Due to the housing market slowdown in Australia, many Industrial and Infrastructure companies have faced and are continuing to face significant headwinds, impacting the overall performance of the companies. Despite the headwinds, many stocks have made strong operational progress over recent months. Letâs take a look at three Industrial sector stocks and their latest updates.

Boral Limited (ASX:BLD)

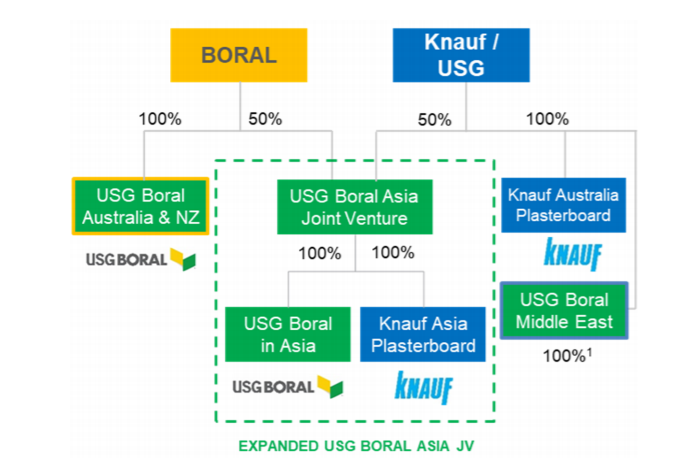

Australiaâs leading construction materials and building supplier, Boral Limited (ASX: BLD) has entered into an agreement with Gebr Knauf KG (Knauf) to form an expanded 50:50 plasterboard joint venture (JV) in Asia, in line with Boralâs strategy to invest in low capital-intensive, high growth businesses. This will allow Boral to return to 100% ownership of USG Boral Australia & New Zealand (NZ).

This joint venture will provide greater scale and improved geographic reach in Asia. Further, it will provide attractive growth opportunities, including enhanced technology support and expected synergies of US$30 million per annum in year 4.

Details: The USG Boral JV will acquire Knauf Asia Plasterboard, for US$532.5 million, and will sell the Middle East business to Knauf for US$50 million, resulting in an expanded USG Boral Asia JV1, subject to regulatory approvals. The acquisition price for 50% of USG Boral Australia & NZ is US$200 million. Boral has agreed to grant Knauf a call option3 to purchase 50% of the business within five years, subject to Australian and New Zealand regulatory approvals.

Structure (Source: Company Reports)

The deal will be funded through debt and proceeds from asset sales, and will be earnings accretive in the first year, even before synergies.

Boralâs total net investment is US$441 million, which is underpinned by a strong strategic rationale. The company believes that it is a compelling investment for Boralâs shareholders with Asia being a highly attractive, long-term growth region for USG Boral.

The expanded USG Boral Asia JV is a ~US$900 million revenue business which will have improved geographic reach in Asia and opportunities to reduce freight costs and substantially improve utilisation across its combined 782 million m2 of plasterboard manufacturing capacity.

The transactions are expected to be completed around the end of the CY 2019. After completing the transaction, Boral will combine its share of equity accounted earnings from the expanded USG Boral Asia JV, with fully consolidated earnings from USG Boral Australia & NZ.

Recently, the company had announced that it is selling its Midland Brick business to Western Australian consortium and expects to receive proceeds of around $86 million from this transaction.

Solid FY19 Results

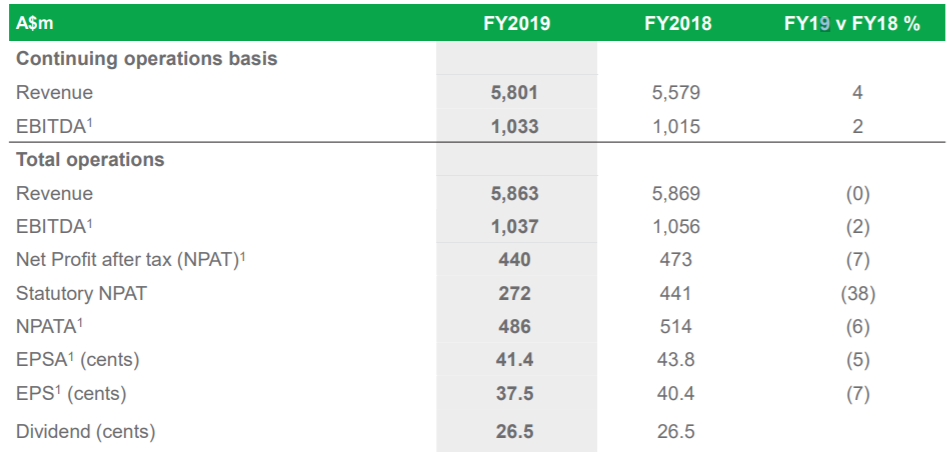

On 26th August 2019, Boral Limited (ASX:BLD) unveiled results for the full year ended 30 June 2019 (FY19). For FY19, the company reported revenue growth of 4% and EBITDA growth of 2%, as compared to pcp. The company witnessed a 6% decline in the NPATA & significant items which reached to $486 million by the end of FY19.

FY19 Results Snapshot (Source: Company Reports)

The full year results of FY19 are reflecting continued strength in Australian infrastructure activity, Headwaters acquisition synergies and benefits from improvement programs offset by the downturn in housing activity and lower property earnings in Boral Australia, a housing market slowdown in Boral North America and a contraction in USG Boralâs earnings due to the downturn in South Korea.

