Generally, the core activities of fund management companies revolves around capital growth and capital preservation, however, there are some companies, which are in the business of investment and superannuation platform services. Letâs have a broader look at the below-mentioned stocks and their recent updates.

Magellan Financial Group Limited (ASX:MFG)

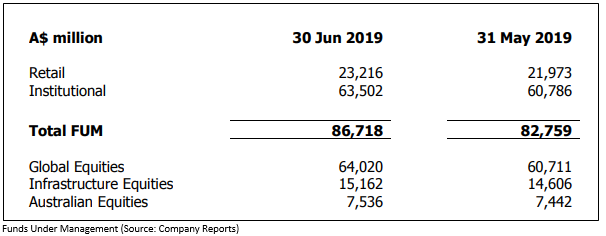

Magellan Financial Group Limited (ASX: MFG) is an Australia registered company involved in the management of funds. Magellan Financial Group was officially listed on ASX in 2004. On 5th July 2019, Magellan Financial Group updated the market about funds under management and portfolio fees as at 30th June 2019. The company reported net inflows amounted to $488 million, including net institutional inflows of $356 million and net retail inflows of $132 million. The global equities for the period stood at $64.02 billion as at 30th June 2019 against $60.71 billion in 31st May 2019.

The company is entitled to around $83 million of estimated performance fees for the year ended 30th June 2019 (FY19), which may fluctuate from time-to-time and average funds under management for the company was $75.8 billion (FY19) when compared to $59.0 billion for FY18. Moreover, the company will pay distributions of around $604 million in July.

Importantly, in the first half of the fiscal year 2019, the principal investment of the company comprised of investment in listed shares, a small number of unlisted investments, Magellan Funds, and surplus cash after allowing for the Groupâs working capital needs. With respect to the retail business, the company has three channels to market, including (1) Independent financial advisers/broker advised channel consisting of relationships with more than 500 independent advice firms and more than 40 stockbroking firms across Australia using the companyâs active ETFs; (2) Bank/AMP aligned channel, consisting of strong relationships and representation with 4 of the top 5 major firms, with separate versions of the Magellan Global Fund available at Commonwealth Bank, BT/Westpac and AMP; (3) Self-directed channel consisting of active ETFs combined FUM of $1.45 billion with ~25,000 direct unitholders and Magellan Global Trust FUM of $1.68 billion with ~34,000 direct unitholders.

The company reported a gross margin of 97.1% in 1H FY19 against the industry median of 95.8%. The EBITDA and net margin for the period stood at 82.2% and 63.1% compared to the industry median of 60.1% and 20.4%. The liquidity position of MFG stood at 9.81x against the industry median of 1.50x.

At the time of writing on 9th July 2019 (AEST 12:45 PM), MFGâs stock was trading at $55.235 per share, up 1.423%, with a market capitalisation of $9.64 billion. The stock has generated a return of 14.94% for one month, 41.68% for three months and 122.47% for the period of six months.

Platinum Asset Management Limited (ASX:PTM)

Platinum Asset Management Limited (ASX: PTM) is an Australia registered fund manager, investing majorly in global equities. Platinum Asset Management Limited was officially listed on ASX in 2007. Recently, the company via a release dated 7th June 2019 stated that its funds under management amounted to $24.93 billion as at 31st May 2019 when compared to $26.57 billion as at 30th April 2019.

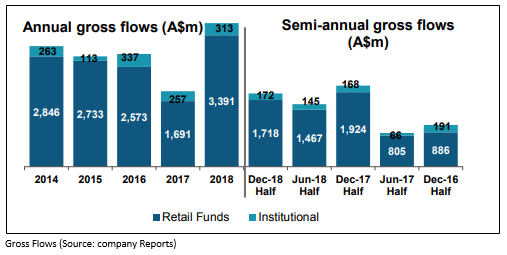

Additionally, Australian Securities and Investment Commission updated the market on implementation of Royal Commission recommendations for a civil penalty amounting to $525 million in order to ensure that the financial services are working efficiently, honestly and fairly. The company has always sought to avoid conflicts of interest and acted in the clientâs best interest. PTM further stated that the gross flows for six months to Dec 2018 were resilient, which came in ahead of the previous half and down slightly on the pcp and reported gross flows in 1H FY19 included ongoing QMF inflows of approximately $164 million and strong PT fund inflows.

Platinum Asset Management Limited is well placed to move forward and has a substantial position in Australia with highly differentiated products. The company aims for higher foreign equity exposure to continue to rise in Australia.

At the time of writing on 9th July 2019 (AEST 12:45 PM), PTMâs stock was trading at $5.090 per share, up 0.394%, with a market capitalisation of $2.97 billion. The stock has generated a return of 10.70% for one month, 7.64% for three months and 4.11% for the period of six months.

HUB24 Limited (ASX:HUB)

HUB24 Limited (ASX: HUB) is an Australia registered company, providing superannuation and investment platform services to its clients. HUB24 Limited was listed on ASX in 2007. The company on 8th July 2019, announced that FMR LLC and its listed entities have ceased to be a substantial holder effective 3 July 2019. Recently, the company via a release dated 3rd July 2019, pointed out that several statements in a recently published article in AFR (Australian Financial Review) were needed to be clarified and incorrect. The company clarified that it takes regulatory obligations and interests of its client seriously in the design and operation of its product. HUB further stated that it maintains flexible fee arrangements with licensees for its clients.

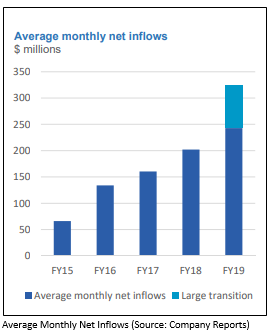

In another announcement, the company reported net inflows amounting to $793 million, reflecting a growth of 33.3% on pcp, with gross inflows of $1.2 billion, a growth of 40.9% on pcp. HUB reported FUA of $11.5 billion at the end of the quarter, representing a growth of 55.7% on pcp. During the quarter, 78 new advisers commenced using the companyâs platform, along with inking of 19 new license agreements. In addition, the company reported a growth of 35.0% in a number of advisers to 1,534 in March quarter as compared to 1,456 in December â18.

Importantly, the company is planning to roll out the availability of Challenger annuities through the HUB24 platform in the subsequent quarter, wherein it will be providing advisers and clients with an integrated experience, including pension products.

At the time of writing on 9th July 2019 (AEST 12:45 PM), HUBâs stock was trading at $11.060 per share, down 1.689%, with a market capitalisation of $701.21 million. The stock has generated a return of -14.71% for one month, -24.60% for three months and -10.07% for the period of six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.