Australia is a powerhouse of biotechnology and pharmaceutical innovation that is being driven by world-class research facilities, leading scientists and a strong yet flexible regulatory regime. Lets us take a look at the following four companies from the Biotechnology sector in Australia.

1ST Group Limited

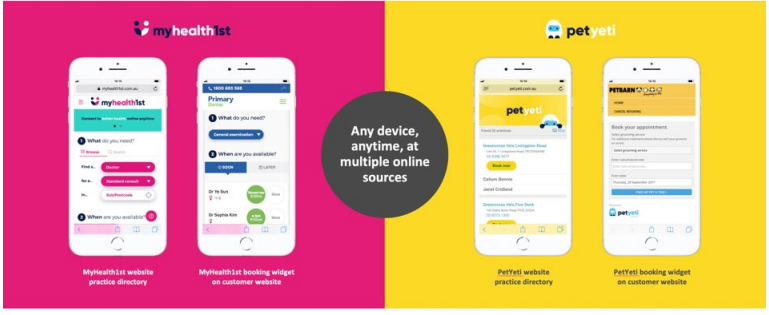

1ST Group Limited (ASX:1ST) is a digital health company developing a health services portal called MyHealth1st.com.au, an online pet service portal called PetYeti.com.au and GoBookings.com, a corporate and government solutions platform.

The company has a market capitalisation of around AUD 35.54 million with approximately 355.39 million shares outstanding. On 29 July 2019, the 1ST stock was trading at AUD 0.097, down by 3.00% by AUD 0.003 with approximately 1.02 million shares traded (as at AEST: 11:33 AM). In addition, 1ST stock has provided positive returns of 244.83% in the previous six months and 257.14 % YTD.

Agreement with Bodycare Workplace â On 26 July 2019, the company informed the market to have reached a new agreement with Bodycare Workplace Solutions to bring MyHealth1stâs solutions to 130 physiotherapy and GP practices in the growing Bodycare network.

1st Groupâs portals and widgets; Source: Companyâs announcement dated 26 July 2019

1st Groupâs portals and widgets; Source: Companyâs announcement dated 26 July 2019

Utilising the MyHealth1st platform as per the agreement, Bodycare would be able to provide its wide number of customers, a seamless and more efficient process for patients to access their services.

The agreement is for a period of two years and provides a mix of setup, subscription and booking fees (advertising revenue). The agreement also entails, Bodycare practices the option of signing up to EasyRecalls, EasyFeedback and other MyHealth1st products. Implementation of the MyHealth1st services is anticipated to be attained in multiple phases and planned to be accomplished within six months.

Oncosil Medical Ltd

Medical device company, Oncosil Medical Ltd (ASX:OSL) is developing advanced radiation for cancer patients with its lead product being OncoSilâ¢, a radioactive isotope (Phosphorus-32), implanted directly into a patientâs pancreatic tumours through an endoscopic ultrasound.

So far, OncoSil has completed four clinical studies for OncoSil⢠that delivered encouraging results with respect to tolerability, safety and efficacy. Currently, a CE Mark application for the commercialisation of OncoSil⢠in the European Union (EU) is under review.

In July 2016, the US Food and Drug Administration (FDA) granted an Investigational Device Exemption (IDE) approving a clinical study trial for OncoSilTM that would provide the safety and effectiveness data, thereby further supporting a Premarket Approval (PMA) application.

Oncosilâs market cap is at around AUD 39.73 million with approximately 630.71 million shares outstanding. On 29 July 2019, the OSL stock was trading at AUD 0.061, down by 3.175% by AUD 0.002 with ~ 3.86 million shares outstanding (as at AEST: 11:33 AM).

In addition, the OSL stock has delivered positive return yields of 31.25% in the last one-month and 18.87% in the last three months.

On 26 July 2019, OncoSil Medical replied to an ASX query with respect to the change in price of OSL securities that day. The company confirmed that there was no reason in particular that could explain the sudden uptick in the share price.

Bank of America Corporation and its related bodies recently became a substantial shareholder in Oncosil upon acquiring 38,416,218 ordinary fully paid shares, translating into a voting power of 6.09%.

Positive Survival data for its PanCo study â On 4 June 2019, OncoSil Medical provided positive Overall Survival data for its PanCo study at the American Society of Clinical Oncology Annual Meeting held this year. The PanCO study is an ongoing international multi-institutional, single arm study which is being conducted across 12 sites in Australia, UK and Belgium to investigate the safety, efficacy, feasibility and performance of the OncoSilâ¢.

