Introduction

In any industry or sector, where direct interaction with consumer comes up, the rule of demand and supply follows. The consumer-oriented companies usually generate their revenues from the increasing demand of their products in the market.

On Australian Securities Exchange, the consumer discretionary sector is recognised as S&P/ASX 200 Consumer Discretionary (Sector), which is trading at 2,607.7 with a rise of 0.23% (On 26th September 2019, AEST 12:07 PM).

Letâs know about the 4 consumer discretionary stocks as follows:

Accent Group Limited

Accent Group Limited (ASX: AX1) is into the distribution and retail of branded lifestyle footwear with more than 400 stores. The company recently announced that Michael John Hapgood has made a change to his interests in the company by disposing 83,283 ordinary shares, at a consideration of $1.67 on 16 September 2019. The number of securities held by him post-change was 12,000,000 ordinary shares.

FY19 Operational and Financial Performance

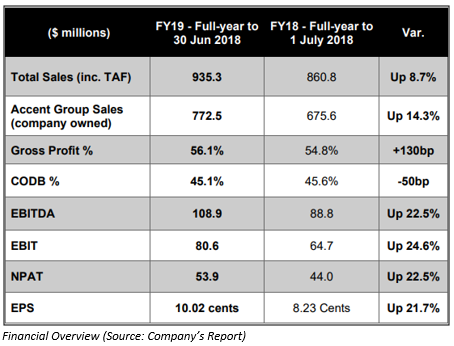

On 22 August 2019, the company had published its full year results for the period closed 30 June 2019, wherein, it updated the market on its operational and financial performance:

- With respect to Retail, the company stated that sales witnessed a rise of 15.8% in comparison to the previous year and the figure stood at $656.2 million. This was a result of the new store launches and solid improvement in digital sales of 93%.

- During the period, Accent Group Limited had shut down 21 stores and inaugurated 54 new stores which takes the total stores numbers to 479.

- On the Wholesale front, the sales for the year stood at $116.3 million, reflecting a rise of 7% against FY18 with robust performances in Dr. Martens, Vans, CAT, and Merrell as well as Stance.

- When it comes to the whole groupâs performance, it delivered a record full-year profit for FY19 with EBITDA amounting to $108.9 million with a rise of 22.5%.

- The statutory net profit after tax stood at $53.9 million, reflecting a rise of 22.5%.

Dividend

The group has announced a fully franked final ordinary dividend amounting to 3.75 cps. The payment date for the final dividend is 26th September 2019. This makes the full year dividends to reach at 8.25cps, reflecting a rise of 22.2% as compared to last year and implying a payout ratio of 82% for the year.

Stock performance

When it comes to the performance of the stock AX1, it was trading at a price of $1.737 per share (at AEST 12:16 PM), with a rise of 0.405% on 26th September 2019. It witnessed a return of 17.69% in the time frame of the past six months. On Year to date basis, the stock produced a return of 45.38%.

Bapcor Limited

Bapcor Limited (ASX: BAP) is involved in the sale and distribution of motor vehicle aftermarket parts and accessories. The company also deals in automotive equipment and services as well as motor vehicle servicing.

Issue of Share Price Under DRP

- As per the release dated 23rd September 2019, the company updated the market with the issue price of shares, which are to be issued to shareholders who have elected to participate in the companyâs Dividend Reinvestment Plan for the 2019 final dividend. It added that the issue price has been calculated as $6.8919 per share.

- The company further stated that its 2019 final dividend, as well as the date on which the DRP shares would be issued to participating shareholders, is 26th September 2019.

An update on substantial holder

- The company recently announced that Mitsubishi UFJ Financial Group, Inc has ceased to be a substantial holder in the company from 6th September 2019.

- In another update, the company announced that The Vanguard Group, Inc. and its controlled entities has become a substantial holder in the company, with the voting power of 5.048% from 16th August 2019.

Operational and Financial Status

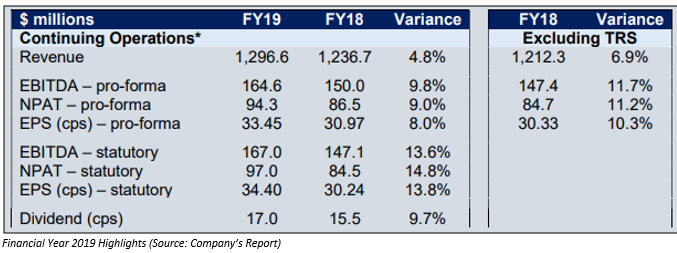

For the 12 months period ended 30th June 2019, a report was published by the company, wherein it provided a detailed overview of its operational and financial status:

- It was mentioned in the release, that the group added 59 new company locations across its network, which was a fabulous work from its team members.

