Demand for services facilitating profitable investments has expanded over the last few decades in search of a better lifestyle. Investors continue to look out for a diverse range of solutions to better manage their cash and increase their wealth. A fund manager (maybe one person or a team) plays a crucial role in the investment and financial world as it implements profitable investing strategies and manages portfolios for the clients.

Two of the leading Australian Fund Managers are discussed below.

Macquarie Group Limited

Macquarie Group Limited (ASX:MQG), based in Sydney, Australia, offers banking, financial advisory, investment and fund management services. The services include financial advice, cash management, wealth management and private banking, life insurance, securities brokerage, corporate debt financing, real estate funds management, real estate development financing, investment funds management, and foreign exchange services.

Completion of MEREP Buying Period: On 25 June 2019, the group announced that the Macquarie ordinary shares required for the 2019 profit share and promotion awards under the Macquarie Group Employee Retained Equity Plan (MEREP Awards) have been acquired by the MEREP Trustee.

A total of approximately AUD607 million of Macquarie ordinary shares were purchased including AUD 326 million off market under arrangements announced to the market on 3 May 2019 and AUD 281 million on market. The shares were acquired at a weighted average purchase price of AUD 122.37 per share, which will determine the number of 2019 MEREP Awards staff receive.

Acquisition in the UK: Recently, Macquarie Group also acquired Premier Technical Services, a listed British company that supplies and tests building safety equipment, at a cash consideration of GBP 265.3 million ($ 487 million). The offer of 210.1 pence a share represented a pretty good premium of 141.5 % to the closing price of 87 pence on 19 June, according to a statement filed to the London Stock Exchange (LSE).

To complete the acquisition and take ownership of the company, Macquarie has established Bernard Bidco, a new subsidiary company under the control of the British branch of its investment and financing unit, Macquarie Principal Finance.

As part of the deal, Co-founder and CEO Paul Teasdale and Managing Director Roger Teasdale will reinvest a combined GBP 18.1 million of their personal share-sale benefit back into the company and will remain in command.

Premier Technical Services, established in 2007 in Yorkshire, is one of the largest businesses of its kind with 31 offices in Britain employing a staff of 1,200. So far, it has served around 20,000 clients and recorded a revenue of GBP 69.1 million (up 31%) and a pre-tax adjusted profit of GBP 14.2 million (up 40%) for the year ended 31 December 2018. The company debuted on LSEâs AIM sub-market in 2015.

Dividends: On 19 June 2019, Macquarie Group announced a dividend of AUD 1.10780 on the security CAP NOTE 3-BBSW+4.00% PERP NON-CUM RED T-12-24 (Record date: 6 September 2019; Payment Date: 16 September 2019) relating to the quarter ending 15 September 2019. A similar dividend of AUD 1.15290 has also been announced for CAP NOTE 3-BBSW+4.15% PERP NON-CUM RED T-09-26 (Record Date: 2 September 2019, Payment Date: 10 September 2019).

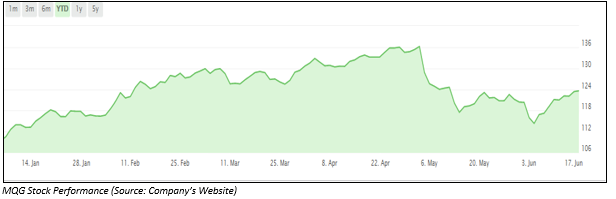

The groupâs market cap stands at ~ AUD 42.99 billion with ~ 340.38 million shares outstanding. Today, on 26 June 2019, the MQG stock price closed the trading session at AUD 126.180, down 0.103%. The MQG has also generated a positive return yield of 18.21% YTD.

Magellan Financial Group Limited

Sydney, Australia-based Magellan Financial Group (ASX:MFG) was established in 2006 as a fund management company, assisting its clients to make intelligent investments across various global equities, as well as global listed infrastructure with an underlying objective of safeguarding their capital. The recipients of Magellan Financial Groupâs premier services include institutional, high net worth as well as retail investors.

Funds under Management: For the month ended 31 May 2019, Magellan Financial Groupâs total funds under management stood at AUD 82,759 million as compared to AUD 83,232 million in the previous month of April 2019.

| AUD million | 31 May 2019 | 30 Apr 2019 |

| Retail | 21,973 | 22,357 |

| Institutional | 60,786 | 60,875 |

| Total FUM | 82,759 | 83,232 |

| Global Equities | 60,711 | 62,380 |

| Infrastructure Equities | 14,606 | 13,528 |

| Australian Equities | 7,442 | 7,324 |

MFGâs FUM for May (Source: Companyâs Report)

Also, in May 2019, Magellan recorded net inflows of AUD 264 million (April 2019: AUD 462 million), which included net retail inflows of AUD 146 million (April 2019: AUD 130 million) and net institutional inflows of AUD 118 million (April 2019: AUD 332 million).

Leadership Changes: On 4 June 2019, Magellan Financial Group announced the appointments of Mr Hamish McLennan as Deputy Chairman of Magellan, and Mr Robert Fraser as Chairman of Magellan Asset Management Limited, Responsible Entity and main operating subsidiary of Magellan, both effective from 5 June 2019.

Previously in March 2019, Ms Marcia Venegas was appointed to the role of the groupâs new Company Secretary. She was also nominated (under Listing Rule 12.6) to communicate with the ASX regarding the Listing Rule matters. This followed the resignation of the former Company Secretary, Mr Geoffrey Stirton.

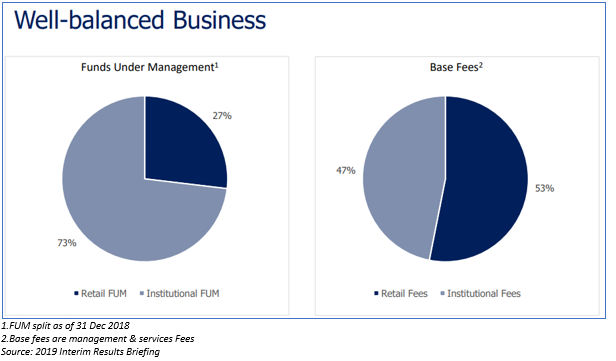

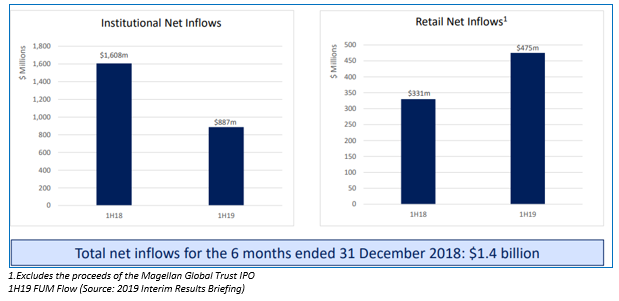

Financial Results: For the six-month period to 31 December 2018, the group announced the average funds under management to be at $ 72.1 billion, up 35%, leading to a 28% increase in management and services fee (base Fees) revenue to $ 228.1 million. The adjusted after-tax net profit also grew by 62% to $ 176.3 million. Magellan had a successful first half that was underpinned by a strong performance of its global equity and infrastructure strategies amidst volatile market conditions. The interim dividend was also up 66% to 73.8 cents per share.

The total FUM flows for the first half of 2019 are depicted in the carts below.

The groupâs market capitalisation stands at around AUD 8.92 billion, and it has ~ 177.09 million shares outstanding. Today, on 26 June 2019, the MFG stock last traded at AUD 50.300, down 0.099%. In addition, the MFG stock has delivered impressive return yields of 43.08% for the last three months, 113.26% for the last six months and 115.45% YTD.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.