The Banking Sector of Australia is a key contributor in developing the economy of the nation. The sector forms a portion of the nationâs economy, which concentrates on the financial assets making a consistent contribution towards creating wealth.

Of late, the banking sector of the country, has been buzzing with updates related to RBAâs interest rate cuts, Royal Commission and housing sector. At the time of writing, on 2 August 2019, the S&P/ASX 200 BANKS (INDUSTRY) under the code XBK was trading at 2,583.8, down by 0.41% (at AEST 2:28 PM).

Letâs discuss the five banking sector stocks with decent CET1 ratio.

Bank of Queensland Limited

Bank of Queensland Limited (ASX: BOQ) is an Australian registered bank, which is involved in the provisioning of financial services to the community. Bank of Queensland Limited was officially listed on ASX in 1971.

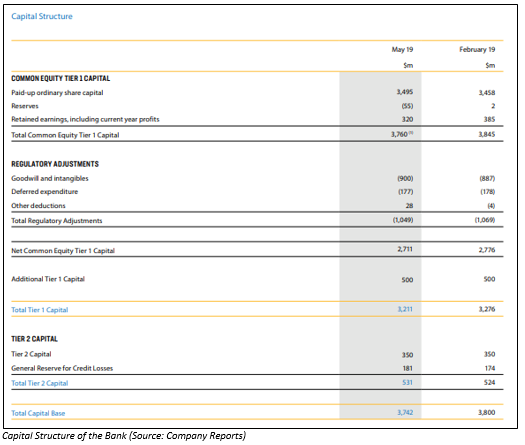

Recently, the Bank, via a release dated 26th July 2019 updated the market with APRA Basel III pillar disclosures for the quarter ended 31 May 2019. The bank added that the disclosures requirement is under the Australian Prudential Regulation Authority or APRA Prudential Standard APS 330. The bank further stated that its capital management strategy targets to ensure adequate capital levels must be maintained in order to protect depositors. BOQâs capital is measured and managed in accordance with Prudential Standards issued by Australian Prudential Regulation Authority. Adding to that, the bank updated that the capital management was planned annually, and the plan is then submitted for an approval from Board of the Bank.

Besides, the bank reported that the Common Equity Tier 1 Capital Ratio was of 8.9% (as on 31st May 2019) as compared to 9.3% (as on 28 February 2019) and posted the total Capital Ratio of 12.3% (as on 31st May 2019).

Additionally, it has also set the Common Equity Tier 1 Capital ratio in the ambit of 8.25% and 9.5% and the Total Capital target in the vicinity of 11.75% and 13.5%. The following picture provides a broader idea of capital structure of the bank. However, in the 1H FY19, the bank had reported a decline of 8% in cash earnings.

In another an update on 31 July 2019, the company, via a release announced that it has appointed Mr Peter Sarantzouklis for the role of Group Executive BOQ Business, with effect from 12th August 2019.

At the time of writing on 2nd Aug 2019 (AEST 1:32 PM), the stock of Bank of Queensland was trading at a price of A$9.19 per share, down by 0.863 percent (at AEST 2:58 PM), with a market capitalisation of A$3.76 billion. The stock has provided returns of -1.89%, 4.95% and -8.26 in the time span of one month, three months and six months period, respectively.

Australia and New Zealand Banking Group Limited

Australia and New Zealand Banking Group Limited (ASX: ANZ) is an Australian registered banking group, which provides banking and financial products and services to individual as well as business customers. It got listed on Australian Stock Exchange in 1969.

On 2 August 2019, notified that the aggregated percentage of voting shares in ANZ, in respect of which its associated entities have power to control voting or disposal and voting shares underlying derivatives, when last required, and when now required, to provide a notice to the ASX are 21,831,948 total number of ordinary fully paid shares, with a 0.77 percentage of total number of shares.

Recently, on 31 July 2019, ANZ via a release announced that CNY 2,500,000,000 4.75 per cent, fixed rate subordinated notes are due 30th January 2025. The issuer i.e Australia and New Zealand Banking Group Limited in the release stated that interest payment and record date are 30th January 2020 and 29th January 2020, respectively. Recently, the bank has decreased the fixed interest rates.

