Reports released by companies in every three months are known as quarterly reports. These reports include accounting as well as financial data of companies, covering details related to gross revenue, net profit, operational expenses and cash flow during the period.

These results are of utmost importance to companies as well as their shareholders, as they highlight the financial health of the company. The comparative analysis of the existing quarter with respect to its previous corresponding period helps the company to understand the extent of progress made during the period. It also helps to know the available cash balance along with working capital needs. Based on which, the company generally makes decisions regarding its future plans.

Below discussed are three mining stocks that have recently released their quarterly reports.

Perseus Mining Limited

Perseus Mining Limited (ASX: PRU) is a strong, diversified producer, developer and explorer of gold, with focus on West Africa. The company achieved its first gold production in January 2018 at the Sissingué Gold Mine in Côte dâIvoire.

June 2019 Quarter Activities Report:

On 18 July 2019, the company released its activities report for the quarter ended June 2019. During the reported period, its total gold production reached 64,125 ounces, including 42,555 ounces from the Edikan gold mine situated in Ghana and 21,570 ounces from the Sissingué gold mine located in Côte dâIvoire. The combined gold production of the company in the March 2019 quarter and June 2019 quarter stood at 131,269 ounces, in accordance with the market guidance released earlier.

Q219 Highlights (Source: Companyâs Report)

The company also updated regarding its gold production and cost guidance for FY2020. The gold production for the first half of FY2020 is expected to be in the range of 120 ounces to 140 ounces, while All-In Site Cost (AISC) is anticipated at USD 850-1,000 per ounce. For the remaining part of FY2020, PRU expects gold production to be in the range of 140 ounces to 160 ounces and AISC at USD 750-950 per ounce.

Apart from this, the company highlighted that it has started the development of Yaouré (its third gold mine). On 26 April 2019, Perseus Yaouré SARL, the Ivorian subsidiary of Perseus, secured the Exploration Permit No 50 for developing as well as operating the Yaouré Gold Mine, which is located in Côte dâIvoire. Yaouré is believed to hold the potential to become a large-scale, low-cost gold mining operation, with a forecast capital cost of USD 265 million.

The initial site works at the mine have commenced. By 30 June 2019, around US$93.5 million was committed, and US$11.8 million amount was used, majorly covering the engineering and procurement of plant and equipment. First gold production at the mine is expected in December 2020.

At end-June 2019, the company had cash and bullion worth USD 119.3 million, including USD 38.5 million during the quarter. Its outstanding bank debt declined by USD 13.0 million to USD 31.5 million, as a result of which net cash and bullion at the end of June 2019 reached USD 87.8 million, up 142% during the quarter. The company generated around USD 19.2 million of notional cashflow via operations. It also received USD 37.8 million from the exercise of warrants and associated underwriting, net of fees.

Stock Performance:

In the previous six months, the shares of PRU have generated a decent return of 65%. The opening price of the shares of PRU on 18 July 2019 was $ 0.675. By the end of the trading session, the price of the shares of PRU was $ 0.665, up 0.758% as compared to its previous closing price. PRU has a market capitalisation of $ 770.52 million and approximately 1.17 billion outstanding shares.

South32 Limited

South32 Limited (ASX: S32) is a diversified mining and metals company, engaged in the production of bauxite, alumina, aluminium, energy and metallurgical coal, manganese, nickel, silver, lead as well as zinc. The company, which is listed on ASX, JSE and LSE, operates in Australia, as well as in the regions of Southern Africa and South America.

Quarterly Report June 2019:

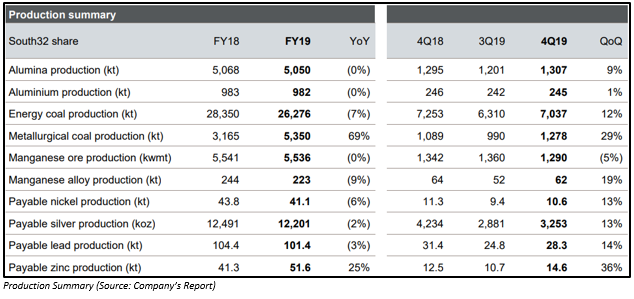

In a market update on 18 July 2019, S32 disclosed its report for the quarter ended June 2019. Despite an increase in load-shedding events in FY19, it reported to have achieved best-ever production levels at Hillside Aluminium and robust performance at Mozal Aluminium.

