The âBuy Now Pay Laterâ (BNPL) industry has flourished a lot in recent times. Due to which, the investors are keeping a close track of the major players from this industry. Letâs take a closer look at the recent updates of these stocks.

FlexiGroup Limited (ASX:FXL)

A provider of the diverse range of finance solutions, FlexiGroup Limited (ASX: FXL) has added a number of high-profile retailers to its BNPL platform, namely humm, etc. In an update provided on 22nd July 2019, the company informed that it humm platform is dominating key homewares, electrical and health verticals. Various homewares and home improvement retailers, electrical and health providers have joined the humm platform. It is believed that hummâs differentiated offering, broader demographic and spending power is attracting retailers. Since the month of May 2019, the company added 2,000 seller locations, taking the total to 15,000 partners.

The merchants joining the humm community include:

- Temple & Webster - A leading online retailer of homewares and furniture in Australia.

- Sunboost - A leading solar provider of residential and commercial solar electricity in Australia.

- Williams Sonoma, Pottery Barn, Pottery Barn Kids and West Elm

- Various electrical retailers, including Bing Lee, Betta Electrica, Bi-Rit, Retravision and Jaycar.

- Among other health providers, 1300 SMILES has also joined the humm community.

FXLâs shares were up by 10.574% during todayâs intraday trade.

In a recently released notice regarding the change of interests of the substantial holder, the company informed that its substantial holder, Renaissance Smaller Companies Pty Ltd now holds 26,917,946 FPOs with a 6.83% voting power. Earlier, Renaissance had 8.00% voting power.

In the first half of FY19, the company delivered a cash NPAT of $31.9 million, which was 22% down on pcp. The company reported a statutory NPAT $31.3 million as compared to the statutory loss of $48.9 million in the previous half, demonstrating growth of 164%. In the half year period, the companyâs corporate debt increased by $47 million as compared to pcp while its gearing increased to 70% as compared to 44% in the first half of FY18.

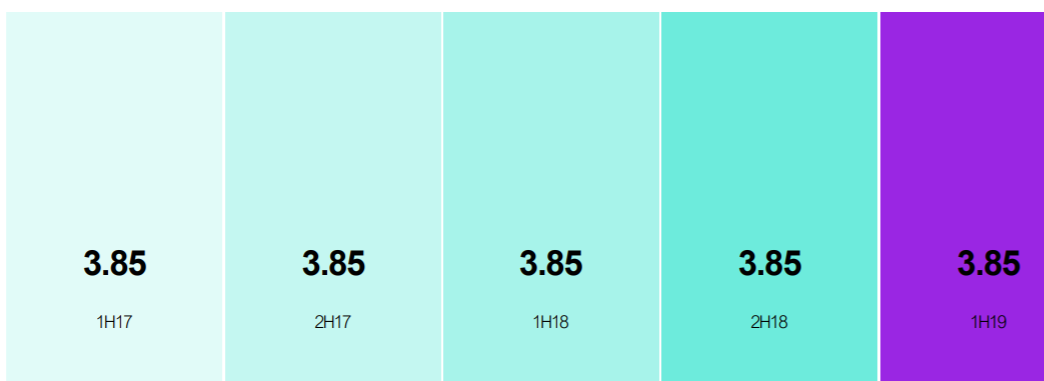

For the half year period, the company declared an interim dividend of 3.85 cents per share (cps), fully franked, in line with the trend, as depicted in the figure below.

Dividend Information (Source: Company Reports)

Board Changes: In the month of April 2019, the company announced the appointment of highly experienced Elizabeth Minogue to the role of Chief Revenue Officer.

Stock Performance: On the stock performance front, the share price of the company has provided a year-to-date return of 22.59% as on 19th July 2019. In addition, for the last six months, the share price of the company has increased by 13.75% as on 19th July 2019. FXLâs shares are trading at a PE multiple of 8.850x and an annual dividend yield of 4.65%. Its 52 weeks high price is at $2.340, and 52 weeks low price is at $0.97, with an average volume of ~1,279,484.

At market close on 22nd July 2019, FXLâs stock was trading at $1.830, with a market capitalisation of circa $652.72 million and a daily volume of ~3,209,465.

Splitit Payments Ltd (ASX:SPT)

The online payment solutions market is making sure that it remains relevant and appealing to the merchant and customer preferences. Splitit Payments Ltd (ASX: SPT), a leading provider of payment method solutions, is trying to establish itself as a prominent player in this market. The companyâs core technology is patent protected in countries like the US, Japan, Russia and Singapore.

Ever since the company released its Payment Platform in 2016, it has witnessed significant growth while the number of merchants using the Splitit Payment Platform has increased year-on-year to the third quarter of 2018. The company is led by CEO and Managing Director, Gil Don and Executive Director, Alon Feit, both having extensive experience in the payments, technology, e-commerce as well as in the financial services sector.

