For investors, the dividend yield analyses is an important tool for equity evaluation as dividends offer a solid indication about the performance and financial well- being of the company.

Annual dividend yields are calculated by dividing the annual dividend by the current share price of the company. Generally, high dividend yield stocks pay good returns to its shareholders in the form of dividends, however, this might not happen in every case as sometimes stocks do carry inflated annual dividend yields.

Letâs take a look at five stocks with a dividend yield above 6%.

National Australia Bank Limited (ASX:NAB)

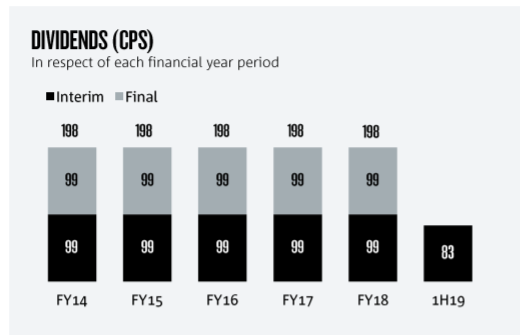

One of Australiaâ leading business bank, National Australia Bank Limited (ASX: NAB) most recently paid a dividend of 83 cents per share (100% franked) to its shareholders, relating to the period of first half of FY19. The H1 FY19 dividend was 16 cents lower than the dividend paid in the previous corresponding period (refer below graph).

Dividend Summary (Source: Company Reports)

The annual dividend yield of the bank is currently at 6.21% (as per ASX as at 20 September 2019).

Despite operating in a challenging environment, NAB was able to report solid returns in the June quarter.

June Quarter Highlights:

- Compared with the 1H19 quarterly average, cash earnings of the June quarter were up 1% (excluding customer-related remediation);

- Net interest margin increased primarily due to lower short-term wholesale funding costs;

- Revenue was up 1% reflecting growth in SME lending and a slightly higher group margin;

- Expenses were flat given ongoing productivity savings from the transformation program, compensating for higher compliance and risk costs;

- Group Common Equity Tier 1 (CET1) ratio of 10.4%, compared with 10.4% at March 2019, but excludes $1 billion (25bps of CET1) of 1H19 Dividend Reinvestment Plan underwrite proceeds, which were received in July;

- Leverage ratio (APRA basis) of 5.4%;

- Liquidity Coverage Ratio (LCR) quarterly average of 128%;

- Net Stable Funding Ratio (NSFR) of 113%.

In the last six months, NABâ stock has provided a return of 17.47% as on 19 September 2019. At market close on 20 September 2019, NABâs stock was quoted $29.790 (very near to its 52 weeks high price of $29.495) with a market capitalisation of $84.53 billion and PE Multiple of 14.290x.

Harvey Norman Holdings Limited (ASX:HVN)

Harvey Norman Holdings Limited (ASX: HVN) is primarily involved in the businesses of integrated retail, franchise, property as well as the digital enterprise business.

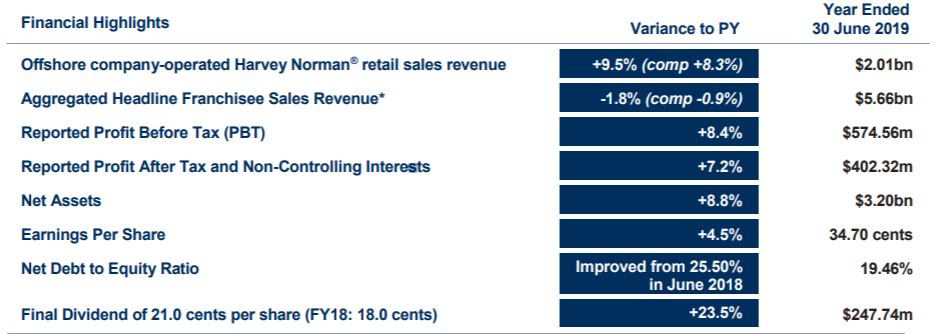

The company recently declared a fully franked 2019 final dividend of 21.0 cents per share, which is 23.5% higher than the previous corresponding period (pcp). The record date of the dividend is set at 11 October 2019, and it will be paid on 1 November 2019.

