Industrials Sector â An Overview

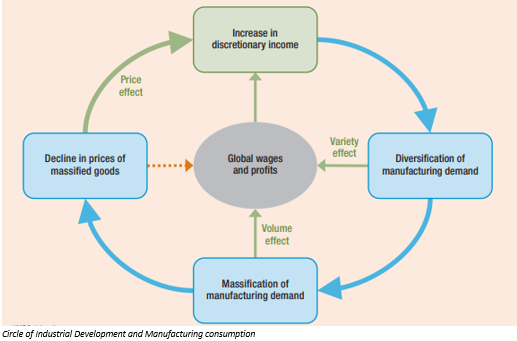

Industrial production in Australia measures the output of businesses integrated with industrials sector of the economy such as mining, manufacturing, and utilities. The commencement of industrial development needs a critical mass of demand for manufactures. Along with the proper set of conditions, the use of manufactures would be able to move a righteous circle of industrial development including of earnings creation, diversification demand and rise in consumption. Australia Industrial Production rose by 1.90 per cent in the second quarter of 2019 period compared to the corresponding quarter in the previous year. Industrial Production in Australia averaged 2.33 percent from 1975 until 2019, reaching an all-time high of 12.60 per cent in the fourth quarter of 1987 and a record low of -7.60 per cent in the first quarter of 1983.

Source: UNIDO

Let us discuss five industrial stocks to invest in:

Air New Zealand Limited

Air New Zealand Limited (ASX: AIZ) is an aviation sector company, which provides passenger and cargo services to and from New Zealand. Air New Zealand covers ~17 million passengers in a year. The companyâs consolidated operating revenue was $5.5 billion in the financial year 2018. AIZâs revenue is generated through a fleet of 100 aircraft and more than 12,500 employees located all over the world.

Stock Performance

The stock of AIZ was trading at $2.54 on 25 September 2019 (AEST 02:08 PM), up by 1.6 percent. AIZ contains a market capitalisation of $2.81 billion and ~$1.12 billion shares outstanding. The 52-week high and low value of the stock was noted at $3.150 and $2.170, respectively. The stock has generated a positive return of 9.17 per cent in the last six months and a negative return of 14.38 per cent on a year-to-date basis.

Annual Shareholders Meeting

On 25 September 2019, AIZ released the chairmanâs address in the Annual Shareholders Meeting, wherein, he mentioned that the company had attained $5.8 billion dollars, which was rise of 5.3% from the previous year. Earnings before taxation stood at $374 million dollars, reflecting a decrease from the previous yearâs report of $540 million dollars. However, the operations cash flow generation was very solid at $986 million dollars. He further elaborated on the challenges faced by AIZ in the 2019 period.

On the outlook front, he mentioned that the outlook was on the basis of existing market demand and assuming an average jet fuel price of US$75/barrel and barring the influence of the new accounting standard of leases. He added that jet fuel had of late been trading above the US$75 level, and the company would keep on monitoring pricing with its existing fuel hedging profile.

He also said that Dame Therese Welsh would assume the role of companyâs Chairperson, at the end of the meeting.

Purchase of Dreamliner Aircraft

On 24 September 2019, AIZ notified the market on the inking of contracts for the purpose of airlineâs multi-billion-dollar investment to buy eight Boeing 787-10 Dreamliner aircraft. The Dreamliner aircraft will be powered by GE Aviationâs and GEnx-1B engines. AIZ is anticipating the first aircraft to join its fleet in late 2022, and the rest will be delivered at intervals until 2027 period.

Financial and Operating Highlights for FY 2019

- AIZ reported earnings (before taxation) for the FY 2019 period standing at $374 million from $540 million noted in the pcp.

- AIZ declared the final dividend of 11.0 cps, bringing the total ordinary dividends/distribution announced for the year of 22.0 cps.

- The number of passengers carried increased to 1,321 (August 2019) against 1,293 in 2018, in the same period.

- Revenue passenger kilometres increased by 4.0 per cent to 2,943 in August 2019.

- Available seat Kilometres moved up by 3.5 per cent to 3,532 in August this year.

