On 20 September 2019, the banking stocks on ASX are trading in the green, with the S&P/ASX 200 BANKS (INDUSTRY) index trading at 2,627, up by 0.32%. While the benchmark index S&P/ASX 200, doing a tad better, trading at 6,745.2 up by 0.41% (as at AEST: 3:00 PM)

During this week, the Reserve Bank of Australia released its minutes of the September policy, in which RBA stated that it would provide further easing to aid inflation growth to 2-3%.

The market is expecting another rate cut of 75 basis points during the end of 2019 followed by a 50-basis point cut during FY2020.

As per the reserve bank commentary, it highlighted a cautious stance on both domestic and global economic conditions. However, a section of market participants believes that the further rate cut would provide lower borrowing cost to the borrowers and market hinted about improved credit system in the coming months.

The credit growth would provide higher growth to the banking system. On account of that, the banking shares are trading with positive gains this week on the ASX.

The banking stocks are trading toward the upper band of their 52-week trading range. Letâs have a quick look at the top banking stocks on ASX.

Commonwealth Bank of Australia

Commonwealth Bank of Australia (ASX: CBA) provides integrated financial services, majorly focusing on retail and commercial banking across Australia, New Zealand, United Kingdom, United States, China, Japan, Singapore and several other countries. The bank has a customer base of more than 17.4 million.

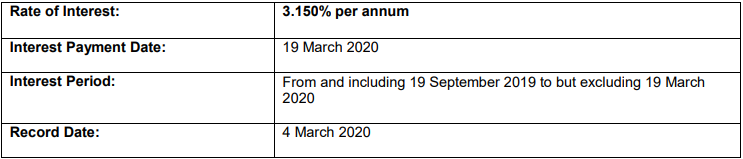

On 20 September 2019, the bank updated the market with details for the next interest payment.

Source: Bankâs Report

Source: Bankâs Report

On 17 September 2019, the bank unveiled an update on the dividend announcement made by the bank in August.

Bank to pay a fully franked dividend of AUD 2.31 for each ordinary share held with a payment date of 26 September 2019. Annualized dividend yield of the company stands at 5.27%.

Dividend History (Company Reports)

Dividend History (Company Reports)

On 12 September 2019, the bank announced the issue of subordinated notes worth U.S.$2.5 billion.

- The U.S.$2.5 billion 3.610% subordinated notes due 2034 and

- The U.S.$1.25 billion 3.743% Subordinated notes due 2039

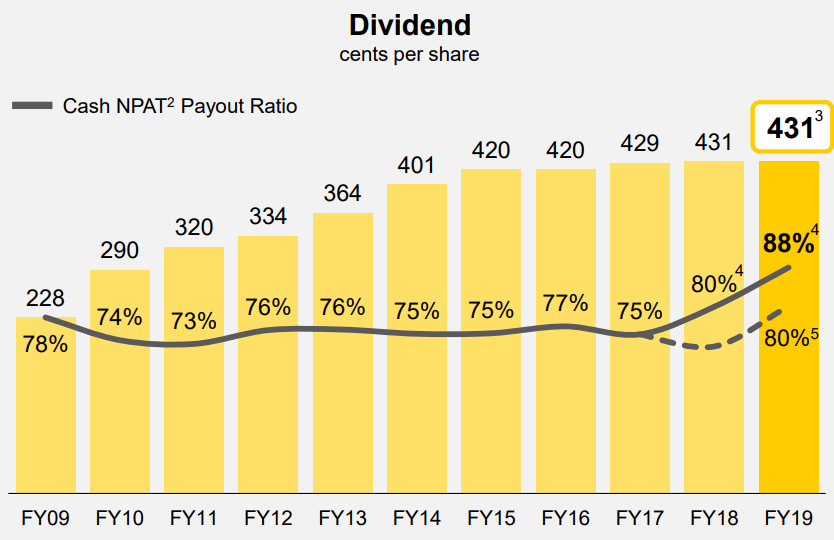

FY19 Financial Highlights for the year ended 30 June 2019:

Operating income stood at $24,407 million down by 2% on y-o-y basis while cash NPAT came in at 4.7% lower at $8,492 million on y-o-y basis.

Stock update: The stock of CBA is quoting at $82.100, lower by 0.097% from its previous close as on 20 September 2019. The market capitalization of the stock stands at $145 billion and the stock is currently available at a P/E multiple of 16.92x. The stock has given a positive return of -0.15% and 15.21% in the last three-months and six-months, respectively.

Westpac Banking Corporation

Westpac Banking Corporation (ASX: WBC) operates across wide verticals of financial services like lending, deposits, investment portfolio management, payment services, superannuation and insurance services, leasing finance, general finance, interest rate risk management and foreign exchange services etc. across Australia and New Zealand region.

