Summary

- During the COVID-19 crisis, the world is witnessing a surge in cryptocurrency usage.

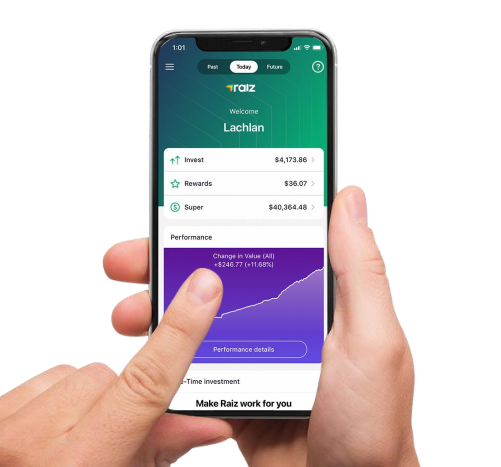

- Raiz Invest launches a new investment portfolio that offers investors access to the most popular cryptocurrency - bitcoin.

- Australia is a growing market for digital currencies trading.

- PrimeXBT is an award-winning trading platform that offers traditional assets and cryptocurrency trading.

- PrimeXBT is ready to capitalise on the increasing interest of traders in these assets.

In a world being driven by the coronavirus crisis, most of the industries are facing the wrath of the pandemic. However, there are very few areas like the cryptocurrency space that has experienced its best time during the crisis. The cryptocurrency is based on a secure and revolutionary IT technology called the blockchain.

As the name suggests, blockchain means a chain of blocks and these blocks store information that cannot be changed once recorded, which means that no one can manipulate the data. There is no central administration in blockchain technology, and the data remains shared for everyone in the chain.

That said, many countries were earlier not recognising cryptocurrency as a legitimate currency. However, recently, countries began to identify it as a sound investment. During the worldwide pandemic, cryptocurrency usage is booming all around the world. Furthermore, many young and female users have started using cryptocurrencies.

INTERESTING READ: Cryptocurrency usage booms amid COVID-19 crisis

Raiz's Sapphire - new bitcoin investment portfolio

Source: Company’s Announcement

Amid growing interests of traders in cryptocurrency trading, ASX-listed Raiz Invest Limited (ASX:RZI), the country's leading micro-investing app has introduced its new investment portfolio to offer investors exposure to the digital currency, bitcoin. The investment portfolio will have a five per cent target allocation to bitcoin. It has been developed in 18 months and designed to meet the growing interest of traders in bitcoin and cryptocurrencies.

ALSO READ: Bitcoin Testing Multiple Resistance Zones, While Potential Bearish Flag Emerges on Daily Chart

Apart from 5 per cent dedicated to bitcoin, the remaining 95 per cent of the portfolio will consist of large-cap stocks of Australia, Europe, the US, and Asia. Also, money markets and Australian corporate debt, all via exchange-traded funds (ETFs).

Raiz CEO George Lucas said the Sapphire falls in the high-risk group. However, going by the customers' feedback, investors are looking for exposure to digital currencies, and the portfolio has been specially designed for traders with an appetite for bitcoin trading.

The minimum recommended investment timeframe is over five years, and the investment goal of the portfolio is to offer exposure to bitcoin in a managed and risk-adjusted way. Many of the company's investors are millennials who could afford long term investment through Sapphire portfolio, Mr Lucas added.

The government is printing more money globally due to the pandemic crisis, and in such a scenario bitcoin will get more space in investors' portfolios in the future. Moreover, financial advisers' interest is growing in the digital currencies for the clients, but there are very few financial advisors who recommend this high-risk investment.

Raiz Invest always listens to the customers' requirements and offers investment portfolios of their choice, which ranges from conservative to aggressive. Since, its first investment portfolio in 2016, it has followed this strategy deliberately to offer what's in demand.

In 2017, the company launched the Emerald portfolio, which was designed as per customers requirement of investment options that are responsible ethically, socially, and environmentally.

Following the trend, the Sapphire portfolio also reflects the growing demand for investment in the digital currencies, especially during COVID-19 crisis where clients want to re-examine the investment options, added Mr Lucas.

Raiz will use exchange Gemini to trade and store bitcoins. Gemini is New York Trust company offering cryptocurrency exchange services. It is founded by Winklevoss twins and regulated by New York State Department of Financial Services. The exchange provides a comparatively safe platform for trading.

Jeanine Hightower-Sellitto, Gemini MD of operations said that the team is excited that Raiz has launched a new portfolio to offer investment in bitcoin and selected Gemini as trusted digital currencies exchange. The portfolio will provide an opportunity to invest in digital currencies in a thoughtful and regulated manner.

RZI was trading at $0.695 with a market cap of $52.47 million on 27 May 2020, down by 0.714 per cent (at AEST 01:41 PM).

Cryptocurrency market grows in Australia, PrimeXBT Platform expands operations in the country

Image Source: Pixabay

Australian traders have recently developed more interest in cryptocurrencies and traditional assets that includes trading of gold, oil, and stock indices. PrimeXBT is a trading platform for bitcoin, stock indexes and forex. The company is growing and expanding globally around Europe, Asia, and the rest of the world.

During the COVID-19 crisis, when we have heard more of layoffs, PrimeXBT is hiring and expanding in Australia. The company looks to be all set to capitalise on the growing interest in bitcoin trading.

At a time, when traditional markets were poorly hit due to the unprecedented crisis, PrimeXBT has experienced record-breaking trading volume during mid-March. Now, more and more traders are using the PrimeXBT platform. After the mid-March Black Thursday market crash, many traders shifted from crypto to traditional markets but interest in bitcoin also increasing among the traders.

The digital currency industry has just begun to grow in the country, and PrimeXBT platform provides a bitcoin-based trading platform for the trading of crypto and traditional assets. It is an award-winning trading platform that is expanding and creating awareness across Australia and New Zealand. PrimeXBT has recently posted for job vacancies for hiring customer service representatives for the company's 24/7 live chat team.

The company has a fixed pattern of expanding, if we look at other regions where it expanded earlier, first market buzz starts, then come job listings and next traders all over the region start sharing their P&L and referral links. It is to be seen if this pattern will continue in Australia.

On this platform, you get exposure to both the market cryptocurrencies as well as traditional markets, including forex, gas, oil, gold, Australian dollar, and ASX 200. The platform allows you to build a diverse portfolio as it offers a variety of assets. The platform provides short and long positions, built-in charts with technical analysis indicators.

NOTE: $ denotes Australian dollar, unless stated otherwise.