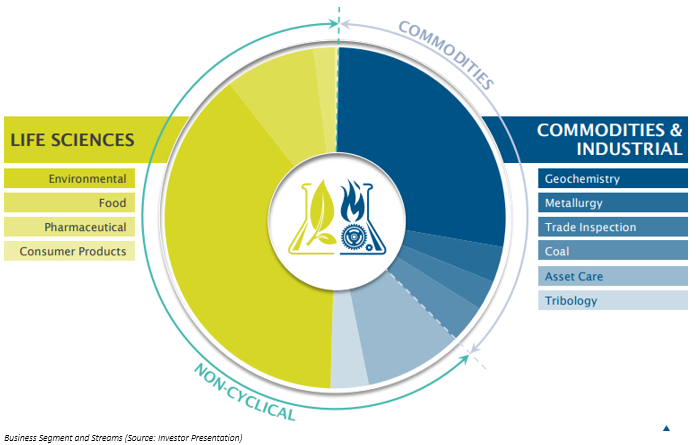

ALS Limited

ALS Limited (ASX: ALQ) is a leader in offering the inspection, certification, laboratory testing, and verification solutions. The company is focused on driving growth by continuing to operate its existing businesses while pursuing the new opportunities successfully.

Stock Performance

The ALQ stock was trading at A$8.10 on 25 September 2019 (AEST 02:35 PM), slipping by 0.491 per cent. ALQ has a market capitalisation of $3.93 bn and approx. $482.43 mn shares outstanding. The 52-week high and low value of the stock is at $9.150 and $6.400, respectively. The stock has generated a positive return of 5.44 per cent in the last six months and a positive return of 22.41 per cent on a year-to-date basis.

Directorâs Interest

On 10 September 2019, ALQ announced the final interest of the director â Mel Bridges, who has ceased to be the director of the company effective 31 July 2019.

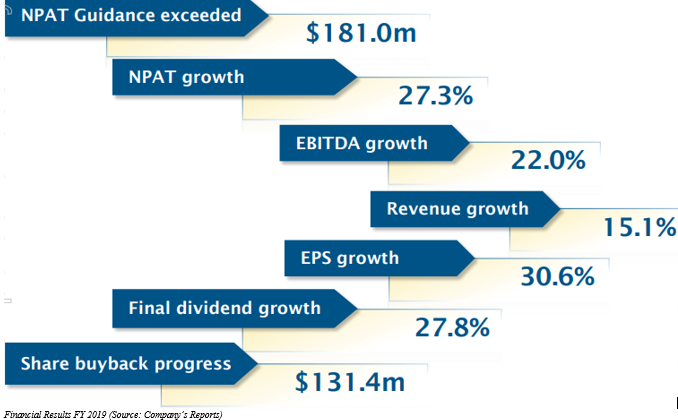

Financial highlights for FY 2019

On 5 September 2019, the company released the Australian Investment Conference Presentation and discussed about the financial results for FY 2019. A few pointers from the results are as follows:

- The companyâs revenue increased by 13.3 per cent to $831.4 million compared to the last year revenue in the same period.

- EBITDA rose up by 18.6 per cent to $166.8 million.

- EBIT margin increased by 110 bps to 15.0 per cent.

- Organic revenue growth was noted at +7.9 per cent with solid contribution throughout all the regions.

The company also acquired the largest private pharmaceutical testing laboratory, the details of which can be read here.

Reliance Worldwide Corporation Limited

Reliance Worldwide Corporation Limited (ASX: RWC) founded in 2001, is a manufacturer, supplier, and designer of high-quality water flow and control products for the plumbing industry. The company serves 2000+ people in 60+ nations globally.

Stock Performance

The stock of RWC was trading at A$3.935 on 25 September 2019 (AEST 03:24 PM), dipping by 0.127. RWC has a market capitalisation of $3.11 bn and approx. $790.09 mn outstanding shares. The 52-week high and low value of the stock is at $5.315 and $3.085, respectively. The stock has generated a negative return of 7.73 per cent in the last six months and a negative return of 11.26 per cent on a year-to-date basis.

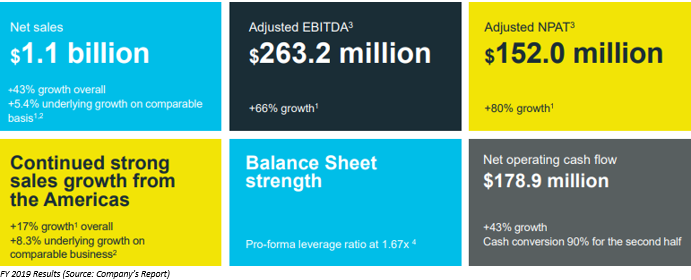

FY 2019 highlights

On 19 September 2019, the company released the investor presentation for FY 2019, which discussed about companyâs various segment overview and general businesses the company.