The company registered a 12% increase in production at Worsley Alumina during the reported quarter, backed by a boost in calciner availability. It also reported to have maintained higher manganese ore production, with the delivery of 5.5 Mt into a strong market during the year.

There was also a 57% increase in saleable production at Illawarra Metallurgical Coal to 6.6 Mt in FY2019, owing to the strong performance of Dendrobium and Appin longwalls after the completion of two longwall moves in the June 2019 quarter. FY2019 production level at Cannington exceeded guidance, while production volume at South Africa Energy Coal was below than anticipated in the June 2019 quarter.

The company registered a 10% increase in revenue equivalent production during the quarter, while its FY19 revenue equivalent production grew 3%, according to South32 Limited CEO Graham Kerr. Moreover, the company was able to complete USD 986 million of its approved USD 1 billion capital management program at the end of the year, said Graham Kerr.

Stock Performance:

In the previous six months, the shares of S32 have generated a negative return of 11.79%. The opening price of the shares of S32 on 18 July 2019 was $ 3.020. By the end of the trading session, the price of the shares of S32 was $ 2.980, down by 1.65% as compared to its previous closing price. S32 has a market capitalisation of $ 15.17 billion with approximately 5.01 billion outstanding shares, PE ratio of 7.74x and an annual dividend yield of 5.23%.

Alumina Limited

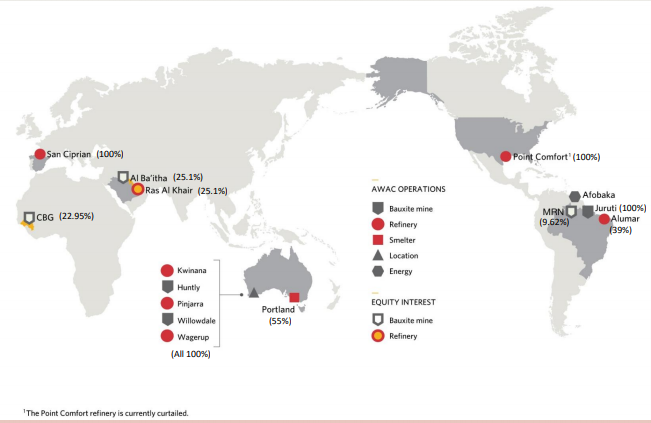

Alumina Limited (ASX: AWC) is one of the leading resource companies in Australia, focusing on alumina, the feedstock for aluminium smelting. The company is the 40% owner of the largest alumina business in the western world, Alcoa World Alumina & Chemicals (AWAC). AWC ranks amongst the top 100 companies in Australia, boasting strong returns, steady performance as well as continuing growth.

Q219 Earnings Update:

On 18 July 2019, the company released the second quarter earnings report of Alcoa Corp, which is AWCâs partner in AWAC. The release covered Alcoa Corpâs Bauxite and Alumina segments.

Alumina Segment: In the second quarter of 2019, total adjusted EBITDA for the segment stood at $ 369 million, which was slightly lower than $ 372 million posted during the first quarter of 2019. Impacts from sales volumes, currency, and raw materials were nullified by lower API and higher maintenance expenses.

Bauxite: In the second quarter of 2019, total adjusted EBITDA for the segment reached $ 112 million, compared with $ 126 million in Q119. The segment witnessed higher cost of maintenance as well as lower equity accounted profit, which got slightly nullified by subdued local currency and sales price mix.

AWAC:

Refining Business: Production from the AWAC refining business reached 3.1 mt in the second quarter of 2019, which was at par with the first quarter of 2019.

Mining Business: Production from the AWAC mining business stood at 10.8 mbdt, slightly lower than the first quarter of 2019.

AWAC Operations (Source: Companyâs Report)

Stock Performance:

In the previous six months, the shares of AWC have generated a negative return of 6.78%. The opening price of the shares of AWC on 18 July 2019 was $ 2.190. By the end of the trading session, the price of the shares of AWC was $ 2.190, down by 0.455% as compared to its previous closing price. AWC has a market capitalisation of $ 6.34 billion with approximately 2.88 billion outstanding shares, PE ratio of 7.030x and an annual dividend yield of 14.23%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.