What are Reverse Mortgages?

A reverse mortgage is a loan secured by a homeowner who is 60 or older, that enables him to convert his home equity into cash by borrowing against the value of their home. The borrower can receive the funds in the form of lump sum amount/fixed monthly payment/ line of credit. However, the reverse mortgage does not require monthly mortgage payments like the traditional mortgage. Also, the ownership of the home remains with the borrower with a reverse mortgage.

After obtaining a reverse mortgage, the borrowers must pay taxes and insurance on the property and keep the home in good repair. The home equity built up by the elders can be accessed with reverse mortgage, and the entire loan balance is payable when they sell, die or move out of the home.

Features of Reverse Mortgages

The following are the primary features of reverse mortgages:

- Interest is charged on a reverse mortgage like any other loan, but the borrower need not pay the interest during the course of the loan. The interest gets compounded to the loan balance over time.

- Borrowers are the owners of the home and can use it as their primary residence.

- A reverse mortgage is designed for the borrowers that are typically âasset richâ but âcash poorâ.

- It is ideal for the person who is retired, and no income is required to qualify for a reverse mortgage.

- Unless the borrowers voluntarily pay out the loan, there is no need to pay anything until they sell their home, or they die.

- The borrower must be over a certain age to qualify for a reverse mortgage.

- The amount of the loan size is determined by many factors like current interest rates, the borrower's age, the property's location, property value, etc.

Benefits of Reverse Mortgages

A reverse mortgage became popular due to certain benefits associated with it. The following are the benefits of a reverse mortgage:

- Ownership remains with the borrower: Compared with paying rent, the benefit of retaining ownership with a reverse mortgage is a significant advantage for the borrower.

- Source of family wealth: As long as property prices continue to increase, the appreciation in the value of the family home will provide better after-tax returns than conservative investments.

- Tax-Free: The money received from a reverse mortgage is tax-free, whether received as a fixed regular income or in a lump sum.

- Protected against falling housing prices: The borrowers taking a reverse mortgage loan are protected against a decline in property price. Even if the property price falls and the loan amount becomes more than the value of the home at the time of repayment, the government insurance will cover the difference.

- Free of Restrictions: The amount received from a reverse mortgage could be used for any purpose by the borrower as there is no restriction on the usage of the funds. One can use it for home renovations and maintenance, an overseas holiday, payment of credit card bills, education costs for grandchildren or any other purpose.

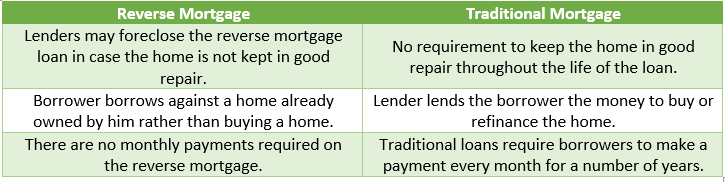

Reverse Mortgage v/s Traditional Mortgage

The Health of Australiaâs Reverse Mortgage Program

The ASIC (Australian Securities and Investments Commission) began with a review of lending for reverse mortgages in mid-2017. The review was focussed on the reverse mortgage lending from 2013â17 under which the regulator commissioned in-depth interviews with 30 borrowers. The review report mentioned that the demand for equity release products would be affected by the growing population of older Australians.

The following are the key highlights of the ASICâs review:

- Reverse mortgages enabled older Australians to achieve their immediate financial objectives.

- The risk of negative equity got eliminated with the introduction of enhanced consumer protections by the Australian government in 2012. The enhanced consumer protections were announced to help consumers in making wiser choices about reverse mortgages.

- A substantial proportion of borrowers might not identify the effect of equity erosion on their potential future needs.

- There were few alternatives available to a reverse mortgage due to a lack of competition.

- The contracts of the lenders under review contained potentially unfair terms.

- There was no tenancy protection for other residents in the home in some loans.

- Some loan applications were identified in which lenders could reduce the risk of financial elder abuse.

Concerns Raised by ASIC in Review

The ASIC raised following concerns over the health of Australiaâs reverse mortgage program in the review:

- The lenders focused primarily on the borrowerâs short-term objectives, ignoring their possible future needs.

- About 92 per cent of the loan files reviewed did not contain any evidence regarding the broker or bank discussing with borrowers that how a loan might affect their ability to afford possible future needs.

- Lack of competition in the reverse mortgage space would probably result in inflating interest rates and fees.

