With interest rates at record lows, macro-economic tensions taking a toll over businesses, protracted trade wars and climate concerns hovering over the globe, stability is the need of the hour in every realm. Investors are on a look out for good dividend paying companies and are tapping safe haven stocks for long-term benefits.

The Blazing Australian Bushfire and Impact on Australian Stock Market

The extreme weather condition and drought already had numerous adverse effects on Australian businesses in FY19. Amid other factors encompassing daily business lives, the unprecedented bushfire season continues to unfold in Australia. The bushfires have been destroying extensive areas and causing severe damage to the life of animals and people alike. The insurance companies are directly affected by the bushfires and other sectors are also exposed indirectly.

To read about how the stance of Australian retailers amid the fire blazing season- READ HERE.

Insurance Australia Group Limited (ASX: IAG), in its November 2019 report named ‘Severe Weather in a Changing Climate’ had stated that bushfires are one of the fastest growing climate risks in Australia. In a much recent update, IAG proclaimed to having received more than 2,800 bushfire-correlated claims ever since September 2019 (as at the close of 2 January 2020).

Besides the bushfires, the Australian stock market is also been affected by the US and Iran war tension. Recently, there have been reports of Iraqi soldiers being wounded due to housed troops from the United States.

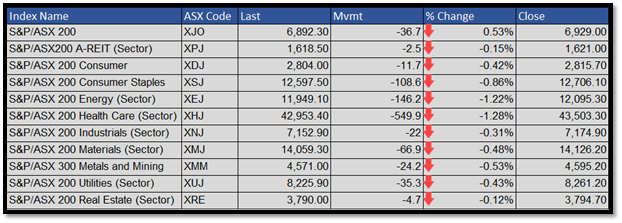

What can be referred to as the combined effect of bushfire and US-Iran war tension can be seen in the table below-

Source: ASX (Market Data as on 13 Jan 2020 (2:57 PM)

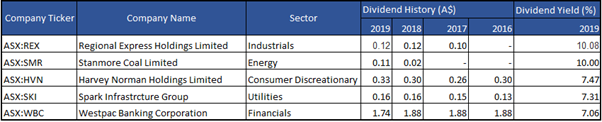

Noticeably, on 13 January 2020, all the major sectors traded lower on the ASX. In spite the adverse impact of bushfires and intense war tension between the Iran and US, we managed to cherry-pick five stocks with a dividend yield of over 7 per cent, which have witnessed a decent operational progress and distributed dividends among their investors in the recent past.

Source: ASX (Market Data as on 13 Jan 2020 (2:57 PM)

Regional Express Holding Limited (ASX: REX)

REX provides air services to facilitate the transportation of freight and passengers. The company segments include charter and regular public transport services. REX’s FY19 final dividend was 8 cents per share (fully franked) following an interim dividend of 4 cents. Moreover, the Board remains committed to a FY20 final dividend, given the challenging economic environment is combatted.

REX’s Revised Profit and Dividend Guidance

After reviewing the financial results of the first four months of FY20, the REX Board revised the profit guidance to a 20-30% reduction in profits for FY 20. Even though the Board remains committed to a final dividend for FY20 pay out, it has decided against paying an interim dividend. This is driven by the capital commitments and the uncertain global economic outlook.

Stock Performance

On 14 January 2020 at 1:28 PM AEDT, REX stock quoted $1.190. The stock has generated a negative return of 15.30 per cent in past six months and a positive return of 2.59 per cent in last one month. Its current annual dividend yield is 10.08 per cent.

Stanmore Coal Limited (ASX: SMR)

Stanmore Coal Limited is an independent coal company. It has exploration and operations projects in the Surat Basins and Bowen. SMR paid a dividend of 8 cents per share in FY19, along with the fully franked interim dividend of 3 cents. Moreover, the combination of share price growth and dividends paid during FY19 delivered a Total Shareholder Return of 69.5%- marking the best outcome of any ASX-listed coal company.

SMR’s Outlook and Guidance

FY19 was a milestone year for SMR, in several ways, including the proficient financial returns. From operations, the company made $140 million in cash and completed FY19 with $90.5 million (net cash).

However, with hard coking coal prices under pressure currently, the Company expects achieved sales prices to be troubled over the short term but remain well over the production cost. Opportunities to boost product quality and prioritise the production of higher value metallurgical coal will aid the company’s achieved margins.

Stock Performance

On 14 January 2020 at 1:28 PM AEDT, SMR quoted $1.015, down by 5.14 per cent from its last close. The stock has generated a negative return of 28.90 per cent in past six months and a positive return of 0.47 per cent on year to date basis. SMR’s current annual dividend yield is 10.28 per cent.

Harvey Norman Holdings Limited (ASX:HVN)

Harvey Norman Holdings Limited is primarily involved in property, integrated retail, franchise and digital enterprise activities. In FY19, HVN’s Dividend yield was 8.1%, based on the HVN share price of $4.07 and a dividend of 33 cents.

In the future, HVN is going to have four store openings- in Ireland, Croatia, Malaysia and Singapore. The aggregated amount of sales from wholly-owned company-operated stores in Croatia, Ireland, NZ, Slovenia and Northern Ireland, majority-owned and controlled company-operated stores in Singapore and Malaysia equalled $2.44 billion (for 1 July 2019 to 31 October 2019).

Stock Performance

On 14 January 2020 at 1:28 PM AEDT, HVN was trading at $4.355, down by 0.57 per cent from its last close. The stock has delivered positive returns of 5.84 per cent in past six months and 7.62 per cent on a year to date basis.

Spark Infrastructure Group (ASX: SKI)

With interest in $17.1 billion of energy network a workforce of more than 5,300 employees, Spark Infrastructure Group is a provider of leading essential services to the infrastructure businesses.

SKI paid the dividend of 7.5 cents on 13 September 2019 and has an annual dividend yield of 7.38 per cent. The market is awaiting its FY19 results due on 25 February 2020.

In November, SKI announced that TransGrid Services, in which it holds a 15% interest, completed its inaugural debt financing. This was a significant milestone for TransGrid, boosting efficient energy services for clients and energy consumers.

The know about SKI’s HY 2019 financial performance READ HERE

Stock Performance

On 14 January 2020 at 1:28 PM AEDT, SKI quoted $2.105, up by 0.23 per cent from its last close. The stock has generated a negative return of 13.11 per cent in past six months and a positive return of 1.44 per cent on a year to date basis.

Westpac Banking Corporation (ASX:WBC)

WBC is one of the four major banking organisations in Australia, the country’s first bank and oldest company. The bank paid the dividend of 80 cents on 20 December 2019 and its current dividend yield is 7.08 per cent.

Moreover, the Bank announced a 100 per cent fully franked dividend of $1.01 to be payable on 30 March 2020.

The Bank has been subjected to APRA’s requirements, wherein the regulator has intimated WBC to increase its operational risk capital requirement by $500 million, in response to AUSTRAC's Statement of Claim.

Stock Performance

On 14 January 2020 at 1:28 PM AEDT, WBC quoted $24.62, up by 0.12 per cent from its last close. The stock has generated a negative return of 11.55 per cent in past six months and a positive return of 1.90 per cent on year to date basis.

Dividend payers have always attracted investors and kept the momentum of the stock market on. However, the true calibre of companies is sought when it is able to cater to shareholders amid an economic downturn and other adversities. An important consideration for one’s investment portfolio, dividends are an integral part of the company’s reputation as well.

To know about the top probable dividend stocks of 2020, READ HERE.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.