At times, it becomes difficult to keep investments safe during the financial crisis, especially, in the current global uncertainty caused by COVID-19. The effect of the pandemic has not left any sector untouched, impacting travel and tourism to consumer discretionary sector. However, the authorities of the worldwide nations are working closely together to hedge the economic harm caused by the virus, in order to prevent the impairment of household and business balance sheets.

Talking about the financial sector, it is understood as an integral part of any economy with the potential to come out from a crisis. The companies in the business of funds management have witnessed significant outflows due to investors’ rebalancing.

In this backdrop, let us have a look at 10 ASX-listed financial companies:

Do Read: Understanding of Behavioural Finance & Investment Decisions

Challenger Limited (ASX:CGF)

Challenger Limited (ASX:CGF) is a diversified financial company having their core businesses in annuities, funds management and administration platforms.

During Q3 FY20 ending 31 March, the company reported a rise of 9% in total life sales, due to strong Japanese and institutional sales. Following the significant investment market sell-off in March 2020, the Company reported a fall of 8% to $79 billion in total assets under management. For the same period, its funds management net outflows stood at $2.3 billion. For FY20, the Company expects normalised net profit before tax in the range of $500 million and $550 million.

The stock of CGF was trading at $4.470 per share, down by 3.456% on 6th May 2020 (at AEST 1:42 PM) and at the same price, the annual dividend yield of the Company stood at 7.67%.

Bendigo and Adelaide Bank Limited (ASX:BEN)

Bendigo and Adelaide Bank Limited (ASX:BEN) provides numerous banking and financial services.

In its latest update, the bank stated that it had strong balance sheet and its capital position was well above the unquestionably strong benchmark target of APRA. BEN has pro-forma CET1 ratio of 9.8%, following the recently completed institutional placement and share purchase plan.

BEN is well-placed on the funding and liquidity perspective; its retail funding strategy and profile is underpinned by a high level of customer deposits that are complemented by prudent exposure sourced from wholesale funding markets.

The bank has retracted its guidance for 2H FY20 considering the uncertainty created by the COVID-19 pandemic.

The stock of BEN was trading at $6.020 per share, down by 1.954% on 6th May 2020 (at AEST 1:57 PM) and at the same price, the annual dividend yield of the company stood at 10.75%.

Pinnacle Investment Management Group Limited (ASX:PNI)

Pinnacle Investment Management Group Limited (ASX:PNI) is engaged with funds management.

For 1H FY20 period closed 31 December last year, PNI noted NPAT (net profit after tax) from continuing operations standing at $13.8 million, indicating a growth of 36.6% compared to $10.1 million noted in pcp. As at 31st December 2019, the aggregate Affiliates’ funds under management stood at $61.6 billion. Net inflows for the half amounted to $2.0 billion, which include $0.9 billion retail inflows. PNI declared fully franked interim dividend of 6.9 cps, up 13.1% from 6.1 cents in the PCP.

The stock of PNI was trading at $3.480 per share, down by 1.136% on 6th May 2020 (at AEST 2:13 PM) and at the same price, the annual dividend yield of the company stood at 4.6%.

Janus Henderson Group plc (ASX:JHG)

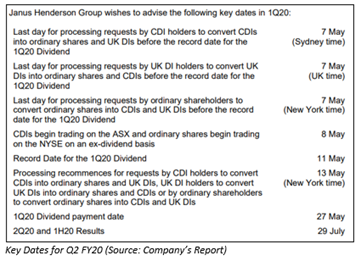

Janus Henderson Group plc (ASX:JHG) is a global investment management company. During Q1 FY20, the Company recorded operating income amounting to US$(332.4) million against US$154.3 million during Q4 FY19 and US$124.5 million Q1 FY19.

AUM for the period stood at US$294.4 billion, reflecting a fall of 21% over Q4 FY19, indicating the impact of COVID-19 and net outflows. It has wrapped up the US$31 million of share buybacks and declared quarterly dividend of US$0.36 per share.

The stock of JHG was trading at $28.360 per share, up by 0.035% on 6th May 2020 (at AEST 2:20 PM) and at the same price, the annual dividend yield of the company stood at 7.52%.

Platinum Asset Management Limited (ASX:PTM)

Platinum Asset Management Limited (ASX: PTM) is a fund manager, which specialises in investing in global equities.

As at 31st March 2020, the funds under management of PTM stood at $21,926.68 million against $23,785.39 million as of 29th February 2020.

