Cannabis industry in Australia is growing at a fast pace, and government authorities across the country are creating a lot of prospects for investors by legalising medicinal cannabis. Moreover, it is being assumed that the Australia cannabis regulation would become less complex in the near future.

Recently in the month of September 2019, a report recommending several changes to the licensing regime that regulates cannabis related business in the country was tabled in the Australian Parliament. The main suggestion in the report is to bring amendments in the Narcotic Drugs Act (NDA) for establishing a single licensing scheme for manufacturing medicinal cannabis.

As of June 2019, the Office of Drug Control (ODC) received ~246 applications for securing the licence, out of which only 63 were granted the licence, which is a higher number than the expectations.

Three types of licences for medicinal cannabis product supply available in the country are.

- Cultivation or production or both

- Licence for research purposes

- Licence to manufacture a product or drug

Let us discuss four stocks operating in the cannabis segment.

Cann Group Limited (ASX: CAN)

Cann Group Limited is an established, ethical leader in the emerging medicinal cannabis industry of Australia. The company received a medicinal cannabis research licence in February 2017 and a medicinal cannabis cultivation licence in March 2017.

Recently, on 4 October 2019, the company unveiled to have issued 67,538 fully paid ordinary shares by way of a placement to a sophisticated investor - Commonwealth Scientific and Industrial Research Organisation (CSIRO) and the shares were issued as settlement of an invoice for services rendered without disclosure to the investor under Part 6D.2 of the Corporations Act.

CAN Reports $4.25 Million in FY19 Revenue

The company at the end of August 2019 declared results for the 12-month period ended 30 June 2019. Some of the highlights from the announcement are:

- Revenue from ordinary activities grew to $4.25 million in FY2019 from $1.50 million in FY2018

- The company entered a partnership with IDT Australia in August 2018 for manufacturing support in relation to cannabis products

- FY19 loss before income tax reported at $10.9 million

- Net tangible assets per ordinary share stood at $0.5443

Stock Performance

The stock of CAN settled at $1.415 on ASX on 14 October 2019, up by 2.909 per cent from its previous closing price. The company has a market cap of $195.07 million and approx. 141.87 million outstanding shares. The 52-week high and low value of the stock is at $2.850 and $01.370, respectively. The stock has generated a negative return of 39.96 per cent in the last six months and a negative return of 31.25 per cent on a year-to-date basis.

Althea Group Holdings Limited (ASX:AGH)

Althea Group Holdings Limited, headquartered in Melbourne, is engaged in the exports, supply and production of medicinal cannabis. The group has various licenses as well as permits for the cultivation and import of pharmaceutical grade cannabis. AGH was officially listed on the Australian stock exchange in September 2018.

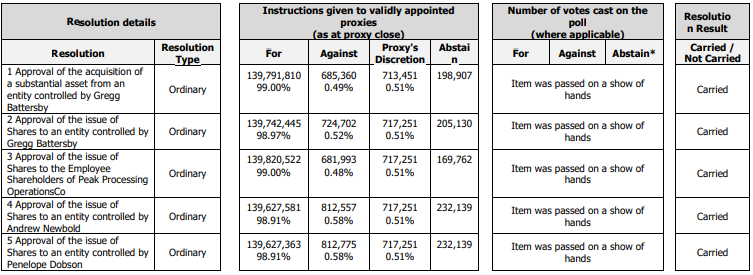

On 14 October 2019, the company released results of annual general meeting.

Source: Companyâs Report

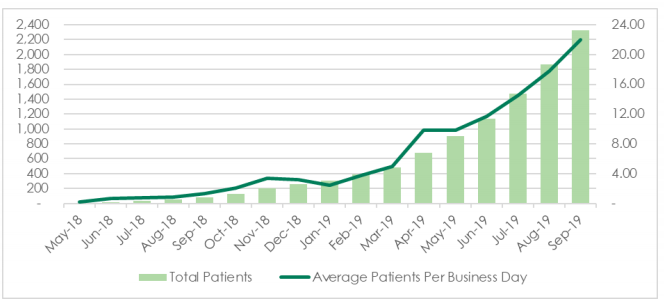

AGH Reaches 2,329 Patients

On 4 October 2019, the company announced that its medicinal cannabis products are being prescribed to 2,329 patients in Australia.

- 462 new patients were prescribed with the companyâs medicinal cannabis products in the month of September, which represented the largest number of patients added in a single month.