In another update, Australia And New Zealand Banking Group Limited, via a release dated 29th July 2019 announced that after receiving notification from the Australian Prudential Regulation Authority that the new risk weight floors would be applied to farm lending portfolios for Level 2 reporting and the New Zealand mortgage. It further mentioned that new risk weight floors were in response to a rise in risk weights applied by the Reserve Bank of New Zealand.

The new risk weight floors will have following impact such as ANZâs Level 2 Common Equity Tier 1 capital ratio to witness a reduction of a 20-basis point, which will be effective 30th September 2019. However, ANZâs Level 1 capital ratioâs no impact and the higher risk weights for NZ were effectively incorporated into the Level 1 ratio (as on 31 March 2019). Adding to that, the Level 1 is the ADI excluding subsidiaries and Level 2 is the Group including banking subsidiaries.

ANZâs Level 2 CET1 capital ratio stood at 11.8%, which was in excess of Australian Prudential Regulation Authorityâs unquestionably strong need of 10.5% (as on 30th June 2019).

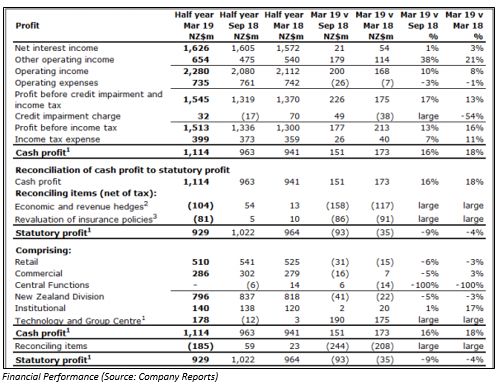

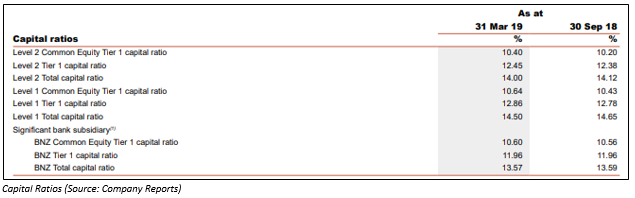

The following image provides an overview of financial position of the company.

At the time of writing on 2nd Aug 2019 (AEST 3:21 PM), the stock of Australia And New Zealand Banking Group Limited was trading at a price of A$27.680 per share, down by 1.178 percent, with a market capitalisation of A$79.4 billion. The stock has provided returns of -0.95%, -0.21% and 12.35% in the time span of one month, three months and six months period, respectively.

Commonwealth Bank of Australia

Commonwealth Bank of Australia (ASX: CBA) provides banking and finance related services such as retail, business and institutional banking, fund management etc. It was officially listed on ASX in 1991. On 2 August 2019, the bank announced that it has ceased to become a substantial holder of National Storage Holdings Limited, National Storage Financial Services Limited and National Storage Property Trust effective 1 August 2019. It further notified the market on the conclusion of the divestment of its Colonial First Global Asset management to Mitsubishi UFJ Trust and Banking Corporation. The final sale proceeds stand at $4.2 billion but is subject to the conclusion adjustments. Post which, it is being anticipated the transaction would be able to provide a rise of $3.1 billion of CET1 capital.

Recently, on 31 July 2019, the bank via a release announced that it has ceased to become a substantial holder in Arena REIT Limited, Arena REIT No. 1, and Arena REIT No. 2 from 29th July 2019. Moving forward, it also made a change in its substantial holding in Aurelia Metals Limited (ASX:AMI) with voting power of 7.03% effective 26 July 2019 in comparison to the previous voting power of 5.67%.

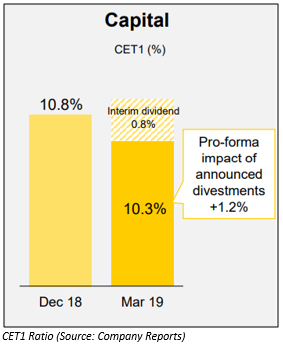

Also, in the March 2019 quarter, the company reported CET1 ratio of 10.3%.

In another update, the bank had notified the market via a release on 25th July 2019 that it received a nod from the regulatory authorities for the divestment to Mitsubishi UFJ Trust and Banking Corporation of Colonial First State Global Asset Management, a Commonwealth Bank of Australiaâs global asset management business.

