In the recent past, Asset management companies have grown in terms of FUM as well as revenues. Some of the Asset management companies in Australia have posted decent results despite Equity market volatility across the globe. Letâs have a look at four such companies:

Platinum Asset Management Limited

Platinum Asset Management Limited (ASX :PTM), is associated in Fund managing and has both retail and corporate clients. The headquarters of the company is located at Sydney, Australia. The company derives revenue by charging a professional fee from the investors.

FY19 Financial Highlights: Recently the company released financial results for the year ended 30 June 2019.Total revenue in FY19 came at $299.3m lower by 15.3% from FY18 revenue followed by a 17% decline in net profit at $158.3 million. Staff costs came at $43.6m, a 17% y-o-y decline followed by custody and unit registry costs at $12.8m and $7.1m business development cost. Total costs for FY19 amounted to $76.4m, a decline of 10% y-o-y.

Operating performance: In the last five years, Platinum International Fund generated a compound return (CAGR) of 9.5% p.a. and a cumulative return of 57.3%, respectively. Meanwhile, the broader market performance was better at a CAGR of 12.6% and a cumulative return of 81.4% during last five years. During last one year, the Index has generated a return of 11.3% whereas Platinum has given a nominal return of 0.7%. Platinum has a mandate to invest 65% of FUM across global equity. While the global market hasnât performed well during recent past, the performance of the Fund has also came under the scanner as it has not performed according to expectations.

(Source: Companyâs Report)

Gross inflows in FY19 was at $2,721m, down by 27% y-o-y followed by full year net outflows at$246m. Retail inflows slowed during second half due to negative investor sentiment. Sentiment was affected due to market volatility and last yearâs tepid returns. The variance between first half inflows and second half outflows was caused due to increase in redemptions and reduced inflows.

The fund house got a Retail fund inflow of $201m over the year while institutional fund flows were stable with marginal net outflows of $59m during the year. The fund house recorded zero account closure in FY19.

Dividend announcement: For the second half, the Board has announced a final fully franked ordinary dividend of 14 cents per ordinary share held. The ex-dividend date for the 2H FY2019 is 27 August 2019 followed by the record date of ordinary dividend is on 28 August 2019. The payment date was announced on 20 September 2019. Dividend yield ratio of the company stands at 6.73%.

Stock performance: The stock PTM was closed at $4.020, up by 0.249% from its previous close. The stock made a 52-week low of $3.960 and a high of $5.860 and currently the stock is priced at the lower side of its 52-week trading range. The daily volume of the stock on 23rd August was at 2,038,718. The total market capitalisation of the stock was at $ 2.35 billion with a P/E multiple of 14.84x.

Perpetual Limited:

Perpetual Limited (ASX:PPT) is an Australia based fund management company engaged in portfolio management, financial planning, trustee, responsible entity and compliance services, executor services, investment administration and custodial services. The headquarter of the company is located at Sydney, Australia. The company has $27.1 b of funds under management.

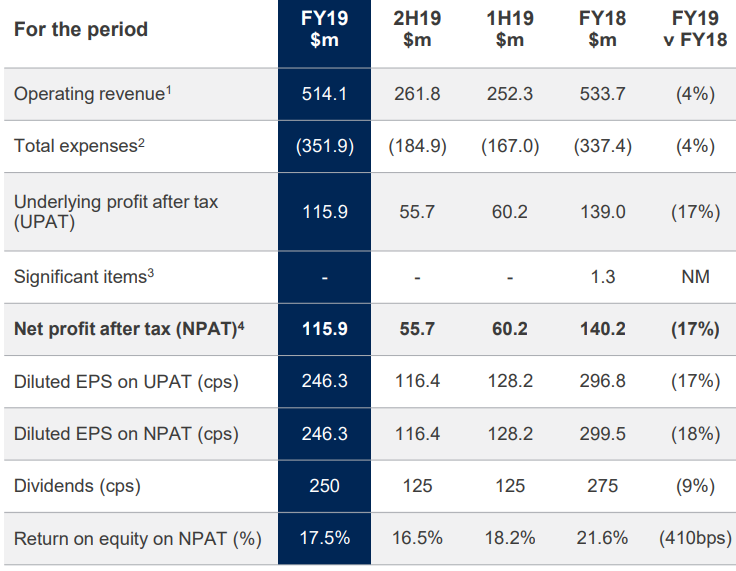

FY19 results for the year ended 30th June 2019: PPT posted FY19 revenue at $514.1m, an 4% y-o-y decrease while net profit came at $115.9m against $139m in FY18. Staff costs were down by 7.8% y-o-y followed by expense on technology came 7.8% more than FY18. Cash stood at $299.6m, while goodwill was valued at $345.8m at the end of 30th June 2019. The balance sheet had corporate debt amounting to $87m and a liquid investment of $69.7m. Net Asset of the company was valued at $662.2m. PCT delivered revenue growth in both Management Fund Services and Debt market services. Higher PCT revenue reflected growth in both MFS and DMS as well as data services growth following RFi acquisition. Lower Perpetual Investment revenue impacted due to lower net flows and lower fees.

(Source: Companyâs Report)

Dividend announcement: The Board announced a fully franked ordinary dividend of 125 cents per ordinary share held. The ex-dividend date is on 4 September 2019 and the record date is on 5th September 2019. The payment date of dividend is 30th September 2019. Dividend yield of the company stands at 6.96%.

