In stock market parlance, the return on capital may be a measure of a company's current profitability, but the return on the companyâs stock encompasses a combination of the dividends being paid by the company along with the stock price trend. Discussed below are four companies from IT, Financials, Health Care and Consumer Discretionary sectors, respectively, that have performed exceptionally well in FY19 along with generating positive stock returns since the onset of the year. Three of these have also paid out dividends throughout the year.

Baby Bunting Group Limited

Victoria, Australia-based Baby Bunting Group Limited (ASX:BBN) operates as a nursery retailer and one-stop-baby shop that offers prams, car seats, cots, nursery furniture, high chairs, change tables, portable cots, home safety, toys, monitors, baby wear, and related products to support new and expectant parents in the early years of parenthood.

The company is scheduled to hold its annual general meeting on 8 October 2019.

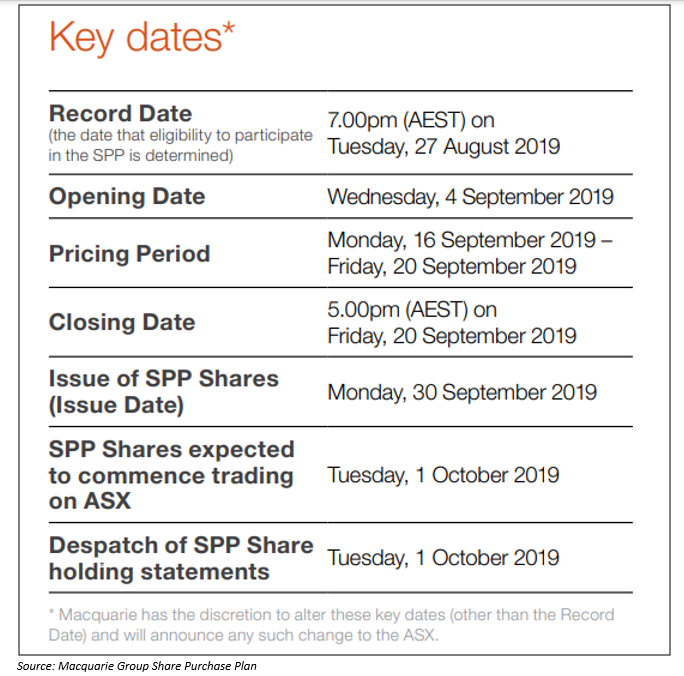

FY19 Results â On 16 August 2019, Baby Bunting Group announced its financial results for the year ended 30 June 2019 (FY19), posting net profit after tax (NPAT) of AUD 12.4 million, indicating a rise of 43.3% on FY18. On a pro forma basis, NPAT stood at AUD 15.1 million, up 58.2% on the prior period.

The Groupâs total sales increased 21% to AUD 368.0 million with an EBITDA of AUD 24.1 million, up 37.4% on FY18. The Group continued to pursue several actions to grow market share and profitability during FY19, including consistent focus on customer service, capitalising on available market share opportunities, securing prime sites for the store network, stabilising gross margin without compromising value and expanding private label.

Baby Bunting Group also declared an ordinary fully paid dividend (fully franked) of AUD 0.0510 (Record Date: 30 August 2019; Payment Date: 13 September 2019) with respect to the six monthsâ period ended 30 June 2019. The company has an annual dividend yield of 2.55% to date (as per ASX).

Stock Performance: Baby Bunting Group has a market capitalisation of around AUD 417.26 million with ~ 126.44 million outstanding shares. On 12 September 2019, the BBN stock price settled the dayâs trading at AUD 3.360, edging up 1.818% by AUD 0.060, with ~ 825,724 shares traded.

Besides, BBN has delivered positive returns of 48.65% in the last one month, 54.21% in the last three months, 39.83% in the last six months and 47.32% Year-to-date.

CSL Limited

Healthcare sector player, CSL Limited (ASX:CSL), established in 1916 and headquartered in Parkville, Australia, is engaged in the research, development, manufacturing,, commercialisation as well as distribution of biopharmaceutical and related products across regions like Australia, the United States, Switzerland, Germany, the UK, China, and other countries. The company has two key operating divisions being CSL Behring and Seqirus.