# Limited

# Limited (ASX: IVQ), headquartered in Singapore and with operations in Australia, China, Hong Kong and Germany, is an innovative life sciences company providing biomedical services including metabolite profiling, cell-based analysis, case reference, sample preparation, and other services, worldwide. It specialises in the development of 3D cell-based models based on from liver and tumour tissues.

Source: Investor Presentation

#âs market capitalisation stands at around AUD 34.15 million with approximately 525.33 million shares outstanding. IVQ last traded on ASX at AUD 0.065 on 23 July 2019.

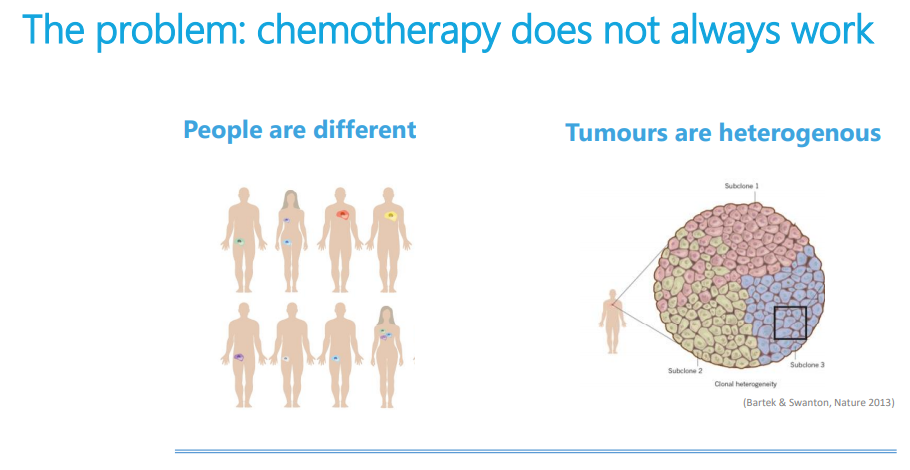

The company released its Corporate Presentation in May 2019 elaborating on Transforming Cancer Outcomes. According to #, chemotherapy treatments in the going era do not always work and are based on âone-size-fits-allâ.

Source: Corporate Presentation

Source: Corporate Presentation

The global cancer burden is expected to increase to 29.5 million in 2040. While only 35% cancer treatments are effective, and the cancer deaths worldwide are expected to rise by 71% by 2040. The company is aiming to be a pioneer in personalised oncology with a highly scalable business model and a powerful platform technology.

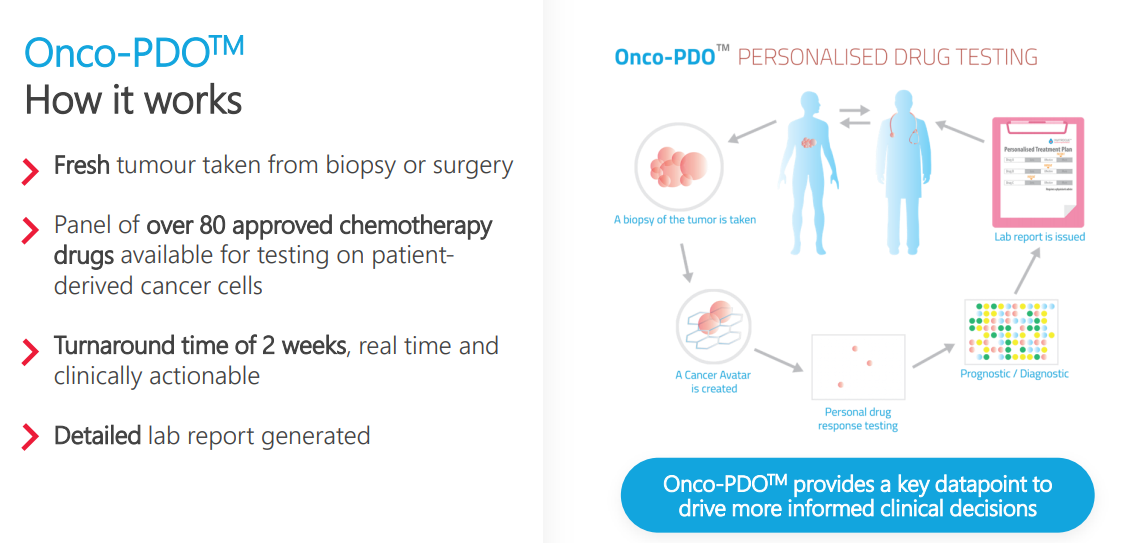

#âs Onco-PDO technology enables culture of patient-derived cancer cells (organoids) in labs to test against a panel of drugs and support personalised clinical decisions.

