One of the main reason for the companies to pay dividends is to gain attraction from investors and increase the demand for their shares. As dividends are a source of steady cash streams for investors, the investors generally get attracted to dividend-paying stocks.

Importance of Dividends

The company uses dividends to create a better picture of itself in the eyes of investors. By paying dividends the companies can effectively communicate about their financial health & performance to their shareholders.

Moreover, dividends are an effective way of maintaining and building the confidence of shareholders in the company. The companies that pay dividends consistently are considered more stable, and they look more attractive to investors.

For investors, the dividends are also important for equity evaluation as dividends offer a solid indication about the performance and financial well- being of the company. Further, the companyâs current and historical dividend payout ratio helps investors in basic fundamental analysis of the company.

Letâs take a look at few stocks which have recently paid dividend/distributions to their shareholders.

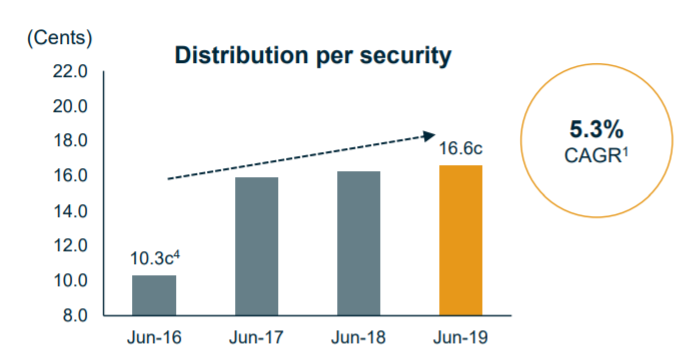

Aventus Group (ASX:AVN)

Australiaâs leading manager and developer of large format retail centres in Australia, Aventus Group (ASX: AVN) reported distributions per security of 16.6 cents for the financial year 2019. In the last four years, the Group has witnessed a CAGR growth of 5.3% (refer below graph).

Most recently, the Group paid a distribution of 4.18 cents, relating to the 2019 June quarter. The company recently revealed its FY19 results, wherein, it reported FY19 FFO of 96 million.

FY19 Highlights

- Revaluation gains of $85 million

- Profit of $110 million

- Gearing of 38.7% within target range of 30% - 40%

- Accelerated like-for-like NOI growth to 3.5% in FY19

- Achieved 98%+ average occupancy

- Boosted everyday needs category to 38% of portfolio by gross income

- Diversified and lengthened debt facilities to 4.1 years

- Low cost of debt of 3.5% whilst mitigating interest rate volatility

FY2020 Outlook

In FY2020, the company is focussed on:

- Diversifying its tenant base with a priority on increasing everyday-needs to continue to drive weekday traffic and energise its centres;

- Investing in the expansion and development of the portfolio to enhance the shopper experience and capitalise on attractive development returns;

- Maintaining disciplined capital management to allow for the execution of groupâs strategy.

Stock Performance: In the past six months, AVNâs stock has provided a return of 20.63% as on 13 September 2019. Its 52 weeks high price if $2.785 and its 52 weeks low price is $1.905. At market close on 17 September 2019, AVNâs stock traded at a price of $2.700 with a market capitalisation of circa $1.47 Billion. The stock is trading at a PE multiple of 12.750x with an annual dividend yield of 6.16%.

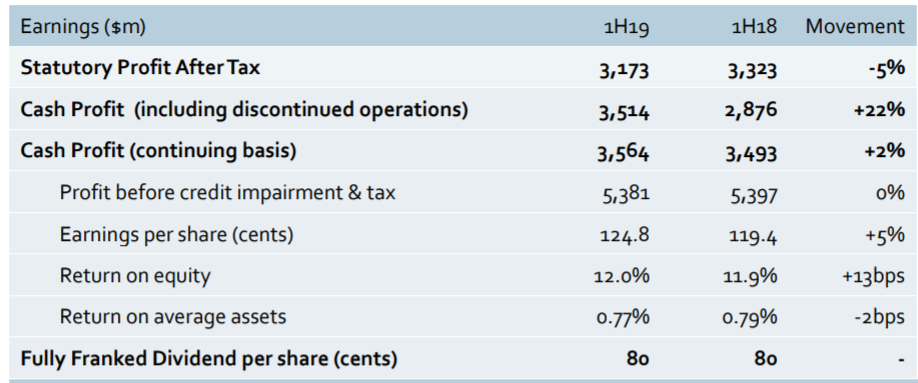

Australia and New Zealand Banking Group Limited (ASX:ANZ)

One of Australiaâs leading bank, Australia and New Zealand Banking Group Limited (ASX: ANZ) most recently paid a dividend of 80 cents per share (fully franked) to its shareholders, relating to the period of six months ending 31 March 2019. For the same period, the company reported Statutory Profit after tax of $3.17 billion, down by 5% on pcp and cash profit (continuing operations) of $3.56 billion, 2% up on pcp.

