Consumer Staples sector includes companies that manufacture and distribute products such as beverages (including beer and alcohol), food items, household products, personal products, and tobacco. The demand for consumer staples remains constant throughout, and thus, the sector is mostly unaffected by the changes in economic cycles. In this article, we look at five consumer staples companies.

Woolworths Group Limited (ASX:WOW)

Woolworths Group Limited is Australiaâs largest supermarket chain and is engaged in food, general merchandise and specialty retailing.

The company held an EGM on 16th December 2019 intending to obtain approval of shareholders for the internal restructuring of Woolworths Group.

Key Points at the EGM

- WOW proposed an internal Restructure of Woolworths Group to create Endeavour Group which would enable the combination of the drinks business of WOW and ALH Group into a single legal entity.

- The company highlighted that it had been simplifying its business portfolio over the last three years, which has benefited the shareholders with a total shareholder return of 64% over the last three years ending June 2019.

- The company believes that post the restructuring both businesses would release the latent growth capability and concentrate on the changing needs of customers.

- WOW added that the Restructure Scheme is subject to shareholders approval as well as the Federal Court approval later in the week. In the event of successful authorization from shareholders and Federal Court, the company intends to implement the Restructure in early February 2020.

- At the current market price of A$37.6995 per share, the annual dividend yield of the company stood at 2.73%.

Also Read: Class action proceedings against Woolworths Group Limited

The stock of WOW closed the dayâs trading at $37.585 per share on 17th December 2019, reflecting a fall of 0.12%. WOW has provided a total return of 3.84 percent and 16.50 percent in the period of 3 months and 6 months, respectively.

Coles Group Limited (ASX: COL)

Coles Group Limited is a leading Australian retailer offering everyday products such as fresh food, general merchandise, liquor, financial services etc via its chain of stores as well as online. The company recently announced that The Vanguard Group, Inc., and its controlled entities, had become a substantial holder in the company with the voting power of 5.007% as on 26th November 2019.

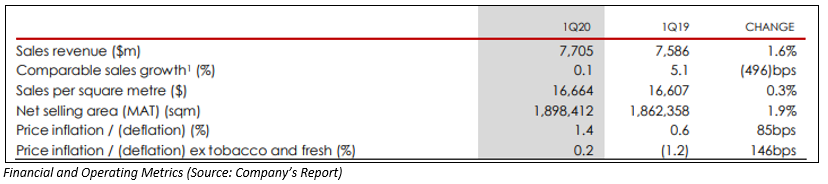

Sales Growth in all segments in Q1 FY20

- The company recently reported its Q1 FY20 results with an increase of 1.8% in sales revenue ($8.7 billion).

- During Q1 FY20, Supermarkets segment witnessed a comparable sales growth of 0.1%, exceeding the strong sales achieved in the pcp.

- The company is currently making investments to provide the best value food as well as drink solutions by reducing the cost of breakfast, lunch as well as dinner with an emphasis on meal solutions and Own Brand fresh products.

- COL has continued investment in the Liquor store network during the Q1 FY20 with the opening of 7 new stores and the closing of three stores. As a result, there were a total of 914 retail liquor sites at the end of Q1 FY20.

Also Read: How Reduction of cost is important for retail industry?

The stock of COL closed the dayâs trading at $15.320 per share on 17th December 2019, reflecting a rise of 0.591%. COL has provided a total return of 3.25 percent and 20.28 percent in the period of 3 months and 6 months, respectively.

Treasury Wine Estates Limited (ASX:TWE)

Treasury Wine Estates Limited is engaged in the production, marketing, sales and distribution of wine as well as growing and sourcing of grape. The company recently announced that The Capital Group Companies, Inc. had made a change to their substantial holding in the company on 11th December 2019 and the current voting power stands at 8.5917% as compared to the previous voting power of 9.6508%. In another update, the company announced that it had appointed Ben Dollard as President of its Americas operations.

TWE addressed the shareholders in its AGM held on 16th October 2019. The AGM included key addresses from the Chairman as well as the CEO.

Highlights of Chairmanâs Speech

- The Chairman of the company stated that the several initiatives taken by the company throughout the year had demonstrated a focus on world-class innovation, winemaking and marketing.

- A key initiative was the introduction of plans to get the best grapes of Napa Valley to the Penfolds stable, also crafting Penfolds wine from the California 2018 harvest onward. Also, the company collaborated with Champagne House Thiénot.

- The company maintains financial metrics coherent with an investment grade credit profile. TWEâs balance sheet continues to be robust, efficient and flexible.

- Considering the strong financial result in FY19, the company declared a fully franked final dividend amounting to 20 cps, bringing the total dividend to 38 cps, a rise of 19% as compared to the previous year. The annual dividend yield of the company stood at 2.25% at the current market price of A$16.785 per share.

Also Read: How are US and Asian Markets for Wine related companies

The stock of TWE closed the dayâs trading at $16.690 per share on 17th December 2019, reflecting a rise of 0.12%. TWE has provided a total return of -9.30 percent and 11.88 percent in the period of 3 months and 6 months, respectively.

The A2 Milk Company Limited (ASX: A2M)

Australia based, The A2 Milk Company Limited is the quality branded dairy nutritional entity, which concentrates on products including the A2 beta-casein protein. The company recently announced that Carla Jayne Hrdlicka has ceased to be a director of the company on 9th December 2019.

Extension of Supply Agreement

- The company, through a release dated 19th November 2019, announced that it had provided its acceptance for a modification to its comprehensive supply and manufacturing arrangements with Synlait Milk Limited (ASX:SM1). The agreement forms a crucial part of its global supply strategy.

- The supply agreement, announced on 3rd July 2018, for a2 Platinum® and other nutritional products provided for a minimum term of 5 years, with a rolling 3-year term from 1 August 2020. The revised agreement primarily includes an extended period of two years, effectively providing for a new minimum term to 31st July 2025 at the earliest.

The stock of A2M closed the dayâs trading at $14.560 per share on 17th December 2019, reflecting a rise of 0.414%. A2M has provided a total return of 6.62 percent and 4.62 percent in the duration of 3 months and 6 months, respectively.

Coca-Cola Amatil Limited (ASX: CCL)

Coca-Cola Amatil Limited is one amid the leading bottlers and distributors of non-alcoholic beverage and alcoholic ready-to-drink in the Asia-Pacific region. The company recently announced that it had appointed Ms Penelope Winn as Non-Executive Director on the Board of the company, which came into effect on 2nd December 2019.

Interim and Special Dividends

- For the half year ended 28th June 2019, the company experienced a growth of 5.2% in group revenue, indicating the outcomes of strategic initiatives throughout the Group.

- The company declared total unfranked dividend amounting to 25.0 cps, which comprises interim dividend of 21.0 cps and a special dividend of 4.0 cps.

- During the period, the company witnessed strong sales growth in Indonesia driven by strong execution and investments in marketing as well as in PNG from operational improvements.

The stock of CCL closed the dayâs trading at $11.310 per share on 17th December 2019, reflecting a rise of 1.709%. CCL has provided a total return of 1.18 percent and 11.61 percent in the period of past 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.