During 1H FY20 for the period closed 31 December last year, the management fee revenue went down by 2.7% on Dec-18, which was broadly in line with lower average FUM. Due to mark to market gains on seed investments, its total revenue for the period mounted up by 15.5%. The Company’s business is strong and well placed for future growth backed by strong position in Australian retail market and highly differentiated products.

The stock of PTM was trading flat at $3.460 per share on 6th May 2020 (2:26 PM) and at the same price, the annual dividend yield of the company stood at 7.8%.

Pendal Group Limited (ASX:PDL)

Pendal Group Limited (ASX:PDL) is a global asset management company. The company’s FUM stood at $86 billion for the quarter ended 31 March 2020, a sper its update in mid-April. This shows a decline of 15.2% over the quarter ended 31st December 2019.

However, this fall is better than market falls of major international equity indices, that were noted in the range of 24.9% to 21.4% across the period. This reflects importance and benefits of the company’s strategy of diversification throughout products and markets.

The stock of PDL was trading at $5.330 per share, down by 0.929% on 6th May 2020 (at AEST 2:33 PM) and at the same price, the annual dividend yield of the company stood at 8.36%.

IOOF Holdings Limited (ASX: IFL)

IOOF Holdings Limited (ASX: IFL) mainly provides financial advice and distribution, portfolio and estate administration.

As at 31st March 2020 Funds under Management, Advice and Administration went up to $195.6 billion, reflecting a rise of 34.2% against 31 December 2019. The acquisition of the P&I business made an addition to $77.1 billion to its FUMA. IFL’s increased scale and diversification placed the Company in a decent position during the unpreceded disruption and impacts caused by COVID-19.

The stock of IFL was trading at $4.240 per share, down by 0.935% on 6th May 2020 (at AEST 2:36 PM) and at the same price, the annual dividend yield of the company stood at 6.54%.

HUB24 Limited (ASX:HUB)

HUB24 Limited (ASX:HUB) provides investment and superannuation platform services. FUA for the quarter ended 31 March 2020 stood at $15.1 billion, reflecting a fall of 4.6% since 31 December 2019. The Company stated that the business continues to operate effectively under its business continuity plan in response to the COVID-19 pandemic. During the quarter, HUB continued to experience strong net inflows of $1.4 billion.

The stock of HUB was trading at $9.880 per share, down by 0.903% on 6th May 2020 (at AEST 2:43 PM).

AMP Limited (ASX:AMP)

AMP Limited (ASX:AMP) provides life insurance, superannuation, pensions and other financial services in ANZ.

For Q1 FY20 closed 31 March this year, the total assets under management of AMP capital went down to $192.4 billion. AMP Capital net external cashflows surged to $1.3 billion from net cash outflows of $20 million in Q1 FY19, indicating strong inflows into fixed income products managed by China Life AMP Asset Management.

The stock of AMP was trading at $1.385 per share, down by 1.423% on 6th May 2020 (at AEST 2:48 PM) and at the same price, the annual dividend yield of the company stood at 2.85%.

Medibank Private Limited (ASX:MPL)

Medibank Private Limited (ASX:MPL) is a private health insurance company.

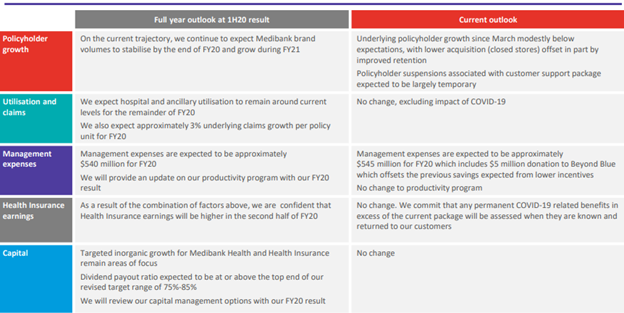

MPL notified the market that it would be presenting itself at the Macquarie Australia Conference on 6 May 2020 and released the presentation consisting of an update with regards to MPL’s financial year 2020 outlook as mentioned below:

Source: Company’s Report

Also, during 1H FY20 for the period ended 31 December last year, the focus of the Company on delivering a better customer experience continued to deliver growth in its business, despite some challenges during the period. Its NPAT stood at $178.6 million, down 9.0% from $196.3 million because of the reduction in Health Insurance operating profit, but partially offset by a rise in net investment income. The Company was anticipating MPL brand volumes to reach a stability by the close of financial year 2020 and expand in the period of financial year 2021.

The stock of MPL was trading at $2.745 per share, up by 3.195% on 6th May 2020 (at AEST 2:56 PM) and at the same price, the annual dividend yield of the company stood at 4.92%.