The Australian Securities and Investments Commission warned the Commonwealth Bank of Australia (ASX: CBA), Heartland Group Holdings Limited (ASX:HGH) and Bankwest over reverse mortgages in August 2018. The regulator called for scrutiny of the stigmatised reverse mortgage product as ASIC found that the lenders primarily focussed on the borrower's short-term objectives.

Banks Withdrawing from Reverse Mortgages Market

By 2006, there were more than twenty banks, non-bank lenders and credit unions that offered reverse mortgage loans in Australia. However, many of these institutions stopped offering new reverse mortgages between 2008 and 2010 due to the global financial crisis. The reverse mortgage market showed some signs of recovery in 2014.

But, the Westpac Banking Corporation (ASX: WBC) and Macquarie Group Limited (ASX: MQG) withdrew from the reverse mortgage market in late 2017 due to the growing demand for reverse mortgage loans in Australia owing to costs and regulation pressures.

The CBA and Bankwest (CBAâs subsidiary) also announced their withdrawal from the reverse mortgage market in October 2018. The banks informed that they will not sell any reverse mortgage products from January 1st, 2019. The CBAâs reverse mortgage product âEquity Unlock for Seniorsâ was withdrawn in the wake of the scrutiny of the reverse mortgage market by ASIC.

Why Did Banks Walkout of Reverse Mortgages Market?

Several banks left the reverse mortgage market due to increasing costs and tougher regulation. In the reverse mortgage, the loan is to be paid by the borrowers when they die, sell, or move out of the home. Thus, the house pricing risk gets shifted to the lender, increasing their costs on providing reverse mortgage products. If the borrower lives a long time or the house prices fall, the entire burden is levied on the lender.

Also, the reverse mortgages are expensive for lenders as the borrowers need not make any repayments, and the interest rates get compounded. With a perception of higher interest rates and higher fees, the banks decided to withdraw from the market.

Banks Offering Reverse Mortgages in Australia

With many companies withdrawing from providing the reverse mortgage products in Australia, only a few lenders remained in the reverse mortgage space like Heartland Seniors Finance, P&N Bank and IMB Bank. One of these companies is listed on the Australian Stock Exchange. Let us take a look at its reverse mortgage product below:

About Heartland Group Holdings Limited

The Heartland Group Holdings Limited (ASX: HGH) headquartered in New Zealand, provides banking services through its subsidiaries. The companyâs reverse mortgage loan is designed for the needs of seniors. A Heartland Reverse Mortgage enable borrowers to get access to the finances required to make their life more comfortable, easier and enjoyable in retirement. The company's current Standard Reverse Mortgage interest rate is 6.54 per cent, and it could change from time to time due to the variations in the funding market and economy.

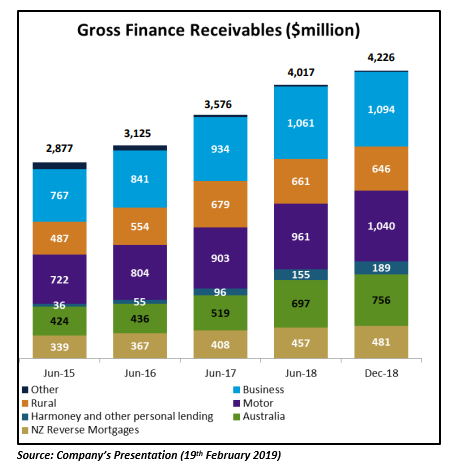

Financial Performance

The company reported a net profit after tax of $33.1 million during the half-year period ending 31st December 2018. Also, it reported a reverse mortgage growth of 24.9 per cent and reverse mortgages gross finance receivables of $733.3 million in Australia during the period.

Stock Performance

The companyâs stock last traded on 16th May 2019 at AUD 1.500. The stock has delivered a YTD return of 14.94 per cent.

Reverse Mortgages in Demand with Falling Interest Rates

As the interest rates in Australia are at the record low levels of 1.25 per cent and are still expected to drop further, the reverse mortgages option is becoming popular among the retirees. The reverse mortgage provides regular cash payments and enable retirees to borrow at a cheaper rate compared to other traditional mortgage options. The retirees are thus considering it as an alternative to generate income without taking big risks. It has become a more attractive option as it is cheaper and more flexible than commercial options. Also, it is becoming popular as many Australians have built up large reserves of home equity in spite of recent price falls.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.