August 2019 is proving to be much more than just a reporting season. Along with the earning releases and outlook notifications, the companies have been hinting towards the various feathers in their caps. Amid these announcements came an update from the Industrials sector player ALS Limited (ASX: ALQ) and Health care group Starpharma Holdings Limited (ASX: SPL). Let us acknowledge the same and look at their updates:

ALS Limited (ASX: ALQ)

Provider of commercial and professional services, ALS Limited caters to customers through professional technical testing services useful to the global minerals, life sciences, energy, industrial and other sectors. The company provides lab testing, inspection, certification and verification solutions.

ALS acquires the largest private pharmaceutical testing laboratory

8 August 2019 would be recorded as a significant day in the history of ALS Limited, as the company notified that it has acquired Laboratorios de Control ARJ S.A de C.V. or ARJ, as the acquired company is referred to, is based out of Mexico and is the biggest pharma testing lab in the private sphere across Latin America, with revenues beyond $30 million. MD and CEO Raj Naran stated that the acquisition was strategic and would most importantly aid the company to maintain and grow its realm in the key markets, tapping Argentina, Brazil, Colombia, and Mexico. ALS has been focusing on food and pharmaceutical opportunities, and the acquisition supports ALSâs 2022 strategic plan of enhancing its non-cyclical businesses. ARJ is expected to enhance the existing ALS Life Sciences Latin America operations and assist in the companyâs expansion.

The acquired laboratory, ARJ was founded in 1967 and is home to more than 500 employees. It provides quality control for medicines, generics, biological products, cosmetics and medical devices. It caters to various global pharmaceutical companies of large-scale. Mexico is a vital hub for Latin and North America as part of the $20 billion global pharmaceutical testing market.

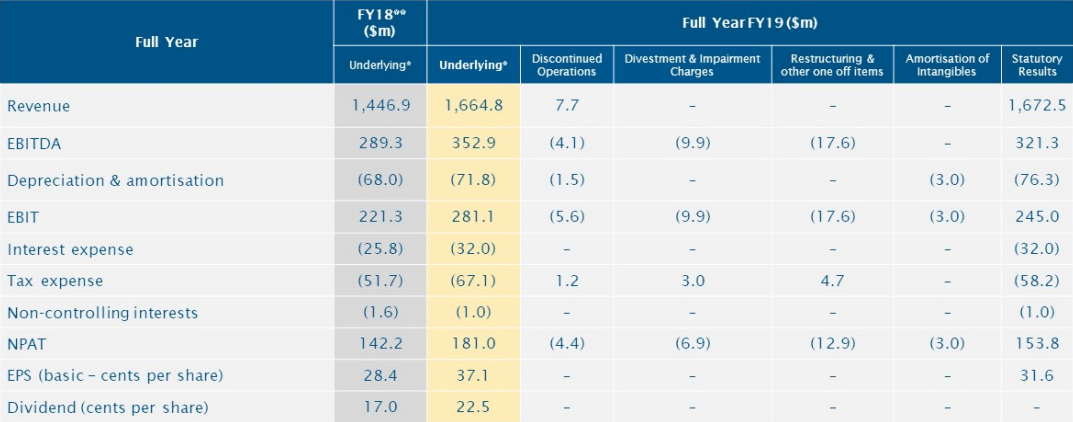

ALQâs Annual General Meeting: ALQ conducted its Annual General Meeting on 31 July 2019, reporting an increase in Underlying NPAT, EPS and dividends in excess of 25% over 2018âs outcome. 2019 was the companyâs best year in terms of safety performance, capital investment and progress on the cultural and strategic initiatives. Amid the uncertain and volatile global markets, ALS announced that the Total Shareholder Returns along with dividends was 87.9% over the past three years.

Revenue from continuing operations was $1.66 billion, up by 15.1% on pcp. NPAT was $181.0 million, 27.3% up on pcp while the EPS grew by 31.1%. On 1 July 2019, the company paid final dividend of 11.5 cents per share, franked to 35%, bringing the total dividend paid for the year to 22.5 cents, up by 32.4%.

FY19 Financial Summary (Source: ALSâs Report)

FY19 Financial Summary (Source: ALSâs Report)

Besides these financials, ALS sold its environmental testing business in China to SUEZ, after it had divested Life Science consumer testing business based in Hong Kong and mainland China. Most of the Oil & Gas technical services business was also divested in July 2017 and in March 2018.

On outlook front, for 1H20 period, ALS expects the NPAT to range between $90 to $95 million in the first half to September 2019. It would report a profit of $60million on the sale of its China businesses, and $18 million relating to historical restructuring.

Share Performance: On 9 August 2019, the ALQâs stock was trading flat at A$7.150 (at AEST1:11 PM). With a market capitalisation of A$3.45 billion, the companyâs stock has generated a YTD return of 7.52%.

Starpharma Holdings Limited (ASX: SPL)

A global lead in the growth of dendrimer produces for pharma, and other applications, SPLâs underlying technology is built around dendrimers. It has two main development portfolios- DEP® drug delivery and the VivaGel® portfolio.

Grant of approvals for DEP® irinotecan

On 8 August 2019, the company pleasingly notified that it had been granted with the requisite regulatory and ethics approvals for DEP® irinotecan. The approvals make DEP® irinotecan to be the third DEP® product to enter the clinic with a fourth candidate, AZD0466, likely to enter the clinic later in 2019. Post receipt of the approvals, SPL is set to commence its phase 1/2 clinical trial at multiple leading UK cancer centres. The intention of the trial would be the analyses of safety, tolerability and pharmacokinetics of DEP® irinotecan, which would further outline a phase 2 dose. The clinical trial would also project the anti-tumour efficacy of the product in hand-picked tumour types. Patients with advanced solid tumours, including CRC would be enrolled for the trial.

CEO Dr Jackie Fairley stated that besides the trial and its results, the company is early awaiting the AstraZenecaâs first DEP® product, AZD0466, to begin clinical trials later this year.

SPLâs Quarterly Report for the period ended 30 June 2019

On 16 July 2019, SPL notified that its cash balance as on 30 June 2019 amounted to $41.3 million. The net cash-burn for FY19 period stood at $10.1 million. The year witnessed the First global launches for VivaGel® BV in several European countries and Australia. The company signed a Development and Option deal to advance the development of a DEP® version with AstraZeneca, for its oncology drugs. AZD0466 was presented to clinicians at ASCO. SPL bagged the US patent for AstraZenecaâs Bcl2/xL DEP® while the FDA highlighted the potential of VivaGel® BV. Okamoto launched the VivaGel® condom in Japan in the year while India, Canada and Israel remain to be in commercial discussions for VivaGel® BV.

The cash flow statement for the quarter ending 30 June 2019 is highlighted below:

| Particulars | Amount (A$â000) |

| Net cash used in operating activities | 3,452 |

| Net cash used in investing activities | 31 |

| Net cash used in financing activities | 6 |

| Cash and cash equivalents at end of quarter | 41,251 |

| Estimated cash outflows for next quarter | 5,940 |

Share Performance: On 9 August 2019, the SPLâs stock was trading A$1.28, down by 0.389% (at AEST 1:31 PM). With a market capitalisation of A$477.66 million, the companyâs stock has generated a YTD return of 21.23%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice