Introduction

On 18 September S&P/ASX200 (Australian benchmark index) was trading at 6679.2 points, down by 0.2 percent (at AEST 3:20 PM). In this article, we would discuss four stocks listed with ASX in which, INR and AUZ are from Metals & Mining Sector, WHA is from Consumer Staples sector and EOS is from Industrials sector.

Letâs know more about the four stocks under discussion in detail.

ioneer Ltd

Commissioned the Rhyolite Ridge Pilot Plant:

ioneer Ltd (ASX: INR), formerly known as Global Geoscience Limited, is an Australian company that is into the production & development of lithium-boron with the focus on Rhyolite Ridge Lithium-Boron Project in Nevada, USA, one of the only two lithium-boron deposits present in the world. Besides, Rhyolite Ridge is currently on the path to become the third major supplier of boron globally and is well placed to meet the strong demands of North America for lithium as the United States intends to develop a battery supply chain domestically.

Pilot Plant

In its Annual Report presentation, released on 17 September 2019, INR mentioned that in June 2019 the company had commissioned the Rhyolite Ridge Pilot Plant, located in Vancouver, Canada. This has been done for the optimisation and finalisation of the processing flow sheet for the Definitive Feasibility Study (DFS) for the Project, which is anticipated to be completed in late third quarter of 2019. INR will now able to accumulate the data that is needed for comprehensive design engineering of the processing plant. The pilot plant commissioned has confirmed the production flowsheet and has produced high quality of boric acid, and high quality of technical grade lithium carbonate.

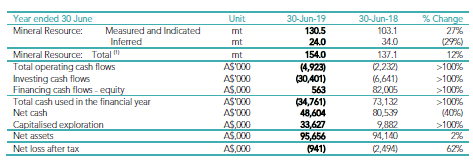

Key Highlights of the financial year to 30 June 2019

Further, in June 2019, the company has reported 27% increase in the Rhyolite Ridge lithium-boron Mineral Resource to 154 million tonnes, comprising of 1.3mt lithium carbonate and 12.4mt boric acid. The PFS of the project has projected the mine life to be more than 30 years and is capable of producing 20,200 tonnes of lithium carbonate and 173,000 tonnes of boric acid annually. The company expects the annual revenue of $450 million, annual EBITDA of $297 million and after-tax cash flow of $6.6 billion with the total capex of $599 million from the PFS of the project. Moreover, the pilot plant commissioned support ioneerâs offtake marketing efforts and is being used as a demonstration plant for discussions regarding strategies and financing. INR and its financial advisor are in active negotiations with various people for strategic and offtake partnership related with the development funding for the Project.

As per the presentation at Diggers & Dealers Mining Forum, released on 6 August 2019, INR is targeting the construction of this major lithium-boron mine in the USA in 2020 and first production is projected to start in late 2021.

FY 19 Financial Performance (source: Companyâs Report)

On 18 September 2019, INRâs stock was trading at A$0.195 (at AEST 1:16 PM), up by 2.632 percent. The company has a market cap of around A$280.25 million, with ~1.47 billion shares outstanding. In the past 12 months period, the stock has provided a negative return of 37.70 percent. However, for the YTD period, the stock has given a return of 11.76 percent.

Wattle Health Australia Ltd

News of the competitor Bellamyâs Australia Ltdâs takeover:

Wattle Health Australia Ltd (ASX: WHA), is an Australian company that is into the production of infant formula (milk supplements) of high quality.

On 16 September 2019, WHA updated the market that Industry Super Holdings Pty Ltd has ceased to be a substantial holder of the company from 12 September 2019.

On 9 May 2019, WHA notified the market that it had inked a deal for completing the acquisition of 75% interest in Blend & Pack (B&P) from Mason Group Holdings Pte Limited. B&P is the largest independent CNCA accredited dairy manufacturing facility in Australia in terms of volume and has a long trading history of being profitable.

As notified earlier on 2 September 2019, for this acquisition, the company had intended to sign the binding debt funding facility by 6 September 2019.

On 18 September 2019, WHAâs stock was trading flat at A$0.400(at AEST 2:03 PM). The company has a market cap of around A$77.8 million, with ~194.5 million shares outstanding. For the YTD period, the stock has given a negative return of 56.04 percent. Though, in the last 5 days, the stock has given a return of 3.90 percent.

