Online trading or e-trading or self-directed investing is the purchase and sale of assets such as stocks, mutual funds, exchange traded funds, currencies, bonds and many more on an internet- via a registered online broker. Shares of a company are traded throughout the trading session on the exchanges like ASX in Australia, Nasdaq in the US, etc, as a result of the trading action the stock price keeps on changing throughout the trading session.

Let us have a look at Australian share trading market and some of the best online brokerage service providers that are under spotlight in Australia.

Trading in Australia: Shares trading in Australia for all the public companies is done through the Australian Securities Exchange (ASX). According to market estimates, ASX reports an average turnover of more than A$4.65 billion each day. Moreover, over 2,000 companies are listed on ASX. Not just Australian investors, international investors from outside Australia can also trade on the ASX. The Australian Securities & Investments Commission (ASIC) regulates the brokerages in the country. Australia is expected to become the next major trading hub for stocks in the world in coming years, currently is among the top 20 listed exchanges in the world.

Technological Changes in ASX: ASX is working to modernise the market infrastructure in order to boost its user base. Recently, ASX adopted blockchain technology, becoming the first global market to implement the technology, which will replace more than 25-year-old Clearing House Electronic Subregister System (CHESS). The technology will enable ASX to keep a track of shareholders in listed companies, along with a transaction and trading settlement record.

Robo Advisers: According to some market research reports, more and more Australians are getting attracted towards robo advisors, which offer financial advice generated by AI. Stockspot was the 1st robo-advisor in Australia.

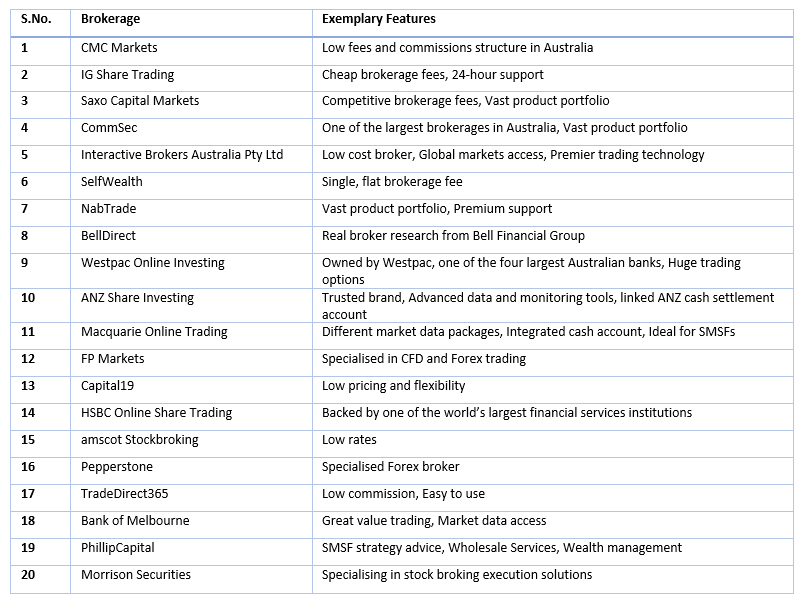

Here is a list of 20 online brokers in Australia:

1- CMC Markets: Offering access to a range of investment products such as indices, forex, shares, exchange traded funds, commodities and treasuries, CMC Markets is an award-winning online trading platform that serves Australian traders with competitive pricing and its Next Generation trading platform. CMC Markets is a UK-based corporation, serving Australia, Singapore, New Zealand, Canada, U.K./Ireland and U.K./Europe.

2- IG Markets: As an online stock broker, IG Markets offers access to Australian and international shares. Its IG Share Trading products offers access to ASX products such as shares, IPOs/floats and exchange traded For standard trade, it charges a brokerage fee of $8.00.

3- Saxo Capital Markets: Giving access to more than 19,000 Australian and global shares, Saxo Capital Markets focuses on helping its clients in developing a well-diversified share trading portfolio. Its ASX products are shares and exchange traded options.

4- CommSec: With over 20-year experience, CommSec is one of the largest online and mobile trading solution providers in Australia. Its product portfolio includes Australian shares, options, international shares, CFDs, exchange traded funds, warrants, fixed income securities, managed funds, margin loan and cash. It is also among the brokerages offering education and trading tools in the country. Additionally, it has launched mobile trading. Its brokerage fee starts from $10.00 for transaction value up to and including $1,000, the broker also provides share packs for instance a $66 per pack of 6 stocks. The broker also provides the users option to purchase international stocks at different brokerage fees.