The companyâs solution is currently deployed in 27 countries. In FY 2018, the company witnessed significant growth in key financial metrics.

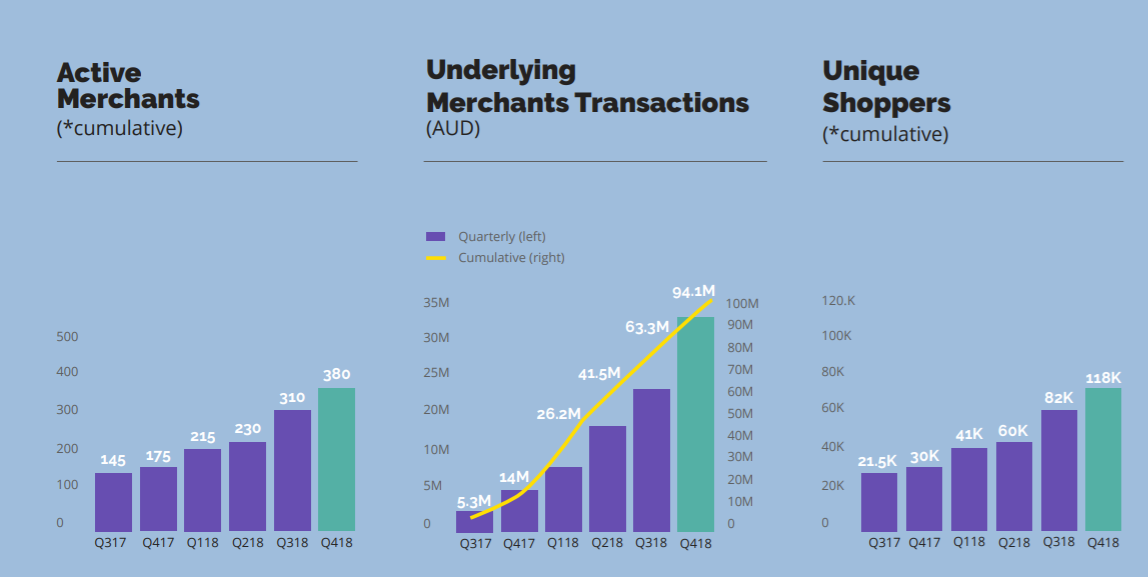

The companyâs active merchants have increased by 117% over the year, while its unique shoppers have increased by 293%. The underlying merchant transactions increased by 253% in 2018 to $80.2 million as compared to 2017. The company believes that its addressable opportunity within key markets is US$4.5 trillion. During 2018, the company was able to establish new merchant relationships in the USA, United Kingdom, France, Italy, Australia and Singapore.

After a successful IPO in January 2019, Splitit Payments Ltd witnessed significant growth in merchants and user take-up.

Key Metrics by Quarter (Source: Company Reports)

The company provides the business process and technology platform to enable merchants to offer Buy Now Pay Later instalments to credit card holders. Splitit is the only global card agnostic instalment solution, which is accepted in more than 27 countries. The companyâs technology supports Visa, Mastercard and UnionPay card schemes, with 48 global payment gateways.

On 22nd July 2019, the company announced a partnership with GHL ePayments Sdn Bhd to provide Splititâs instalment solution to online merchants in Malaysia, Indonesia, Thailand, and the Philippines.

Following the release of this news, SPTâs shares witnessed an increase of 8.911% during the dayâs trade.

Splitit Payments Ltd has signed a three-year partnership agreement with GHL ePayments Sdn Bhd, under which, GHL merchants will be able to provide Splititâs instalment payment solution to their customers so that they could pay for online purchases with an existing credit card, splitting the cost into interest and fee-free monthly payments. It is expected that this partnership will help Splitit to grow in the APAC region and expand its presence in multiple industries.

Earlier in July 2019, the company announced a partnership with Kogan.com, which was in line with SPTâs strategic vision of partnering with Australiaâs largest retailers. The company signed an agreement with Kogan.com Limited, under which, it will provide a unique instalment payment solution for online purchases in Australia through the Kogan.com website, which will help the company in growing its business in the Asia Pacific region.

The company has recently completed a placement and a Share Purchase Plan (SPP), raising a total amount of $30.3 million. These funds will be used to increase the companyâs capacity to fulfil the current excess demand as well as to pursue its growth strategy at a faster rate.

Besides being a global solution, the Splitit Payment Platform is an omni-channel solution, which enables monthly payments online, on mobile and in-store as well as is a cloud-based solution that is pre-integrated with all major credit card processors.

Stock Performance: On the stock performance front, the share price of the company has provided a negative return of 51.90% for the past three months as on 19th July 2019. Besides, in the last one month, the share price of the company has decreased by 23.48%. At market close on 22nd July 2019, SPTâs stock was trading at $0.550, with a market capitalisation of circa $155.3 million and a daily volume of ~6,470,548.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.