The calendar year of 2019 witnessed a rise of several multi-bagger stocks, which have generated hefty returns for the investors. Due to strong business model, new business strategies and constant growth in their earnings, the stocks have rallied to result in appreciable growth. We will be discussing about few stocks which have outperformed the broader market index in CY19.

NRW Holdings Limited (ASX : NWH)

NRW Holdings Limited is engaged in services like civil contracting, services related to mining and servicing of equipment for the resources sector. On 06 December 2019, NWH informed regarding the issuance of 42,105,264 fully paid ordinary shares at a price consideration of $2.85 per share to institutional and professional investors under its âinstitutional placementâ program.

Recently, the company informed its acquisition of National Contractor BGC for an equity value of $116.4 million and a calculated enterprise value of $310 million, excluding $25 million of net cash flow generated from 31st August 2019, which happens to be the effective date of the transaction. The business provided greater visibility on FY20F earnings and it is expected to generate revenue of ~$850 million followed by an EBITDA of ~$100 million and pretax earnings of ~$29.5 million. The company reported order book of ~$4.0 billion, including ~$2.2 billion scheduled for delivery in FY20.

FY20F expectations for BGC Contracting

Stock Update: The stock of NWH closed at $3.060 with a market cap of $1.29 billion on 6th December, 2019. The stockâs P/E stands 35.580x. The stock has gained 91.25% on year to date basis.

Coles Group Limited (ASX : COL)

Coles Group Limited is a retail-focused company. The company deals in household goods, liquor, fresh food, fuel, groceries and financial services and through stores and online. Recently, the company reported that one of its shareholders has increased its stake to 5.007% and has become a substantial shareholder.

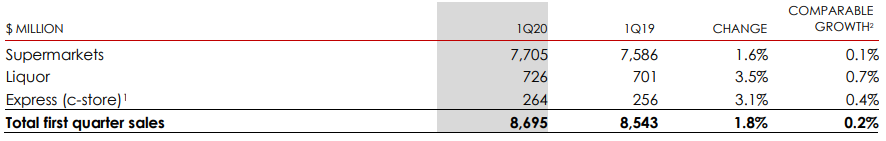

Q1FY20 Operating Highlights for period ended 30 September 2019: COL declared its first quarter operating highlights for FY20 wherein, the company reported sales of $8,695 million, up 1.8% on y-oy basis. The supermarket segment reported 1.6% sales growth on y-o-y basis at $7,705 million. As far as the liquor segment is concerned, the business posted 3.5% y-o-y growth in sales at $726 million.

Q1FY20 Operating Highlights (Source: Company Reports)

Stock Update: on 6th December 2019, COL closed at $15.26 with a market cap of ~$20.48 billion. The stock has given returns of 31.43% on year-to-date basis. The stock is available at a P/E ratio of 14.19x on TTM basis.

Change Financial Limited (ASX : CCA)

Change Financial Limited is a fintech company focused on developing scalable and innovative and payments technologies primarily for financial institutions and businesses. Recently, the company reported appointment of Mr Alastair Wilkie at the position of CEO.

Q1FY20 Cash-flow Highlights for the period ended 30 September 2019 : CCA announced it three months cash flow statements wherein the company reported net cash used in operations activities at US$0.92 million, net cash from financing activities at US$0.234 million as on 30 September 2019. As per the estimated cash flow for the next quarter, the company reported total estimated cash outflow at $0.69 million, including staff costs at $0.32 million and other expenses at $0.37 million. The company reported that its platform registered as a paymentsâ processor for Mastercard during Q1FY20. During the quarter, the company confirmed the recipient of PCI DSS certification.

Stock Update: On 6th December 2019, CCA had a market cap of $14.91 million and closed at $0.145. The stock has given returns of 150% on year-to-date basis.

EML Payments Limited (ASX : EML)

EML Payments Limited is a payments banking company which operates in providing prepaid financial cards to the retailers and as well as the corporates. Recently, the company announced the successful completion of the retail component of its entitlement offer, wherein the company issued ~26 million EML shares at a price consideration of $3.55 per share for an estimated capital raising of ~$93 million.