Source: Corporate Presentation

Source: Corporate Presentation

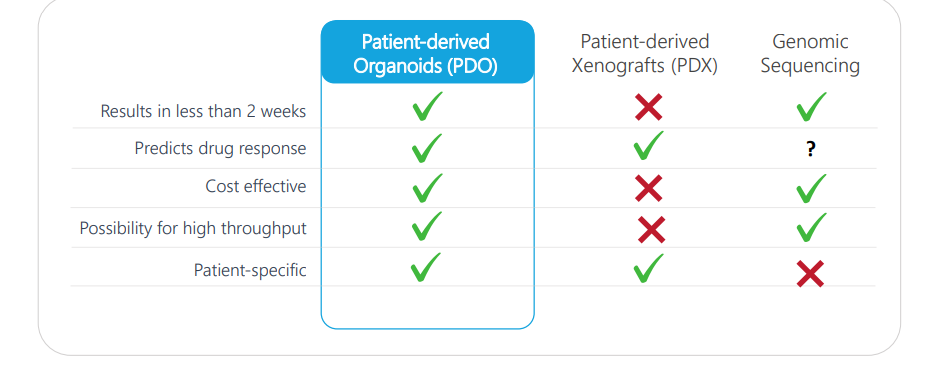

It has various competitive advantages over other technologies as depicted below.

Source: Corporate Presentation

Source: Corporate Presentation

The first commercial revenue for Onco-PDOTM was received in 2018 and the company has initiated a Global Key-Opinion-Leader education program. Onco indication, 2018 -PDOTM is currently available in:

- Asia: China, Philippines, Singapore, Thailand, Malaysia, Indonesia, Vietnam, Thailand, Australia, New Zealand.

- Europe: Germany, Spain, UK, Austria.

Proteomics International Laboratories Ltd

Perth based Proteomics International is a subsidiary (100%-owned) of PILL (ASX: PIQ), a medical tech company engaged in offering predictive diagnostics and bio-analytical offering. The companyâs expertise lies in proteomics â the industrial scale study to understand the protein structure and functions. Therefore, Proteomics International is primarily focussed on the commercialisation of PromarkerD which is a ground-breaking innovation and a world-leading test for diabetic kidney disease.

Proteomics Internationalâs market capitalisation stands at around AUD 27.84 million with approximately 80.69 million shares outstanding. On 29 July 2019, the PIQ stock was trading at AUD 0.330, edging down 4.348% by AUD 0.015 with approximately 36k shares traded (as at AEST: 11:41 AM).

In addition, PIQ has generated positive return yields of 25.45% in the last three months.

New pharmacokinetic analysis contract â On 26 July 2019, Proteomics International announced to have secured two new contracts to perform pharmacokinetic (PK) analyses. The agreements have a total value of $ 0.418 million and form part of the companyâs existing tie-up for clinical trials with Linear Clinical Research for pharmacokinetic testing. The phase I clinical studies would investigate the safety performance of novel autoimmune disease drugs for two ChinaÂ-based pharmaceutical companies, with the studies to be undertaken over the next three to ten months.

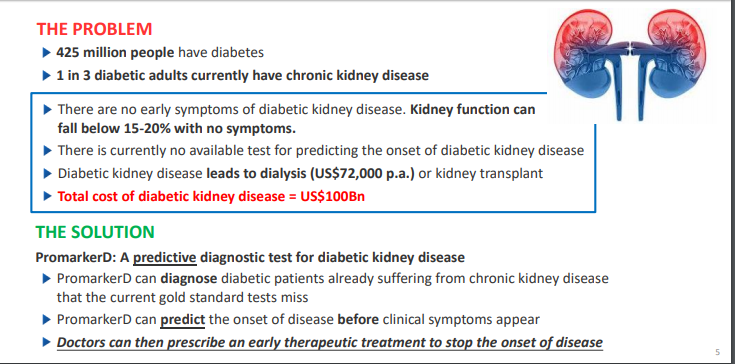

PromarkerD is a ground-breaking predictive test for diabetic kidney disease and presents a significant opportunity to serve the unmet demand (see figure below). The company is consistently developing existing regional PromarkerD licensing agreements, whilst actively pursuing new opportunities as they arise.

Source: Investor Presentation - 121 Tech Investment Hong Kong

Source: Investor Presentation - 121 Tech Investment Hong Kong

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.