A companyâs annual report and dividends help an investor make better investment decisions. Investors focus on the financial performance and the dividend-paying capacity of a company to discern the investment qualities of a firm. Considering this, let us take a look at two stocks listed on the ASX that have announced their dividends and full-year results today:

Baby Bunting Group Limited

Australiaâs largest specialty nursery retailer, Baby Bunting Group Limited (ASX:BBN) is a one-stop baby shop that assists expectant and new parents in managing the early years of parenthood. The company was established in Melbourne in 1979 as a family-owned business. Baby Bunting now has around fifty-two national superstores and 11,000sqm warehouse in Melbourne, employing more than 800 people.

FY19 Full Year Results

In an update on the Australian Stock Exchange, Baby Bunting published its full year results for the financial year 2019, highlighting its strong performance during the year. On a statutory basis, the company reported a rise of 21 per cent in its total sales and 37.4 per cent in its EBITDA to $368.0 million and $24.1 million, respectively in FY19. The statutory NPAT of the company also improved by 43.3 per cent during the year to $12.4 million.

Results on a Pro-forma basis

Baby Bunting saw an increase in gross profit by 25.6 per cent to $126.7 million on a pro forma basis in FY19. The gross profit as a percentage of sales also improved 190 basis points to 35 per cent. The pro forma EBITDA and NPAT were 45.9 per cent and 58.2 per cent up on pcp, at $27.1 million and $15.1 million, respectively.

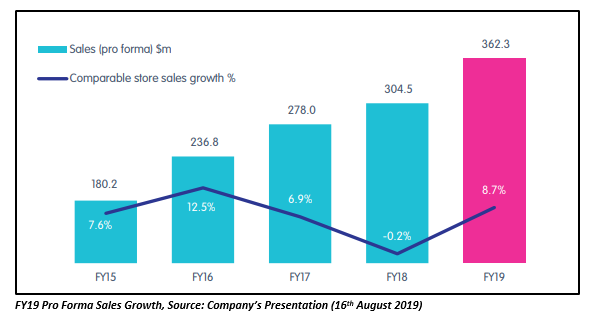

The company also achieved significant growth in market share post the competitor disruption experienced in FY18. On a pro forma 52-week basis, its comparable store sales growth concluded the year with a rise of 8.7 per cent on the comparable trading period. The total sales of the company were 19 per cent up to $362.3 million.

The FY19 pro forma sales growth of 19 per cent was driven by:

- Strong growth in comparable store sales of 8.7 per cent,

- 46 per cent rise in online sales, making up 11.8 per cent of sales

- Opening of six new stores in FY19 and first full year of sales from five stores opened in FY18

- Opening of Regionals in F18 (Albury) and F19 (Toowoomba), both at approximately $4m sales in the first year (ahead of expectations)

Major Developments in FY19

During the year, Baby Bunting witnessed the following major developments:

- Baby Bunting opened six new stores, taking the total number of store count to 53. The new stores were opened at Chadstone (Vic), Toowoomba (Qld), Hobart (Tas), Bankstown (NSW), Chatswood (NSW) and Shellharbour (NSW). One of its existing stores at Cannington (WA) was also relocated to a more prestigious location in Cannington.

- Baby Bunting acquired the businesses of few of its car seat installation partners in Queensland, Victoria, South Australia and New South Wales, that enabled it to bring service offerings in-house and expand and standardise its installation services across the store network.

Outlook for FY20

The company expects its Pro forma EBITDA to be in the range of $34 to $37 million in FY20, representing a growth of 25 per cent to 36 per cent. The Pro forma NPAT is anticipated to lie between $20 million and $22 million, and gross profit margin is likely to surpass 36 per cent during the next financial year.

Dividend Announcement

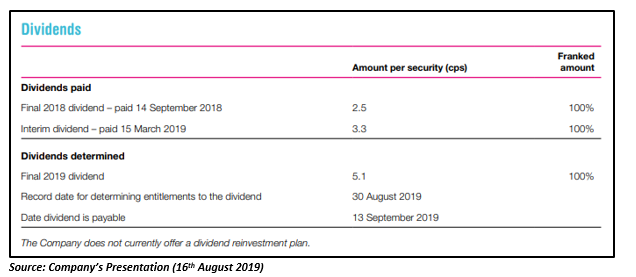

Baby Bunting has announced a fully franked dividend of AUD 0.051 for the half-year ending 30th June 2019. It is the final dividend of FY19 which will be paid on 13th September 2019. Baby Bunting Boardâs policy is to target an ongoing payout ratio of 70 per cent â 100 per cent of pro forma NPAT. The company paid FY18 final dividend of 2.5 cents per share in September, and 1H FY19 interim fully franked dividend of 3.3 cents per share paid in March.

