Lithium, as a significant component in the energy storage sector, plays a pivotal role because of its unique property to store the electricity. The demand of the metal has surged in the recent past amid global stance to curb the environmental pollution in line with Euro 6 emission standards.

The increased measures by global economies to shift towards zero-emission economies has marked the emergence of the electric vehicle segment and renewable energy sector, wherein lithium is majorly used for energy storage.

Global demand and high prices have prompted many industry players to dive in the sector, and various lithium-based chemistry such as lithium carbonate, lithium hydroxide took roots in the international market.

Australiaâs emergence as leading Lithium Player

With lithium demand boosted up in the international market, Australia has emerged as a giant player with its extensive mineral resources, up-beating Chile, which once remained the worldâs largest lithium supplier.

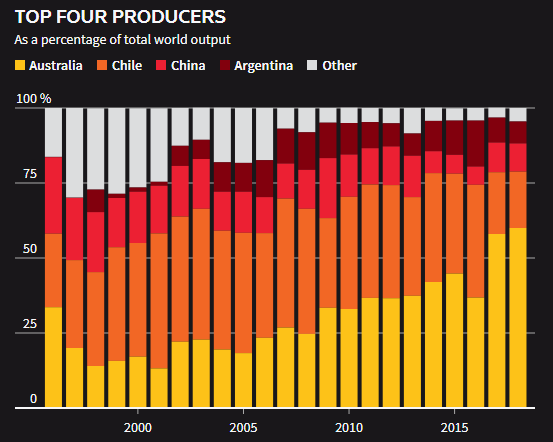

Top Lithium Producers (Source: Thomson Reuters)

Australia ranks top among the top four lithium producers in the international market and the country has secured the global status gradually.

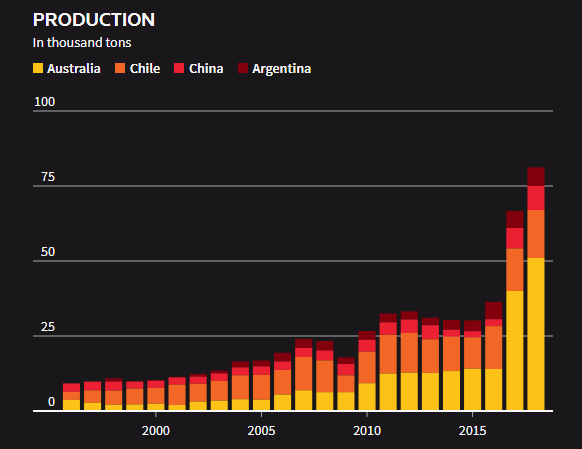

Lithium Production (Source: Thomson Reuters)

High conversion of mineral resources into primary production by the Australian lithium players provided the country an impetus to emerge as a global mammoth of the lithium industry.

Lithium Output vs Reserves (Source: Thomson Reuters)

With Australia now standing among the top four primary producers of lithium, let us look at lithium players on the Australian Securities Exchange (ASX), which are gaining investorsâ traction.

Although, higher production in the industry pushed down the prices of lithium from the beginning of the year 2019, but, as per the estimation of significant industry players, the demand of lithium is expected to inch up by three times of the current demand by 2025.

In a nutshell, lithium prices witnessed a downside amid over supply in the market, and in the recent event major player like Rio Tinto is also working on its high-grade Jadar lithium project, which could exert more pressure on the prices in the international market.

Price Scenario:

The lithium prices have declined by 7.50 per cent since the commencement of the year 2019 amid higher supply and significant increase in entry of mineral players in the lithium market to take advantage of the battery boom.

Historically the prices emerged from its February 2016 low of 62.79 to the level of 156.80 in January 2018. The prices plunged in the market post making its record high of 156.80.

The prices are currently around 98.92 (as on 4th June 2019) 1.69 per cent higher as compared to its previous close, and 0.99 per cent higher as compared to its previous week close.

However, on a monthly basis, the prices declined by 10.15 per cent (as per the current prices) as compared to its monthly close in May 2019 and by 25.24 per cent lower as compared since the commencement of the year 2019.

As per the industry consensus, the lithium market is expected to mark a boom by 2025 over the demand from electric vehicle segment, which is expected to pull the lithium prices; however, the market participants would keep a close eye on the development of various project of mammoth miners, which are now aiming for the lithium market.

Four Lithium Stocks on ASX:

Anson Resources Limited (ASX: ASN)

The share prices of the company took a hit from the level of A$0.310 (Dayâs high on 15th January 2018) to the level of A$0.037 (Dayâs low on 25th June 2019) initially. Post marking a level of A$0.037, the prices recovered to the level of A$0.185 (Dayâs high on 12th July 2018). The shares of the company again continued its original downtrend after marking a high of A$0.185 to the level of A$0.047 (Dayâs low on 31st May 2019).

The share prices of Anson have shown recovery in the recent days, making a high of A$0.082 on 3rd June 2019. The shares are currently trading at A$0.062 (as on 5th June 2019 AEST 1:50 PM).

Anson recently produced a battery quality sample of lithium carbonate from the brine sourced from its Paradox Brine Project, a chemistry in deep competition with lithium hydroxide, which is growing at a slower than expected projections of the lithium industry.

The company further plans to extend the production capacity and is planning to produce an off-site sample of 20kg to test the qualifications of the sample in accordance with the companyâs prospective customersâ specifications.