Boral Australia witnessed a decline of 6% in its EBITDA, mainly due to lower Property earnings. Boral North America revenue increased by 3% to US$1,592 million while its EBITDA grew by 10% to US$297 million for continuing operations. EBITDA margins of Boral North America grew by 1% to 18.6%. USG Boral Underlying EBITDA declined by 6% to $252 million, as compared to pcp. The decline in South Korea and increased competition in Indonesia was partly offset by growth in Vietnam, and early benefits from cost reduction programs. Australia continued to deliver strong results, despite softening in Q4.

For FY19, the company reported operating cash flow of $762 million, up 32% on pcp, largely reflecting improved working capital outflows, lower tax payments and lower restructuring, acquisition and integration payments of $54 million compared to $118 million in FY18.

During the year, the company made investments of $435 million which included investments in the new Port of Geelong clinker import terminal in Vic, quarry upgrades, and investments in storage facilities and reclaim activities in US Fly Ash. As at 30 June 2019, the company net debt of $2,193 million.

The company has declared a final dividend of 13.5 cents per share (50% franked), taking the full year dividend to 26.5 cents per share, representing a payout ratio of 71%.

In FY2020, Boral expects its NPAT to be ~5-15% lower than FY2019, due to lower earnings in Boral Australia and USG Boral but underlying earnings growth in Boral North America, together with higher depreciation charges. It is to be noted that, this is before the impact of additional earnings from the announced USG Boral/Knauf transaction and before the impact of accounting changes resulting from the adoption of the new leasing standard (IFRS 16).

Other FY2020 financial considerations

- Above average Property earnings are expected in FY2020;

- Headwaters synergies of ~US$20 million are expected in FY2020;

- Depreciation & amortisation is expected to be higher and in the range of $400 millionâ$410 million in FY2020 (before the impact of the new leasing standard), reflecting completion of quarry upgrades in Australia;

- Boralâs interest expense is currently expected to reflect a continued cost of debt of ~4.25â4.50% pa with net debt increasing to reflect the announced investments in USG Boral;

- Boralâs effective tax rate is currently expected to be in the range of 22â24%;

- Capital expenditure to be lower in FY2020 in the range of $350 million â 400 million.

Stock Performance: In the past six months, BLDâs stock has provided a return of 1.22% in the past six months. At market close on 26 August 2019, BLDâs stock was trading at a price of $3.950, down by 20.363% intraday, with a market capitalisation of circa $5.81 billion. The stock is trading near to its 52 weeks low price of $3.930.

Transurban Group (ASX:TCL)

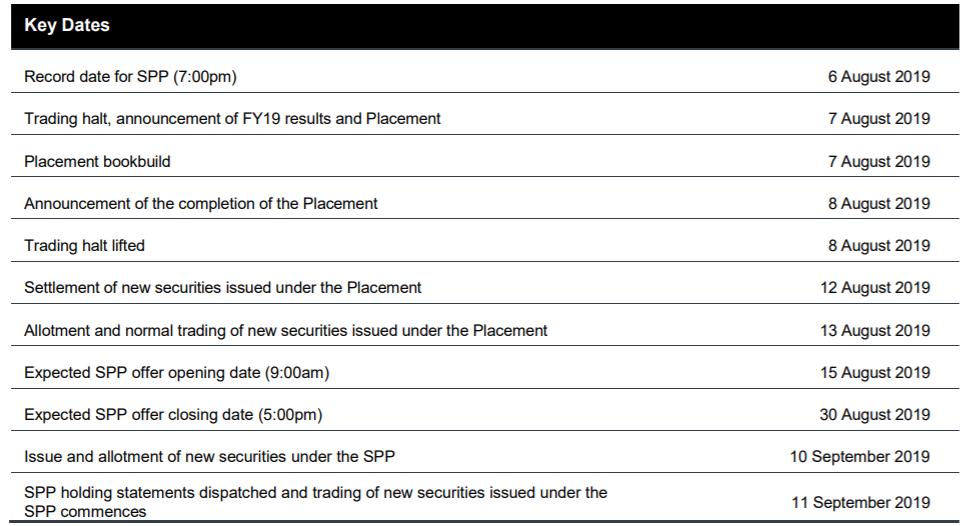

Toll-road operator company, Transurban Group (ASX: TCL) recently completed its $500 million âpro-rataâ institutional placement, proceeds from which will be used for funding the Transurban's acquisition of the remaining 34.62% interest in M5 West for $468 million.

Along with the placement, the company has also undertaken a Share purchase plan, capped at $200 million. The offer for SPP will soon be closed on 30 August 2019.

Key Dates of SPP (Source: Company Reports)

In FY19, the company average daily traffic (ADT) grew by 2.0% and its Proportional toll revenue increased by 10.3% to $2,581 million. For FY2020, the company has set distribution guidance of 62.0 cents per share (cps), which includes 4 cps fully franked.

Stock Performance: In the past six months, TCLâs stock has provided a return of 19.76% as on 23 August 2019. At market close on 26 August 2019, TCLâs stock was trading at a price of $14.940, down by 0.2% intraday, with a market capitalisation of circa $40.58 billion. The stock is trading at a very high PE multiple of 226.820x.

Downer EDI Limited (ASX:DOW)

Infrastructure and facilities services provider, Downer EDI Limited (ASX: DOW) works hand in hand with its customers to help them succeed, using world-leading insights and solutions. The company was recently selected as the preferred overhaul and capital works contractor for CS Energy, responsible to conduct following activities:

- The planning and execution of major overhauls, associated engineering and asset management;

- Collaborating on CS Energyâs maintenance and sustaining capital strategy to improve asset performance efficiency and reliability as well as managing and predicting costs across the asset lifespan;

- Major projects and engineering work to support CS Energyâs asset strategy;

Stock Performance: In the past six months, DOWâs stock has provided a return of 5.48% as on 23 August 2019. At market close on 26 August 2019, DOWâs stock was trading at a price of $7.740, down by 1.901% intraday, with a market capitalisation of circa $4.69 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.