Recently, the bank informed the market about the retirement of its existing CFO, Mr Brian Hartzer in 2020. Mr Brian Hartzer is retiring after serving the bank for the last 25 years.

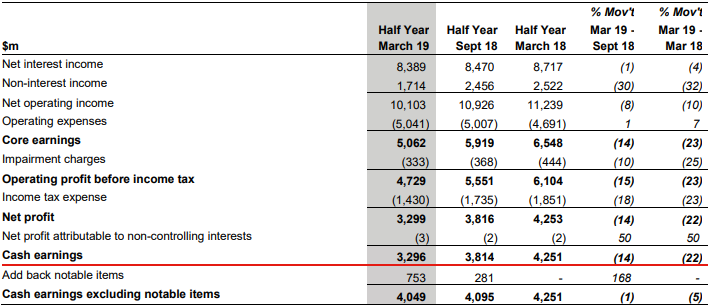

During H1FY19, WBC reported cash earnings $3,296 million, down 22% on pcp and net interest income at $8,389 million, down by 4% on pcp terms.

FY19 Financial Highlights (Source: Company reports)

FY19 Financial Highlights (Source: Company reports)

Stock update: The stock of WBC is quoting at $29.73, higher by 0.541% from its previous close as on 20 September 2019. The market capitalization of the stock stands at $103 billion and the stock is currently available at a P/E multiple of 14.35x, with a dividend yield of 6.36% The stock has given a positive return of 4.38% and 11.9% in the last three-months and six-months, respectively.

National Australia Bank Limited:

National Australia Bank Limited (ASX: NAB) operates in a wide range of financial products such as banking, loans, credit and debit card services, investment banking, wealth management, leasing, housing and general finance, funds management etc. The bank has a wide presence across Australia, New Zealand, Asia, UK and the US.

Recently the NAB has announced regarding the change in its substantial holdings in Metro Performance Glass Limited from 5.163% voting power to 6.557% voting power representing 9,570,413 ordinary shares. Further, it also informed the market that it is no more a substantial holder for MGG.

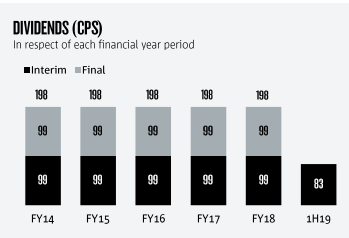

During H1FY19, the bank reported $2,694 million of statutory profit with 10.4% Group Common Equity Tier1 (CET1) ratio. The bank has announced a fully franked dividend of 83cps during the first half. Annualized dividend yield of the banks stands at 6.24%.

Dividend Distribution over the years (Source: Company Reports)

Dividend Distribution over the years (Source: Company Reports)

Stock update: The stock of NAB is quoting at $29.575, higher by 0.87% as on 19 September 2019. The market capitalization stands at $84.53 billion and the stock is available at 14.29x. The stock has generated positive return of 9.28% and 17.457% in the last three-months and six-months, respectively.

Australia and New Zealand Banking Group Limited

Australia and New Zealand Banking Group Limited (ASX: ANZ) is engaged in an array of financial services like retail and corporate banking, insurance services and financial advisory services. The bank has branches across Australia, New Zealand, UK and in Asia Pacific.

Recently the bank notified that it has appointed Ken Adams as the Company Secretary of ANZ while Bob Santamaria and John Priestley have ceased to be Company Secretaries from the bank.

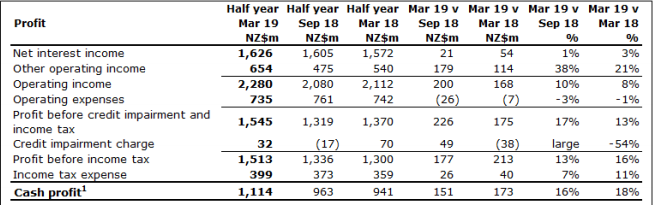

During H1FY19, Australia and New Zealand Banking Group Limited reported statutory profit at NZ$929 million, down 4% pcp while customer deposits grew by 7% y-o-y and gross lending increased by 4% on y-o-y terms. Net interest income came in at NZ$1,626 million, higher by 3% on H1FY18.

FY19 Financial Highlights (Source: Company reports)

FY19 Financial Highlights (Source: Company reports)

Stock update: The stock of ANZ is trading at $27.93, up 0.359% as on 20 September 2019. The market capitalization of the company stood at $78.89 billion while the stock is available at a price to earnings multiples of 12.70x. The annualized dividend yield of the stock stood at 5.78%. The stock has generated returns of -2.9% and 5.82% in the last three-months and six-months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.