By the closure of ASX on 5 July 2019, the S&P/ASX 200 Financials Index was up by 0.59%. In this piece of article, we would be discussing four stocks, all from the financial sector, covering their recent updates and performance on the Australian Securities Exchange. The stocks in discussion are CCP, MFG, PPT and ECX.

Credit Corp Group Limited (ASX: CCP)

About the company:

Credit Corp Group Limited (ASX: CCP) is the largest debt buyer and collector in Australia. The company offers financial solutions such as longer-term repayment plans for improving the financial situations of its customers.

Recent Update/s:

Recently on 30 May 2019 and 31 May 2019, companies, Pengana Capital Group Limited (ASX: PCG) and Washington H. Soul Pattinson & Company Limited (ASX:SOL), respectively, ceased to become a substantial holder in Credit Corp Group Limited.

On 31 May 2019, Donald Evan McLay, who is the Chairman and Non-Executive Director of the company, holding indirect interest in Torres Industries Pty Ltd, disposed of 30,000 fully paid ordinary shares of CCP for $ 752,825.

Earlier, Donald Evan McLay had a total of 1,339,270 FPO shares. After disposing of these 30,000 shares, he now has a total of 1,309,270 FPO shares.

Stock Performance:

The shares of CCP have given a decent YTD return of 41.97%. With the market open on 5 July 2019, the price of the shares of CCP was A$ 27.230. It went as high as A$ 27.260. However, by the end of the trading session, the price of the shares of CCP was A$ 27.150, up by 0.111% as compared to its previous closing price. The closing price of CCP stood towards its 52 weeks high price. CCP holds a market capitalization of A$1.49 bn and approximately 54.92 mn outstanding shares. On the same day, around 117,910 shares of Credit Corp Group Limited traded on ASX.

Magellan Financial Group Limited (ASX: MFG)

About the company:

Magellan Financial Group Limited (ASX: MFG), which was formed in the year 2006, serves as an investment manager, with the aim of generating attractive returns for its clients by making investments into global equities as well as global listed infrastructure, and protecting their capital simultaneously.

The investment strategies of the company are focused towards global equities, global listed infrastructure and sustainable. Moreover, the company, via its fully owned subsidiary, Airlie Funds Management, focuses on Australian equities.

Magellanâs Funds

The Global Equities strategy of the company provides its investors with the opportunity of injecting their money in a specialized and focused global equity portfolio. The investment objective of this strategy is to obtain attractive risk-adjusted returns during medium to long term and simultaneously reduce any capital loss risk. For this, Magellan does rigorous company research and recognize what it measures to be superior companies along with continuing competitive advantages. This, along with the valuation of the macroeconomic environment as well as an orderly risk-controlled method to portfolio construction, leads to a focused portfolio of superior global equity stocks.

The Global Infrastructure strategy of the company provides the investors with an option to make an investment in a specialized and focused global listed infrastructure portfolio in order to achieve attractive risk-adjusted returns over the medium to long term and at the same time reduce the scope of capital loss.

Recent Update/s:

Recently, the company provided three updates. The first was regarding the change in the substantial holding of the company in Atlas Arteria (ASX: ALX). Earlier, the company had 34,214,121 ordinary stapled securities of Atlas Arteria and a voting power of 5.01%. After the changes, the company is now holding 41,155,884 ordinary stapled securities of the entity with a 6.02% voting power.

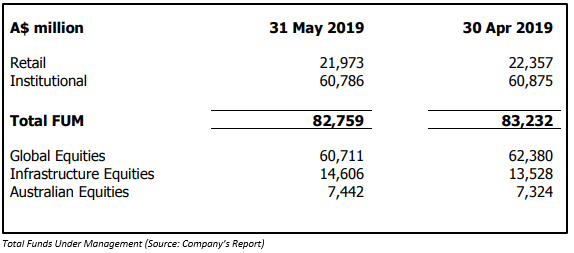

The second update from the company was regarding its funds under management. As at 31 May 2019, the total funds under management declined from A$83,232 in April 2019 to A$82,759 in May 2019. The net inflows for the period were A$264 mn which comprises of net retail inflows of $146 mn as well as net institutional inflows worth $118 mn.

The third update was regarding the changes made to the board. Magellan Financial Group Limited appointed Mr Hamish McLennan as Deputy Chairperson of the company. At the same time, a new appointment was made in Magellan Asset Management Limited. Mr Robert Fraser will join as the Chairperson of the main operating subsidiary and a responsible entity of MFG.

