Australian Stock Market

Australia is one of the strong and healthy economies around the globe. The nation in the last few decades, has transitioned itself into an international export leader. It is considered as one of the appealing environments for international investments.

The year 2019, witnessed a lot of mergers and acquisitions, since Australian dollar was softer than before, enticing a lot of foreign investors, as well as the private equity funds cashing up, post growing billions of dollars during the last few years.

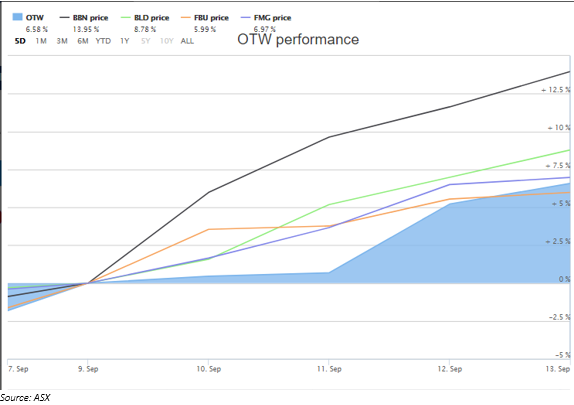

In the last five days period, some of the stocks on ASX - BBN, OTW, BLD, FBU, FMG have ended on a positive note providing better investment return when compared to others.

Letâs look at five such stocks, depicted below with a positive change in their stock price in the last five days (as on 15 September 2019) period.

Baby Bunting Group Limited

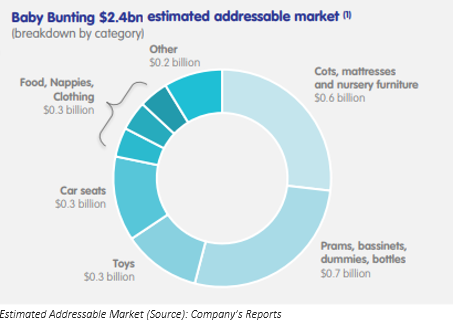

Baby Bunting Group Limited (ASX: BBN) established 1979, is an Australia based company, that operates as a nursery retailer and one-stop-baby shop. The company offers prams, car seats, cots, nursery furniture, highchairs and related products to support the parents in the early years of parenthood. The company has ~800 employees across 52 national superstores in Melbourne region.

Recent Updates

On 9 September 2019, the company announced the change in the director- Gary Kentâs interest with 10,000 newly acquired fully paid ordinary shares, at a consideration of $28,700 on 4 September 2019. Mr Gary Kent now holds 15,000 fully paid ordinary shares in Baby Bunting Group Limited.

On 4 September 2019, the company announced on the Annual General Meeting to be held on 8 October 2019 in Sydney.

On 30 August 2019, the company announced the change in the director - Matthew Spencerâs interest. On 26 August 2019, the director disposed 100,000 fully paid ordinary shares, sold at an average price of $2.9686/share. Mr Matthew Spencer now holds 1,077,848 fully paid direct ordinary shares (direct) and 133,130 (indirect) ordinary shares.

Financial Highlights

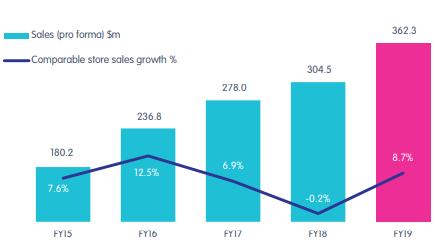

On 16 August 2019, BBN announced results for FY 19, for the period closed 30 June 2019 and below are the few snapshots of the same.

- Total sales grew by 19.0 per cent to $362.3 million compared to the previous corresponding year (PCP).

- Gross profit grew by 25.6 per cent to $126.7 million.

- NPAT of the company increased by 58.2 per cent. EPS was at 12 cents, rising up by 57.9 per cent, year-on-year.

- EBITDA increased by 45.9 per cent to $27.1 million.

