On 14 August 2019 (AEST 12:03 PM), the S&P/ASX 200 Information Technology (Sector) was up by 1.28% to 1,282.7. On the other hand, the benchmark index S&P/ASX 200 was up by 0.08%to 6,568.5.

Letâs take a look at the recent developments of six IT stocks along with their performance on the ASX.

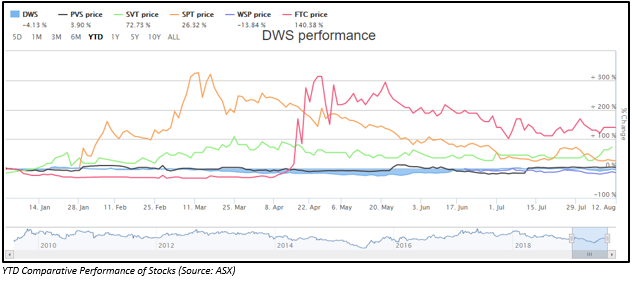

YTD Comparative Performance of Stocks, As on 13 August 2019 (Source: ASX)

DWS Limited

DWS Limited (ASX:DWS), an information technology company, is a provider of services like IT consulting, program & project management, managed application, digital transformation, customer-driven innovation, data and business analytics, strategic advisory and productivity as well as robotic process automation. On 13 August 2019, the company released results related to its performance during the financial year ended 30 June 2019.

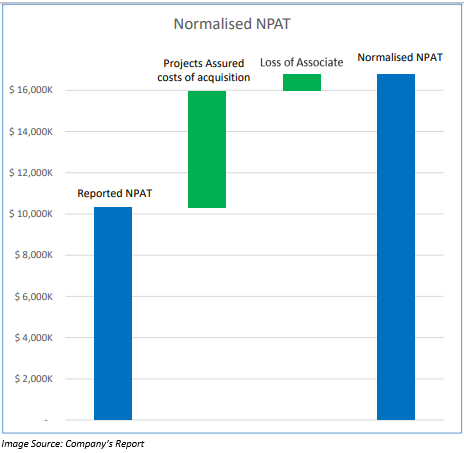

Its revenue from continued operations was up by 29.7% to $ 163.5 million as compared to the previous corresponding period (pcp). The companyâs underlying EBITDA for the period stood at $ 26.4 million, a 15.7% increase from the same period a year ago. There was a significant decline in net profit after tax of 35.3% to $ 10.3 million during FY19, driven by a change in the accounting treatment of acquisition costs. Normalised NPAT was up by 5.4% year-on-year to $ 16.8 million for the year ended 30 June 2019. The companyâs bank debt during the year increased by $ 10 million to $ 42 million, as a result of Projects Assured acquisition as well as investment in RPA and licensed products. The dividend declared for the period is A$ 0.04 per share.

The balance sheet witnessed a fall in net assets due to a significant increase in total liabilities during the financial year 2019. The total shareholders' equity at the end of the year stood at $ 70.578 million.

Its net cash inflow through operating activities and financing activities was $ 14.977 million and $ 20.135 million, respectively, at the end of the financial year 2019. The net cash outflow from investing activities increased from $ 1.431 million to $ 34.360 million, while net cash at the end of FY2019 stood at $ 8.880 million.

Outlook: Depending on the market conditions, DWS expects a further improvement by Projects Assured in the Federal Government work in Canberra. The company also expects improvement in the digital space with enhanced profitability. It would focus on good cost management, continued growth and margin improvement. The other areas of focus would include monitoring investments in licensed products during FY2020. The company would also try to leverage benefits from its core as well as acquired businesses.

Stock Performance: On 14 August 2019 (AEST 12:04 PM), the price of the shares of DWS was A$ 1.150, down 1.709% from its previous closing price. DWS has a market cap of A$ 154.24 million and ~ 131.83 million outstanding shares.

Pivotal Systems Corporation

A leading provider of innovative gas flow control (GFC) solutions, Pivotal Systems Corporation (ASX:PVS), on 2 August 2019, released a cleansing notice, under which it highlighted the issue of 49,791 shares, as a result of the exercise of unquoted options.