Stock Performance:

The shares of MFG have given an excellent YTD return of 132.82%. With the market open on 5 July 2019, the price of the shares of MFG was A$54.430. It went as high as A$55.680. By the end of the trading session, the price of the shares of MFG was A$ 55.350, up by 1.728% as compared to its previous closing price. The closing price of MFG stood towards its 52 weeks high price. MFG holds a market capitalization of A$9.64 bn and approximately 177.09 mn outstanding shares. On the same day, around 945,661 shares of Magellan Financial Group Limited traded on ASX.

Perpetual Limited (ASX: PPT)

About the company:

Perpetual Limited (ASX: PPT) is an ASX listed diversified financial services company. It is serving its clients across Australia since 1886.

Through its 3 main businesses which include Perpetual Private, Perpetual Investments and Perpetual Corporate Trust, the company protects as well as grows its clients' wealth.

The Perpetual Global Share Fund of the company comprises of a portfolio of high-quality corporations that are selected for the purpose of their long-term investment potential as well as striking valuations. Over a five=year period, the fund has given a net return of 12.4% to 31 March 2019, on an annual basis.

Recent Update/s:

On 3 July 2019, Perpetual Limited provided an update related to the change in the interest of a substantial holding, according to which Perpetual Limited and its related bodies corporate had 28,372,245 ordinary shares of HT&E Limited (ASX:HT1) with a 9.18% voting power; however, the same has been changed to 23,176,899 ordinary shares with an 8.14% voting power.

According to another company announcement on 2 July 2019, Perpetual Limited and its related bodies corporate have ceased to become a substantial holder in Japara Healthcare Limited (ASX:JHC).

Stock Performance:

The shares of PPT have given a decent YTD return of 40.33%. With the market open on 5 July 2019, the price of the shares of PPT was A$43.950. It went as high as A$44.490. By the end of the trading session, the price of the shares of PPT was A$44.430, up by 1.253% as compared to its previous closing price. The closing price of PPT stood towards its 52 weeks high price. PPT holds a market capitalization of A$ 2.04 bn and approximately 46.57 mn outstanding shares. On the same day, around 198,577 shares of Perpetual Limited traded on ASX.

Eclipx Group Limited (ASX: ECX)

About the company:

Eclipx Group Limited (ASX: ECX) serves its Australian and New Zealand clients by offering fleet management and vehicle fleet leasing services. The company is also engaged in providing diversified financial services.

Brands:

FleetPartners, FleetPlus, FleetChoice, AutoSelect, CarLoans.com.au, and GraysOnline are some of the companyâs brands.

Recent Update/s:

On 31 May 2019, the company provided its 1HFY2019 results along with an update on simplification plans.

Group 1HFY2019 results:

The net operating income of the company declined by 15% to $ 132 mn as compared to the previous corresponding period (pcp). Its EBITDA and one-off costs, which include goodwill impairment, declined by 46 percent to $31.3 mn on pcp. The NPATA also declined by 62 percent to $13.8 mn. The statutory loss after tax for the period stood at $120.3 mn, which comprises of $118.4 mn of non-cash impairment charge.

Core Fleet and Novated 1HFY2019 results:

The Core Fleet and Novated businesses of the company delivered a stable EBITDA of $40.7 mn, down by 3% on pcp. The NPATA for 1H FY2019 was down by 13% year-on-year to $24.1 mn. The total assets under management or financed was up by 7% year-on-year to $2.1 billion.

Simplification Plans:

According to the companyâs simplification plan update, the reinvigorated leadership team, which is being headed by Julian Russell (CEO) and Bevan Guest (promoted to Chief Commercial Officer) will focus on growing the core businesses through the organic strategy. Its new operating model will cover the re-sizing of the cost base to reflect simplification and disciplined capital allocation to maximize returns. Moreover, under the strategy, the company will have a strong focus on innovation, and management accountability under a transparent organizational structure with collective input from a newly formed Executive Committee.

Stock Performance:

The shares of ECX have given a decent return of 54.82% in the last three months. With the market open on 5 July 2019, the price of the shares of ECX was A$1.300. It went as high as A$1.650. By the end of the trading session, the price of the shares of ECX was A$1.550, up by 20.623% as compared to its previous closing price. ECX holds a market capitalization of A$410.73 mn and approximately 319.64 mn outstanding shares. On the same day, around 9,011,608 shares of Eclipx Group Limited traded on ASX.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.