial year 2019, the Altium experienced revenue growth as well as expansion in its profit margins. The favourable financial numbers have proved to be a robust confirmation of the underlying power of the company’s "Line and Length" strategy.

- Operating revenue of ALU stood at US$171.8 million, reflecting a growth of 23.1% for the financial year 2019. The company reported an increase of 41.1% in net profit after tax at US$52.9 million. The company generated earnings per share (EPS) of US$40.57 cents. Further, the company’s EBITDA margin stood at 36.5%.

- The company highlighted that its revenue and EBITDA growth are on target to attain their commitment for fiscal year 2020 amounting to $200 million in revenue and 35% EBITDA.

- Every segment of the company witnessed double-digit revenue growth. The growth aided the increased profits with the help of the strong operating leverage innate in the company.

- During the financial year 2019, the ALU had a strong balance sheet, and operating cash flow for the period stood at US$69.1 million. The group ended the financial year with a cash balance of US$80.5 million after making dividend payments amounting to US$28.1 million.

- The company stated that cash management is one of the important areas of focus as it optimises investments in its long-term vision while delivering a meaningful return to shareholders.

Revenue Growth in Various Business Segment

- Board and Systems business of the company reported revenue amounting to US$126.8 million, with all regions reporting positive results.

- EMEA division reported revenue of US$44.6 million, reflecting a rise of 15%. This segment also continued the transformation of its business model to direct transactional sales in key markets.

- The Americas segment posted revenue amounting to US$50.9 million with a growth of 14%. During FY 2019, the company experienced a revenue growth rate of 37% in its China business.

Also Read: How these two information technology companies are performing?

Let’s now have a look at some of the products of the company, how they have performed during the financial year 2019 as mentioned in the Annual Report for the period ended 30 June 2019. Some of the highlights of revenue growth given by major products of the company as follows:

- The company stated that the Altium Designer license new seats witnessed an increase of 27% with 8,015 seats sold in FY 2019. Altium Designer helps an individual to create multichannel and hierarchical designs effortlessly. It also mentioned that the subscription pool, including term-based licenses, experienced a growth of 13% to reach 43,698 subscribers.

- Also, the growth rate of the subscription pool is consistent with the requirement to attain the 2020 financial goal of US$200 million in total revenue for FY 2020.

- Another product, Altium Nexus, reported revenue amounting to US$6.6 million, reflecting a growth of 38% as compared to the previous year. Nexus is Altium’s enterprise-level product for customers who are in the requirement of structured collaboration with data management functionality. During FY 2019, the Nexus team had built the organisational capability for managing the solutions selling process at a level which would translate into substantial revenue.

- Significant customer interaction, as well as alignment via structured assessment and specific deployment capability, are the prime requirements for the sales process of Nexus.

Future growth prospects of Altium

Altium places its business in terms of four zones, each with different investment and return profiles for the next phase of growth. It also outlined the following growth perspective for the future as follows:

- The company is committed to becoming the market leader in Printed Circuit Board design software. By 2020, the company is dedicated to attaining revenue amounting to US$200 million. Also, by 2025, the company is expecting to achieve market dominance as well as to enrol 100,000 subscribers.

- The growth drivers of the company revolve around the creation of electronics via the rise of smart connected devices, which would support growth for its business in the upcoming future.

- The company’s growth prospects also include the pursuit of partnerships as well as M&A opportunities for supporting its long-term vision in order to create a product design and realisation platform.

- ALU’s next stage of growth would be distinctly different as compared to its previous stages, and it would be pursuing Industry Transformation via Market Dominance, which requires execution on two parallel tracks.

- As stated by the company Altium Designer, NEXUS, TASKING would be in the dominance zone, while Altium 365 and Octopart will be placed in the transformation zone.

The stock of ALU closed the day’s trading at $41.540 per share on 07 February 2020, an increase of 0.63% compared to its previous closing price. The company has a market capitalisation of $5.41 billion, and the total outstanding shares of the company stood at 130.97 million. The 52-week low and high is $25.050 and $41.910, respectively. The company has generated a total return of 31.72% and 30.47% in the last three months and six months, respectively. ALU has a P/E ratio of 71.360x.

While the company has made investors rich over in the past with an astronomical increase in share prices over the last five years, a similar return is uncertain given the high P/E ratio of the company. However, the company is on track to deliver impressive growth and could be in focus in 2020.