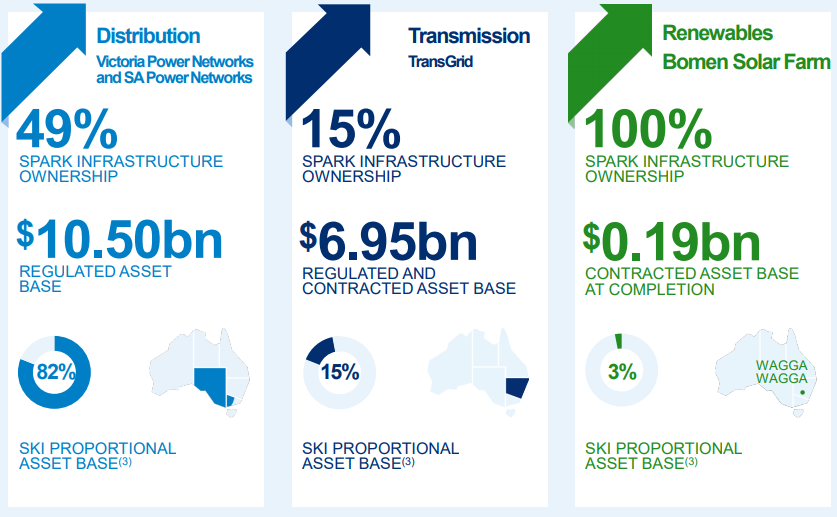

Spark Infrastructure is a utilities sector stock, which has been a listed investor in essential services infrastructure since 2005 and has primary investments in regulated electricity transmission and distribution networks in SA, VIC and NSW. It has held several investments in SA Power Networks, Powercor in Vic and others since its IPO. The company has also led the consortium that acquired TGD off the NSW Govt as part of privatisation program in 2015. In April 2019, the company announced step-out into adjacent renewable assets with 100% acquisition of the 120MWDC Bomen Solar Farm project.

About the Company:

Spark Infrastructure (ASX: SKI) is one of the utilities sector stocks on ASX, which has major interest in Australian Energy Network Service Providers, which is regulated by the Australian Energy Regulator (AER). Spark Infrastructure values a stable and predictable regulatory framework that supports lower prices to customers and improves access to low cost capital.

The company has a total workforce of over 5,300 employees and have interests in about $17.1 billion of energy network assets in total. The company provides energy to more than 5.6 million customers across the three states.

AER Publishes SA Power Networksâ Draft Decision:

AER has released Draft Decision on SA Power Networksâ 5-year regulatory period, which will start on 1st July 2020. SA Power Networks is revising the Draft Decision and would continue to talk with the AER, and the stakeholders throughout the process and is expected to release the Final Determination by April 2020.

Spark Capital says that the Draft Decision provides a WACC of 4.95%, which incorporates a regulated equity return of 4.98%, provided the regulatory forecast of inflation of 2.45%. Spark Infrastructure has restated its view that the rate of return is not adequate to provide predictable and competitive return to the long-term owners of network assets, which is required under the National Electricity and Gas objective. This will put at risk, efficient investment in energy network assets to the long-term detriment of consumers.

About SA Power Networksâ Draft Decision:

The Australian Energy Regulator (AER) regulates electricity transmission and distribution networks in all the Australian jurisdictions except Western Australia. As part of this process, regulated electricity network businesses must periodically apply to AER for a ruling on the amount of money they can collect from their customers to run their business. AER uses its insights and expertise to determine how much money the businesses can recover from consumers for using their networks. The company is currently doing this for SA Power Networks for the 2020-25 regulatory period.

Draft Decision will enable SA Power Networks to retrieve $3,905.3 million between 2020 to 2025 from its consumers. The revenue AER allow, forms the distribution network component of electricity bills. Other components of the electricity bill consist of generation, transmission environmental policy and retail costs. AER estimates that if this draft decision is implemented average residential customers and small business customers in South Australia would save, leading to a drop of $20 and $90, respectively by 2024â25.

In making this draft decision we took three key factors into account:

- Ensuring that consumers pay no more than they need for safe and reliable services;

- SA Power Networksâ engagement with consumers;

- Recognition that an evolving electricity system requires investment.

What does this mean for consumers?

AER estimates that if this draft decision is implemented, network charges in 2024â25 would be:

- $20 lower for average residential customers in South Australia;

- $90 lower for average small business customers in South Australia.