Stock Performance

BBNâs stock last traded lower on ASX at AUD 3.380 as on 17 September 2019, with a fall of 4.789 per cent in comparison to the last close. With ~126.44 million shares of the company in the market, the market cap of the stock stands at AUD 448.87 million. The 52-week high and low value of the stock was noted at AUD 3.645 and AUD 1.950, respectively, at the time of writing the report. The company generated a positive return of 51.06 per cent in last six months and 58.48 per cent return for YTD period. In the last 5 days period, the stock had generated 11.29 percent return on ASX.

Over the Wire Holdings Limited

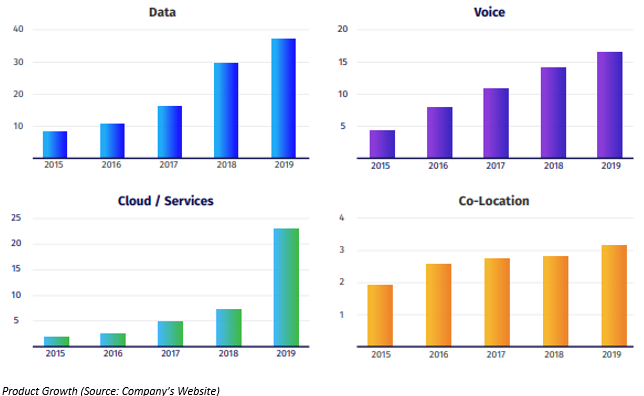

Over the Wire Holdings Limited (ASX: OTW), is an information technology company that offers customised solution to its clients. The company provides cloud-based, telecommunications, and IT solutions to various entities. The company was listed on Australian Stock Exchange in the year 2015.

Financial Highlights

On 15 August 2019, the company announced the results for FY 2019, for the period ending 30 June this year, a snapshot of the results are as depicted below:

- Revenue increased by 49 per cent to $79.6 million compared to the corresponding period last year. EBITDA of the company rose to 64 per cent to $20.1 million

- NPATA surged by 91 per cent to $13.1 million from last year.

- 64 per cent growth was witnessed in the earnings per share during FY 2019.

Stock Performance

OTWâs stock last traded flat on ASX at AUD 4.7 on 17th September 2019. With ~51.06 million shares of the company in the market, the market cap of the stock stands at AUD 242.53 million. The 52-week high and low value of the stock was at AUD 5.640 and AUD 3.750, respectively, at the time of writing the report. The company generated a negative return of 7.84 per cent in the last six months, and a positive return of 03.07 per cent in year-to-date period. Further, in the 5-day return of the stock has been of 6.09 percent.

Boral Limited

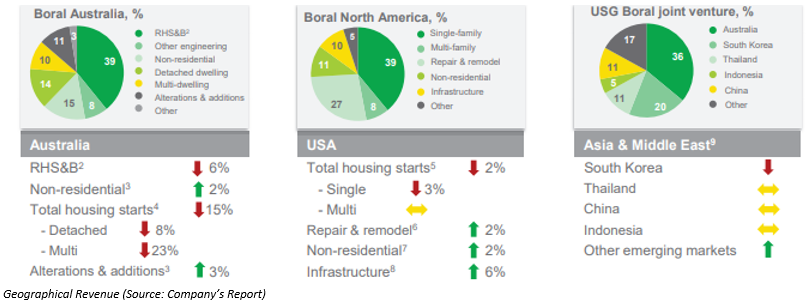

Boral Limited (ASX: BLD) is an Australia based biggest entity involved in the supply of construction materials and building goods. The company was integrated in 1946 and functions through all the states of the nation.

September Updates

On 4 September 2019, The Capital Group Companies, Inc. notified that it has ceased to be a substantial holder of BLD.

On 4 September 2019, the company has announced a change in the director- Peter C Alexanderâs interest with 14,300 newly acquired ordinary shares at a value of $4.17/share on 28 August 2019. Mr Alexander now holds 73,871 fully paid ordinary shares in the company.

Financial & Operating Highlights

On 26 August 2019, BLD announced the results for FY 2019 for the period closed 30 June 2019. A snapshot for FY2019 period is as follows:

- On the continuing operations basis, the company recorded a revenue growth of 4 per cent to A$5,801 million compared to the previous corresponding period.

- EBITDA increased by 2 per cent to 1,033 million, on continuing operations basis.

- Operating cash flow increased by 32 per cent to $762 million. A decline in working capital and interest and tax outflows was witnessed versus FY2018 period.

