An IPO while the world deals with a pandemic? A rather strong and confident move, we would say!

It took an extremely short period of time for global markets to move into the bear territory in the face of COVID-19 crisis. However, while the market has been ostensibly making investors nervous, the Australian share market, known for its rock-solid investing style welcomes a new Company on the ASX- Atomo Diagnostics Limited (ASX:AT1), a medical device entity.

What’s interesting is the fact that a couple of days post the ASX debut, AT1 has received a second purchase order from a French diagnostics company to supply an additional 550k integrated blood test devices for the rapid blood-based testing of antibodies produced in response to COVID 19.

We will deep dive into AT1’s latest purchase order, but foremost, let us acquaint ourselves with the Company that is one of newest hottest stocks currently on the exchange-

Atomo Diagnostics- Simply Better Diagnostics

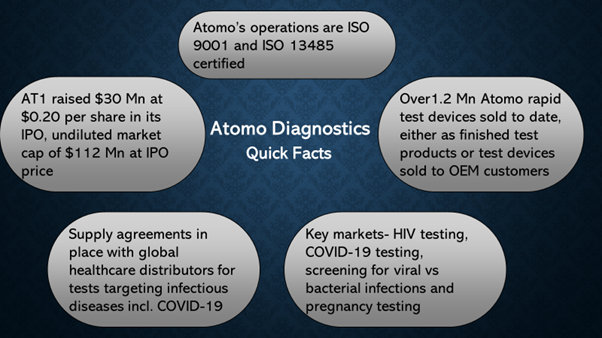

Australian medical device player headquartered in Sydney, AT1 is an internationally accoladed company that supplies unique, integrated rapid diagnostic test (RDT) devices to the global diagnostic market. It has emerged as a global leader in the development of point of care devices for RDT; the all-in-one RDT platforms makes it simpler for users to test and screen for chronic conditions and infectious diseases.

The patented devices make testing procedures simpler and boost the usability for untrained self-testers as well as professional users. The Company’s HIV self-test has regulatory approval in Australia (TGA) and the EU and UK (CE) and stands prequalified by WHO.

AT1 Bags Second Purchase Order For COVID 19 Blood Test Devices

In recent weeks, the Company had announced strong interest in the use of its integrated rapid test device for the testing of the ongoing pandemic. AT1’s Founder, MD and CEO, Mr John Kelly has been vocal about ways in which the Company is utilising technology from its HIV RDTs to make a product that will be used testing for COVID 19 infection.

On 15 April 2020, AT1 intimated that it has received its second purchase order from NG Biotech, SAS, a French diagnostics company, to supply a supplementary 550k integrated blood test devices to be used for the rapid blood-based testing of antibodies produced in response to COVID19. The order pertains to for the period from May to July 2020.

The NG Biotech rapid test is CE Marked for professional use in Europe for the novel coronavirus testing. The Company aims to bring forward the planned expansion of its production capacity to meet the expected ongoing demand for COVID 19 test devices and continue to support its existing HIV distributors and other original equipment manufacturing (OEM) customers.

The recent second order follows an initial purchase order for 397.2k devices in late March 2020. The total number of devices ordered now stands at 947.2k. The Company intimated that the supply agreement offers NG Biotech the right to buy up to 2.465 million worth devices during CY20.

Reportedly, both the companies propose to enter into a further binding purchase agreement for the continuing supply of AT1 products post 2020. The agreement covers supply of devices to France and the UK, including to the French Ministry of Defense.

It should also be noted that the Atomo rapid test device has secured professional as well as self-test approvals in Europe as an HIV screening rapid test and the HIV Self-Test is the only HIV product approved in Australia by the Therapeutic Goods Administration (TGA) for self-test use.

All About AT1 IPO

AT1’s proven technology has been deemed to be the globe's first wholly integrated, blood-based rapid test devices. The Company is addressing a large global market with US$4.57 billion lateral flow test revenues recorded globally in 2019 and has recently established a market position with more than 1.2 million devices sold.

The newest feather in AT1’s cap has been its oversubscribed IPO on the ASX and the first ASX virtual bell ringing listing, wherein the Company successfully raised $30 million at a price of $0.20 per share. The undiluted market capitalisation being $112 million at the IPO price and enterprise value being $80.31 million, the float was supported by strong institutional and retail investor demand.

Mr Kelly stated that AT1 started the listing process to underpin the expansion of the Company’s global HIV business and commercialise other opportunities in the rapid blood test market. However, through the offer period, the Company noticed that it is uniquely placed to make a key impact in the COVID 19 situation.

Currently, AT1 is well-capitalised and can possibly adhere to the substantial global demand for dependable rapid testing for the virus in the community, says Mr Kelly.

The IPO is likely to support accelerated commercialisation and scale up of the Company’s manufacturing capacity. Breaking this down, the funds raised will be applied to the expansion of the manufacturing and distribution capacity to support demand for tests using the Company’s devices, including of COVID-19, HIV and other purposes and continue to support its existing HIV distributors and other OEM customers.

Bottomline

AT1’s vision is to improve health outcomes globally as it accelerates developing growth opportunities and delivering sustainable value to its customers, partners and shareholders. The Company has already demonstrated the transformative impact of rapid HIV detection globally, recently witnessed a successful public offering that can facilitate its technology to the commercialise COVID 19 test devices.

This can be regarded as a key milestone for AT1 and could offer the Company with a leadership spot in diagnostic testing, lessening stress on healthcare systems and lifting patient access to testing globally.

On 17 April 2020, the stock quoted $0.52, up by 33.333% relative to its last close.