Chinaâs Manufacturing Index Released: Business Confidence Level Drops

A recently released âCaixin Manufacturing Purchasing Managers Indexâ (PMI) indicated that Chinaâs manufacturing index remained stable at 50.2 in May, slightly more than the level of 50 that differentiates expansion with contraction. The Caixin manufacturing PMI is a survey of Chinaâs export-oriented businesses SMEâs (small and medium-sized enterprises). As per the sources, the manufacturing activities rebounded in May with a boost in export orders following the US Presidentâs announcement of raising tariffs on Chinese imports.

The index suggested that the boost in buying activity among the Chinese manufacturing firms was supported by a stronger rise in the overall new businesses. The improvement in the purchasing activity for the five consecutive months has been witnessed for the first time in China.

However, it also indicated a largest fall in the business confidence level since April 2012 amid the ongoing trade tensions between the United States and China. According to the report, the business confidence dropped as the escalating US-China trade war eroded firmsâ confidence. The service providers lost trust in the outlook of the economy and their businesses, resulting in weak business confidence figures.

The private surveyâs figures demonstrated a stability in the manufacturing industry in May against the official manufacturing PMI data (related to Chinaâs bigger corporations) recently released by Chinaâs National Bureau of Statistics. According to the official manufacturing PMI data, the PMI fell more than expected to 49.4 in May, indicating a contraction in the Chinese manufacturing sector activity.

As per the official data, the sub-index for small enterprises reduced from 49.8 to 47.8 in May. The non-manufacturing PMI covering construction and services sector remained the same in May as in April at 54.3, indicated data.

According to the economists, the headline index fell due to a sharp fall in the export orders, resulting from undermined foreign demand due to the latest tariff hike announced by the US President. The US President Donald Trump decided to raise the tariffs to 25% on US 200 billion dollarsâ worth of Chinese goods last month. The Tariff man- Trump's thought is to utilize the grimy trap of high levy burden as a snare to look for colossal market concessions and exchanges and refill his economy's vault. This conflict has influenced the Chinese economy as well as the stock exchange market unfavourably in the past.

China, as a rebuttal, declared an arrangement for retaliatory taxes on $US60 billion (A$83 billion) of U.S. products from June 1, expected result being lessened interests for and openness of American made things in China.

The Chinese pioneer Xi Jinping and President Trump have arranged a gathering at the G 20 summit in Osaka on June 28-29, 2019. The outcome of the meeting could clear the speculations over chances of easing of trade tensions and imposition of trade tariff imposed by Mr Trump. Earlier, Mr Trump has warned of forcing more duty in case of a failure of G 20 summit meeting with Chinese pioneer Xi Jinping. However, he has stated recently that it doesnât matter to him whether Chinese President Xi Jinping would agree to meet him or not in the summit as the US is taking in billions of dollars a month from China.

Dwelling Values Across Australian Capital Cities Fall in May

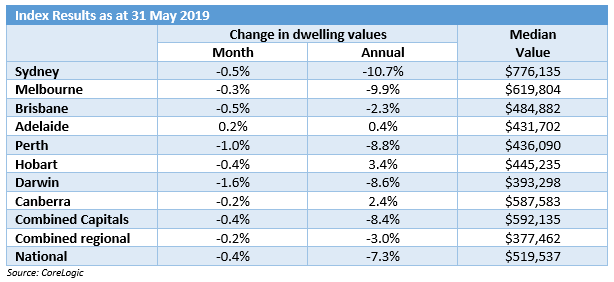

House value plunges further through the May election period with few parts of Sydney and Melbourne knocking down to the more than 14 per cent over the past year, suggests a recently released Home Value Index data. Dwelling values in Sydney fell by 0.5 per cent, while in Melbourne, it dropped by 0.3 per cent in May. It was the least decline in dwelling values across both the cities since March 2018.

The property values across all the Australian capital cities were down 0.4 per cent in May, slightly better than the fall of 0.5 per cent witnessed in April. The improvement in the housing values was driven by a slower rate of decline in Sydney and Melbourne that fell 0.7 per cent and 0.6 per cent, respectively in April.

A recently released data by the Australian Bureau of Statistics has shown that the value of new lending commitments to households (in seasonally adjusted terms) improved 0.6 per cent in April 2019. There was a minor rise of 0.1 per cent in the number of loans to owner occupier first home buyers in April, contrary to a fall of 2 per cent in the number of loans to owner occupier non-first home buyers.

Taking into account the fall in property prices and weak household incomes, the Reserve Bank of Australia (RBA) had downgraded the levels of near-term consumption and dwelling investment for Australia in May this year. In a move to encourage the new home loan buyers, the Australian Prudential Regulation Authority (APRA) has also proposed a plan to remove the 7 per cent home loan buffer.

The data on the dwelling values was released a day before the announcement of an official cash rate cut by the Reserve Bank of Australia of 25 basis points. The RBA slashed the official interest rates for the first time since August 2016 to a new record low of 1.25 per cent from 1.5 per cent.

Economic experts anticipate this initial interest rate fall to be followed up with a further 25 basis point easing at the August 6 RBA Board meeting. They expect this rate cutting cycle to mark the end of the housing downturn.

According to certain experts, the house prices could start rising from early next year and the RBA might slash the cash rate to 0.75 per cent before the year is out. However, some of them view consecutive cuts by the RBA as highly unlikely. They think that the RBA can afford to wait and evaluate the recent rate cutâs impact.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.