Technology stocks are the stocks of those companies that are engaged in technology development, as well as providing services related to technology. Technology companies are involved with innovation and research & development, wherein they invest a huge amount of money annually.

In this article, we would acquaint ourselves to three technology companies and their recent developments.

Whispir Limited

Company Overview

Whispir Limited (ASX: WSP) is a software-as-a-service (SaaS) company that offers a communications workflow platform which facilitates interaction between businesses and people.

Recent Update:

Wilsons Investor Seminar Presentation:

On 26 September 2019, Whispir Limited published its Wilsons Investor Seminar Presentation, highlighting the below:

- About the company;

- Its present position;

- Its partners;

- Its market opportunity;

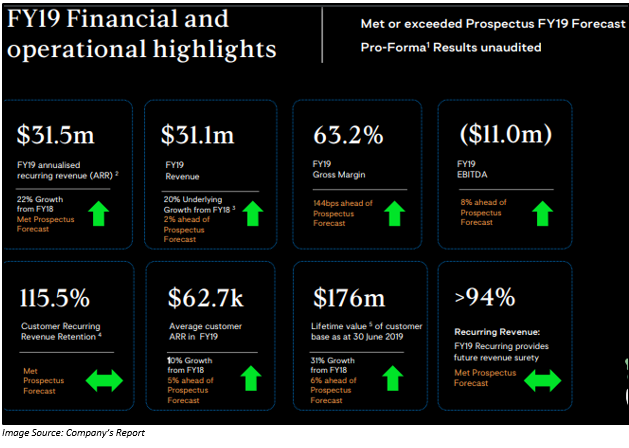

- FY2019 highlights;

- Q1 FY2020 achievements;

- FY2020 outlook;

- The revenue model.

Addition of IoT functionality with Amazon EventBridge:

Addition of IoT functionality with Amazon EventBridge:

In a recent press release of the company, Whispir notified that it has entered into a partnership with AWS to increase its IoT functionality. With this, all the users would now be able to build improved event-triggered integrations without any requirement for coding.

Facilitated by Amazon EventBridge, the users of Whispir and AWS would be able to apply communication workflows easily, generating a string of responses based on instantaneous alterations in geolocation data.

The enhanced functionality is suitable in case of emergency along with operational business communications, improving marketing communications. Thus, the companies can act based on the replies received via email, website click or through form submission instantly.

The access allowed Alert Logic, a cyber security company and a client of WSP, to combine the EventBridge potential for stimulating its client engagement. Alert Logic uses WSPâs platform to send notifications automatically once system log searches have been run. Through EventBridge, Alert Logic has developed smart new Call To Action buttons, which helps customers to respond to a notification via a click.

Jeromy Wells, the CEO of WSP, commenting on the integrated workflow automation tools, stated that it would help organisations in streamlining their business processes and enhance their cost efficiencies. According to him, by 2023, the global workflow automation market would achieve US$18.4 billion.

Stock Information:

The shares of Whispir Limited in the last three months have generated a return of 10.27%. The shares on 1 October 2019 opened at $1.610, while the shares were trading at a price of $1.650 on 1 October 2019 (AEST 12:00 PM), up by 2.484% relative to its previous close. Around 61,624 shares of WSP traded on ASX. WSP has a market cap of $166.53 million and ~103.43 million outstanding shares.

Audinate Group Limited

Company Overview

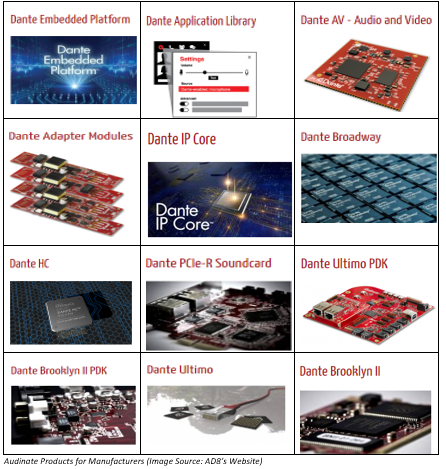

Audinate Group Limited (ASX: AD8) offers professional digital audio networking technologies worldwide.

Recent Update:

CEDIA Expo:

On 10 September 2019, Audinate Group Limited updated the market with a press release, unveiling that at the CEDIA Expo, Dante would be included in new products including JBL Synthesis, ELAN and Powersoft. The New Dante enabled products for the Expo 2019 are:

- Mezzo AD amplifier line from Powersoft;

- JBL Synthesis SDP-55 surround processor;

- SDR-35 AV receiver;

- SDA-2200 two-channel amplifier along with SDA-7120 seven-channel amplifier;

- IP Amplifier line from ELAN.