The company recently revealed its FY19 results wherein it reported offshore company-operated Harvey Norman® retail sales revenue of $2.01 billion, up 9.5% on pcp, mainly driven by the rise in offshore retail revenue by $181.06 million, from $1.87bn to $2.05bn.

Key FY19 Financials:

- The companyâs reported PBT increased by 8.4% to $574.56 million in FY19, driven the continued dominance of the companyâs 90 Harvey Norman® company-operated retail stores overseas, improved profitability of property segments and sale of equity investments during the year;

- Net assets soared to $3.2 billion as at 30 June 2019, surpassing the $3bn milestone for the first time in FY19;

- $13.57 million increase in the profitability of the overseas company-operated retail stores;

- $16.11 million increase in the overall property segment result;

- $36.33m reduction in losses incurred by the non-core joint ventures.

FY19 Results Summary (Source: Company Reports)

In the last six months, HVNâs stock has provided a return of 25.15% as on 19 September 2019. At market close on 20 September 2019, HVNâs stock quoted $4.530 with a market capitalisation of $5.34 billion. The stock has a PE multiple of 13.050x with an annual dividend yield of 7.28%. HVNâs stock is trading very near to its 52 weeks high price of $4.667.

AGL Energy Limited (ASX:AGL)

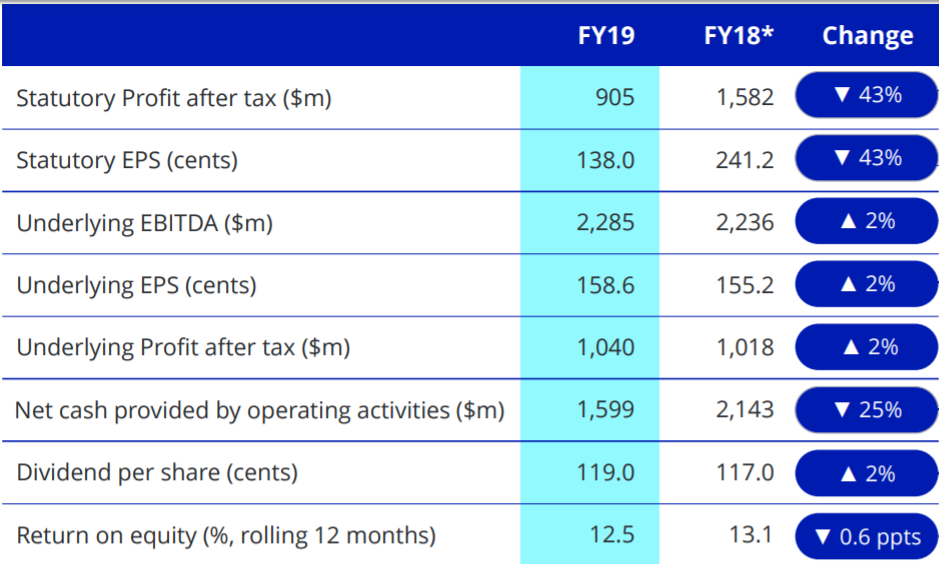

Leading integrated energy business AGL Energy Limited (ASX: AGL) recently paid a final dividend of 64 cents per share (80% franked on 20 September 2019), taking the total FY19 dividend to 119 cents per share (80% franked).

At the recently held Annual General Meeting (AGM), the companyâs Chairman highlighted that in 2016, AGL introduced a dividend policy to target a payout ratio of around 75% of Underlying Profit. Since that time, AGLâs dividends have increased by 51 cents per share.

In FY19, AGL's statutory profit after tax was $905 million, compared with $1,582 million in FY18. The decrease in the profit was due to the loss on fair value of financial instruments of $139 million. The Underlying Profit after tax of the company was $1,040 million, up 2% on prior year, primarily driven by electricity portfolio.

FY19 results Summary (Source: Company Reports)

FY19 Performance Highlights:

- $50 million Customer Affordability Program implemented, primarily to Staying Connected customers;

- 300,000 residential and small business customers now on simple, fixed, low-rate plans;

- Lower standing offer prices and rollout of AGLâs Safety Net for electricity customers in FY19;

- AGL Torrens and Hydro supported peak demand through summer.

In FY2020, AGL is expecting its earnings to be in the range of $780 million- $860 million. At the recently held AGM, the Chairman confirmed that the company has entered FY2020 in a solid position to execute its strategy â and to make the investment decisions that will generate value in years to come.

In the last six months, AGLâs stock has provided a negative return of 12.68% as on 19 September 2019. At market close on 20 September 2019, AGLâs stock quoted $18.850 with a market capitalisation of $12.56 billion. The stock has a PE multiple of 13.880x with an annual dividend yield of 6.21%.

Westpac Banking Corporation (ASX:WBC)

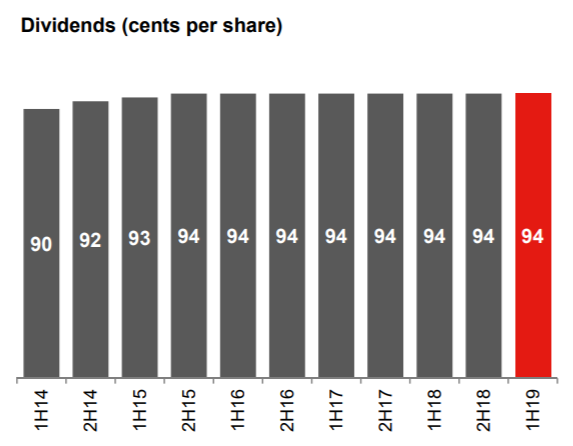

Australiaâs leading bank, Westpac Banking Corporation (ASX: WBC) recently paid an interim fully franked dividend of 94 cents per ordinary share for 1HFY19, representing a payout ratio of 98%, in line with the WBCâs previous dividends of recent years.

Dividend Summary (Source: Company Reports)

In the first half of FY19, the company reported a 19% decline in its reported net profit and 14% decline in cash earnings, as compared to then previous corresponding period.

H1 FY19 Operational highlights:

- Reset wealth strategy and commenced exit of personal financial advice;

- Provided more clarity on major areas of remediation;

- Continuing product reviews and simplification;

- Improved complaints handling;

- Working to close out legacy regulatory/compliance issues;

- Increased new Australian banking customers by over 36,000.

In the last six months, WBCâs stock has provided a return of 11.92% as on 18 September 2019. At market close on 19 September 2019, WBCâs stock quoted $29.660 with a market capitalisation of $103.2 billion. The stock has a PE multiple of 14.350x with an annual dividend yield of 6.36%.

IOOF Holdings Ltd (ASX:IFL)

Financial services company, IOOF Holdings Ltd (ASX: IFL) provides advisers and their clients with the following services:

- Financial Advice services via extensive network of financial advisers and stockbrokers;

- Investment Management products that are designed to suit any investorâs needs;

- Portfolio and Estate Administration for advisers, their clients and hundreds of employers in Australia.

IOOF Holdings recently declared fully franked dividend of 19 cents per share for the half year of FY19, taking the total fully franked dividend for the year to 44.5 cents, representing a dividend payout ratio 79%.

For FY19, the company earned Underlying NPAT of $198.0 million and Statutory NPAT of $28.6 million.

The company recently provided an update regarding Federal Court proceedings in relation to IOOFâs APRA regulated entities and five individuals who were responsible persons of those entities at relevant times.

The court took following decisions:

- The Court held that IOOFâs APRA regulated entities and the five individuals did not contravene the Superannuation Industry (Supervision) Act 1993 (Cth);

- The Court also declined to make the disqualification orders sought against the five individuals and awarded costs in IOOFâs favour.

In the last six months, IFLâs stock has provided a negative return of 11.42% as on 19 September 2019. At market close on 20 September 2019, IFLâs stock quoted $5.990 with a market capitalisation of $1.95 billion. The stock has a PE multiple of 68.100x, and an annual dividend yield of 6.76%.

Bottom Line

As many stock do carry inflated dividend yields, dividend yield analyses should not be the only criteria for screening stocks. Investors should take a more holistic approach while selecting a stock and should carefully look at the fundamentals and different technical aspects of a stock.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.