The average annual electricity bill for a residential or small business customer is estimated to be around 1 per cent lower in 2025 compared to the current level.

What does this mean for SA Power Networks?

- The total allowed revenue provides for SA Power Networksâ operating and capital expenditure;

- It also provides a rate of return of 4.95 percent consistent with current market conditions;

- Tax allowance has been reduced in line with recent review of the regulatory tax approach, and the 2018 rate of return instrument resulting in a reduction of $226.1 million compared to the 2015â20 regulatory period.

Spark Infrastructure Appoints New CFO:

Spark Infrastructure released an update on Mr Gerard Dover as its new CFO or Chief Financial Officer. Mr Dover is a highly experienced CFO and finance executive with deep experience across the energy, infrastructure and renewables sectors in Australia and internationally.

He is a highly commercial executive with an established track record of success in IPOs, trade sales, equity and debt raisings, M&A and financial performance improvements.

Consistent result by investment businesses in HY2019:

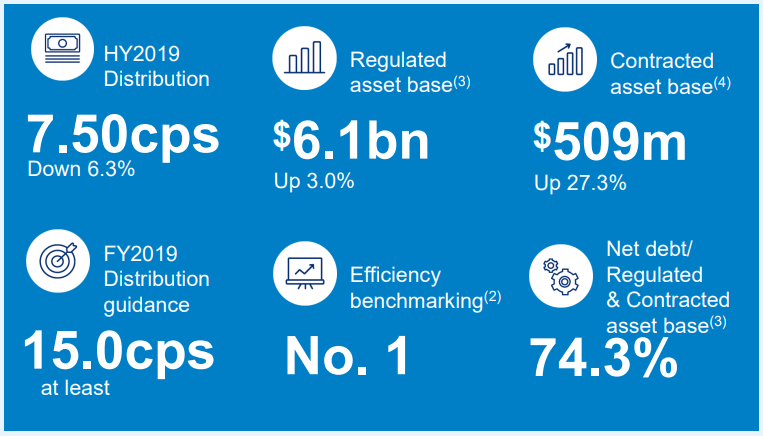

Financial highlights for the 6 months ended 30 June 2019 are as follows:

- The company reported adjusted EBITDA of $426.4 million up by 1.9% from previous half-year period;

- Adjusted Standalone net operating cash flow up 10.8% to $144.4m;

- Distributions from investment businesses up 10.6% to $152.6m;

- The company has declared a dividend of 7.5 cents per share for this half-year;

- It has also given a guidance of at least 15 cents per share for 2019 period.

Spark Infrastructure at A Glance, Source: Investorâs Presentation

HY2019 Performance Summary:

Spark Infrastructure at A Glance Source: Investorâs Presentation

Victoria Power Networks

- In HY2019, EBITDA decreased by 4% to $413.6 million and on an adjusted EBITDA basis reduced by 0.8%;

- On relatively flat revenues, operating costs in HY2019 increased as a result of higher vegetation management and clearance costs;

- Victoria Power Networks has increased the numbers of spans cut in 2019 and as at 30 June 2019, the cutting program is well ahead of the equivalent 2018 schedule.

SA Power Networks

- In HY2019, on adjusted basis EBITDA increased by 3.9% and on normal basis EBITDA increased by 0.8% to $337.8 million;

- SA Power Networksâ semi-regulated revenues were up by 12.8% to $46.7 million, which was due to higher public lighting works and increased asset relocation activity, partially offset by a decrease in council funded LED upgrades;

- Distribution revenue growth was 3.6%, while operating costs increased as a result of higher vegetation management costs.

TransGrid

- In HY2019 period, EBITDA rose by 7.5 person, standing at $352.0 million, being a blend of boosted transmission revenues and decreased operating costs;

- In unregulated revenues, line modifications revenues lessened as several projects were concluded, while revenues from finalised contestable transmission connections expanded;

- Unregulated revenue shrunk by 8.9 percent to $74.4 million, which also witnessed a corresponding substantial reduction in related operating costs.

Stock Performance:

On the stock performance front, the company has produced negative returns of 12.76% and 3.64% in the time period of three months and six months respectively. On 9 October 2019, SKI stock was trading near its 52-week low of $2.080 per share, at a price of $2.130, up by 0.472 percent (at AEST 1:30 PM). The company has a market cap of $3.6 billion, with total outstanding shares of ~1.7 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.