The company, on 24 July 2019, provided an update on Q2 FY2019 ended 30 June 2019. During the period, the company achieved the preferred supplier status for Standard GFC as well as High Flow GFC at a leading Original Equipment Manufacturer (OEM) in the United States. It also obtained a record booking for Standard GFC and the High Flow GFC at a top Integrated Device Manufacturer (IDM) from China. Additionally, the company attained qualification along with numerous repeat orders for the High Temperature GFC with a top Japanese OEM. The company was also able to qualify the standard GFC at a top European foundry. It also qualified and obtained repetitive orders at a top Japanese Logic IDM. The company also obtained repetitive orders at a leading Taiwanese IDM. A second Flow Ratio Controller was transported to one of the top Korean IDMs. It also cleared the ISO 9001:2015 recertification.

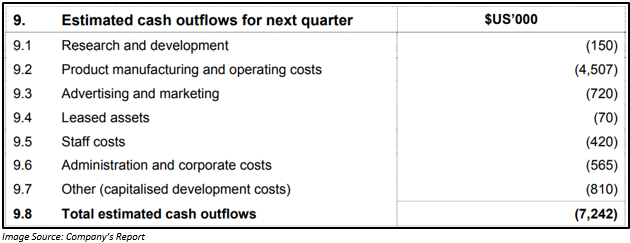

Financial Highlights: The company reported unaudited revenue of US$ 8 million for 1H 2019. The net cash outflow from operating as well as investing activities of the company was US$ 2.854 million and US$ 0.838 million, respectively. The net cash inflow via financing activities was through the exercise of the option, which generated US$ 0.034 million. The net cash available with the Pivotal Systems Corporation by the end of Q2 FY2019 was US$ 9.805 million. Estimated cash outflow in Q3 2019 would be ~ US$ 7.242 million.

Stock Performance: On 14 August 2019 (AEST 12:05 PM), the price of the shares of PVS was A$ 1.620, up 1.25% from its previous closing price. PVS has a market cap of A$ 178.38 million and ~ 111.49 million outstanding shares.

ServTech Global Holdings Ltd

ServTech Global Holdings Ltd (ASX: SVT), a multinational software company that develops Virtual Reality (VR) and Augmented Reality (AR) solutions, announced an additional agreement work in a new industry for Vection Italy Srl (Vection) which is SVTâs 100% owned subsidiary.

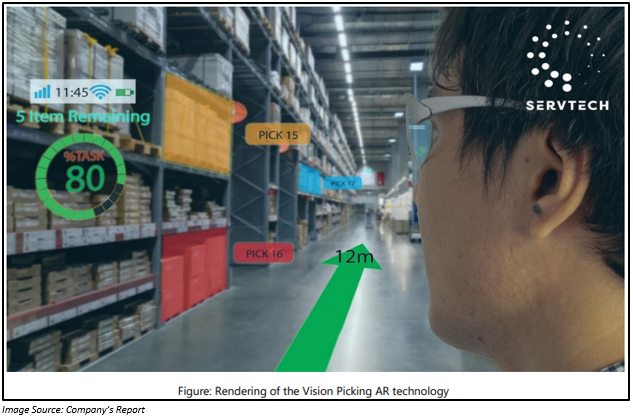

Under this additional agreement work, Vection is supposed to deploy its AR technology into the logistics industry through an arrangement with Alfacod Group, which is a leading logistics and traceability solutions provider based out of Italy. It would help Vection in generating revenue up to ~ $90,000.

The application of the AR technology would support employees in the logistics industry by offering correct information at the proper place and time. AR technology also helps in identifying the position of the correct product, thereby helping to reduce time as well as the related warehousing operation costs, which is around 20% of all logistics costs. It also helps in lowering picking errors and search time.

The company is in negotiations with Alfacod regarding the further distribution of the existing VR & AR products and services of Vection.

Stock Performance: On 14 August 2019 (AEST 12:06 PM), the price of the shares of SVT was A$ 0.018. SVT has a market cap of A$ 11.83 million and ~ 657.17 million outstanding shares.

Splitit Payments Ltd

A leading global monthly instalment payments solution provider, Splitit Payments Ltd (ASX: SPT), on 13 August 2019, announced its partnership with Ableton AG.