- The per day addition rate of patients in the month of September was approximately 22 patients.

- NSW Health has simplified the requirements for medicinal cannabis prescribers in the countryâs most populous state, NSW.

Patient Growth (Source: Companyâs Report)

On 25 September 2019, the company reported a change in the substantial holding of PAC Partner Securities Pty Ltd to a voting power of 6.0 per cent from an earlier voting power of 10.5 per cent.

Stock Performance

The stock of AGH closed the dayâs trading at $0.645 on ASX on 14 October 2019, down by 0.769 per cent from its previous closing price. The company has a market cap of $151.51 million and approx. 233.1 million outstanding shares. The 52-week high and low value of the stock is at $1.445 and $0.175, respectively. The stock has generated a positive return of 34.02 per cent in the last six months and a positive return of 145.28 per cent on a year-to-date basis.

IDT Australia Limited (ASX: IDT)

IDT Australia Limited, established in 1975, is an expert pharmaceutical services provider, engaged in research & development activities, in addition to project management, chemical and pharmacy services, analytical chemistry. Other business activities of the company are Active pharmaceutical ingredient (API) and finished dosage form manufacture, clinical and commercial and pharmaceutical development in all dosage forms.

CBD API Development Agreement to Conclude

On 14 October 2019, the company announced that cannabidiol (CBD) active pharmaceutical ingredient (API) development agreement with the State Government of Victoria is set to conclude in early 2020. Under the contract, the company retained the know?how and intellectual property that it had developed with respect to the production of pharmaceutical grade (GMP) cannabidiol.

The company is now looking ahead to the activities required for commercialising cannabidiol products for domestic and global markets.

FDA Lifts Warning Letter

On 4 September 2019, the company provided a market update regarding the warning letter received from the US Food and Drug Administration in May 2018. The company received the close-out letter from the Division of Drug Quality II. The agency issues the close-out letter after fully assessing the corrective actions undertaken by the concerned entity in response to the warning letter. The removal of the warning letter boosted the reputation of the company in the market and gave a big relief to the company.

Stock Performance

The stock of IDT traded flat at $0.175 on ASX on 14 October 2019. The company has a market cap of $41.36 million and approx. 236.36 million outstanding shares. The 52-week high and low value of the stock is at $0.245 and $0.125, respectively. The stock has generated a positive return of 9.38 per cent in the last six months and a positive return of 20.69 per cent on a year-to-date basis.

Elixinol Global Limited (ASX: EXL)

Listed on ASX in January 2018, Elixinol Global Limited is a leading player in the global cannabis industry. The companyâs products include hemp-derived CBD dietary supplements, food and wellness products and medicinal cannabis products. The companyâs businesses include Elixinol LLC, Nunyara Pharma Pty Ltd and Hemp Foods Australia Pty Ltd.

Exclusive Distribution Agreement for Finland

On 26 September 2019, the company announced that Elixinol BV, the wholly owned subsidiary of EXL based in the Netherlands, signed an exclusive distribution agreement with Harmonia Life Oy for multiple channels in Finland. Under the agreement, Harmonia Life Oy will sell EXL labelled products through various retail networks for a time span of five years. The exclusivity of the distribution agreement is dependent on attainment of minimum sales targets (annual).

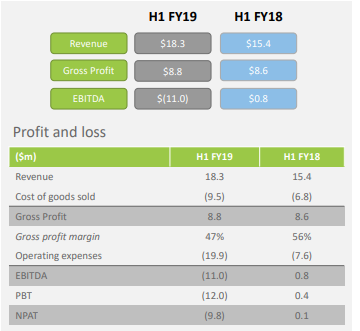

19 Per Cent Revenue Growth for H1 FY2019

In the financial results for H1 FY2019 ended 30 June 2019, the company unveiled

- Revenue grew by 19 per cent year-on-year to $18.3 million from $15.4 million in the same period a year ago (H1 FY2018)

- Strong sales of Elixinol branded products

- Cash in hand stood at $48.1 million, up from $14.2 million in the previous corresponding period

Financial Highlights (Source: Companyâs Report)

Stock Performance

The stock of EXL closed the dayâs trading at $2.070 on ASX on 14 October 2019, up by 0.485 per cent from its previous closing price. The company has a market cap of $284.06 million and approx. 137.89 million outstanding shares. The 52-week high and low value of the stock is at $5.930 and $1.575, respectively. The stock has generated a negative return of 61.57 per cent in the last six months and a positive return of 23.42 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.