The cannabis industry is the world’s nascent and most dynamic industry. Cannabis has become a multibillion-dollar global boom from being a criminalised drug in a short time. It is expected that the requirement of cannabis would increase in future, as the chronic pain diseases are increasing and there is an increasing requirement for the effective pain management remedies globally.

As the countries liberalise cannabis legislation for medical and recreational use, it is predicted that the industry would grow rapidly in upcoming years. According to some research and media reports, the global cannabis market currently worth $8 billion and it is expected that the hemp-derived CBD market hit approximately $22 billion by 2022.

Even though the marijuana industry is the fastest growing industry across the world but there are also some risks associated along with the industry growth. In this article, we are highlighting the risks as well as opportunities associated with the cannabis market.

The cannabis industry comprises of three divisions- primary, secondary and tertiary. The primary division comprises raw material providers (seed providers and cultivators), secondary division comprises manufacturers who transform raw materials into products (product manufacturers), and tertiary division comprises retailers and supporting service organizations (ancillary service providers).

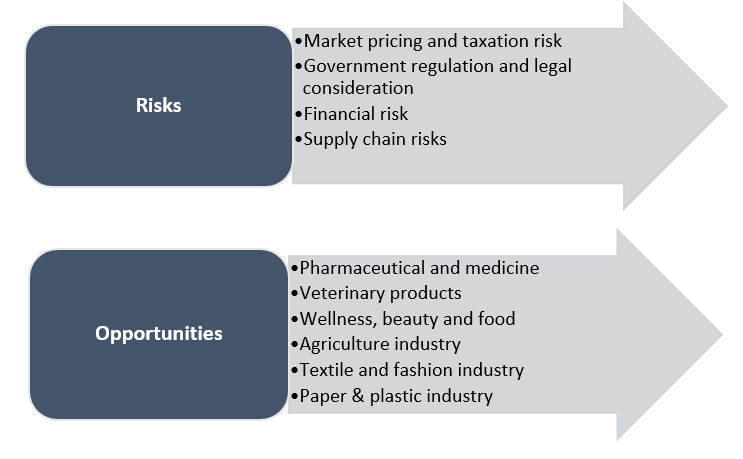

Risk & Opportunities associated with the cannabis industry are-

Market pricing and taxation risk- To attract customers, the price of cannabis products, especially those intended for recreational use, should be lower than their black-market value. If the government costs cannabis products too high or if black market suppliers undercut rates of products available in stores, the companies involved in growing and selling the products might not be able to sell enough product to turn a profit.

Government regulation and legal consideration- Legal Risk can be seen in terms of regulation, contractual obligations, the threat of litigation and structural risks faced by an industry or a business.

Financial risk- The legality of marijuana further impacts how the company conducts business, pays taxes, does its banking and purchases its insurance, posing a financial risk to the business.

Supply Chain risk- Supply chain risks are associated with the primary, secondary and tertiary players of the industry.

Besides all the above-mentioned risks, the marijuana industry is still expanding. Let us now discuss the business opportunities for the cannabis sector players-

Pharmaceutical and medicine- Cannabis is revolutionizing the way several ailments are being treated worldwide and is increasingly seeing applications in pain treatment, anxiety, sleep disorders, as well as fibrotic problems and neuropathic pain.

Veterinary products- Now some companies are also marketing cannabis for veterinarians and pet owners with access to cannabis-derived high quality, evidence-based pharmaceutical products to boost well-being and health of animals. One ASX listed company CannPal Animal Therapeutics Limited (ASX:CP1) developing innovative and naturally derived therapeutic plant based products for animals to target the endocannabinoid system.

Wellness, beauty and food- The applications of marijuana-derived products across the wellness and beauty sector are rapidly developing, particularly cannabidiol (CBD) oil is attracting a lot of attention. Likewise, the food industry has seen cannabis edibles take off over the last decade and in Australia a comprehensive variety of cannabis related consumer foodstuffs including sleep-inducing tea, coffee, drinks etc. was legalised in 2017.

Moreover, hemp products could be used in the agriculture industry, textile and fashion industry, paper industry. Hemp derived products could also offer an alternative and more eco-friendly option to plastic.