On 27 August 2019, the company released financial results for FY 2019 period, and a few highlights from the presentation are as follows:

- RWC reported a net profit after tax, rising up by 102 per cent to $133 million compared to the same period previous year.

- The company declared the fully franked final dividend of 5.0 cents per share, and the total dividends for FY 2019 was 9.0 cps.

- The net sales of RWC grew by 43 per cent to $1,104.0 million.

- The company is making an investment in new product development and commercialisation to recognise the prospective from the fresh growth areas.

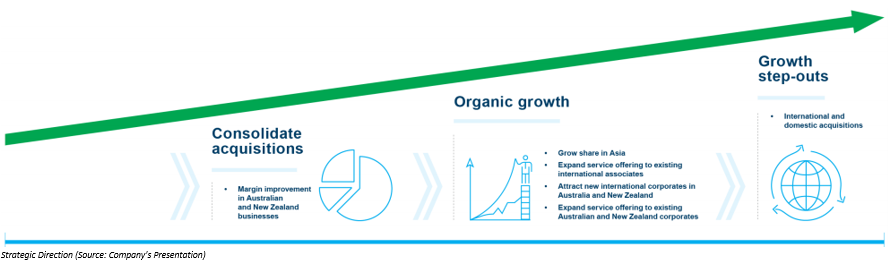

IPH Limited

IPH Limited (ASX:IPH) provides a broad range of IP services and products throughout Papua New Guinea, ANZ region, Asia, and the Pacific Islands. The company has its registered office in Sydney and consists of team which has almost 1000 people in Australia, Singapore, New Zealand, Malaysia, China, Indonesia, Thailand and Hong Kong. The company serves a client base of Fortune Global 500 companies.

Stock Performance

The stock of IPH settled at $8.59 on 25 September 2019, slipping down by 1.378 per cent from its previous closing price. IPH has a market capitalisation of $1.86 bn and approx. $213.74 mn outstanding shares. The 52-week high and low value of the stock is at $9.570 and $4.850, respectively. The stock has generated a positive return of 26.78 per cent in the last six months and a positive return of 60.70 per cent on a year-to-date basis.

Change in Directorâs Interest

On the 19 September 2019, the company has notified the market on the change of director Richard John Grellman interest with the acquisition of 992 fully paid ordinary shares on 18 September 2019 at a value/consideration of $9,285.12. The number of fully paid ordinary shares held by the director after the change was 50,992.

Sale of Shares by MD and CEO of IPH

On 16 September 2019, the company informed that the CEO and MD, Dr Andrew Blattman sold 300,000 shares in the company for personal reasons, including to meet tax obligations. The sale of shares was approved by the companyâs Chairman in agreement with the IPHâs Share Trading Policy.

Dividend Reinvestment Plan Issue Price

On 11 September 2019, IPH notified the market on the issue price for securities to be allotted to participants of the Dividend Reinvestment Plan for dividend (13.0 cents per share, declared on 20 August 2019) of $9.36 per share. The shares issued under the plan rank equally with all other shares on issue.

IPHâs results for the Financial year 2019 can be READ HERE.

Smartgroup Corporation Ltd

Smartgroup Corporation Ltd (ASX: SIQ) is one of the leading providers of workforce optimisation services and employee benefits for the corporate and government sector across Australia. SIQ's segments consist of outsourced administration, distribution and group services (SDGS) and vehicle services.

Stock Performance

The stock of SIQ settled at $12.07 on 25 September 2019, moving up by 2.288 per cent from its previous closing price. The company has a market cap of $1.55 billion and approx. $131.65 million outstanding shares. The 52-week high and low value of the stock is at $12.580 and $7.079, respectively. The stock has generated a positive return of 50.52 per cent in the last six months and a return of 36.75 per cent on a year-to-date basis.

Cancellation of shares

On 16 September 2019, the company announced the cancellation of 243,790 ordinary shares bought back under an employee share scheme buy-back programme.

Resignation and Appointment of Company Secretary

On 16 August 2019, the company announced that Amanda Morgan had resigned as SIQâs secretary effective 16 August 2019. The company appointed Jonathan Swain as the Company Secretary effective 19 August 2019.

The companyâs half-year result 2019 can be viewed here.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.