Technology can be defined as the application of science used to solve problems. In our day to day life, we apply technology to accomplish various tasks and boost our abilities. Technology is used at work, for communication, scaling businesses, storing data, and so much more. If technology is applied well, it benefits human and vice versa. Many companies use advanced technology to gain competitive edge, develop new products/services and provide better solutions to their customers.

Some of the trending technologies are:

Cloud Computing

As e-commerce and content streaming is growing exponentially, the requirement of data centres is also increasing day by day. Data centres store information in their cloud network and maintain high-level security to the stored data. However, data centres require lots of space in order to store data on their network.

Cloud computing is replacing the use of various storing devices. Cloud computing helps various companies to store their large amount of data on the virtual network.

Machine Learning

Machine learning is one the trending technologies in various sectors including automotive and finance & banking. Several industries are introducing machine learning to their processes. Chatbots are being introduced by industries to solve the generic queries of customers. The implementation of artificial intelligence and machine learning helps companies to reduce their manpower and costs.

Blockchain Technology

Blockchain is something that has gained a lot of attention in the last couple of years. Blockchain technology is the foundation to bitcoins and other crypto currencies; however, blockchain technology is not limited to crypto currencies. The technology uses decentralised consensus to maintain the network, which means it is not controlled by any centralised bank or any other government authority. Large investment banking and financial service providers are already using blockchain network to simplify their processes.

Let us discuss two stocks from the IT sector - Dicker Data Limited and Splitit Payments Limited, which have delivered more than 50 per cent in returns in the last few months.

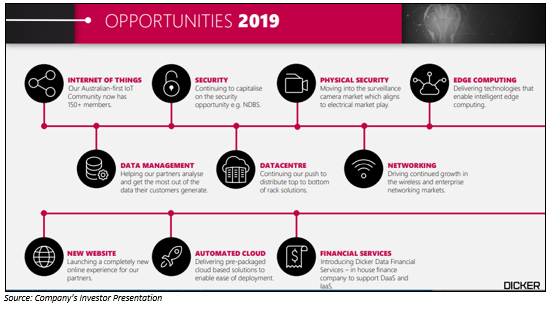

Dicker Data Limited (ASX: DDR)

Dicker Data Limited, founded in 1978, is a distributor of software, hardware and other related products for computers. DDR is an Australian owned and ASX listed company, selling its products to more than 5,000 resellers. The company focuses on customer-centric approach, reflecting that it is proactively engaged with its resellers and makes dynamic shifts with changing market conditions.

Change of Directorsâ Interest

In October 2019, the company made several announcements regarding the change in interest held by its directors.

1.Vladimir Mitnovetski, one of the companyâs directors, acquired 7,092 fully paid ordinary shares (indirect) in DDR. The number of securities held by the director after the announcement was 663,753 (direct) and 16,992 (indirect) fully paid ordinary shares.

- DDR, on 8 October 2019, announced a change in interest held by Fiona BROWN, who now holds 53,279,768 fully paid ordinary shares (direct), 103,365 fully paid ordinary shares (indirect via South Coast Developments Pty Ltd in which she is a director) and 1,217,095 fully paid ordinary (indirect as trustee for Fi Brown No. 1 Trust).

- With the company update on change in interest held by Mary STOJCEVSKI, Mrs Stojcevski now holds 33,909 and 171,959 direct and indirect fully paid ordinary shares, respectively.

Revenue Up 17.8 Per Cent in 9M FY19

On 24 October 2019, the company provided a market update for the nine-month period ended 30 September 2019, highlighting

- Total revenue of the company increased by 17.8 per cent to $1,289.1 million when compared to the corresponding previous year, on the back of strong performance across all vendor partnerships and realisation of full value for new vendors.

- Strong growth was reported for subscription revenue.

- Net profit margin of YTD stood at 3.7 per cent.

- Costs to the company were slightly high due to increased headcount investment which is expected to continue in the last quarter of FY2019 to support new vendor additions and future growth.

- Operating profit before tax rose by 38.6 per cent to $47.4 million compared to previous corresponding period.

Dicker Data is expecting to register more than $60 million in operating profit before tax for FY2019, based on the results for the nine-month period.

Stock Performance

The stock of DDR settled at $6.840 on ASX on 4 November 2019, down by 1.724 per cent from its previous close. The company has approximately 161.58 million outstanding shares and a market cap of $1.12 billion. The 52 weeks low and high value of the stock is at $2.780 and $8.090, respectively. The stock has generated a positive return of 64.54 per cent in the last six months and a positive return of 145.94 per cent on a year-to-date basis. The stock has an annual dividend yield of 3.07 per cent.

Splitit Payments Limited (ASX: SPT)

Splitit Payments Limited is a payment solution provider, enabling merchants to allow their customers to pay for purchases in easy monthly instalments with additional registrations or applications. The company has more than 1,000 merchants and provides buy now pay later (BNPL) services in more than 200 countries, thereby becoming the only global omnichannel instalment payment solution provider.

2019 Annual General Meeting

The company held its Annual General Meeting on 30 October 2019. Following resolutions were considered during the meeting;

- Resolution 1 â Re-election of Director â Mr Spiro Pappas

- Resolution 2 â Appointment of Auditor

- Resolution 3 â Ratification of Placement shares

- Resolution 4 â Payment of Cash bonus to CEO â Gil Don

- Resolution 5 â Approval of amendments to an employment agreement with Gil Don and Performance Rights

- Resolution 6 â Approval of entry into a consultancy agreement with Spiro Pappas and issue of options

- Resolution 7 â Ratification of prior issue of options

- Resolution 8 â Approval of remuneration policy

- Resolution 9 â Approval of 10 per cent placement capacity

- Resolution 10 â Approval of modification EIP

- Resolution 11 â Approval of Appointment of Brad Paterson as CEO and Modification to the compensation package

September Quarter Update

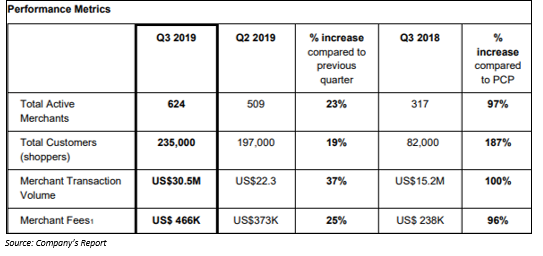

On 29 October 2019, the company released a market update for the quarter ended 30 September 2019, highlighting strong growth across all key operational performance metrics.

- SPT reported a 97 per cent rise in total merchant base to 624.

- An increase of 187 per cent was registered in total customer base (shoppers) to 235k when compared with the same period a year ago.

- Merchant Transaction Volume stood at US$ 30.5 million, representing an increase of 100 per cent on prior corresponding period.

- Merchant Fees grew by 96 per cent year-on-year to US$ 466K.

- Some of the new merchant names in the companyâs portfolio are Kogan.com, Philips Respironics and Ableton.

- At the end of the quarter, the company had US$16.1 million in cash

The company also released an update on North America operations related to agreements with Shopify and Divido, which can be read here.

Stock Performance

The stock of SPT closed at $0.995 on ASX on 4 November 2019, up by 1.531 per cent from its previous close. The company has approximately 307.53 million outstanding shares and a market cap of $301.38 million. The 52 weeks low and high value of the stock is at $0.305 and $2.000, respectively. The stock has generated a negative return of 9.29 per cent in the last six months and a positive return of 71.93 per cent in the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.