Lithium Australia NL (ASX: LIT)

The share prices of the company are moving in major downtrend from the level of A$0.380 (Dayâs high on 20th April 2016). The shares dropped from the level of A$0.380 to the level of A$0.073 (Dayâs low on 5th July 2017) initially and recovered after that to the level of A$0.265 (Dayâs high on 13th November 2017).

Post touching the level of A$0.265, the shares of the company plunged and resumed the original downtrend till the present level of A$0.077 (Dayâs low on 8th May 2019).

The share prices have recovered in recent sessions and are consolidating in a narrow range of A$0.082 to A$0.090 from past many trading sessions.

The prices are currently trading at A$0.083 (as on 5th June 2019 AEST 2:17 PM).

Lithium Australia NL recently generated unrefined lithium phosphate by using its proprietary SiLeach® technology from waste material and further produced Lithium Iron Phosphate battery from it.

LIT also discovered some discrepancies in the Australian battery market and entered into a sale agreement with a significant Chinese battery player- DLG to take advantage of the identified inconsistencies in the Australian battery market supply chain.

PepinNini Lithium Limited (ASX: PNN)

The share prices of the company are moving in a continuous downtrend from the level of A$0.094 (Dayâs high on 28th December 2017) to the present level of A$0.003 (as on 5th June 2019 AEST 2:37 PM).

The shares of the company are trading in a narrow range with less liquidity compared to its peer group.

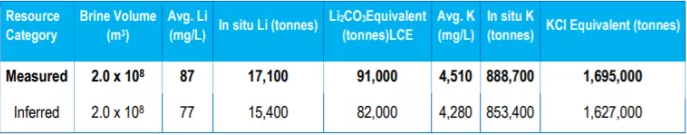

In its quarterly activity report, the company mentioned that the JORC 2012 edition classified Measured Resources of brine at Pular Project stands at 91,000 tonnes and the Inferred LCE of the project stands at 82,000 tonnes.

The project contains 1.7 million tonnes of Measured potash, a fertilizer component on which major miners such as Rio Tinto, and BHP Billiton are eyeing, and 1.6 million tonnes of Inferred potash.

Source: Companyâs Report

The Measured Resources of the company contains Brine, which accounts for 17,100 tonnes of in-situ lithium, which is equivalent to 91,000 of lithium carbonate with an average potash chloride source of 1,695,000 tonnes and in-situ potash of 888,700 tonnes.

Simultaneously, the Inferred Resources of the company contains Brine, which accounts for 15,400 tonnes of in-situ lithium, which is equivalent to 82,000 tonnes of lithium carbonate with an average potash chloride source of 1,627,000 tonnes and in-situ potash of 853,400 tonnes.

Apart from lithium, the company hosts major other commodity projects which include copper, gold, potash, etc. The company includes a vast portfolio of various projects.

Core Lithium Ltd (ASX: CXO)

The share prices of the company moved in a downtrend from the level of A$0.150 (Dayâs high on 7th October 2016) to the level of A$0.033 (Dayâs low on 25th August 2017). The prices showed recovery from the level of A$0.033 to A$0.105 (Dayâs high on 1st December 2017), but the prices took a hurdle of the same level of A$0.105.

Post experiencing the hurdle, the shares of the company moved in a continuous downtrend from the level of A$0.105 to the level of A$0.037 (Dayâs low on 11th September 2018). The share prices recovered after that to the level of A$0.065 (Dayâs high on 29th September 2018), from where it fell again to the level of A$0.041 (Dayâs low on 2nd May 2019).

The shares further rose from the level of A$0.041 till A$0.053 (Dayâs high on 13th May 2019) and are currently trading at A$0.043 (as on 5th June 2019 AEST 3:06 PM).

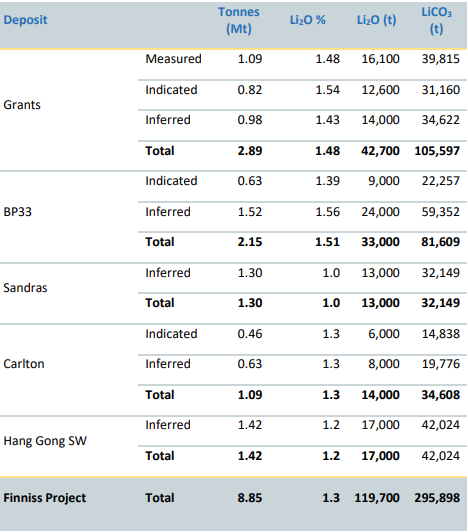

Core Lithium received high-grade intersection form BP33 deposit at its flagship Finniss prospect of 1.78 per cent and 2.06 per cent, where the company recently conducted a drilling program.

The company managed to inch up the Mineral Resource of the project during the March 2019 quarter and increased the Global Mineral resources till 8.85 million tonnes with an average grade of 1.3 per cent lithium oxide.

The Mineral Resources of other prospects are as:

Source: Companyâs Report

The Total Resources of the Grants prospect stands at 2.89 million tonnes with an average grade of 1.48 per cent, which would account for 42,700 tonnes of lithium oxide and 105,597 tonnes of lithium carbonate.

Likewise, the Total Resources of the Sandras prospect stands at 1.30 million tonnes with an average grade of 1.00 per cent, which would account for 13,000 tonnes of lithium oxide and 35,149 tonnes of lithium carbonate.

The Total Resources of the Carlton prospect stands at 1.09 million tonnes with an average grade of 1.3 per cent, which would account for 14,000 tonnes of lithium oxide and 34,608 tonnes of lithium carbonate.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)