H1 FY19 Results snapshot (Source: Company Report)

During the half year period, ANZ took various business initiatives which are as follows:

- ANZ introduced a single home loan origination system for all channels in Australia to improve the application and assessment process, and it also increased the number of dedicated home loan assessors in Australia to assist with enhanced verification;

- ANZ grew home loans and retail deposits in New Zealand by 6% respectively year on year;

- ANZ was named number 1 trade financier in Australia in Institutional for eighth consecutive year

- ANZ was also named Asian Bank of the Year for 2018 by IFR Asia

- Maintained leading market position in Australia and New Zealand and retained number 1 position for overall relationship quality in Asia for the second consecutive year

- Maintained digital wallet leadership with more than 88 million transactions in the last 12 months, with total customer spend up 114% in that same period.

Stock Performance of ANZ: In the past six months, ANZâs stock has provided a return of 4.51% as on 16 September 2019. Its 52 weeks high price if $29.300 and its 52 weeks low price is $22.980.

At market close on 17 September 2019, ANZâs stock traded at a price of $27.750 with a market capitalisation of circa $78.23 billion. The stock is trading at a PE multiple of 12.600x with an annual dividend yield of 5.8%.

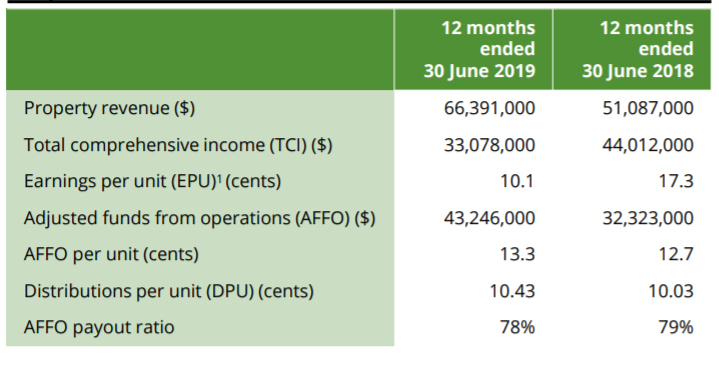

Rural Funds Group (ASX:RFF)

Real estate investment trust, Rural Funds Group (ASX: RFF) is involved in the leasing of agricultural properties and equipment. As at 30 June 2019, the Group had 47 properties which included 17 poultry farms, 3 almond orchards, 14 cattle properties and several other properties.

The group recently declared a distribution amount of AUD 0.027, relating to the September 2019 quarter. The distribution is having a record date of 30 September, ex-date of 27 September and payment date of 31 October 2019.

Recently, the group released its FY19 results wherein it reported FY19 net profit after income tax of $38.17 million and adjusted funds from operations $43.246 million. For FY19, the distributions per unit was at 10.43 cents, up 0.40 cents on previous year.

During the year, the Groupâs Property revenue increased by 30% due to JBS transactions, acquisitions, development capital expenditure, and lease indexation.

FY19 Results Snapshot (Source: Company Reports)

FY19 Highlights:

- Increase in adjusted total assets of $222.2 million primarily due to acquisitions, capex and revaluations of almond orchards, vineyards and water entitlement

- Gearing of 31% remains within target range of 30-35%, with sufficient capacity to settle remaining acquisitions and committed capital expenditure

- Adjusted NAV per unit growth of 7%, primarily attributable to independent revaluations of almond orchards, vineyards and water entitlement

- Cattle acquisitions, revaluations and capex includes acquisitions of $114.9m during the period

Stock Performance of RFF:

In the past six months, RFFâs stock has provided a negative return of 8.93% as on 13 September 2019. Its 52 weeks high price if $2.420 and its 52 weeks low price is $1.360.

At market close on 17 September 2019, RFFâs stock traded at a price of $2.010 with a market capitalisation of circa $665.85 million. The stock is trading at a PE multiple of 19.550x with an annual dividend yield of 5.27%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.