At the time of writing on 2nd Aug 2019 (AEST 3:41 PM), the stock of Commonwealth Bank of Australia was trading at a price of A$82.02 per share, with a market capitalisation of A$145.02 billion. The stock has provided returns of -0.49%, 8.5% and 17.43% in the time span of one month, three months and six months period, respectively.

Westpac Banking Corporation

Westpac Banking Corporation (ASX: WBC) is engaged into provision of financial services, which includes lending, accepting deposit, payments services etc. WBC was listed on Australian Stock Exchange on 18th July 1970. Westpac Banking Corporation updated the market with the help of release that Mr Steven John Harker has made a change to his holding in WBC by acquiring 10,365 Westpac fully paid ordinary shares at the consideration of $28.8455 per fully paid ordinary share. The change in holding was made on 25th July 2019. Previously, the company has revised its strategies related to Wealth.

Revision of Rating

As per the release, dated 17th July 2019, Westpac announced that Fitch has confirmed its Long-Term issuer default rating at AA-. However, Fitch also revised the outlook of WBC from âStableâ to âNegativeâ. Adding to that, Westpacâs New Zealand subsidiary, Westpac New Zealand Limited has also witnessed the same action from Fitch. Turning towards the S&P outlook revision, S&P Global Ratings has affirmed its AA- long term and A-1+ short-term issuer credit ratings. WBC also added that S&P has also revised its outlook for Westpac and the other major Australian banks from âNegative to âStableâ.

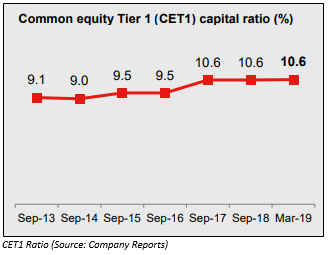

Westpac reported Common equity Tier 1 (CET1) capital ratio of 10.6% in March 2019, which reflects that WBC has maintained a strong balance sheet.

At the time of writing on 2nd Aug 2019 (AEST 3:52 PM), the stock of Westpac Banking Corporation was trading at a price of A$28.765 per share, down 0.122%, with a market capitalisation of A$100.51 billion. The stock has provided returns of 1.52%, 2.35% and 17.17% in the time span of one month, three months and six months period, respectively.

National Australia Bank Limited

National Australia Bank Limited (ASX: NAB) provides banking and financial services. The bank was officially listed on Australian Stock Exchange in 1974.

On 2 August 2019, NAB notified that pursuant to its USD100,000,000,000 global medium term note programme, NAB would be issuing USD1,500,000,000 3.933 percent subordinated notes due 2034 on 2 August 2019.

Recently, on 30th July 2019, the company had notified that Ms Susan Ferrier has been hired as the Chief People Officer of NAB. On 19 July 2019, NAB updated that it had also appointed Ross McEwan as Chief Executive Officer and Managing Director of the group, However, the appointment of Ross McEwan is subject to regulatory approvals.

APRA Requirement

On 11 July 2019, NAB had noted the announcement from the Australian Prudential Regulation Authority (or APRA) regarding the requirements of additional capital to the three major banks in response to risk governance self-assessments.

Adding to that, the Australian Prudential Regulation Authority would be requiring NAB to hold an additional $500 million of operational risk capital. This additional capital requirement would lead to 16 bps on CET1, which was based on capital position of the bank on 31st March 2019.

However, the company reported Common Equity Tier 1 capital ratio of 10.40% (as on 31st March 2019) in comparison to 10.20% (as on 30th September 2018).

Also, on 8 July 2019, the bank had declared a dividend of AUD1.0729, which was fully franked and relates to a period of one quarter. The dividend also relates to the payment period ended 7 October 2019. It has a record date of 30 September 2019 and the payment date is due on 8 October 2019.

By the closure of the trading session, on 2nd Aug 2019, the stock of National Australia Bank Limited was at a price of A$28.41 per share, down 0.803%, with a market capitalisation of A$82.57 billion. The stock provided returns of 6.87%, 20.39% and 19.49% in the time span of one month, three months and six months period, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.