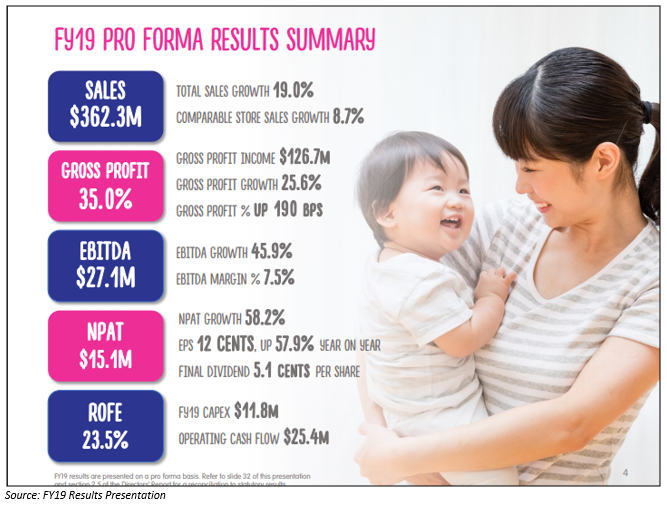

FY19 Results â On 14 August 2019, CSL announced its financial results for full year to 30 June 2019, posting NPAT at USD 1,919 million, up 17% on a constant currency (CC) basis as compared to FY18. This increase has been attributed to upward growth in the adoption of immunoglobulin and albumin therapies, high demand for Haegarda & Kcentra (specialty products) from the patients, evolution of the companyâs haemophilia therapies portfolio and strong profit growth in the Seqirus business.

The earnings per share stood at USD 4.236, up 16% at CC.

The Board of the company also declared a dividend of USD 1.00, ~ AUD 1.48, (Record Date: 11 September 2019; Payment Date: 11 October 2019) with respect to the six monthsâ period ended 30 June 2019. This takes the total full year dividend to USD 1.85 per share, up 8% (AUD 2.68 per share at CC, up 18% on FY18).

Going forth in FY20, the company expects NPAT to be somewhere between USD 2,050 - USD 2,110 million at CC, which would be growth of ~ 7% - 10% over FY19, considering the financial headwind created due to recent transition to a new model of CSL directly distributing across China.

Stock Performance: CSLâs market cap is around AUD 104.9 billion with ~ 453.26 million shares outstanding. On 12 September 2019, the CSL stock price ended the trading at AUD 231.600, edging up 0.069% by AUD 0.160 with ~ 566,147 shares traded. CSLâs annual dividend yield is around 1.16% to date (as per ASX).

Besides, CSL has delivered positive returns of 24.85% YTD, 16.37% in the last six months, and 8.91% in the last three months.

Macquarie Group Limited

Macquarie Group Limited (ASX: MQG) is a global diversified financial group, based in Australia and providing a range of financial services including financial advisory, banking, investment and funds management services including wealth management, cash management, private banking, life insurance, securities brokerage, foreign exchange services and related services.

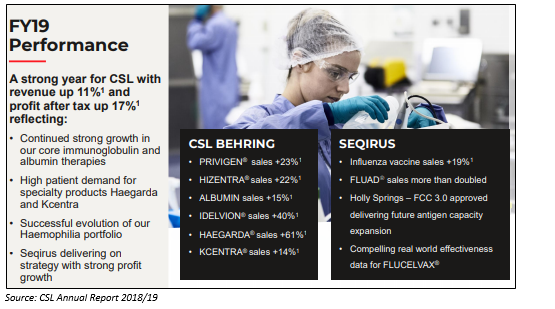

Share Purchase Plan- On 4 September 2019, Macquarie Group announced to conduct its non-underwritten Share Purchase Plan (SPP) for eligible shareholders with a maximum application size of AUD 15,000 per eligible shareholder. The SPP offer opened on 4 September 2019 and is scheduled to close at 5:00 pm (AEST) on 20 September 2019.

