While investing their hard-earned money, investors look for various business aspects including business model, top-line and bottom-line growth, debt, and cash levels.

Strong balance sheet is a term that is often used in the investing world. A company with a strong financial footing means that it holds the ability to pay off its debts. Evaluating the balance sheet helps investors to gauge the financial health of business while also assessing the risk of parking their funds.

Discussed below are five ASX-listed companies that boast a solid balance sheet.

Codan Limited (ASX: CDA)

Codan Limited (ASX: CDA) is a developer of high value-added electronics products, catered to mining companies, governments, security and military groups, and aid and humanitarian organisations. In a market update dated 23rd April 2020, the Company notified that CDA continued to experience strong sales through to the end of March 2020. Profitability for the quarter ended March 2020 was in line with the record run rate for 1H.

Its Malaysia-based outsourced contract manufacturers were operating, at reduced levels, owing to exemptions from the Malaysian Government amid the suspension of all non-essential activities from 18th March 2020 to 31st March 2020 and then to end-April 2020, in Malaysia. Consequently, the Company had been able to reduce the impact on production.

However, till the date of the company announcement, for the month of April 2020, CDA had observed a reduction in sales across its total business in the order of 20%, owing to inability to meet demand, particularly in the Company’s gold markets.

Cash generation continued to be strong for Codan Limited, which has further strengthened its balance sheet to a net cash of $70 million, after making an interim dividend payment of $13.5 million.

Do Read: Are these two IT companies undervalued?

On 18th May 2020 (AEST 11:32 AM), the stock of CDA was trading upward by 0.767% to $6.570 from its previous closing price. The Company has a market cap of $1.17 billion, and in the last one-month period, its stock has delivered a return of 16.85%.

Altium Limited (ASX: ALU)

Operationally and commercially well-positioned electronic design software company, Altium Limited (ASX: ALU) is continuing to close sales of its electronic design tools amid the ongoing COVID-19 market conditions, according to a recent market update.

However, the Company expects some headwinds on its performance in May and June, due to the prolongation of restrictions, as well as the consequential economic and social impacts of COVID-19 on the key economies of the US and Western Europe.

ALU remains profitable and financially very strong with a robust balance sheet and a current cash balance of more than US$77 million, according to the Company announcement dated 12th May 2020.

The Company plans to leverage its balance sheet strength to support its customer base while continuing to invest in its electronic design tool, Altium 365 as well as its digital sales platform.

During 1H FY20 ended 31st December 2019, Altium experienced record growth of 19% in new Altium Designer seats and an increase of 16% in subscriber base to 46,693 subscribers. The Company closed the half-year with strong balance sheet, highlighting a robust increase in cash and cash equivalents to US$80.7 million and zero debt position.

On 18th May 2020 (AEST 11:50 AM), the stock of ALU was advancing further by 1.487% to trade at $35.500 per share against its previous closing price. The Company has a market cap of $4.58 billion, and in the period of last one month and six months, its stock has provided shareholders with a return of 10.28% and 2.37%, respectively.

Do Read: 10 ASX stocks that have geared up in May till date

Medibank Private Limited (ASX: MPL)

Private health insurance company, Medibank Private Limited (ASX: MPL) is growing its business by leveraging dual-brand strategy in order to create a competitive advantage in health insurance. During 1H FY20, the Company reported a decline of 9% in NPAT to $178.6 million because of the reduction in Health Insurance operating profit, but partially offset by an increase in net investment income.

MPL, which has a strong balance sheet with zero debt, is well positioned to consider additional M&A opportunities. For FY20, the Company anticipates management expenses to be around $545 million, which include donation of $5 million to Beyond Blue. Cash and cash equivalents at the end of first half at 31 December 2019 stood at $432.2 million, up from $409.3 million in the same period a year ago.

On 18th May 2020 (AEST 11:59 AM), the stock of MPL was trading flat at $2.860 per share. The Company has a market cap of $7.88 billion, and in the last one-month and six-month period, its stock has delivered a return of 5.54% and -9.21%, respectively.

Interesting Read: 10 financial stocks for financial crisis

Pro Medicus Limited (ASX: PME)

Health imaging information technology (IT) solutions provider, Pro Medicus Limited (ASX: PME) recently announced an on-market share buyback of up to 10% of the ordinary shares on issue for a period of 12 months.

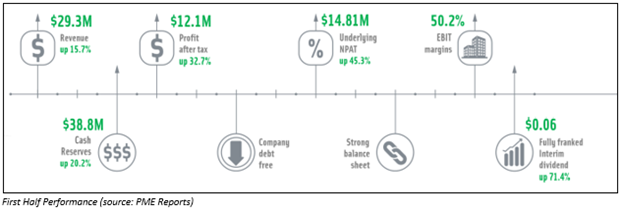

During 1H FY20 ended 31st December 2019, the Company reported net profit after tax amounting to $12.1, reflecting a rise of 32.7% over pcp. Revenue from operations went up by 15.7% to $29.3 million. It secured two contracts valued at a total of $15 million.

PME closed the period with an increase of 20.2% in cash reserves to $38.8 million despite a bigger dividend, a share buy-back and increased tax payments. At the end of half-year, the Company remained debt free.

On 18th May 2020 (AEST 12:01 PM), the stock of PME was trading upward by 3.865% against its previous closing price to $27.140 per share. The Company has a market cap of $2.72 billion and in the time span of last one month and six months, its stock has provided shareholders with a return of 5.32% and -1.10%, respectively.

Nanosonics Limited (ASX: NAN)

Infection control and decontamination solutions provider, NAN witnessed a decent growth in unaudited sales for Q3 FY20 ended 31st March 2020 over prior corresponding period.

In early April 2020, the Company highlighted that supply was being closely managed and remained well positioned to meet demand. During Q3 FY20, the Company rolled out effective measures on operating expenses. NAN is continuously investing in its strategy on the back of sound business fundamentals.

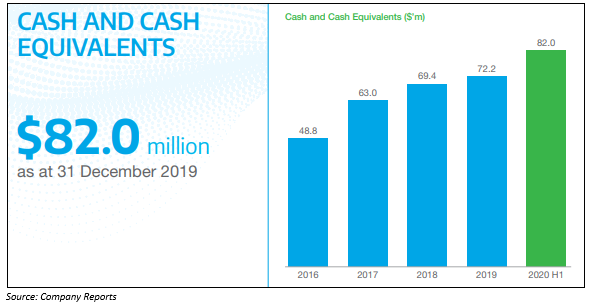

Nanosonics has negligible debt and a solid balance sheet with cash reserves of $82.0 million as at 31st December 2019.

Do Read: How these growth shares are helping investors in building portfolio?

On 18th May 2020 (AEST 12:11 PM), the stock of NAN was trading flat at $6.810 per share. The Company has a market cap of $2.05 billion and its stock has provided shareholders with a return of 8.79% and -7.60% within the time span of one month and six months, respectively.

Transformational Shifts for Medical Devices Companies: Must Read

$ used refers to Australian dollar unless stated otherwise