- Free cash flow stood at $712 million from $235 million last year.

Stock Performance

BLD stock last traded lower on ASX at AUD 4.770 on 17th September 2019, with a slip of 1.852 per cent in comparison to the last closed price. With ~1.17 billion shares of the company in the market, the market cap of the stock stands at AUD 5.7 billion. The 52-week high and low value of the stock was at AUD 7.085 and AUD 3.930, respectively, at the time of writing the report. The company generated a negative return of 0.82 per cent in the last six months and a positive return of 0. 21 per cent in YTD period. BLD stock, in the five-day timeframe has given a positive return of 2.97%.

Fletcher Building Limited

Fletcher Building Limited (ASX : FBU) operates in the production and distribution of building products. The company employs 16,000 people in Australia, South Pacific and New Zealand regions.

Recent Updates

On 17 September 2019, FBU announced that under the on-market buyback programme, as notified on 26 June this year, 265,7455 ordinary shares have been acquired at (NZ$5.1329 (average), in respect of 125,377 ordinary shares was acquired on NZX) and A$4.7677 (average) in respect of 140,368 ordinary shares was acquired on ASX on 16 September 2019. The total number of financial products of the class after the acquisition (excluding Treasury stock) was 851,956,990 ordinary shares.

Stock Performance

FBU stock traded lower on ASX at AUD 4.740 on 17th September 2019, with a dip of 0.837 per cent in comparison to the last closed price. With ~852.22 million shares of the company in the market, the market cap of the stock stands at AUD 4.07 billion. The 52-week high and low value of the stock was at AUD 6.050 and AUD 3.990, respectively, at the time of writing the report. The company generated the positive return of 2.80 per cent in the last six months period, and a return of 5.75 per cent in YTD. The 5 days return of FBUâs stock is of 4.82 percent.

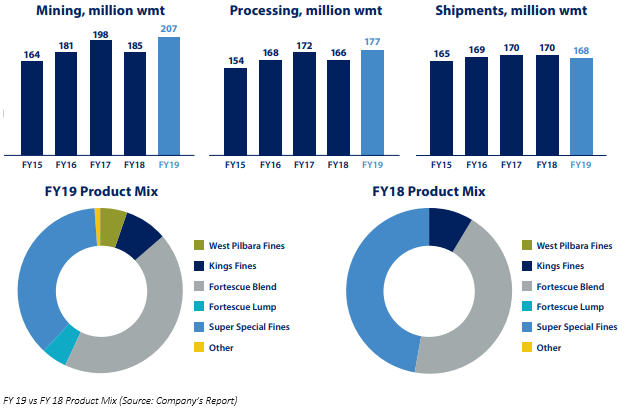

Fortescue Metals Group Limited

Fortescue Metals Group Limited (ASX: FMG) founded in 2003, and leads the iron ore sector internationally. The company is the lowest cost provider of seaborne iron ore to the Chinese market and has consistently been shipping ~170 million tonnes of iron ore per annum. FMG holds and manages a fully unified infrastructure and supply chain in the Pilbara region.

Recent Updates

On 6 September 2019, the company announced a change of interest in one of the directors- Ms Elizabeth Gaines with 206,294 newly acquired ordinary shares. The director disposed 216,695 (FY2019 ESSIP Performance rights- unvested).

Additionally, FBU announced the successful completion of US$600 million offering of Senior Unsecured Notes at an interest rate of 4.5 per cent. The notes would be maturing in September 2027. The proceeds from the notes under discussion will be used in the partial repayment of U$600 million of US$1.4 billion (outstanding) 2022 Syndicated Term Loan Facility.

Stock Performance

FMG last traded lower on ASX at AUD 8.990 on 17th September 2019, with a dip of 0.222 per cent in comparison to the last closed price. With ~3.08 billion shares of the company in the market, the market cap of the stock stands at AUD 27.74 billion. The 52-week high and low value of the stock was noted at AUD 9.550 and AUD 3.256, respectively, at the time of writing the report. The company generated a positive return of 41.34 per cent in the last six months and a return of 136. 69 per cent in YTD period. FMGâs stock in five days period, has generated a positive return of 4.77 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.