Australian Mines Limited

Rise in Cobalt price:

Australian Mines Limited (ASX: AUZ), is an Australia based resource entity, engaged with manufacturing and delivery of battery and technology metals to the international markets. AUZ is into development of a world-class cobalt-scandium-nickel projects.

Lately, CoCl2 or Cobalt chloride and Co3O4 or cobalt (II, III) oxide have had traded in premiums compared to the costs of CoSO4 or cobalt sulphate and ternary materials. Lower inventories have had led to the rise in futures and spot prices of raw materials related to cobalt and has also increased its expenses. Further, according to data from the CAAM or China Association of Automobile Manufacturers, both the manufacturing and selling of pure-electric passenger automobiles, propelled the turnaround to increase during the last month period through additional commercial automobiles that were put into operation.

However, the selling of NEVs or new energy vehicles in the Chinese market have fallen for consecutive second month in August this year, as it plunged by 15.8 percent from the previous year to 85k units. NEV sales had also reported its first year-over-year contraction of 4.7% in July. As per CAAM, NEVs production had fallen 12.1 percent on the year to be noted at 87k units in August this year, post it had declined 6.9 percent on an annual basis in July.

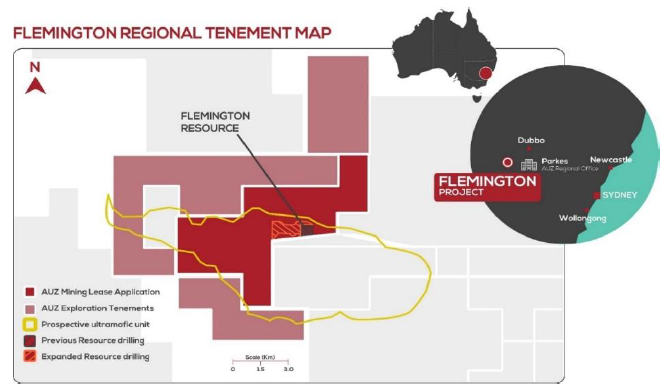

On 12 August 2019, the company released final assay results from the first phase of the resource expansion drilling campaign at its 100%-owned Flemington Project in New South Wales, Australia, that confirmed the continuity of high-grade zone of cobalt and scandium mineralisation which extends 1,200 metres west from, existing Flemington Mineral Resource.

Flemington Project (source: Companyâs Report)

On 18 September 2019, AUZâs stock was trading flat at A$0.029(at AEST 2:25 PM). The company has a market cap of around A$99.9 million, with ~3.44 billion shares outstanding. For the YTD period, the stock has given a negative return of 23.68 percent. However, for the past 6 months period, it has generated a return of 11.54 percent.

Electro Optic Systems Holdings Limited

Subsidiary is selected for the Australian Armyâs LAND 400 Phase 3 program:

Electro Optic Systems Holdings Limited(ASX: EOS) is into development of the technology related to the designing of electro optic meant for the markets of space and defence.

On 17 September 2019, the companyâs subsidiary related to Defence systems got down-selected by the Commonwealth of Australia for the Australian Armyâs LAND 400 Phase 3 program to proceed to the next stage, Risk Mitigation Activity (RMA). The company has partnered with the Hanwha Defence Australia as the prime contractor to provide EOSâ T2000 turret with the Hanwha âRedbackâ vehicle required to be used by the Army.

Moreover, during RMA, the shortlisted vehicles would go through rigorous testing and evaluation. The shortlisted tenderers would conduct Australian industry showcase workshops all over Australia and this would end in 2021 after submitting the best and final offers and final evaluation. Overall, the full contract is anticipated to be awarded in 2022.

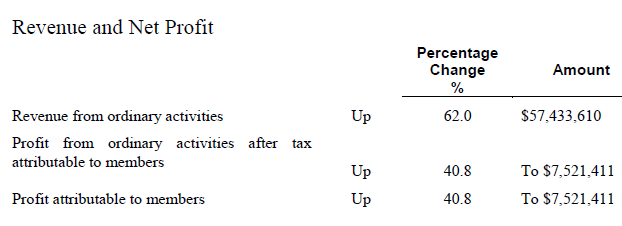

1H FY 19 Financial Performance (source: Companyâs Report)

On 18 September 2019, EOSâ stock was at A$6.820 (at AEST 3:03 PM). The company has a market cap of around A$647.74 million, with ~96.1 million shares outstanding. For the YTD period, the stock has given a remarkable return of 173.98 percent. In the past 6 months period, it has generated a return of 47.16 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.