Operational Highlights for the year ended 30 June 2019: Revenues were at $97.2 million, up 37% on y-o-y basis. Gross Debit Volume (GDV) came in at $9.03 billion, up 34% on y-o-y basis. As per the business performance, the companyâs gift & incentive (âG&Iâ) segment posted strong GDV growth of 42% on y-o-y basis at $1.06 million driven by consistent trading in North American Malls and exponential growth in Europe driven by new product launches and acquisitions of Nordics and Irish businesses. During the period, the company confirmed the acquisition of Flex-e-Card, which resulted in the addition of 226 malls to its portfolio in Europe.

Stock Update : On 6th December 2019, EML had a market cap of $1.43 billion and closed at $4.48. The stockâs P/E stands at 134.94x.

Zip Co Limited (ASX : Z1P)

Zip Co Limited operates in the digital retail finance and payments industry and focuses on point-of-sale credit and digital payment services primarily to the industries like retail, education, healthcare and travel etc. Recently, the company confirmed the upsized placement of $60 million offered to the institutional, sophisticated and professional investors. As indicated by the management, the company would use the allocated fund for global expansion into the UK market, launch its new product Zip Biz and to strengthen the companyâs balance sheet.

Financial results for 1Q FY20: Z1P announced results for 1QFY20. The revenue of $31 million was up 15% on q-o-q basis. The business reported total merchants at $17,890, growing 10% on q-o-q basis. Transaction volume during the quarter stood at $402.1 million, depicting an increase of 14% on q-o-q basis.

Stock Update: On 6th December 2019, Z1P had a market cap of $1.43 billion and closed at $3.59. The stock has generated returns of 226.36% on a year-to-date basis.

CSL Limited (ASX: CSL)

CSL Limited is engaged in research & development, manufacturing and distribution of pharmaceuticals and diagnostic products.

On 4 December 2019, the Management informed that the business is actively looking to support its R&D Business in order to focus on plasma product development including prioritizing in technical operations, process improvement, new formulations & indications etc.

Outlook: The company is focusing on innovation of new therapies used for the remedy of life-threatening diseases. On the marketing and distribution end, the company is looking for strategies which would bring therapies to new markets and new indications. CSL will further focus on improvement of existing products of the business.

Stock update: On 6th December 2019, CSL had a market cap of $126.04 billion and closed at $281. The P/E multiple of the stock is 46.520x. The dividend yield of the stock is 0.95%. The stock has generated a year-to-date return of 51.58%.

Integrated Research Limited (ASX: IRI)

Integrated Research Limited offers products used for computer systems management.

Operating performance for the year ended 30 June 2019: IRI announced its FY19 financial results. Revenues of $100.8 million went up 11% on y-o-y basis. The company reported NPAT of $21.9 million, witnessed a growth of 14% on y-o-y basis. The company posted EBITDA of $40.2 million as compared to $36.43 million in FY18.

During ongoing FY20, the company reported inclusion of larger contracts towards the end of each reporting period. The company added 11 new logos during the current financial year.

Stock Update: On 6th December 2019, the stock of IRI closed at $3.25 with a market capitalization of $565.42 million The stock is available at a P/E multiple of 25.55x on TTM basis. The stock has generated 85.71% on year-to-date basis.

CSR Limited (ASX: CSR)

CSR Limited operates in manufacturing of industrial products and applications intended for building materials, properties and mining products.

1H FY20 Operating Highlights for period ended 30 September 2019: CSR announced its first half financial results for FY20 wherein the company reported trading revenue from continuing operations at $1,150.1 million as compared to $1,198.7 million in previous corresponding period on account of slowdown in residential construction across the country. Statutory NPAT from continuing operations down 19% on y-o-y basis to $68.8 million.

Stock Update : On 6th December 2019, CSR had a market cap of $2.31 billion and closed at $4.72. YTD return of the stock is 71.85%. The P/E multiple of stock stands at 19.67x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.