- The companyâs New Zealand business continued to perform strongly. The revenue and EBITDA witnessed a rise of 7.4% and 13.8% in FY19, respectively, excluding the impact of the divestment of TRS.

- The revenue from continuing operations amounted to $1,297 million, reflecting a rise of 4.8%. Whereas, pro-forma net profit after tax from continuing operations stood at $94.3 million with a rise of 9.0%

Stock performance

When it comes to the stock performance of BAP, it was trading at a price of $7.165 per share with a dip of 0.348% on 26th September 2019. It witnessed a rise of 26.68% in the time frame of the last six months timeframe. On Year to date basis, the stock produced a return of 22.56%.

G8 Education Limited

G8 Education Limited (ASX: GEM) operates early education centres owned by it, along with having an ownership of early education centre franchises.

A look at Substantial Holding

- The company recently announced that Challenger Limited (ASX: CGF) and its entities had ceased to be a substantial holder in the company from 27th August 2019.

- In other updates, the company notified the market on Sumitomo Mitsui Trust Holdings, Inc. (SMTH) and Its Subsidiaries had made a change to their substantial holdings in the company on 27 August 2019. Their current voting power is of 10.31% as compared to the previous voting power of 9.24%.

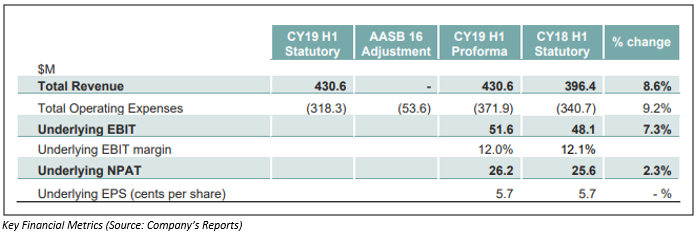

A look at Half-Year 2019 Results

The company on 26 August 2019, announced its half?year results for the period ended 30 June 2019, wherein, it mentioned the key points as follows:

- The company reported revenue amounting to $430.6 million, reflecting a rise of 9% against pcp. This has been a result of occupancy, fee growth and acquired centres.

- GEM reported underlying EBITDA amounting to $51.6 million during 1H FY19 period, which was in accordance with the consensus forecasts and stood at 7% above pcp.

Stock performance

When it comes to the performance of the GEM stock, it was trading at a price of $2.575 per share (at AEST 12:41 PM), with a rise of 1.779% on 26th September 2019. It gave a negative return of 13.95% in the time frame of the last six months period.

Super Retail Group Limited

Super Retail Group Limited (ASX: SUL) is into the operation of specialty retail stores in the categories like automotive, tools, leisure and sports. The company through a release dated 20th September 2019 announced that it will be conducting its 2019 Annual General Meeting on 22nd October 2019.

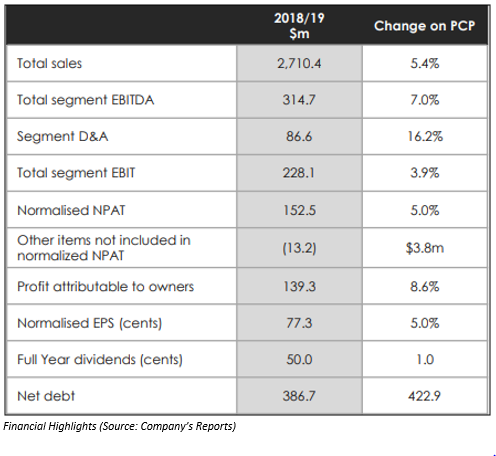

Key Takeaways from FY19 Results:

- The company stated that it has increased its active loyalty club membership to more than 6 million members. SUL added that its club members now, demonstrate more than 56% of total Group sales.

- The total group sales stood at $2.71 billion, reflecting a rise of 5.4% on pcp.

- The net profit after tax attributable to owners for the 52-week period to 29 June 2019 stood at $139.3 million.

- The Group segment earnings before interest and tax amounted to $228.1 million, with a rise of 3.9% against pcp.

Cashflow and Net Debt Position

- The operating cashflow of the company stood at $240.9 million, which reflects normalised EBITDA cash conversion of 94%. The operating cashflow also represents the Groupâs continuing focus on working capital management.

- The closing net debt of SUL amounted to $386.7 million, which was $36.2 million lower in comparison to the previous year. The fixed charge cover ratio remained steady at 2.1x and normalised net debt to EBITDA declined to 1.2x.

Stock performance

When it comes to the performance of the SUL stock, it was trading at a price of $10.020 per share (at AEST 12:54 PM), with a rise of 0.3% on 26th September 2019. It witnessed a rise of 35.00% in the time frame of the past six months timeframe.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.