In this article, we will be discussing a few diversified stocks that has given positive returns in the recent past. Investors with diversified portfolio, can reduce the losses associated with market risks by investing in different kind of stocks. The diversification of stocks also comes to rescue during the time of financial WFcrunch.

On 12 December 2019, the Australian benchmark index S&P/ASX200 was trading at 6708.1 points, down by 0.7 percent (at AEST 1:49 PM).

Letâs go through the recent financial and other updates of the five diversified stocks.

Crown Resorts Limited (ASX : CWN)

Crown Resorts Limited is engaged in the operations of gaming and casino activities and has several businesses and investments across major international markets.

Recently in November, CWN informed that it has purchased 50% stake in One Queensbridge development site from Schiavello Group.

Earlier, on 24 October 2019, the company reported the retirement of Geoffrey Dixon from the position of Director of Crown.

FY19 Financial Highlights for the period ended 30 June 2019: During FY19, the company reported a topline (normalised results) of $3,139.2 million, down 9.9% on y-o-y basis. Normalised EBITDA during the year stood at $802.1million as compared to $878.3 million in previous financial year. Reported NPAT (normalised) came in at $369.7 million as compared to $385.6 million in FY18.

Stock Update: On 12 December 2019, the stock of CWN was quoting at $12.195, down 0.123% (at AEST 1:47 PM), with a market capitalisation of ~$8.27 billion. The 52-week trading range of the stock stood at $11.010 and $14.370 and currently, the stock is quoting at the lower band of its 52-weeks trading range. The stock is available at a price to earnings multiples of 20.670x on trailing twelve months (TTM) basis. The stock has generated 4.81% return in the last one year.

REA Group Ltd (ASX : REA)

REA Group Ltd is engaged into digital advertising business focusing on real estate. The company operates across the Australiaâs leading property websites like realestate.com.au, realcommercial.com.au, Flatmates.com.au etc.

Q1FY20 Financial Highlights for the period ended 30 September 2019: REA reported its first quarter results for the period ended FY2020 wherein, the company reported revenue after broker commissions at $202.3 million as compared to $221.9 million in Q1FY19. The company reported lower sales on account of extended duration of Premiere All listings from 45 to 60 days which has resulted in higher deferred revenue for the period. EBITDA during the period came in at $114.9 million, 14% on y-o-y basis. The groupâs business was impacted by the challenging market conditions prevailing in the sector.

Stock Update: The stock of REA was quoting $103.560, down 0.125%, as on 12 December 2019. The stock has generated a mixed return of -0.92% and 11.94% in the last three months and six-months, respectively. The stock is available at a P/E multiple of 130.100x, while the stock has delivered an annualised dividend yield of 1.14%.

Xero Limited (ASX: XRO)

Xero Limited is an accounting software service provider primarily for the small-scale business. Recently, XRO informed that the company has issued 5,097 Ordinary Shares including 5000 Ordinary Shares issued on exercise of vested options and 97 Ordinary Shares issued on vesting of restricted stock units.

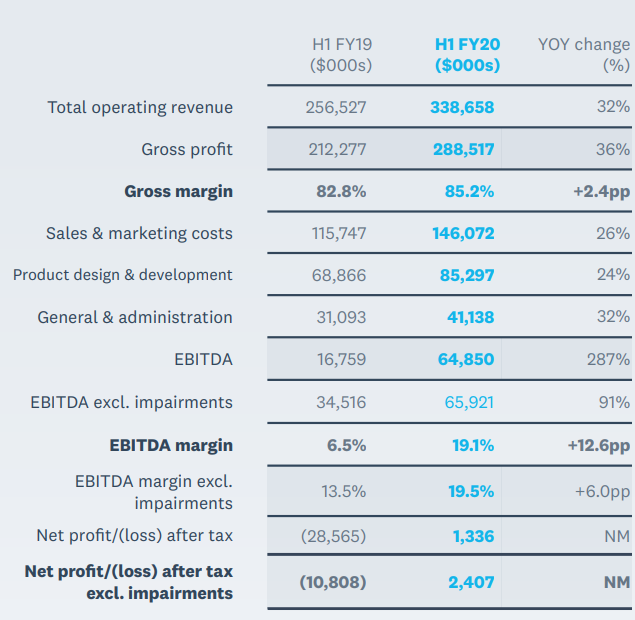

H1FY20 Financial Highlights for the period ended 30 September 2019: XRO announced its first half financial result for the financial year 2019 wherein, the company reported total operating revenue at $338.658 million, up 32% on y-o-y basis. The company reported gross margin at 85.2% as compared to gross margin of 82.8% in previous financial year. The companyâs EBITDA margin grew from 6.5% in FY18 to 19.1% in FY19 on account of the business continuing to benefit from scale and efficiency improvements. The company reported a net profit of $2.407 million as compared to a loss of $10.808 million in previous corresponding year.

H1FY20 Income Statement Highlights (Source: Companyâs Report)

Stock Update: On 12 December 2019, the stock of XRO is quoting at $78.440, down by 2.085 percent (at AEST 1:40 PM) with a market capitalisation of $11.33 billion. The stock is quoting at the upper band of its 52-weeks trading range of $37.050 to $82.980. The stock is available at a P/E multiple ratio of 5.681.56x on TTM basis.

Washington H Soul Pattinson & Company Limited (ASX: SOL)

Washington H Soul Pattinson & Company Limited operates across several businesses like coal mining, pharmaceuticals, telecommunications, building materials and investment.

Recently, the company informed that it has become a substantial holder, with 5.04% voting power in Flexigroup Limited (ASX: FXL).

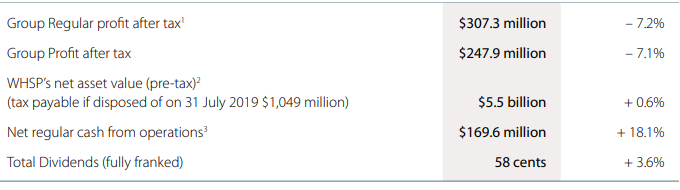

FY19 Key Financial Highlights for the period ended 31 July 2019: SOL announced its FY19 financial highlights, wherein the company reported Group Regular profit after tax of $307.3 million, down 7.2% on y-o-y basis. Net regular cash from operation stood at $169.6 million FY19, up 18.1% on y-o-y basis. The company has given a 11.6% return to the shareholder in the last 15 years.

FY19 Key Financial Highlights (Source: Companyâs Report)

Stock Update: On 12 December 2019, the stock of SOL is quoting at $21.940, up by 0.458 percent (at AEST 1:41 PM) with a market capitalisation of $5.23 billion. The stock is available at a P/E multiple of 21.090x on TTM basis. The stock has delivered an annualised dividend yield of 2.66%.

Macquarie Group Limited (ASX: MQG)

Macquarie Group Limited provides financial, banking and advisory services and other services related to investment and funds. Recently, the company notified that it has changed its interests in Bellevue Gold Limited by increasing its voting power to 6.23 percent.

H1FY20 Operational Update: MQG declared its first half numbers for FY20 for the period ended 30 September 2019, wherein the company reported Net Operating Income of $6,320 million, up 8% on y-o-y basis. The company also reported net profit of $1,457 million, with a rise of 11% on pcp.

Stock Update: On 12 December 2019, the stock of MQG is quoting at $133.660, down by (at AEST 1:42 PM), with a market capitalisation of $48.02 billion. The stock is available at a price to earnings multiples of 14.65x on TTM basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.