Apart from the above, AD8 provided training on the new Dante-enabled products with JBL Synthesis.

Financial Highlights:

- Revenue of the company in FY2019 increased by 44% to $28.3 million on pcp.

- EBITDA grew by 395% to $2.8 million on pcp.

- Operating cash flow for the period was $3.6 million, which represents a 249% growth from the previous corresponding period.

- The sale of Dante-enabled products in FY2019 soared by 30% to 2,134.

- The net profit for the period was $0.662 million, a fall of 74% on pcp.

Stock Information:

The shares of Audinate Group Limited have generated a YTD return of 113.48%. The shares on 1 October 2019 opened at a price of $7.630 and were trading at a price of $7.850 (AEST 12:19 PM), up by 3.289% relative to its last trade. Around 347,079 shares of AD8 traded on ASX. AD8 has a market capitalisation of $508.61 million and approximately 66.92 million outstanding shares.

Iress Limited

Company Overview:

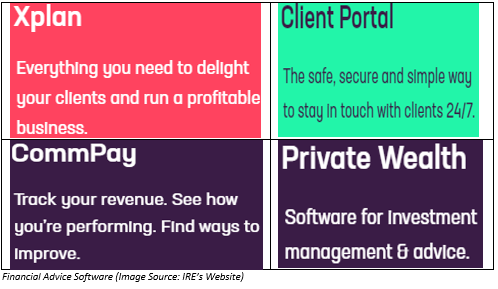

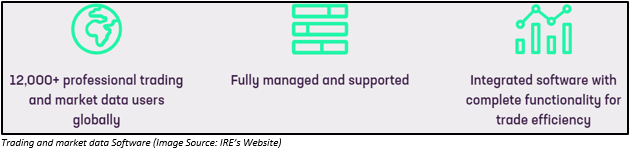

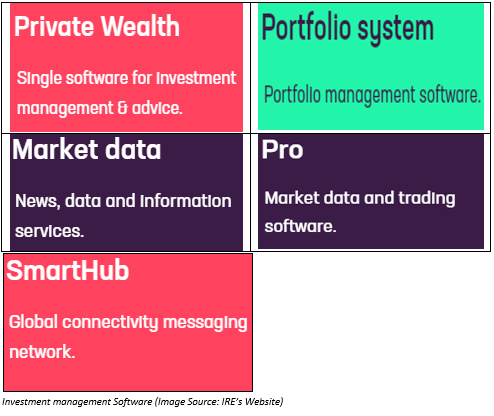

Iress Limited (ASX:IRE) is a tech-company which offers software to financial service players. The company provides software for financial advice, trading and market data and investment management, to name a few.

Below are the three types of software offered by IRE:

Financial Advice Software

Trading and Market Data Software

Investment Management Software

Recent Update:

IREâs ViewPoint selected by Maybank

Iress Limited on 2 September 2019 published its media release, under which it highlighted that Maybank selected the companyâs ViewPoint for driving its continued growth in online trading services across Asia. ViewPoint is IREâs virtual trading and market data software.

Maybank Kim Eng would cater ViewPoint to its online trading community. This software would be rolled out to the clients in Malaysia, Thailand, Singapore and Vietnam.

Since 2015, Iress and Maybank are into partnership, wherein IRE has provided a range of market data and trading software to Maybank. Through this extended agreement, the customers of Maybank Kim Eng would be able to research and trade global markets via web-based, multi-asset, the multi-currency interface of ViewPoint.

1H FY2019 Highlights:

In 1H FY2019 for the period ended 30 June 2019, the Group revenue of IRE was up by 5% (constant currency basis) and segment profit was up by 10% compared to pcp.

The net profit for the period declined (by 5%), as a result of new lease accounting standard AASB16 adopted by IRE, acquisition of QuantHouse and improved share-based payments post amendments made to the remuneration models.

Iress Limited announced an interim dividend of sixteen cents per share (10% franked).

Stock Information:

The shares of Iress Limited have generated a YTD return of 7.22%. The shares on 1 October 2019 opened at a price of $11.600 and were trading at a price of $11.600 (AEST 12:22 PM), up by 0.173% from its previous closing price. Around 213,946 shares of IRE traded on ASX. IRE has a market cap of $2.02 billion and ~174.75 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.