In this piece of writing, we would discuss three stocks that trades on the ASX. On 23 August 2019, the companies under discussion had released full year results, and reported on an acquisition. Concurrently, the Australian benchmark index, S&P/ASX200 closed on ASX higher by 21.3 points or 0.3% at 6,523.1 compared to its last close (as on 23 August 2019).

BWX Limited (ASX: BWX)

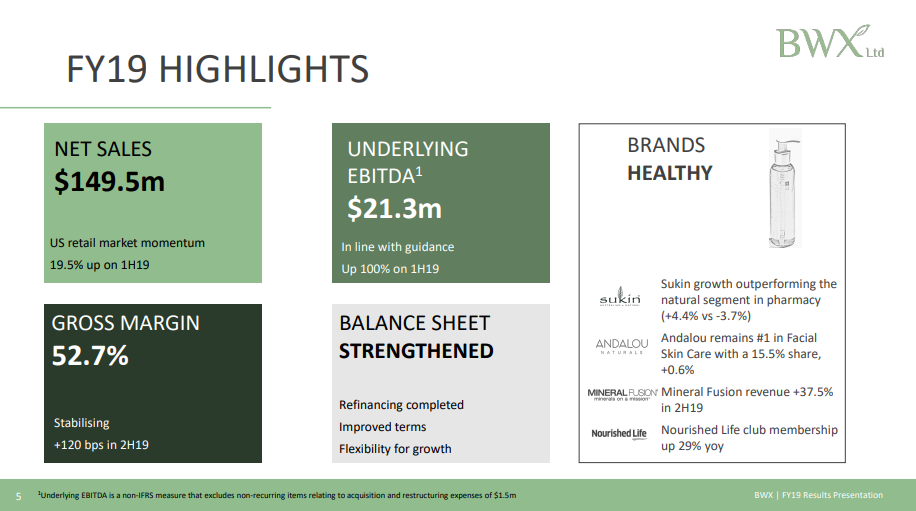

On 23 August 2019, the company released full-year results for the year ended 30 June 2019. Accordingly, the total revenues of the company were at $149.5 million in FY2019 compared to $148.7 million in FY2018. The reported NPAT was $9.5 million in FY2019, down by 50.4% compared to $19.21 million in FY2018.

Besides, the company has announced a dividend (fully franked) of 2.7 cents per share payable on 25 October 2019, with a record date of 27 September 2019.

FY19 Highlights (Source: BWXâs FY19 Results Presentation)

Reportedly, the full-year revenue was backed by strong sales momentum in the USA market with major growth in Andalou Naturals. Whereas, Sukin revenue was down compared to the previous period due to the impact of non-repeating short-term promotions.

As per the release, the revenue from the segment was at $52.8 million in FY2019 compared to $65.8 million in FY2018. The brand is now selling in 448 USA door channels of Natural & Total, and 318 new Australian door which involves Big W and Target as well.

Meanwhile, the brand had posted record double digit sales in the UK, Canada, New Zealand, Malaysia, Singapore and China. In China, the company expects significant revenue potential while the revenues from China accounted for less than 10% of the group revenues.

Andalou Naturals

Reportedly, the revenue from the segment was $48.6 million, which depicted year-on-year growth with significant growth recorded in the USA market. In the USA whole foods markets, the brand leading natural retailer space, and experienced 19% growth in FY2019.

Meanwhile, the launch of CannaCell â a facial skin care collection derived from hemp stem cell accounted for 21% of Andalou sales in Facial Skin Care.

Mineral Fusion

Reportedly, the total revenue from the division was $24.6 million, down from $30.3 million in FY2018. The second half sales revenue increased 37.5% over pcp, and the better second half could be attributed to the packaging re-launch in January 2019 and successful sell-in to the mass grocery channel in the USA.

Nourished Life & Other Revenue

Reportedly, the segment recorded revenues of $20.9 million in FY2019, and the membership base of the platform continues to strengthen with 29% growth year-on-year to 300k. The segment is strategically important for the company due to its leading digital platform for customer insights on natural wellness and beauty trends.

Outlook

Reportedly, the company is placed with the leading brands backed by material growth trends favouring natural products. It intends to continue investments in brand building, process improvement, capability and innovation. It expects revenue growth of 25-35% and EBITDA growth of 25-35% for the FY2020.

On 23 August 2019, BWX stock last traded at A$3, zooming up by 28.755% from the previous close. Over the last one year, the stock has given negative return of 48.11%. Besides, the stock has delivered a return of +41.21% in the year-to-date period.

Bravura Solutions Limited (ASX: BVS)

On 23 August 2019, the company reported annual results for the period ended 30 June 2019.

Financial result

Accordingly, the revenue of A$257.7 million in FY2019 was up by 16% over FY2018âs revenue of A$221.5 million. The EBITDA increased by 27% to A$49.1 million compared to $38.6 million in FY18. Meanwhile, the net profit after tax for the period stood at A$32.8 million, increasing by 21% from A$27 million in FY2018 period.

Dividend

The company declared an unfranked dividend of 4.8 cents per share payable on 27 September 2019, and the record date for the dividend is 4 September 2019.

FY19 Highlights (Source: BVSâ FY19 Results Presentation)

Reportedly, the revenues from the segment increased 14% to A$176.8 million in FY19 from A$155.1 million in FY2018. The EBITDA increased 17% to A$53.9 million in FY2019, up from A$46.2 million in FY2019. The growth had been underpinned by new contracts, successful client implementations and commencement of additional projects for new and existing clients.