Stock Performance

BBN is currently trading higher at AUD 2.740 on the ASX (As at 2:16 PM AEST on 16th August 2019), with a rise of 12.75 per cent relative to the last closed price. With ~1.96 million shares in rotation, the market cap of the stock stands at AUD 307.25 million. BBN has generated a return of 8.48 per cent on a YTD basis.

The Star Entertainment Group Limited

An ASX 100 listed company, The Star Entertainment Group Limited (ASX: SGR) owns and operates Treasury Brisbane, The Star Gold Coast and The Star Sydney. On behalf of the Queensland Government, the group also manages the Gold Coast Convention and Exhibition Centre.

FY19 Full Year Results

The Star Entertainment Group has announced its FY19 results today, with solid domestic performance offset by VIP. The group reported a rise of 5.4 per cent in its Domestic EBITDA with margin expansion in both Queensland and Sydney.

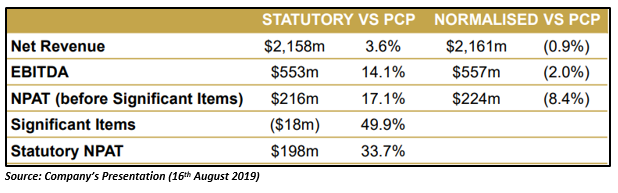

The group recorded solid growth in its statutory earnings, with a rise of 33.7 per cent in its statutory NPAT after significant items, 3.6 per cent in statutory net revenue and 14.1 per cent in its statutory EBITDA on pcp.

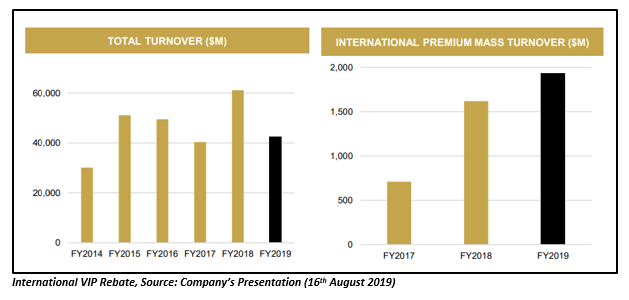

International VIP Rebate business Performance

The groupâs financial performance in FY19 was offset by the performance of its International VIP Rebate business, which was affected by weaker market conditions. Its International VIP Rebate normalised EBITDA was 35.6 per cent down, with lower spend per visit and unique VIP visitation which was up 10 per cent to record levels. The Front money declined 7.1 per cent on pcp to $4.4 billion and unusually low turns of 9.6 times resulted in turnover reducing 30.7 per cent on pcp to $42.4 billion.

In Sydney, the spend per customer declined in the International VIP Rebate business. Sydneyâs underlying performance was impacted by Front money reductions and unusually low turns. The normalised EBITDA was 5.7 per cent down on pcp.

In Queensland, Gold Coast experienced a rise in domestic and International VIP Rebate business visitation, with International VIP Rebate business volumes rising 20.1 per cent on pcp.

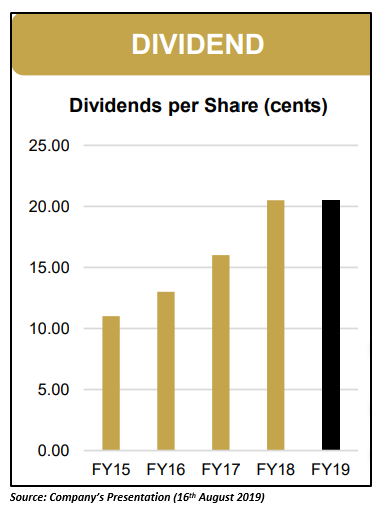

Dividend Announcement

The group declared a fully franked final dividend of 10 cents per share (92 per cent of normalised 2H FY19 NPAT) at the company tax rate of 30 per cent, to be paid on 26th September 2019. The dividend carries an ex-date and record date of 21st and 22nd August, respectively. With the current dividend announcement, the total dividend has now become 20.5 cents per share, representing 84 per cent of the normalised FY19 NPAT.

The group has a Dividend Reinvestment Plan operating on the final dividend. However, the group informed that there will be no underwriting and no discount applicable to the DRP. Shareholders with a registered address in New Zealand or Australia can only participate in the DRP.

Stock Performance

As at 2:16 PM AEST on 16th August 2019, SGR is trading at a gain of 6.70 per cent on the ASX, at AUD 3.820. With ~10.02 million shares in rotation, the market cap of the stock stands at AUD 3.28 billion. SGR has delivered a negative return of 19.91 per cent on a YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.