Australiaâs funds under management (FUM) industry, also known as investment funds or managed funds is the sixth largest in the world and largest in the Asia-Pacific region, according to the survey produced by Washington-based Investment Company Institute (ICI). The global importance of Australiaâs financial markets and the intricacy of its managed funds industry indicates the countryâs strengths in having the worldâs:

- Fourth largest alternative assets under management (US$275 billion);

- Sixth largest managed fund (MF) assets under management (US$1.6 trillion);

- Eighth largest foreign exchange market (US$121 billion daily average turnover);

- Ninth largest stock market measured by free-float market capitalisation (US$1 trillion);

- Ninth largest high-net-worth market (US$735 billion);

- Tenth largest market for international and domestic debt securities combined (US$2 trillion).

Global Significance of Australiaâs Financial Markets (Source: Australiaâs Managed Funds Update)

Letâs look at six stocks in FUM and Superannuation Space.

Magellan Financial Group Limited (ASX: MFG)

Magellan Financial Group Limited is a funds management company, with the aim of offering international investment funds to institutional investors globally, and retail investors and high net worth in New Zealand and Australia.

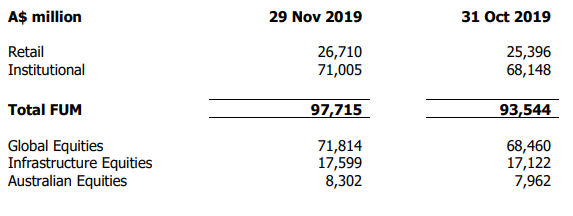

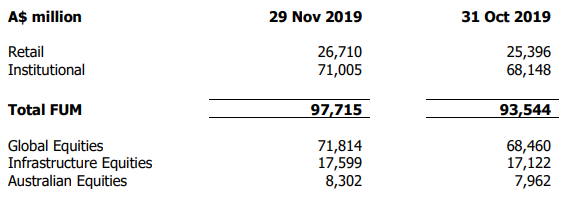

Magellanâs FUM Reaches $97.7 Million Mark

Magellan Financial Group Limited reports the total funds under management (FUM) of $97.715 million for the month of November 2019.

The company witnessed net inflows worth $410 million, inclusive of net retail inflows worth $305 million and net institutional inflows worth $105 million.

FUM as at 29 November 2019 (Source: Companyâs Report)

Stock Performance

The stock of MFG closed the dayâs trading at $52.080 per share on 6th December 2019, up by 2.37% from its previous closing price. The company has a market capitalisation of $9.27 billion with an annual dividend yield of 3.64%. The total outstanding shares of the company stood at 182.28 million, and its 52-week low and high is $22.550 and $62.600, respectively. The stock has delivered a total return of -3.82% and 18.03% in the time period of 3 months and 6 months, respectively.

Platinum Asset Management Limited (ASX: PTM)

PTM operates a funds management business and is one of Australiaâs most trusted international investment managers.

FUM Down by 4% on June 2018

PTM reported FUM of $24.8 billion for June 2019, down by 4% on June 2018. There were net outflows of $246 million led by Platinum Trust Funds, partially offset by net inflows of $201 million by the Platinum Quoted Managed Funds.

- The company declared fully franked final dividend of 14 cents per share, taking the full year to 27 cents per share;

- The PAT to shareholders was down by 17% and earnings per share was down 16% on FY18, due to lower performance fees and reduced gains on seed investments.

Outlook for FY20

- The companyâs FUM on 31st October 2019 stood at $24.6 billion, down by 0.7% on 30th June 2019;

- The company offers a highly differentiated product and maintains a strong position in the Australian retail market;

- In the future, the company will focus on delivering strong long-term returns for clients and shareholders.

Stock Performance

The stock of PTM closed the dayâs trading at $4.210 per share on 6th December 2019, up by 0.4% from its previous closing price. The company has a market capitalisation of $2.46 billion, with an annual dividend yield of 6.44%. The total outstanding shares of the company stood at 586.68 million, and its 52-week low and high is $3.660 and $5.680, respectively. The stock has generated a total return of 7.44% and -4.99% in the time period of 3 months and 6 months, respectively.

Macquarie Group Limited (ASX: MQG)

Macquarie Group Limited is listed in Australia and acts primarily as an investment intermediary for institutional, corporate, government and retail clients and counterparties around the world, generating income by providing a diversified range of products and services to its clients.

Macquarie Exempted from Sec 259C

Macquarie has been granted relief from section 259C of the Corporations Act 2001 relating to certain acquisitions of Macquarie shares by Macquarie Group companies. In relation with the exemptions, the company has notified that as at 1 November 2019 the number of voting shares of Macquarie in respect of which it or its controlled entities have the power to control voting or disposal expressed as a percentage of the total number of voting shares of Macquarie is 5.70%, out of which 4.52% is related to employee share plans.

Stock Performance

The stock of MQG closed the dayâs trading at $135.01 per share on 6th December 2019, up by 1.08% from its previous closing price. The company has a market capitalisation of $47.33 billion, with an annual dividend yield of 4.5%. The total outstanding shares of the company stood at 354.38 million, and its 52-week low and high is $103.300 and $139.100, respectively. The stock has generated a total return of 6.63% and 14.29% in the time period of 3 months and 6 months, respectively.

Pendal Group (ASX: PDL)

Pendal Group Limited is an independent, global investment management business, which has its primary focus on providing high investment returns to its clients by active management.

FUM Performance

The companyâs FUM stood at $100.4 billion, a decrease of $1.2 billion over the year. The FUM witnessed net outflows of $4.7 billion due to geopolitical tension and market instability.

Stock Performance

The stock of PDL closed the dayâs trading at $8.130 per share on 6th December 2019, up by 0.86% from its previous closing price. The company has a market capitalisation of $2.6 billion with an annual dividend yield of 5.58%. The total outstanding shares of the company stood at 322.8 million, and its 52-week low and high is $6.430 and $9.590, respectively. The stock has generated a total return of 18.88% and 16.14% in the time period of 3 months and 6 months, respectively.

HUB24 Limited (ASX: HUB)

HUB24 Limited is an ASX listed company, that joins advisers and their clients via innovative solutions that generate opportunities.

Appointment of Non-Executive Director

The company has appointed Ruth Stringer as a Non-Executive Director of the Company, effective 1 February 2020. She is an experienced financial services lawyer with expertise in funds management, superannuation, life insurance and financial planning. Her diverse career has included working in significant national and international law firms, as well as serving as in-house counsel with various financial institutions and more recently, working with the Australian Securities and Investments Commission.

Stock Performance

The stock of HUB closed the dayâs trading at $10.270 per share on 6th December 2019. The company has a market capitalisation of $644.92 million with an annual dividend yield of 0.45%. The total outstanding shares of the company stood at 62.8 million, and its 52-week low and high is $10.130 and $15.550, respectively. The stock has generated negative returns of 20.33% and 22.08% in the time period of 3 months and 6 months, respectively.

Netwealth Group Limited (ASX: NWL)

Netwealth Group Limited provides financial services like investor directed portfolio services, separately managed accounts, managed funds, superannuation master fund and self-managed superannuation admin services to financial investors and intermediaries.

Stock Performance

The stock of NWL closed the dayâs trading at $7.98 per share on 6th December 2019, down by 1.7% from its previous closing price. The company has a market cap worth of $1.9 billion. The total outstanding shares of the company stood at 237.69 million, and its 52-week low and high is $6.350 and $10.110, respectively. The stock has given a total return of 2.14% and -11.7% in the time period of 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.