Reportedly, the revenues from the segment were up by 22% to A$80.9 million from A$66.4 million in FY2018. EBITDA increased by 21% to A$32.3 million from A$26.7 million in FY2018. The growth was propelled by the implementation of new contracts, and enhancement of contract with an important global client.

Market Outlook

Reportedly, the products of the company are utilised by the pensions, life insurance, investment products, and wrap platform across the UK, Australia, New Zealand and South Africa, which hosts many financial service companies.

Besides, financial service companies in these regions are still running legacy or competitor systems, which result in high-cost structures. This attributes to less product flexibility, slow implementation of dynamic regulatory requirements, and delay in meeting the emerging requirements of the current digital world.

Meanwhile, the company is placed with a strong pipeline in these regions, and a number of major financial institutions are evaluating the competency of the companyâs product and digital offerings to replace the existing systems used by these major financial institutions.

Sonata â the companyâs wealth management offering makes up almost all of the Wealth Management segment. Admittedly, the continued investments in Sonata by the company and its clients has been supporting customer demand while improving the market leading position. As a result of resilient recurring revenue & new sales opportunities, the company expects full-year 2020 NPAT to be in the mid-teens.

Acquisition of Midwinter Financial Services

Concurrently with full-year results, the company announced the acquisition of Midwinter Financial Services. Accordingly, the company has entered into an agreement to acquire Midwinter â the provider of AdviceOS.

Reportedly, following the Royal Commission, the countryâs financial planning market operates under a strictly regulated environment. The acquisition allows enhancing financial advisory business by a differentiated technology-based solution to support traditional advice delivery methods, compliance obligations and self-directed digital advice delivery methods.

Meanwhile, the deal is expected to be completed in August 2019 following the satisfaction of conditions. The founder and senior management members of Midwinter would continue to be an important part of it.

On 23 August 2019, BVSâ stock last traded at A$4.6, down by 1.919% from the previous close. Over the last one year, the stock has given return of +28.49%. Besides, the stock has delivered a return of +23.42% in the year-to-date period.

Brickworks Limited (ASX: BKW)

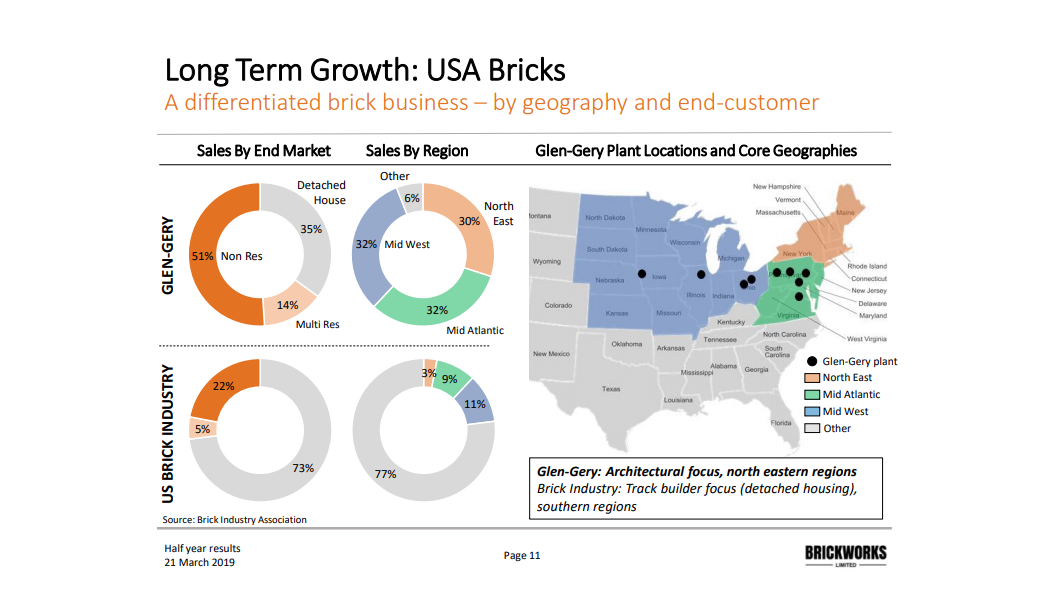

On 23 August 2019, the company announced the acquisition of US-based brick manufacturer. Accordingly, the company has entered into a binding agreement to acquire Sioux City Brick for US$32 million (AUD 47 million).

Reportedly, Sioux is based in Iowa, a privately-owned brick manufacturer, traces its roots back to 1913. It has an established leading market position in the Midwest region of the US, and it is backed by three modern production lines with a total capacity of ~160 million bricks per year.

Meanwhile, the transaction would be financed via existing debt facilities, and it is expected to deliver 3% EPS accretion after the realisation of cost synergies. Sioux sells around 90 million bricks per year via direct sales to builders and resellers, through five retail distribution outlets.

BKWâs USA Market (Source: BKWâs Analyst Presentation HY Jan 2019, March 2019)

Besides, Sioux has a broad end market exposure along with a strong reputation of architectural projects, servicing and non-residential and multi-residential segments. Further, the transaction allows significant growth opportunities for the company in the US market.

Mr. Lindsay Partridge, Brickworks Managing Director, stated that the company is pleased to welcome Sioux and its 200 staffs to the Brickworks Group, and BKW is looking forward to improving on the strong position in the Midwest region of the United States.

He added that the above discussed transaction has built on the companyâs position in the architecturally focussed Midwest and Northeast regions of the United States.

On 23 August 2019, BKWâs stock last traded at A$16.28, up by 2.39% from the previous close. Over the last one-year time frame, the stock has provided negative return of 5.36%. Besides, the stock has delivered a return of -13.02% in the last six months period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.