Ableton AG ranks amongst the top providers of music software in the world. Its unique software and hardware products assist musicians, sound designers, and artists worldwide in creating, producing as well as performing music.

As a partner, the company would be providing its monthly instalment payment solution, Splitit Payments Platform, to the online customers of Ableton AG in the regions of North America and South America, Australia, and select countries in the European Union. Against this service, the company would be earning merchant fees for each transaction undertaken by the customer via the platform.

Stock Performance: On 14 August 2019 (AEST 12:07 PM), the price of the shares of SPT was A$ 0.465, down 1.064% from its previous closing price. SPT has a market cap of A$ 144.54 million and ~ 307.53 million outstanding shares.

Whispir Limited

Recently on 29 July 2019, Whispir Limited (ASX: WSP), a global scale software-as-a-service company offering communications workflow platform which automates communication between businesses as well as people, released its Q4 activities and cash position report for the period ended 30 June 2019.

The company in the fourth quarter reported a 22% increase in cash receipts to A$ 8.3 million as compared to the previous corresponding period. New customers were acquired during the period. Also, the usage of the platform increased by existing customers. There was also a strong demand for the companyâs software, on track as highlighted in the prospectus forecasts. The company also launched developers.whispir.com to extend its Application Programming Interface plan for developers.

Q4 also saw the beta integration of new EventBridge software of Amazon Web Services (AWS). Thus, increasing the functionality by allowing the users to develop latest event-triggered integrations without writing any code. The company also completed the migration of APAC customers to the cloud-based services of AWS.

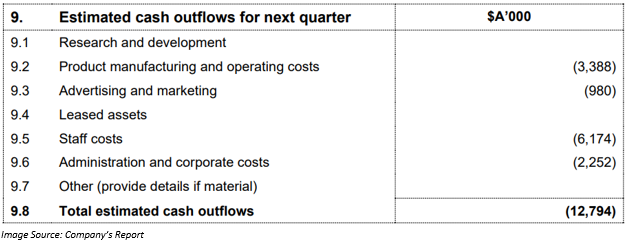

Financial Highlights: Whispir Limited, during Q4 FY2019, used A$ 4.663 million in its operating activities and A$ 1.208 million in its investing activities. The net cash inflow from the companyâs financing activities was A$ 29.888 million. By the end of Q4 FY2019 on 30 June 2019, the available cash with WSP was A$ 26.791 million. Expected cash outflow in Q1 FY2020 would be A$ 12.794 million.

Stock Performance: The WSP stock last traded on 13 August 2019 at A$ 1.350. WSP has a market cap of A$ 139.59 million and ~ 103.4 million outstanding shares.

FinTech Chain Limited

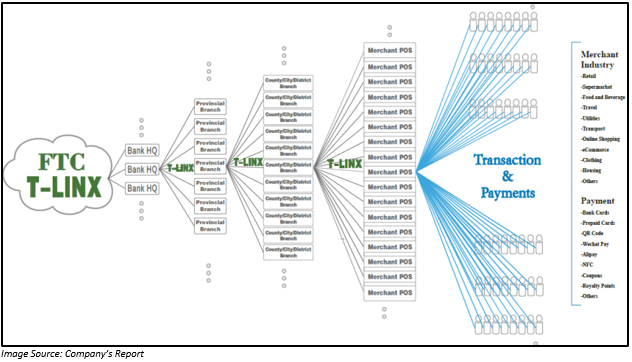

Leading FinTech provider, FinTech Chain Limited (ASX: FTC), on 13 August 2019, announced its agreement with the Huanan Rural Credit Union for the deployment of its integrated TLinxTM system in the latterâs banking payment solutions.

The intention of the company for establishing a strategic alliance was to incorporate TLinxTM for facilitating and accelerating the billing checkout process and providing the customers with the most reliable and safest banking solution.

The agreement would help the company in generating recurring revenue of three basis points for any TLinxTM initiated payment transactions in Heilongjiang after the expansion and commercialisation of TLinxTM in other parts of Chinese provinces such as Shaanxi, Hunan, Xinjiang and Shanxi.

Stock Performance: The FTC stock last traded on 13 August 2019 at A$ 0.130. FTC has a market cap of A$ 84.6 million and ~ 650.77 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.