Let us now zoom lens over three ASX listed cannabis stocks- CAN, CP1, AC8

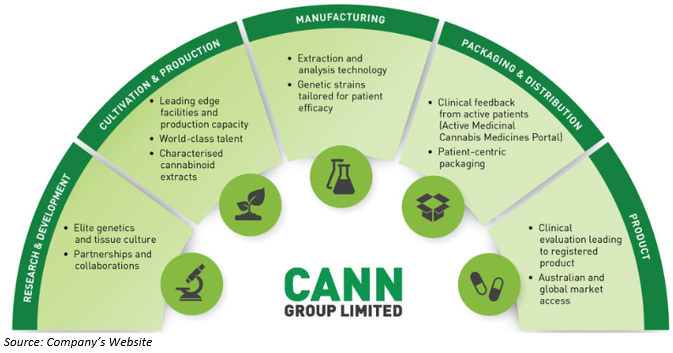

An ASX listed cannabis sector player Cann Group Limited (ASX:CAN) is engaged in building a world-class business that is focused on breeding, cultivation and manufacturing therapeutic cannabis for sale and use in Australia. In Melbourne, Cann Group has established R&D and cultivation facilities and the company is endeavouring to offer access to therapeutic cannabis for patients in Australia.

Can group is the 1st company to receive a Cannabis Research Licence form the Australian Government (Office of Drug Control) in February 2017 and license for the cultivation of medicinal cannabis was issued in March 2017.

GMP extraction of medicinal cannabis resin-

In an announcement dated 07 January 2020, Cann Group and IDT Australia Limited (ASX: IDT) have jointly updated the market that the good manufacturing practice (GMP) extraction activities for the first batches of resin derived from medicinal cannabis are underway.

The extracted resin will be used as an Active Pharmaceutical Ingredient in the formulation and packaging activities at IDT to manufacture GMP medicinal cannabis oil products. Moreover, the cannabis oil derived formulations would also be made available for buying as an active pharmaceutical product.

After the packaging, the products would be tested for stability to support its commercial release which is targeted for release in late March 2020.

Stock Performance-

On 10 January 2020, the CAN’s stock closed the day’s trading at $0.945, soared 11.17% from its last closing price. The company’s market capitalisation stood at approximately $121.06 million, with nearly 142.42 million shares outstanding. The 52 weeks high and low price of the stock was noted at $2.570 and $0.375, respectively. The stock has delivered a positive return of 36.00% on a year to date basis and 107.32% in the last one month.

CannPal Animal Therapeutics Limited (ASX:CP1)

An ASX listed animal health company CannPal Animal Therapeutics Limited (ASX:CP1) is engaged in providing veterinarians and pet owners with access to plant derived high quality, evidence- based therapeutic products to promote better animal health and well-being.

CannPal is presently focused on developing nutraceutical and pharmaceutical products for dogs by using compounds derived from cannabis and hemp plant. The company is also focused on the commercialisation of therapeutic products in various markets across the world.

Exclusive Licencing Agreement with CSIRO-

In an announcement dated 06 January 2020, the company unveiled that the evaluation of microencapsulation of oils derived from hemp with the Commonwealth Scientific and Industrial Research Organisation (CSIRO) has been completed.

CSIRO has granted an exclusive global licence to the company for the commercialisation of its proprietary MicroMAX® microencapsulation technology to be used in Animal Therapeutics field, following an eighteen months evaluation.

It was further reported that, in the first quarter of 2020, CannPal would start a commercial trial (small-scale) to market test a new product format in a selected consumer group. The product format will be a combination of the anti-inflammatory formulation and MicroMAX®.

Moreover, this market test is to complement regulatory focused lead products of CannPals which remain its core priority.

Stock Performance-

On 10 January 2020, the CP1’s stock closed the day’s trading at $0.160. The company’s market capitalisation stood at approximately $14.9 million, with nearly 93.13 million shares outstanding. The 52 weeks high and low price of the stock was noted at $0.200 and $0.091, respectively.

AusCann Group Holdings Limited (ASX:AC8)

An Australian-based pharmaceutical company AusCann Group Holdings Limited (ASX:AC8)

is focused on the development and distribution of pharmaceutical products based on cannabinoid within Australia as well as across the globe. The company is working with the belief that patients in Australia have the right to access cost effective, high quality cannabinoid medicines.

AusCann’s hard-shell capsules under clinical evaluation-

In mid-December 2019, AusCann unveiled that the company has released its cannabinoid-based solid-fill capsules for clinical evaluation.

The end objective of clinical evaluation is to provide significant exposure information to notify the selection of dose and the company will update the market once the clinical evaluation initiates.

These cannabinoid-based capsules would be commercially available in Australia for prescription during the first half of the calendar year 2020.

Stock Performance-

On 10 January 2020, the AC8 stock closed the day’s trading at $0.315, up by 6.78% compared to its last closing price. The company’s market capitalisation stood at approximately $93.53 million, with nearly 317.05 million shares outstanding. The 52 weeks high and low price of the stock was noted at $0.790 and $0.170, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)