In this reporting season, many companies have been successful in achieving the targeted performance for FY2019 but it seems that they still have missed out on investor expectations. On 20 August 2019, S&P/ASX 200 was spotted in the green zone, closing at 6545 points, up 1.2% in a day-trade. Letâs have a look at the financial performance of three ASX-listed companies coming from industrials, metals and mining sectors.

Monadelphous Group Limited (ASX: MND)

Engineering company Monadelphous reported FY19 revenue of $1.608 billion, down 9.85% on the previous corresponding period, but in line with the companyâs expectation for the year ended 30 June 2019. Earnings before interest, tax, depreciation and amortisation (EBITDA) declined 10.3% to $106.8 million, mainly due to the reduction in resources construction activity levels.

The bleak results of the company sent MND stock price to fall 0.612% in a day-trade to close at $17.850 on 20 August 2019.

Underlying net profit after tax of the company stood at $57.45 million in FY19 compared to $71.48 million in the prior year. This includes a one-off provision of ~7 million in relation to the repayment of Research and Development tax incentives previously received as per the amended rules of the Government.

On the positive front, Monadelphous reported a significant growth in its Maintenance and Industrial Services division, which achieved a record annual revenue performance of $998.4 million, up 19% on the previous corresponding year, due to increased activity levels in iron ore and offshore oil and gas markets and strengthened demand for its services more broadly.

Also, the company has secured $1.35 billion of new contracts and extensions since 1 July 2018, including over $500 million of resources construction contracts, reflecting renewed confidence in the sector. Major construction contracts were reportedly secured in Western Australia at BHPâs South Flank Project and Rio Tintoâs West Angelas Project in the Pilbara and Albemarle Lithiumâs new Kemerton lithium hydroxide plant.

Monadelphous strengthened its position in the infrastructure sector, with revenue growth achieved in both the water and renewable energy markets. The company secured three additional wind farm contracts beside its renewable energy joint venture Zenviron making good progress on the projects secured in the prior period.

But the Engineering Construction division, which provides large-scale, multidisciplinary project management and construction services, reported revenue of $622.9 million, down 34% on the previous year, reflecting subdued activity levels in the resource construction market.

The Board of Directors has declared a final dividend of 23 cents per share, taking the full-year dividend to 48 cents per share fully franked at a dividend payout ratio of ~90% of reported net profit after tax, i.e., 53.7 cents. Monadelphous has scheduled to pay this final dividend of 23 cents per share on 4 October 2019 to the shareholders entitled to receive the amount as on the record date of 13 September 2019.

MND stock price last traded at a price to earnings multiple of 26.140x with a market capitalisation of $1.69 billion. Over the past 12 months, the stock has witnessed a positive price change of 20.05% including a surge of 3.34% recorded in the past six months.

Also Read: MND subsidiary secures an EPC Contract with Talison Lithium

Western Areas Limited (ASX: WSA)

On 20 August 2019, WSAâs stock price edged up 0.81% after the company announced a 20% uplift in Net Profit After Tax (NPAT) to A$14.2 million for the fiscal year ended 30 June 2019.

Metal and mining sector company, Western Areas Limited reported a solid financial results on the back of increased nickel sales of 21,483 nickel tonnes with a higher realised nickel price in FY19. Total revenue of the company increased to A$268.7 million, compared to A$248.3 million in the prior year, leading to a strong operating cash flow of $98.3 million.

The success story of the company also includes the recent completion of a new twelve months offtake agreement for its premium high-grade Mill Recovery Enhancement Project (MREP) products with Sumitomo Metal Mining Co., Ltd., a Japanese party associated with the EV battery supply chain. The company forecasts MREP to contribute between 500 to 700 nickel tonnes in Fiscal 2020.

Further, Western Areas advanced its organic growth projects during the year completing the Odysseus project definitive feasibility study and confirming a âdecision to mineâ. The long life, low operating cost project secures Western Areasâ long-term future with a 10-year base case production profile, scheduled to commence concentrate production in late 2022. As at the end of FY19, Odysseus Projectâs early works package has been completed on time and on budget, with water management ponds installed and the mine dewatered.

Western Areas Managing Director, Mr Dan Lougher stated that the robust cash position of the company would enable continued investment in organic growth projects like Odysseus, as well as support the maintenance of reasonable returns to shareholders.