This follows the successful completion of the companyâs AUD 1.0 billion institutional placement on 29 August 2019, conducted by bookbuild, that resulted in the issue of around 8.3 million new, fully paid ordinary shares at a price of AUD 120.00 per new share. The settlement of the shares was scheduled for 2 September 2019, with trading to commence from the next day onward.

FY19 AGM Update â On 25 July 2019, the Group informed the stakeholders that Macquarie Groupâs operating groups were performing in line with expectations with the Group capital surplus of AUD 5 billion, Bank CET1 ratio of 12% and leverage ratio of 5.4% as at 30 June 2019, all above minimum regulatory requirements. The 1QFY20 operating group net profit contribution was broadly in line with 1QFY19 but slightly down from 4QFY19.

In May 2019, the Group announced an ordinary fully paid dividend of AUD 3.600 with respect to the six months period ended 31 March 2019, with a record date of 14 May 2019 and the payment date of 3 July 2019.

The Group has an annual dividend yield of 4.47% to date (as per ASX).

Stock Performance - Macquarie Groupâs market capitalisation stands at around AUD 44.81 billion with ~ 348.72 million shares outstanding. On 12 September 2019, the Macquarie Group stock settled the trading session at AUD 128.500 with ~ 887,854 shares traded.

In addition, the MQG stock has delivered positive returns of 20.26% YTD, 2.32% in the last six months and 6.07% in the last three months.

Afterpay Touch Group Limited

Information technology sector player, Afterpay Touch Group (ASX:APT) is one of the leading global technology-driven payments services providers. The Group offers two main products- Afterpay and Pay Now (Touch).

Afterpay is essentially a âbuy now, receive now, pay laterâ service being used by over 5.2 million active customers and ~35,300 active retail merchants, and does not require the retailers to sign any traditional loan or pay any upfront fees or interest to Afterpay. While Pay Now is an innovative digital payment service catering to consumer businesses in sectors like telecommunications, health and retail.

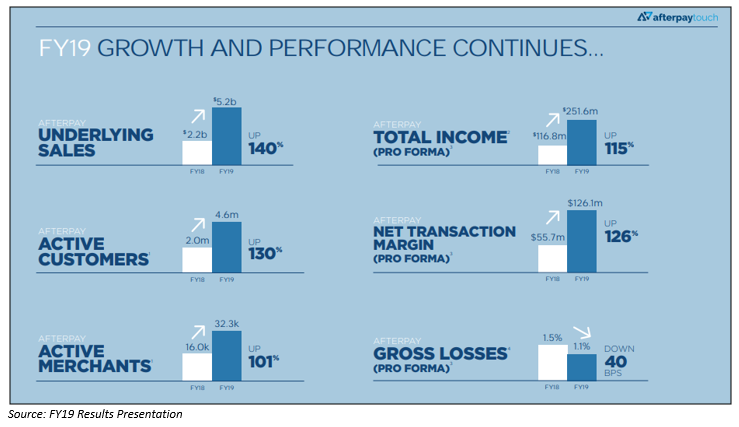

FY19 Results- On 28 August 2019, Afterpay Touch Group announced financial results for the year to 30 June 2019, posting an outstanding increase of 140% in the global underlying sales to AUD 5.2 billion with a run-rate underlying sales in excess of AUD 7.2 billion.

As at 30 June 2019, the active customers were around 4.6 million, up 130% on FY18, and in excess of 5.2 million as of the date of announcement. The group is presently signing up over 12,500 new customers per day and the active merchant number also increased by 101% to 32,300 at the end of FY19.

The Group continues to record stellar growth across the UK and US with US underlying sales of standing at ~ AUD 1 billion for FY19 (run-rate over AUD 1.7 billion).

Stock Performance- Afterpay Touch Groupâs market capitalisation is around AUD 8.11 billion and on 12 September 2019, the APT stock price settled the dayâs trading at AUD 31.800, down 0.935% by AUD 0.300 with ~ 3.82 million shares traded.

In addition, APT has generated positive returns of 167.50% in Year-to-date, 58.83% in the last six months and 25.20% in the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.