Financial technology companies or fintech companies use technology to provide their customers with efficient and better financial services.

On 23 October 2019 at 2:21 PM AEST, the S&P/ASX 200 Financials (Sector) was trading down by 0.4% at 6,368.6. On the contrary, the S&P/ASX 200 Information Technology (Sector) was trading up by 0.02% at 1,329.8. The benchmark index S&P/ASX 200 was trading down by 0.3% at 6,653.6.

Noticeably, most sectors have been tumbling of late, a major cause being the protracted trade war between the US and China, which has hampered Chinaâs quarterly economic revenue growth and factory production.

Australia is Chinaâs top trade partner and consequently, any impact on Chinaâs economy would leave a mark on the Australian economy.

In China, the buy now and pay later services have become very popular. Over 90% of the population in China avails this service for making payments, with WeChat Pay or Alipay as their primary means of payment.

In this article, we would cover two fintech companies that provide the buy now and pay later services and have experienced an impact on their share price.

Zip Co (ASX: Z1P)

FY2019 Highlights:

- Revenue of the company in FY2019 increased by 108% to $84.2 million.

- Number of customers was up by 80% to $1.3 million as compared to FY2018.

- Transaction volume increased by 108% to $1,128.5 million, receivables went up by 116% to $682.6 million and retail partners grew by 53% to 16.2k.

- Net bad debt declined by 1.63%.

- Loss after income tax during the period declined by 51% to $11,133,810.

FY2020 Growth & Outlook:

- In FY20, Z1Pâs priorities include targeting 2.5 million customers with an active Zip account.

- The company would also target to deliver $2.2 billion in annualised transaction volume.

- Launch the instalment product for SMEs (Zip Biz).

- Grow Spotcap.

- Secure more strategic deals with partners.

- Enter daily spend categories and speed up acceptance.

- Integrate PartPay and increase its market share in New Zealand and fast track the launch in the United Kingdom.

- Seek new market opportunities where strategic fit is solid.

- Invest in brand awareness, customer acquisition, along with partner marketing.

FlexiGroup Limited (ASX: FXL)

humm retailer update

On 26 September 2019, FlexiGroup Limited announced that it had added several high-profile retailers to its Buy Now Pay Later platform, humm, registering strong growth in the key homeware, retail and health verticals. Across its key verticals in the first two months of FY2020, the company reported a soared volume growth of 85% as compared to the previous corresponding period.

Retailers are attracted to FXLâs unique offering, broader demographic and spending power of the platform. Since July 2019, 3,000 seller locations were added, and the total number of retail partners reached 18,000 by September 2019. The financial YTD overall transactions increased by 25% y-o-y, due to an increase in the purchase of Little Things (up to $2,000 which grew by 67%).

Merchants who have joined the humm platform are.

- Hanes Australasia

- KOOKAÃ

- ISHKA

- Hallenstein Glasson Holdings Limited

- Zanui Homewares

- JPG

- Bevilles

- Oxford

- com.au

- com.au

- SurfStitch

- Novo

- Mitre 10

- Home Timber & Hardware

- RedEarth Energy Storage

- Aussie Farms Group

- Hearing Choices

- Smile Solutions

- Core Dental

- Smiles Group

- Baxter Blue.

FY2019 Results- Active customers grew by 8%

- For FY2019 (year ended on 30 June 2019), there was an increase in active customers by 8% as compared to the previous corresponding period (pcp).

- Number of retail partners increased by 8% to 65,000.

- Transaction volume went up by 12% to $2.56 billion on pcp.

- Cash NPAT for FY2019 was $76.1 million (in line with the revised guidance).

- FXL announced the launch of three new products during the period- bundll, cartt and wiired.

- Significant progress was made during the period for simplifying product suite and business systems.

- The company declared a fully franked dividend of 3.85 cents per share, bringing the FY2019 total dividend to 7.70 cents per share.

Operational Highlights:

- Since the launch of humm in April 2019, it has attracted 63,000 new customers and 5,000 new merchant signings, with 65,000 merchants in its kitty. Daily, 1,200 apps were downloaded.

- The company also noted an increase in the Australian Credit Card volumes by 10% and portfolio income growth of 39% due to strong growth in receivables along with a 21% rise in interest-bearing balances.

- There was also an increase in the New Zealand Buy Now Pay Later volume by 383%.

- New Zealand Credit Card volumes went up by 12%. The interest-bearing balances grew by 10%.

- The company reported consumer leasing NPAT of $5.1 million, an outcome of the improved collection processes.

FY2020 Outlook:

Post FY2019, the company has taken several initiatives to expand the reach of FlexiGroup into the new market segment. The first is bundll (an extension to the Buy Now Pay Later offering), second is cartt, and the third is wiired (Product designed for the Small and Medium Enterprises).

Conclusion

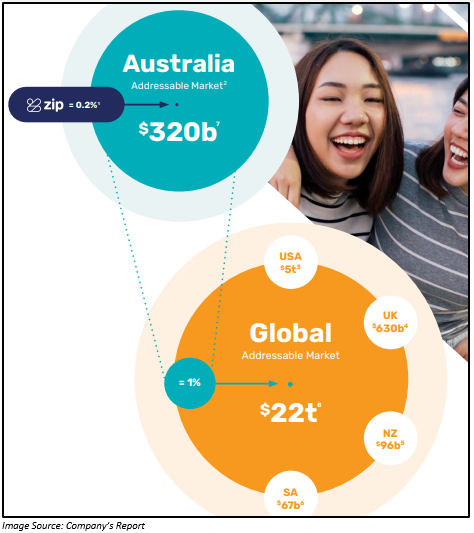

As highlighted in the Annual Report, Zip Co has started building its global presence, and since 2018, it has progressed towards its mission to be a lucrative payment choice.

Along with various retailers (majorly from Australia) associated to the humm platform of FlexiGroup, the presence of the companyâs offerings in Australia is on a growth trajectory.

China is the largest trading partner of Australia in terms of import as well as export whereas Australia is its sixth-largest trading partner. Australia is the fifth-largest supplier of imports and its tenth largest customer for exports is China. 25% of its manufactured imports come from China.

Based on the growing popularity of the buy now pay later services, there could be huge scope for these companies in China, though the trade war might pose adverse repercussions.

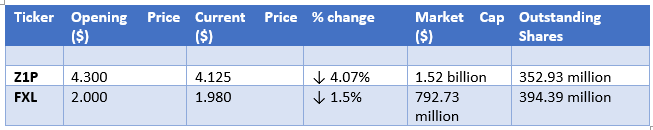

Stock Price Information

As at 3:50 PM AEST:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.