Summary

- During the lockdown period, retailers saw a massive surge in their online sales. E-retailing boom is here to stay due to safety concerns and shift in consumer behaviour.

- Sector players like Kogan, Wesfarmers and Baby Bunting are experiencing robust growth in online sales and customer base.

- Kogan has successfully completed an institutional placement of AUD 100 million and is set to roll out SPP.

From mid-March 2020 to entire April, Australia has been under strict lockdown, which significantly impacted the retail industry, as majority of physical stores remained closed. On seasonally adjusted terms, retail turnover declined by 17.7 per cent in April 2020, compared with an 8.5 per cent increase in March 2020, as per stats released in early June by the Australian Bureau of Statistics (ABS).

With brick and mortar stores closed and buyers having no other option for shopping than the online platform amid COVID-19-led restrictions, online stores witnessed a new wave of shoppers. This new trend almost compelled all retailers to focus on the development of their digital stores to survive the crisis-those who already had a functional online platform benefitted during the pandemic.

E-commerce has come as a saviour for both retailers and buyers. Australian companies saw a spike in their online sales when their in-stores were closed. Now, with easing out of restrictions, retailers have re-opened their stores with strict government guidelines of practising social distancing, mask-wearing by staff, strict hygiene rules for store sanitising and availability of hand sanitisers in all departments.

Furthermore, to follow social distancing, not many people can be inside a store at a single time. Now, with so many restrictions and psychological fear of getting an infection, online remains as an easy solution for purchasers.

Kogan.com Completes AUD 100Mn Placement

Kogan.com Limited (ASX:KGN) is a prominent name in the Australian consumer brand space. It is renowned for price leadership via digital efficiency, as the Company mostly creates affordable and in-demand products and services. The Company has both retail and services businesses under its umbrella by the name of Kogan Cars, Kogan Money, Dick Smith, Matt Blatt, Kogan Energy, Kogan Internet, Kogan Mobile, Kogan Travel, Kogan Insurance, and Kogan Marketplace.

KGN, on 11 June, announced to have completed its AUD 100 million underwritten institutional placement updated to the market a day before. The placement involves issue of ~8,733,625 new fully paid ordinary shares, representing 9.2 per cent of KGN’s existing issued capital, at an offer price of AUD 11.45 per share.

The offer price represents a 7.5 per cent reduction to the last closing price on 9 June 2020 of AUD 12.38 and a cut of 7.9 per cent to the two-day VWAP on 9 June 2020 of AUD 12.43. Allotment of the new shares is scheduled for 17 June 2020.

The joint lead managers and underwriters to the placement were Royal Bank of Canada and Canaccord Genuity (Australia) Limited.

Under a non-underwritten share purchase plan, KGN will now roll out an offer of new shares to its existing stakeholders, enabling each eligible stakeholder to apply for up to AUD 30,000 worth of new shares at the same price of AUD 11.45. The Company is seeking to raise up to AUD 15 million under the SPP offer, but it reserves the right to increase the size of SPP.

Must Read: Online retailer Kogan.com in Action; Registers Fresh 52-Week High

In early June 2020, KGN released a business update, highlighting

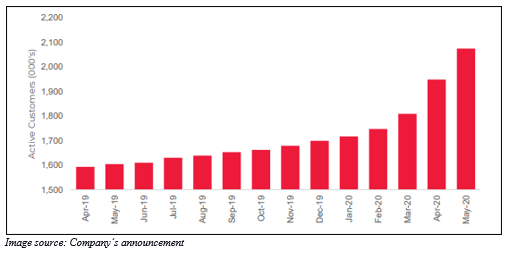

- Kogan.com got new 126,000 active customers in May 2020, and on 31 May 2020, total active customers stood at 2,074,000.

- Gross sales increased by over 100 per cent, while gross profit went up by over 130 per cent across fourth quarter-to-date, April and May 2020 (4QTDFY20).

- Adjusted EBITDA increased by a massive 200 per cent across 4QTDFY20, while financial year-to-date adjusted EBITDA grew by over 50 per cent.

- Average run-rate of adjusted EBITDA was AUD 7.0 million per month across the reported period.

- Total cash stood at AUD 58.6 million at 31 May 2020 with debt facility drawn to AUD 26.0 million.

On 11 June 2020, KGN closed at AUD 13.230, moving upward by 6.866 per cent.

Wesfarmers' FYTD Total Online Sales Up by 60 per cent

Wesfarmers Limited (ASX:WES), a prominent retailer in Australia, recently announced a retail trading update and steps that the group is taking in the wake of the pandemic.

While highlighting safety of staff and customers as the Company's top priority, Managing Director Rob Scott also expressed his content towards the phase-wise reopening of the economy with appropriate measures to curb the spread of coronavirus. Limiting the number of people in brick and mortar stores to follow social distancing may create some inconvenience; however, the Company is grateful for customers’ patience, he added.

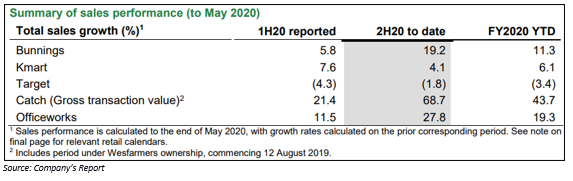

Bunnings reported a robust sales performance due to continuous growth in all product divisions and customers, and commercial markets across all primary trading regions in Australia. Bunnings has spent around AUD 20 million in providing better safety with additional cleaning, protective equipment, and security.

Furthermore, Bunnings is expected to incur AUD 70 million in the 2020 financial year, due to several factors - trading restrictions in NZ, permanent shutdown of seven small-format stores, and increased rollout of its online offering.

Kmart and Target sales recovered due to a general boost in customer football in shopping centres, coupled with improvement in clothing demand.

In the calendar year to date, retail businesses registered strong online sales growth of 89 per cent. On a financial year to date basis, total online sales across the group increased by 60 per cent.

On 11 June 2020, at the end of trading session, WES traded at AUD 42.570, down by 2.853%, with a market cap of AUD 49.68 billion.

Do Read: With numerous people at home amid COVID-19, Wesfarmers gain traction

Baby Bunting Reported Robust Online Sales

Baby Bunting Group Limited (ASX: BBN) is Australia's most prominent speciality merchant of baby goods with more than 50 stores nationwide.

During the period of 30 December 2019 to 17 May 2020, BBN's total sales increased by 13.2 per cent and comparable store sales growth stood at 8.1 per cent. Online sales contributed 17.3 per cent of total sales, representing growth of around 66 per cent on the corresponding prior period.

On a year-to-date basis:

- Total sales growth was noted at 10.3 per cent;

- Comparable store sales growth was 3.4 per cent

- Online sales were 14.3 per cent of overall sales, representing growth of around 34 per cent on the corresponding prior period.

BBN's online channel has performed exceptionally well and surged from 12.4 per cent of all sales before 23 March to 22.4 per cent of sales in two months to 17 May 2020. For this period, online sales were up by 121 per cent year-on-year. Furthermore, the Company’s no contact click and collect service has been well-received by customers with around 42 per cent of all online order coming through this only.

On 11 June 2020, BBN stock closed the day’s trade at AUD 3.130, down 3.096 per cent from its previous close.

Must Read: No Baby Steps for Baby Bunting, Sales up Double Digits Despite COVID-19