The Board has declared a final dividend of 2.0 cents per share, fully franked, payable on 4 October 2019 with the record date of 13 September 2019. The dividend represents a payout ratio of ~38% of FY19 NPAT.

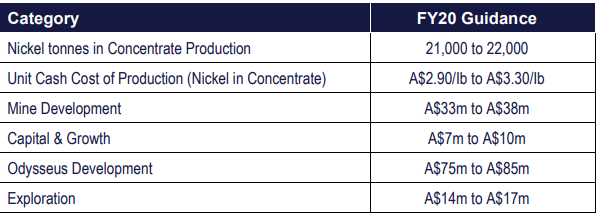

FY20 Guidance:

Looking forward, Western Areas predicts the fundamental outlook of Nickel to remain positive both in the medium and long-term, given the fact that stainless steel demand continues to grow and the new electric vehicle battery market is moving toward utilisation of higher nickel content batteries.

Western Areasâ FY20 Guidance (Source: Company Announcement)

The company expects its nickel production in FY20 to include the 60% of ore feed from Spotted Quoll with Flying Fox providing the balance. Its estimate for capital and growth expenditure relates to ongoing feasibility studies at both Forrestania and Cosmos.

With respect to Odysseus Development Expenditure, the company expects overall preproduction capital expenditure for Odysseus remains unchanged. As per the companyâs information, the updated development expenditure profile includes FY20 â A$80 million, FY21 â A$66 million, FY22/23 â A$143 million.

WSA stock price closed at $2.490 on 20 August 2019 with the price to earnings multiple of 79.680 and a market capitalisation of $675.66 million. Over the past 12 months, the stock has declined by 17.94% despite a positive price change of 11.26% in the past three months.

Have a glance at the quarterly performance of Western Areas for the period ended 31 December 2018.

Jupiter Mines Limited (ASX: JMS)

Jupiter Mining Limited is a metals and mining sector company, which owns 49.9% beneficial interest in Tshipi é Ntle Manganese Mining Proprietary Limited, an operator of Tshipi Borwa Manganese Mine located in the southern portion of the Kalahari manganese field.

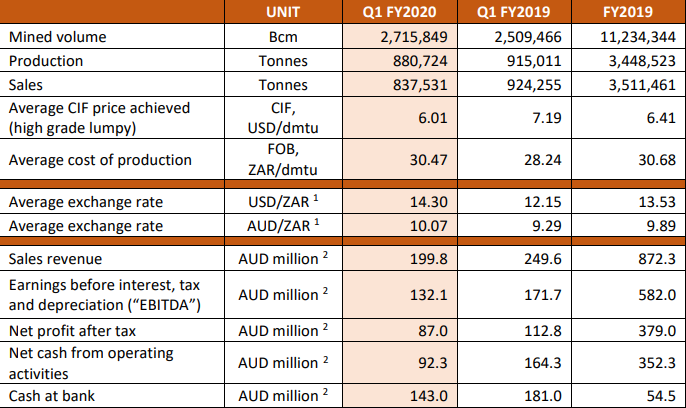

For the quarter ended 31 May 2019, Jupiter Mines Limited reported a production of 880,724 tonnes manganese at the average cost of production of ZAR 30.47 per dmtu during the quarter, in line with FY2019 costs of R30.68/dmtu.

The company reported a sales revenue of A$199.8 million in Q1 FY2020, compared to A$249.6 million in Q1 FY2019. At the bottom-line front, Jupiter reported a Net Profit After Tax of A$87.0 million for the quarter ended 31 May 2019, compared to A$112.8 million in the previous corresponding period. The cash reserves of the company stood at A$ 143 million as at the end of Q1 FY2020.

Jupiter Q1 FY20 Results (Source: Company Announcement)

The Tshipi Board declared a special dividend of R1.15 billion for May quarter and is expected to declare a further dividend of ZAR400-500 million for the HY2020, subject to manganese prices.

For full fiscal year 2020, Jupiter aims to generate strong cash flows by delivering 3mpta business plan while continuing to be one of the lowest cost manganese producers globally. Further, the company exclusively focuses to put âcash into the shareholders pocketâ via a high payout and double-digit yielding dividend.

JMS stock price declined by 2.564% to last trade at $0.380, with a price to earnings multiple of 5.360x and a market capitalisation of $764.01 million. Over the past 12 months, the stock has surged up by 13.04% including a positive price change of 5.41% in the past month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.