5- Interactive Brokers Australia Pty Ltd: As a participant of the markets operated by ASX, ASX 24 and Chi-X Australia, the brokerage offers a varied range of products such as stocks, options futures, forex and fixed income. The brokerage is well suited for forex, professional and frequent traders. It is the Australian entity of US-based brokerage firm Interactive Brokers. It charges nearly 0.08% of the trade value.

6- SelfWealth: Australian owned and operated share trading broker SelfWealth is a provider of a single, flat brokerage fee of $9.50 per trade. It was established in 2012. Its product offering includes Australian shares, Australian Listed Debt Securities, Australian Exchange Traded Funds, Australian Listed Investment Company shares and Australian Listed Property shares.

7- NabTrade: This Australia-based brokerage is a single login platform offering access to more than 10,000 investment options such as managed funds, listed bonds, and Australian and international shares. It is good for beginners. Moreover, it is an easy to use desktop platform. For per trade (trade worth $5,000), Nabtrade charges $14.95.

8- BellDirect: This trading platform gives access to ASX listed equities, ETFs, warrants, interest rate securities, options, managed funds via mFund, exchange traded bond units and IPOs. In addition to offering a host of other smart features, it provides real broker research from Bell Financial Group. Additionally, it offers discounted slabs for high turnover traders.

9- Westpac Online Investing: Westpac Online Investing is the online share trading platform of Westpac Banking Corporation (ASX: WBC), which is among the top four banks in Australia. It serves ordinary Australians and companies as well as SMSFs or trusts. Westpac Online Investing helps in buying and purchasing ASX-listed shares, managed funds, international shares, exchange traded funds, listed convertible notes, renounceable rights, and other securities online.

10- ANZ Share Investing: Engaged in trading Australian and international shares, managed funds and exchange traded funds, it also offers access to market research and real-time market data. ANZ, one of the largest four banks in Australia owns Australia and New Zealand Banking Group Limited (ASX:ANZ) Share Investing. Its products are shares, exchange traded options, instalment warrants, endowment warrants and IPOs/floats.

11- Macquarie Online Trading: It offers shares, options - exchange traded, options - company issued, warrants - instalment, warrants - endowment, IPOs / floats and margin trading on ASX markets. Macquarie Online Trading is owned by Macquarie Group Limited (ASX: MQG). Since 1985, Macquarie is offering stockbroking services.

12- FP Markets: Australian-owned brokerage firm FP Markets specialises in CFD and Forex trading. Giving access to more than 10,000 financial products, the firmâs major trading instruments are indices, shares, equities, commodities and futures. Keeping in mind the needs of different traders, the firm offers multiple account types, service levels and trading platforms.

13- Capital19: The company enables its investors to get access to all types of investment products through its online trading platform. It gives access to products including trade stocks, options, futures, bonds, forex and CFDs. It provides model portfolio backed by professionally researched team.

14- HSBC Online Share Trading: Through its online share trade account, global financial services institution HSBC gives access to a broker helping people with their trading needs. The account is managed via an agreement that HSBC has with a third-party platform.

15- amscot Stockbroking: It offers both online and phone share trading services. It is a member of the ASX mfund service. Its product portfolio includes warrants, ETFs and ETCs and XTBs. amscot is a complete trading and clearing participant for leading stock exchanges in Australia.

16- Pepperstone: Based in Melbourne, Australia, it offers access to the MetaTrader 4 and MetaTrader 5 platforms as well as the cTrader platform. It is the leading forex broker in the country, giving access to over 70 tradable forex and CFD markets. ECN, no dealing desk business model, is the companyâs stand out feature.

17- TradeDirect365: It is one of the best values, east to use CFD brokers in Australia. TradeDirect365, founded in 2014, gives access to more than 400 stocks on the ASX. It deals in trade indices, stocks, forex, commodities and cryptocurrencies.

18- Bank of Melbourne: The bank enables trading in shares, options, exchange traded funds, initial public offerings, managed funds and warrants by opening a directshares account as an individual, a company, a registered body, a joint account holder, a trustee or a super fund. directshares is a secure online platform. In addition to this, all directshares account holders get access to research, financial news and several other services.

19- PhillipCapital Australia: holding an experience of more than 25 years, PhillipCapital is a provider of online trading platform and services. The company offers a suite of CFDs over indices, forex and commodities, in addition to Australian & international share trading.

20- Morrison Securities: As a participating organisation of ASX since 1985, Morrison Securities serves investors of all sizes. Its share trading account enables investors to invest their money in equities, day trading, options and one-off or deceased estates. It offers stock broking execution solutions to banks, financial advisors, financial planners, and others.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.