Australiaâs Healthcare Sector is recognised as one the best in the world with significant advances in technology that help provide better ways of delivering healthcare services. However, the sector is also prone to a number of challenges like in other countries that include, rising chronic diseases, ageing population and the rising demand for new treatments and more hospital beds.

Let us now have a look at the performance of two Australian stocks in the healthcare space.

Heramed Limited

Heramed Limited (ASX: HMD) is engaged in development and manufacturing of foetal heart beat monitors and other pregnancy monitoring solutions.

The company recently secured a purchase order for approximately â¬30,000 from Duttenhofer Group, for distribution of the companyâs smart foetal heart rate monitor HearBEAT in Austria, Switzerland and Germany. The deal will help the companyâs sales to progress in near term and supports the companyâs expansion in Europeâs rapidly expanding market. Duttenhofer will provide social media and affiliate marketing through its in-house team to promote brand awareness.

June Quarter Update: During the quarter, the company integrated with one of Brazilâs largest healthcare organisations, Hapvida. The company integrated its HeraBEAT and HeraCARE Pro platform into Hapvidaâs Electronic Medical Records. This included the technical testing of the platform and device, by Hapvidaâs medical professionals. The company reported that the reliability and accuracy of the products was validated upon passing of all the tests conducted. There are now 112 HeraBEAT devices being shipped across Hapvidaâs network of hospitals.

During the quarter, the company strengthened its presence in Australia through launch of a B2C website, www.hera-beat.com.au. The website has been developed in collaboration with Meerkats, a top tier creative agency. The period also saw the company expanding its global footprint in Turkey and Mexico through binding Memorandum of Understanding agreements.

In Turkey, the company secured a binding MOU from Medizane Inc, a leading baby and toddler product distributor, for distribution of its HeraBEAT device. In addition, the company also entered into an agreement with IBL Holdings Limited to progress HeraBEATâs soft launch in Mexico. The agreement involves distribution of the device in the country, through IBLâs Mexican partner, MacStore. Under the agreement, HeraBEAT will be featured in designated stores in MacStoreâs network.

Financial Summary: During the period, the company received US$62,000 from customers, with cash outflows amounting to US$788,000. At the end of the period, the company had a cash at bank amounting to ~A$3.6 million or US$2.546 million.

Outlook: In the remainder of 2019, the company expects to deliver on a number of growth objectives including international expansion through distribution agreements for HeraBEAT, progress trial of HeraCARE PRO with Hapvida, ongoing commercialisation initiatives and roll out of HearCARE PRO and HeraCARE Home and exploration of opportunities relating to partnerships for HeraCARE and HeraBEAT in USA and UK.

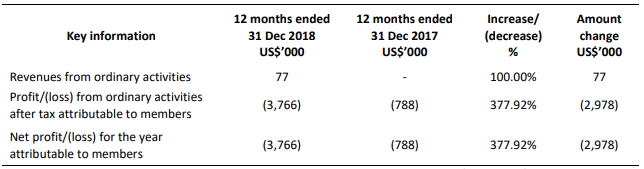

During the year ended 31 December 2018, the company generated revenue from ordinary activities amounting to US$77,000. Net loss for the year amounted to US$3,766,000.

Financial Summary (Source: Company Reports)

Stock Performance: The stock of the company generated negative returns of 9.52% and 24.00% over a period of 1 month and 3 months respectively. The stock is currently trading at a market price of $0.195, up 2.632% on 12 August 2019 (AEST â 3:17 PM) and has a market capitalisation of $16.63 million.

Mesoblast Limited

Mesoblast Limited (ASX:MSB) is a manufacturer of cellular medicines for inflammatory diseases. The company recently announced the appointment of Dr Fred Grossman as the Chief Medical Officer. He holds an extensive experience of 20 years at global pharmaceutical companies including Eli Lilly, Bristol Myers Squibb, Sunovion, Johnson & Johnson and Glenmark.

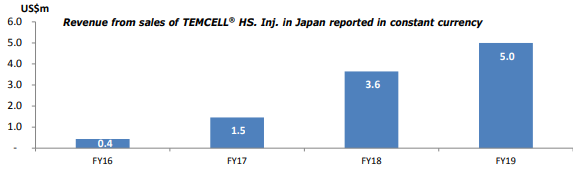

Highlights of June Quarter: During the quarter ended 30 June 2019, the company reported US$5.0 million in revenue from sales of TEMCELL®HS. Inj. in Japan. The revenue has continuously grown from FY16 to FY19, with FY16 revenue from sales amounting to US$0.4 million. The company witnessed increase of 54% on quarterly basis and 37% on yearly basis. During the quarter, the Orphan Drug Designation for use of rexlemestrocel-L for preventing of post implantation mucosal bleeding in patients suffering from heart failure, was granted by the Food and Drug Administration. In addition, the company also met with the administration in late July for further defining the registration process for usage of Revascor in treatment of heart failure in patients with an LVAD.

Revenue from Sales of TEMCELL® (Source: Company Reports)

Receipts: In FY19, the company reported US$26.4 million of milestone receipts. Out of the total receipts, establishment of partnership with Tasly Pharmaceutical Group in China accounted for US$20.0 million, patent license agreement with Takeda Pharmaceutical Company Limited accounted for US$5.4 million and the remaining amount was in relation to JCR reaching cumulative net sales milestones for sales of TEMCELL® in Japan, that stood at US$1.0 million. Royaly receipts for the period were recorded at US$1.0 million, that represented sales of TEMCELL in Japan for the treatment of aGVHD. Total royalty receipts for FY19 amounted to US$4.4 million. The company recognised royalty income of US$1.7 million and US$5.0 million for Q4FY19 and FY19, respectively.

Payments: Research and Development payments for the fourth quarter amounted to US$8.3 million. Payment for full year 2019 stood at US$48.5 million, that represented costs being incurred on Phase 3 programs in aGVHD, chronic low back pain due to degenerative disc disease and advanced chronic heart disease. Manufacturing payments for the quarter amounted to US$4.3 million and those for FY19 amounted to US$13.4 million.

Cash Position: As at 30 June 2019, the company reported cash in hand amounting to US$50.4 million, with possibility of obtaining additional capital of US$35.0 million under existing arrangements with NovaQuest Capital Management, LLC and Hercules Capital, Inc.

Stock Performance: The stock of the company generated negative returns of -2.00% and -4.23% over a period of 1 month and 3 months, respectively. Currently, the stock is trading at a market price of $1.480, up 0.68% on 12 August 2019 (AEST â 3:56 PM). The stock has a market capitalisation of $733.03 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.