Stock update: On 23rd August 2019, the stock of PPT last traded at $35.060, down by 2.449% from the previous closing. PPT has a market capitalisation of $1.67 billion and shares outstanding of 46.57 million. The stock has given negative returns of 8.71% and 18.32% in the last six months and one year, respectively.

Netwealth Group Limited:

Netwealth Group Limited (ASX : NWL) is engaged in managing funds, investor portfolio managing services for its clients. The company is headquartered in Melbourne, Australia. The companyâs clients are mostly wealth professionals and retail investors.

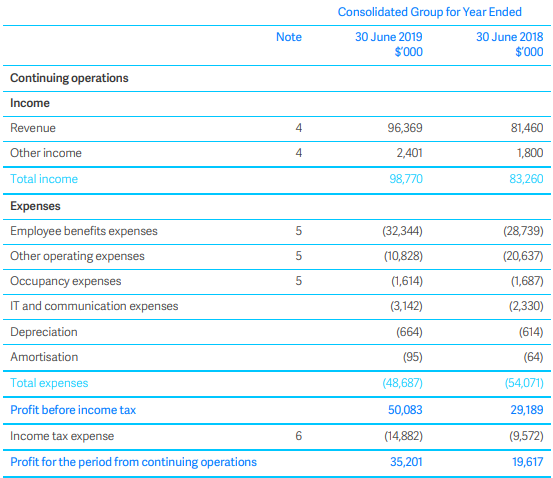

The company announced FY19 results for the year ended 30th June 2019: Recently, the company announced its FY19 financial report, wherein it posted $98.8m of revenue (~18.6% y-o-y) and net profit at $34.2m, higher by 64.7% y-o-y. EBITDA of the company stood at $52m, increased by 22.9% y-o-y followed by higher operating net cash flow at $49.5m (up 25.7% year over year). Employee costs stood at $32.3m (~12.5% y-o-y) which includes inhouse IT development and client service teams. Cash and cash equivalent stood at $58.45m, trade and other receivables at $8.56m; while total current assets stood at $73.809m. Plant Property and equipment stood at $2.533m, Deferred tax assets at $4.7m, intangibles were valued at $0.383m. Trade payables were at $6.327m, while provisions and current tax liability came at $3.2m and $7.378m, respectively. Net assets of NWL for the year ended 30th June 2019 stood at $63.84m.

(Source: Companyâs Report)

Operational update: Average account size came at $323,000 during the year end. FUM stood at $3.9B, grew 38.7% y-o-y. The increment consists of $0.9B FUM net inflow and $0.2BFUM market movement. The company reported FUA net inflow of $4.3B. Fee paying FUA at the end of 30th June 2019 remain stable at 61%. The company reported higher Average platform revenue per account at $1,460, which grew by $55 from FY18.

Dividend announcement: The Board announced fully franked ordinary dividend of AUD 0.0660 per ordinary share held. The ex-dividend date is on 26 August 2019 and the record date of ordinary dividend is on 27 August 2019. The payment date is 26 September 2019.

Stock update: The stock NWL on 23rd August closed at $7.690, down by 0.13% from its previous close. The stock made a 52-week low of $6.350 and a high of $10.110. The daily volume of the stock on 22nd August was at 318,305. The total market capitalisation of the stock was at $ 1.83b. The stock has given negative returns of 19.42% and 6.99% in last three and six months, respectively.

Pendal Group Limited

Pendal Group Limited :(ASX: PDL ) is associated with investment management services and operates in the Australian market. The group had $100.9 b of Funds under management as on March 31, 2019, and derives income by charging management fees from its clients. PDL was listed in ASX during 2007. The company is headquartered in Sydney, Australia. The group invests on global equities and different asset classes for diversification.

(Source: Companyâs Report)

Issue of ordinary shares: Recently the company announced its issue of 4,795,815 ordinary shares (Shares) under the scheme of the Fund Linked Equity program. The Shares are issued following an exercise of rights by fund managers who will participate in the above program. The Shares will have vesting restrictions for next five years and will enjoy dividend and voting rights during this period.

Appointment of Alexandra Altinger as CEO for UK, Europe and Asia: With a market update on 23rd July 2019, the company has announced the appointment of Alexandra Altinger as CEO for the operations across UK, Asia and Europe. Mr. Alexandra served the role of CEO of Sandaire Investment Office and worked for four years. He has cross-border experience and expertise in wealth and asset management as well. He has experience across multiple markets, proprietary trading, research, portfolio management. The management has cited that the company will be looking for value addition and guidance from Mr. Alexandraâs wide experience.

Financial performance for the first half of 2019

Base fund management fees were down 4% year over year at $237.6, which led to total fee revenue of $243 m, a decline of 18% over the year-ago period. Operating expenses declined by 13% year over year to $140 m while statutory NPAT stood at $69.6m, a decline of 37% year over year. The company declared a 10% franked interim dividend of 20 cents per share which was a reduction of 9% over the year-ago period.

Stock update: Currently, on 23rd August 2019 stock of PDL closed at $6.690, down 0.446% from previous dayâs close .The stock has given negative returns of 16.31% and 22.49% in the last three and six months, respectively. At current market price, the stock is available at a P/E multiple of 13.050x. The 52-week trading range of PDL was in between $6.530 to $9.630 and currently trading on the lower end of its 52-week trading range. The stock has given a dividend yield of 7.44%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.